Trends in DRAM and memory appear to be remaining strong in the fourth quarter. We have seen this on a broader industry basis for the third quarter and into the fourth quarter, but now we are getting further word from Micron Technology Inc. (NASDAQ: MU) that its business is tracking stronger in the quarter.

The problem is that much of this seems to have been anticipated and Micron’s shares are up just over 100% in the past six months. One point of concern may be that this report was initially not well received by the market.

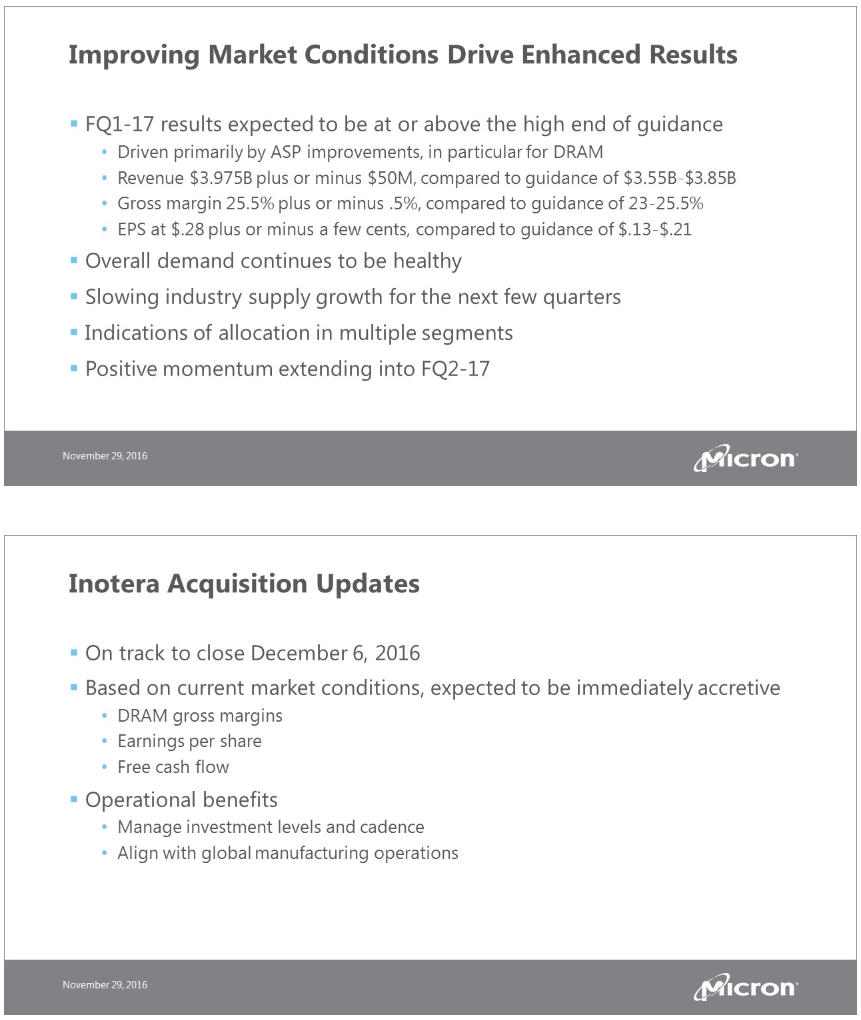

Micron had announced on November 23 an updated presentation time at the Credit Suisse Technology, Telecom and Media Conference in Scottsdale, Arizona. Now a filing with the U.S. Securities & Exchange Commission shows what that guidance will be: Micron talked about the first quarter’s results being at or above the high-end of guidance.

The driving forces are improvements in average selling prices, particularly in DRAM. Micron’s slide presentation also showed that overall demand remains healthy and that the company sees a slowing industry supply growth for the next few quarters.

Revenue was put at $3.975 billion, plus or minus $50 million. Micron’s prior guidance was $3.55 billion to $3.85 billion, and Thomson Reuters was calling for $3.714 billion.

Earnings per share were put at $0.28, plus or minus a few cents per share. Its prior guidance was $0.13 to $0.21, and Thomson Reuters was at $0.20 per share.

Micron also gave guidance of 2.5% for gross margin, plus or minus 0.5%. Its prior guidance was 23% to 25.5%. A Standard & Poor’s report just a few days earlier signaled that Micron’s gross margins would be 27% in both fiscal years 2017 and 2018.

Micron further offered an update on its Inotera acquisition, with it being on track to close December 6, 2016. That acquisition is expected to be immediately accretive on DRAM gross margins, earnings per share and free cash flow. Operation benefits are managing investment levels and cadence and aligning with global manufacturing operations.

When investors and traders see stronger guidance, they have to consider that companies may have made prior forecasts, more recently than the prior earnings report. They also have to consider how much a stock has risen. In the case of Micron, the guidance created no move upward for any initial reaction.

Micron was also a case in which its short interest slid along with other chip peers.

S&P has a mere Hold rating and an $18 price target. On November 28, Deutsche Bank maintained its Buy rating and raised its target price to $24 from $20.

Micron shares were last seen down 33 cents, or −1.7%, at $19.66. It has a 52-week trading range of $9.31 to $20.44, and it is extremely close to its consensus analyst price target of $20.31.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.