Stratasys Ltd. (NASDAQ: SSYS) reported its first-quarter financial results before the markets opened on Tuesday. The company said that it had $0.05 in earnings per share (EPS) and $163.2 million in revenue, versus consensus estimates from Thomson Reuters of $0.05 in EPS and revenue of $162.65 million. The same period of last year reportedly had EPS of $0.01 and $167.91 million in revenue.

During this quarter, the company announced a strategic agreement with SIA Engineering to help accelerate the adoption of 3D-printed production parts for commercial aviation.

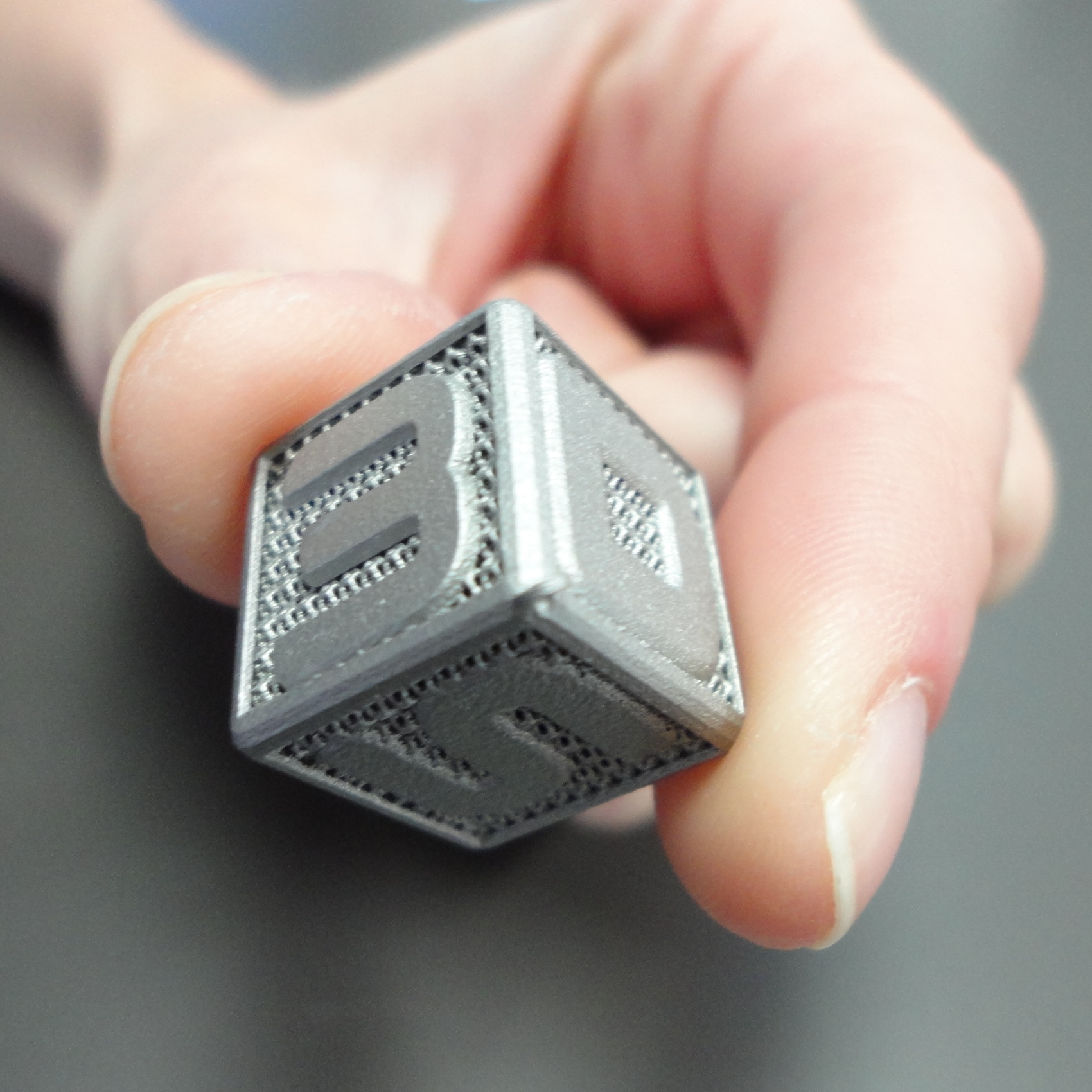

Other developments in this quarter included a strategic investment in LPW Technologies, a developer of metal powders and metal powder management systems. Also, Stratasys entered into a strategic partnership with Desktop Metal, a manufacturer of metal 3D-printing systems, that will enable leveraging Stratasys’ distribution channels for the sale of their innovative solutions.

In terms of guidance for the 2017 full year, the company expects to see EPS in the range of $0.19 to $0.37 and revenues between $645 million to $680 million. The consensus estimates call for $0.30 in EPS and $669.36 million in revenue.

On the books, Stratasys cash and cash equivalents totaled $297.25 million at the end of the quarter, up from $280.33 million at the end of December 2016.

Ilan Levin, CEO of Stratasys, commented:

We remain encouraged by our performance within our key vertical markets during the first quarter, driven by our initiatives to drive customer engagement. In addition, we believe that strong utilization of our installed base of systems was demonstrated by steady growth in consumables and customer support revenue during the period, while improved focus resulted in reductions in our operating expenses.

Shares of Stratasys traded down more than 5% at $28.32 Tuesday morning. The consensus analyst price target is just $19.88, and a 52-week trading range of $16.37 to $30.75.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.