Technology

Do the Youngest Millennials Prefer YouTube or Spotify?

Published:

Last Updated:

In case you missed it, the millennial generation is not a monolith of young adults between the ages of 18 through 34. While a clear definition remains elusive, the youngest portion of millennials — Generation Z — includes the group of 16- to 19-year-olds, at a minimum. Some definitions go down to as low as 10-year-olds.

The impact of these 16- to 19-year-olds on social media and digital entertainment platforms is just beginning to be studied and the results have been surprising, to say the least. Researchers at U.K.-based Midia looked at the music listening habits of Gen Z in Britain and found that Alphabet Inc.’s (NASDAQ: GOOGL) YouTube is viewed at least monthly by 94% of U.K. teens of those ages. Staggeringly high, perhaps, but not especially surprising.

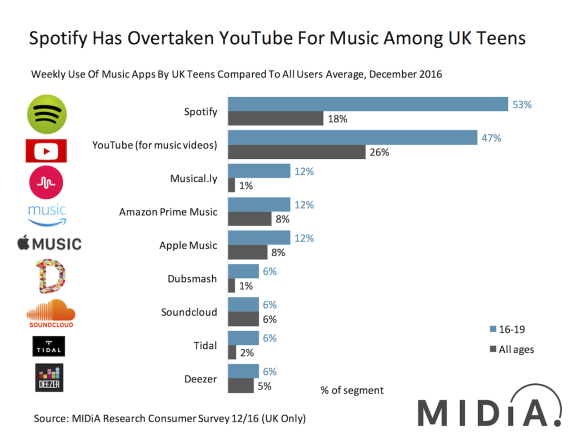

YouTube is the world’s most widely watched music app, but among older teenagers in the United Kingdom, privately held Spotify has overtaken YouTube as the primary music app. In a survey conducted in December 2016, 53% of older U.K. teens used Spotify weekly as their primary app for listening to music, compared to 47% who used YouTube for the same thing.

Midia’s researchers note that of the four countries where the research was done — the United Kingdom, the United States, Canada, and Australia — only U.K. teens used Spotify more than YouTube and only among 16- to 19-year-olds. The researchers noted:

So, what’s going on here? Spotify has become an aspirational brand for Gen Z. It has, for teens, become a byword for streaming in the same way the iPod became synonymous with the MP3s and Netflix has with streaming video. Spotify is not exactly an old brand but neither has it been a youth brand, instead prospering within its core demographic of 25-34 year olds. Now a new generation of youth, many of which were only just starting school when Spotify first launched, have seized the brand as their own.

And the party is just getting started for Spotify:

It is hard to exaggerate the potential of this development. Teenagers have taken the Spotify brand and made it their own. Unless Spotify totally screws up somehow, which is unlikely, it has a platform for future growth that could make its current success simply look like the warm up act. Although the UK is the only one of the 4 markets in this study where Spotify has taken the lead, it is on track to do the same in the 3 other English speaking markets surveyed. And it has also taken the lead in other markets we track: Sweden (where national sentiment plays a major role) and Germany (where YouTube offers a much more restricted music range due to rights issues).

For Spotify, which reportedly is headed for an initial public offering (IPO) sometime this year, this is good news both for the company and its investors. The company is valued at around $13 billion and the most recent IPO chatter calls for a direct listing on the New York Stock Exchange that would not require underwriting from investment banks and would eliminate most of the heavy fees of a typical IPO. The downside, of course, is that the company realizes no cash from the IPO. In a direct listing, existing shares are offered to the public, offering a liquidity event for existing shareholders.

One caveat on the Midia research: Most of those U.K. teenagers are not paying for Spotify, which offers a free streaming option. But, as with any startup, scale forgives a multitude of sins, and Spotify now has more than 100 million users worldwide and about half pay the monthly subscription fee. Once teens taking advantage of Spotify’s free tier get out on their own, they are more likely to pay for music streaming and the service they are most likely to pay for is the one they’ve grown up with.

And where does Apple Inc.’s (NASDAQ: AAPL) Apple Music service figure in? The following chart from Midia indicates that Apple Music gets less than a quarter of Spotify’s weekly users.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.