Technology

4 Contrarian Tech Stocks That Could End Up Huge Winners

Published:

Last Updated:

If you are a technology investor, there is a good chance that you look at the prices of many of the top companies and shake your head. For the most part, the sector has been overweighted by portfolio managers for years, and many of the best companies are simply too expensive to buy right now. That doesn’t mean they are not still awesome. It just means they are too rich.

We screened our 24/7 Wall St. research database looking for tech stocks that are either very oversold or wildly out of favor now, and we found four that aggressive investors with a longer timeline may want to look at now. While only suitable for those with big risk tolerance, they could have some stellar upside potential.

This company has been very up and down over the past 52 weeks, and it has frequently been the subject of takeover rumors. Ciena Corp. (NASDAQ: CIEN) is a vendor for high-capacity optical transport and Ethernet switching equipment to carriers, enterprises, cable operators and governments. It specializes in transitioning legacy communications networks to converged, next-generation architectures capable of efficiently delivering a broader mix of high bandwidth services.

The company’s Converged Packet Optical segment offers networking solutions optimized for the convergence of coherent optical transport, Optical Transport Network (OTN) switching and packet switching. Its products comprise the 6500 Packet-Optical Platform, 5430 Reconfigurable Switching System, CoreDirector Multiservice Optical Switches and OTN configuration for the 5410 Reconfigurable Switching System.

Ciena reported strong third-quarter numbers, but disappointing guidance led to a steep sell-off in the shares. Fourth-quarter revenue growth is expected to drop to 3%, versus 9% year to date, and management noted the overall optical market is slowing. Ciena is positioned to take share, and new products could help spur growth next year.

The stock is rated as a Buy at Stifel, but the firm recently lowered its price target to $30 from $32. The Wall Street consensus target is $30.22. The shares closed trading most recently at $22.06.

This stock was on fire a couple of years ago but was absolutely eviscerated after missing earnings numerous times. FireEye Inc. (NASDAQ: FEYE) has been mentioned over the years as a takeover target, and trading 85% below highs that were printed this time three years ago, it may indeed be on the radar.

The company provides cybersecurity solutions for detecting, preventing, analyzing and resolving cyberattacks. The company offers vector-specific appliance solutions that provide threat protection from network to endpoint for inbound and outbound network traffic that may contain sensitive information.

FireEye also offers Central Management System that provides cross-enterprise threat data correlation to identify and block attacks across multiple attack vectors. Its Threat Analytics Platform helps to identify and respond to cyber threats by correlating enterprise-generated security event data from any security product with real-time threat intelligence, and its Malware Analysis System helps to manually execute and inspect advanced malware, zero-day and other advanced cyberattacks embedded in files, email attachments and web objects.

The company reported solid second-quarter numbers in August and has rallied back smartly from lows printed in March.

Merrill Lynch rates the stock at Buy and has an $18 price target on the shares. The posted consensus target is $16.41. The stock closed most recently at $14.89 apiece.

This company was part of the big split in operations at the iconic Hewlett-Packard. Hewlett Packard Enterprise Co. (NYSE: HPE) is now an industry leading technology company that enables customers to go further, faster. With the industry’s most comprehensive portfolio, spanning the cloud to the data center to workplace applications, the company’s technology and services help customers around the world make IT more efficient, more productive and more secure.

The company operates under four segments: Enterprise Group (50% of revenue) has servers, storage, networking hardware and Technology Services. Enterprise Services (37%) has a broad IT outsourcing focus. Software (7%) and Financial Services (7%) make up the remaining portfolio. The company has leading market share across many of its businesses.

Hewlett Packard Enterprise also has a partnership with Microsoft that offers new innovation in Hybrid Cloud computing through Microsoft Azure and Hewlett Packard Enterprise infrastructure and services, as well as new program offerings. The extended partnership appoints Microsoft Azure as a preferred public cloud partner.

The company’s spin-off and merger of the software segment with Micro Focus closed last week, and some investors were less than please with shares getting hammered. The company is expected post fresh quarterly results on Tuesday.

UBS continues to rate the stock a Buy, and the firm has a $21 price objective. The consensus target price is $19.35. The shares closed most recently at $14.31 apiece.

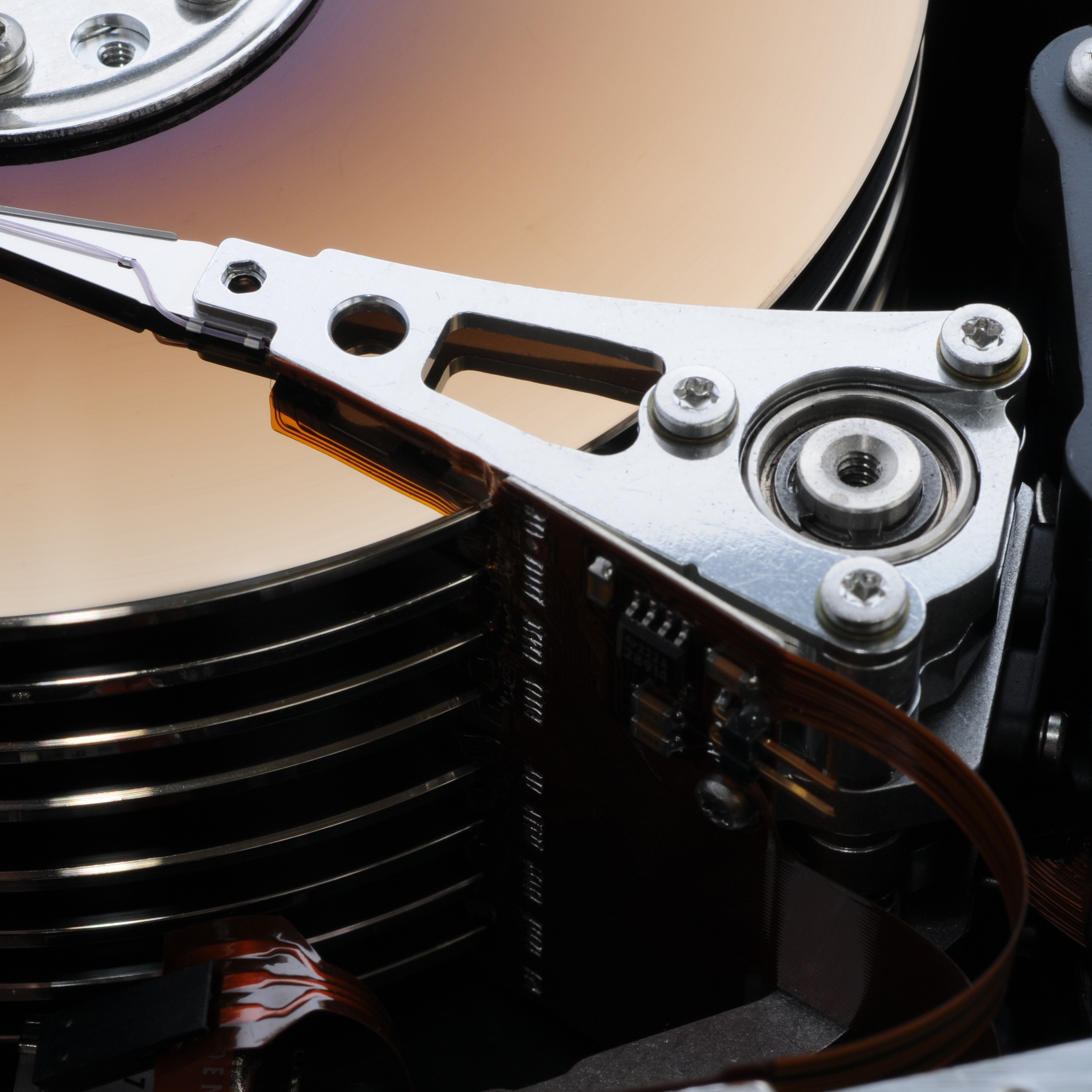

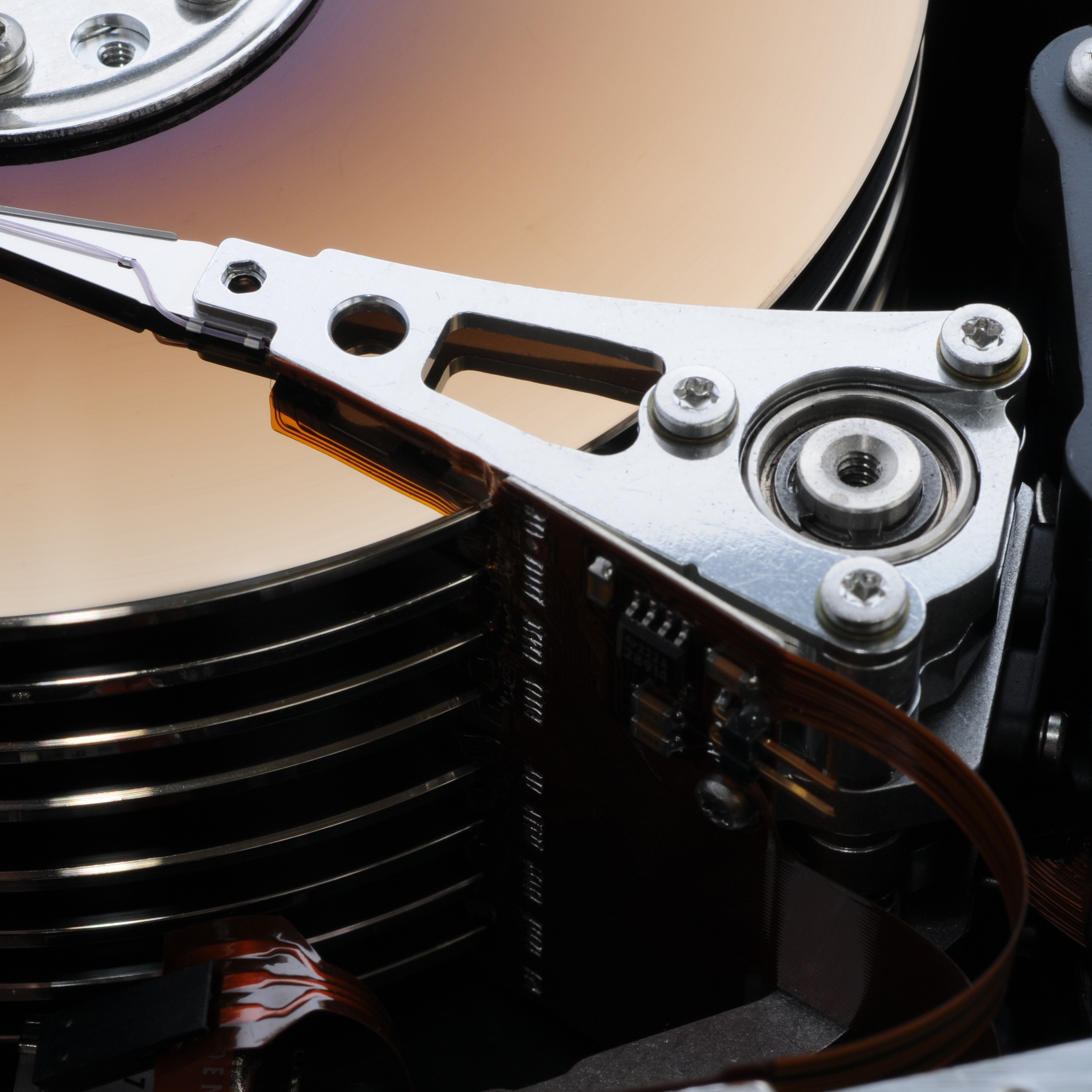

This is probably one of the most disliked tech stocks now, and it is down over 40% since April. Seagate Technology PLC (NASDAQ: STX) designs, manufactures and sells electronic data storage products in the Asia-Pacific, the Americas and EMEA (Europe, Middle East and Africa) countries.

The company provides hard disk drives, solid state hybrid drives, solid state drives, PCIe cards and serial advanced technology architecture controllers that are designed for enterprise servers and storage systems in mission critical and nearline applications, as well as for client compute applications comprising desktop and mobile computing.

Seagate has reported two lousy earnings quarters already this year, and the stock has been absolutely crushed on the bad reports and lowered guidance. One of Wall Street’s biggest activist investors, ValueAct Capital, became one of Seagate’s largest shareholders last year with a 9.5 million share stake. The company reported in August it has added more shares, and currently it owns a 7.2% stake in the company and 13.82 million shares.

Many think at current levels the stock is a candidate for a leveraged buyout. That would make the second time in the past 20 years the company has been taken private.

Investors in Seagate are paid a huge 7.92% dividend, but that could be subject to a cut. Jefferies still rates the shares a Buy and has a $40 price target. That compares with the posted consensus estimate of $38.48. The shares closed most recently at $31.80.

Four stocks that all have good product lines that have taken a beating. While only suitable for very aggressive accounts, they could bring some massive upside gains if they can iron out their current issues.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.