Technology

4 Hammered Tech Stocks That May Have Massive Upside Potential

Published:

Last Updated:

While most technology investors are pretty giddy these days as they celebrate their returns over the past couple of years, as most investors know, good fortune doesn’t smile on everybody. However, taking a contrarian stance when a company is down can be among the best trades ever. If you don’t think that is the case just ask people who bought Amazon.com Inc. (NASDAQ: AMZN) as low as $35 in 2008 or Google, now part of Alphabet Inc. (NASDAQ: GOOGL), in 2004 at $85.

We screened our 24/7 Wall St. research database looking for technology value and found four incredible companies that have been absolutely hammered this year that may be offering investors incredible upside potential. These are not penny stocks or ones with some sort of kryptonite that could keep them forever shunned. They are solid companies that in some cases are among the leaders in their specific tech arenas.

While we acknowledge these are only suitable for very aggressive, risk-tolerant accounts that also may need to be bestowed with patience, it may make sense for savvy investors to take a long hard look.

This stock was hit hard earlier this year due to very disappointing guidance for the second quarter, and then again when the company delivered bad second-quarter results. Akamai Technologies Inc. (NASDAQ: AKAM) provides cloud services for delivering, optimizing and securing content and business applications over the internet in the United States and internationally.

The company offers performance and security solutions designed to help websites and business applications operate while offering protection against security threats. It also provides media content delivery solutions that are designed to deliver movies, television shows, live events, games, social media, software downloads and other content on the internet in fixed-line and mobile networks; adaptive delivery solutions for streaming video content; and download delivery solution that offers accelerated distribution for large file downloads, including games, progressive media files, documents and other file-based content.

The shares of Akamai are down a stunning 30% this year, and rumors still continue to swirl around the company as a potential takeover target.

MKM Partners has a Buy rating on the shares and a $58 target price. The Wall Street consensus price target for the company is $57.23, and the shares closed Tuesday’s trading at $47.83 apiece.

This is another technology giant that has been absolutely mauled. F5 Networks Inc. (NASDAQ: FFIV) is a provider of application delivery networking products that manage, control and optimize internet traffic within a network. The company’s products include Server Load Balancer, Secure Socket Layer (SSL), Virtual Private Network (VPN), WAN optimization, Network Attached Storage, DDoS and diameter signal routing.

The company reported fiscal third-quarter results that were generally in line with the consensus forecast, but it offered up fourth-quarter revenues and earnings per share guidance that were below lofty Wall Street expectations. While much of the weakness was attributed to Asian and Japanese markets, some analysts also cited purchase delays due to the public cloud, as well as new architectures.

While market pressures remain, the current valuation, the company’s cash position and new management are all positives that bode well for the future.

D.A. Davidson has the stock rated Buy with a massive $156 price target. The consensus price objective for the shares is $132.76. The stock closed trading on Tuesday at $118.61 a share.

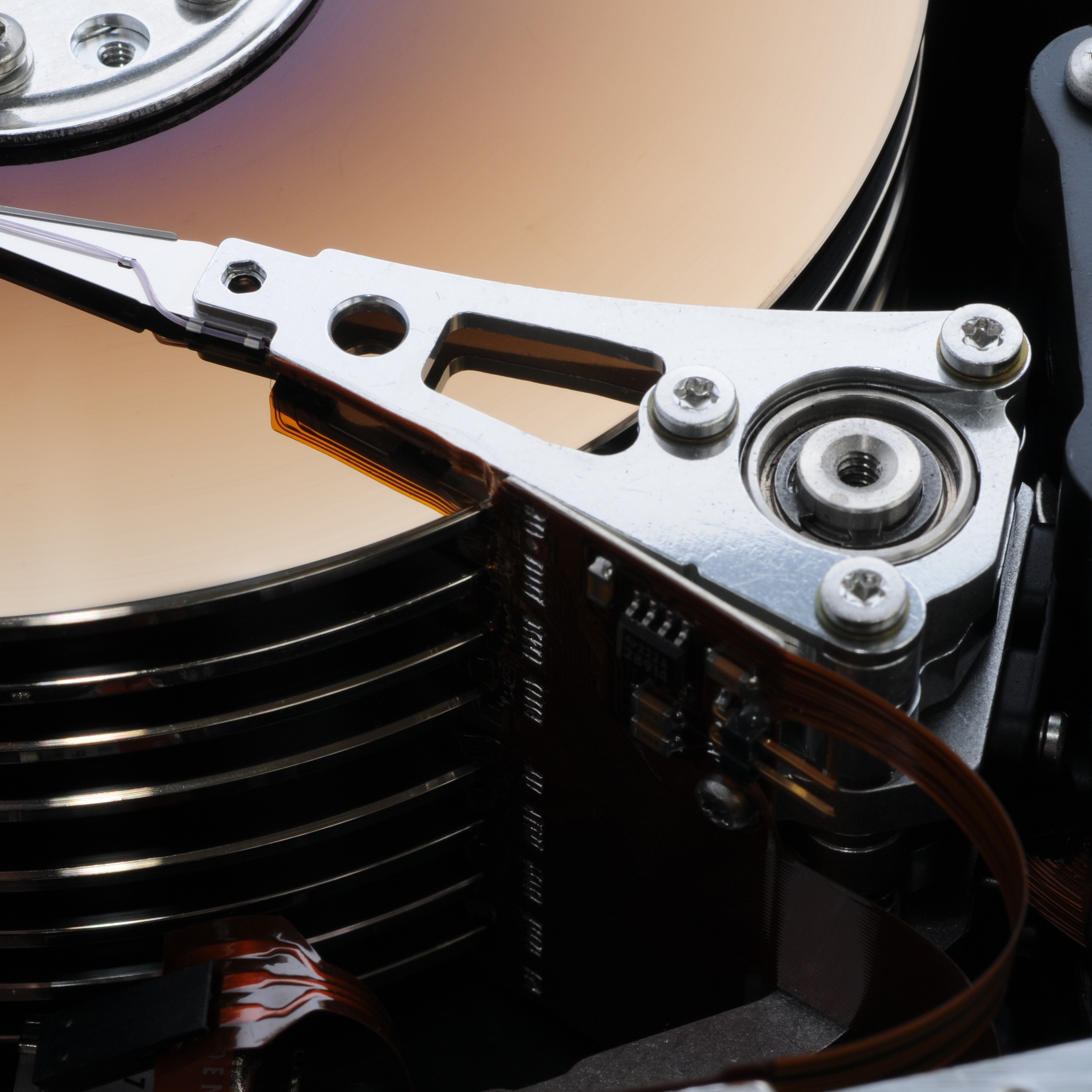

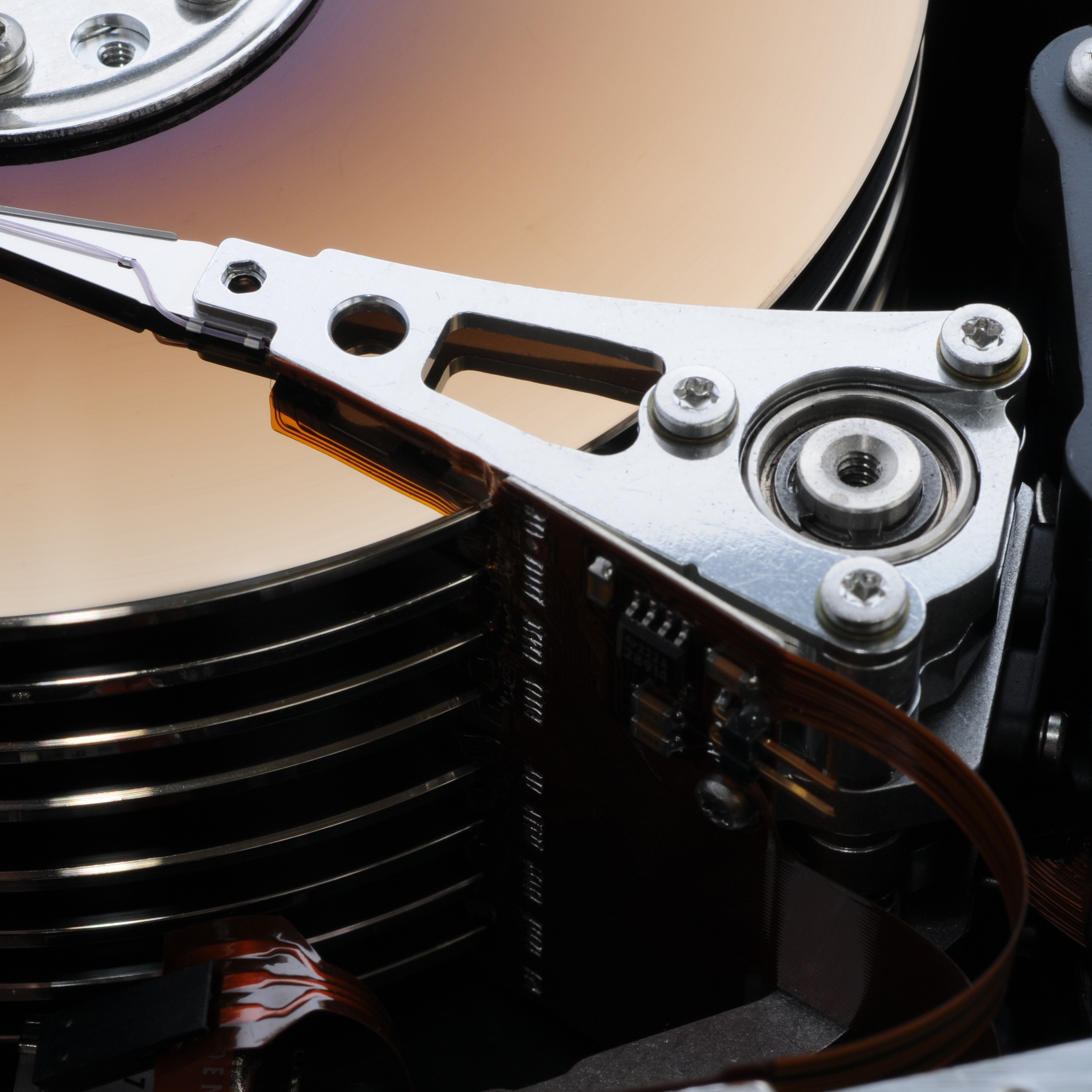

This is probably one of the most disliked tech stocks now, and it is down over 40% since April. Seagate Technology PLC (NASDAQ: STX) designs, manufactures and sells electronic data storage products in the Asia-Pacific, the Americas and EMEA (Europe, Middle East and Africa) countries.

The company provides hard disk drives, solid state hybrid drives, solid state drives, PCIe cards and serial advanced technology architecture controllers that are designed for enterprise servers and storage systems in mission critical and nearline applications, as well as for client compute applications comprising desktop and mobile computing.

Seagate has reported two lousy earnings quarters already this year, and the stock has been absolutely crushed on the bad reports and lowered guidance. One of Wall Street’s biggest activist investors, ValueAct Capital, became one of Seagate’s largest shareholders last year with a 9.5 million share stake. The company reported in August it has added more shares, and currently it owns a 7.2% stake in the company and 13.82 million shares.

Many think at current levels the stock is a candidate for a leveraged buyout. That would make the second time in the past 20 years the company has been taken private.

Seagate investors are paid a huge 7.67% dividend, but that could be subject to being cut. Jefferies still rates the shares a Buy and has a $40 price target. That compares with the posted consensus target of $37.48. The shares closed trading most recently at $32.87.

This top technology stock was hit hard earlier this year and is still offering investors a great entry point. The stock jumps to number three from the 12th spot at JPMorgan. Qualcomm Inc. (NASDAQ: QCOM) designs, develops and supplies semiconductors and collects royalties on wireless handheld devices and infrastructure based on its dominant position in CDMA and other related technology patents.

In addition, Qualcomm provides systems software and components to wireless handset vendors and promotes applications and services that run on high-speed wireless networks. The company operates primarily through two segments: CDMA Technologies and Technology Licensing.

Top analysts on Wall Street are expecting Qualcomm’s revenue exposure to decline in next-generation iPhone handsets due to a potential allocation shift toward Intel. Prior to 2016, the company held 100% market share of discrete baseband processors at Apple. In 2016, however Intel made significant in-roads to drive the company’s unit market share closer to 60%, in many estimates.

Toss in the ongoing royalty dynamic between Apple and Qualcomm, which generates both a greater amount of revenue/profit from Apple, and the bears have circled the shares.

Investors in Qualcomm still receive a rich 4.46% dividend. Merrill Lynch rates the stock a Buy. Its $66 price objective compares with the consensus price target of $59.44. The shares closed most recently at $51.13.

While none of these top companies have the upside potential of Google or Amazon from back in the day, they do have solid business models and make sense for accounts looking for bounce-back potential.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.