Technology

Merrill Lynch Says Buy These 5 Out-of-Favor Tech Stocks Now

Published:

Last Updated:

When you see the kind of gains that have been printed for people long Amazon or Google, it makes you incredibly mad you didn’t jump in sooner. The bottom line is that, although they are great companies, and will continue to be significant in the technology-driven economy and world we live in, it’s a good bet that the big money has long since been made. For those looking for some solid tech gains, it may make sense to look at sector laggards now.

We screened the Merrill Lynch technology research universe looking for big-time companies that are either just plain out of favor or perhaps facing a cyclical backlash as their business rotates through the cycle. The following five companies are all rated Buy, well established and offer patient investors some serious upside potential, with probably limited downside.

This stock was truly on fire a couple of years ago but was absolutely eviscerated after numerous earnings misses. FireEye Inc. (NASDAQ: FEYE) has been mentioned over the years as a takeover target, and trading 85% below highs that were printed this time three years ago, it may indeed be on the radar.

The company provides network security solutions addressing advanced persistent threats, which traditional IT security tools like anti-virus, intrusion prevention systems, email/web gateways and firewalls, have largely failed to protect from. These solutions typically compare incoming traffic to a list of known threat signatures, failing to identify and protect against unknown targeted attacks, versus FireEye’s solution that focuses on the behavior of traffic rather than a signature.

The Merrill Lynch price target for the shares is $20, and the Wall Street consensus target is $19.05. The stock closed Friday at $16.82 a share.

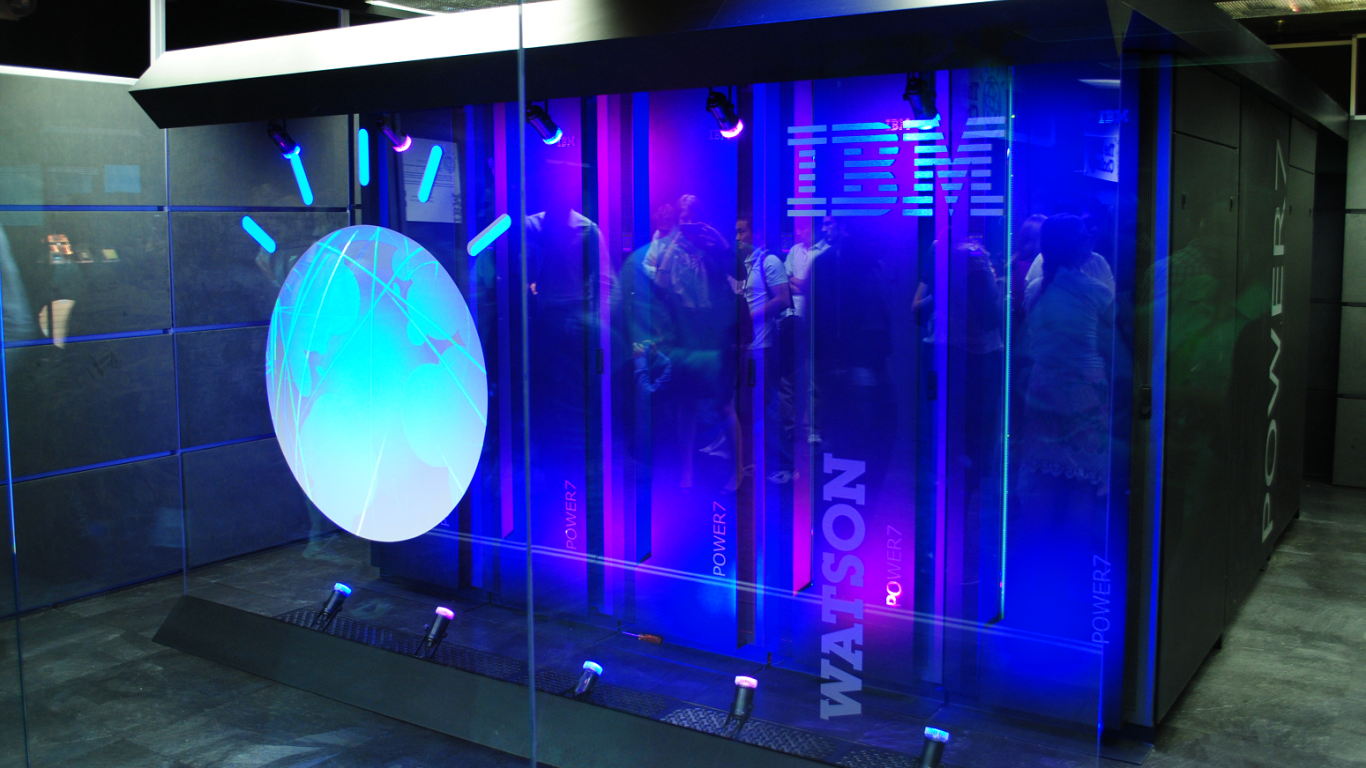

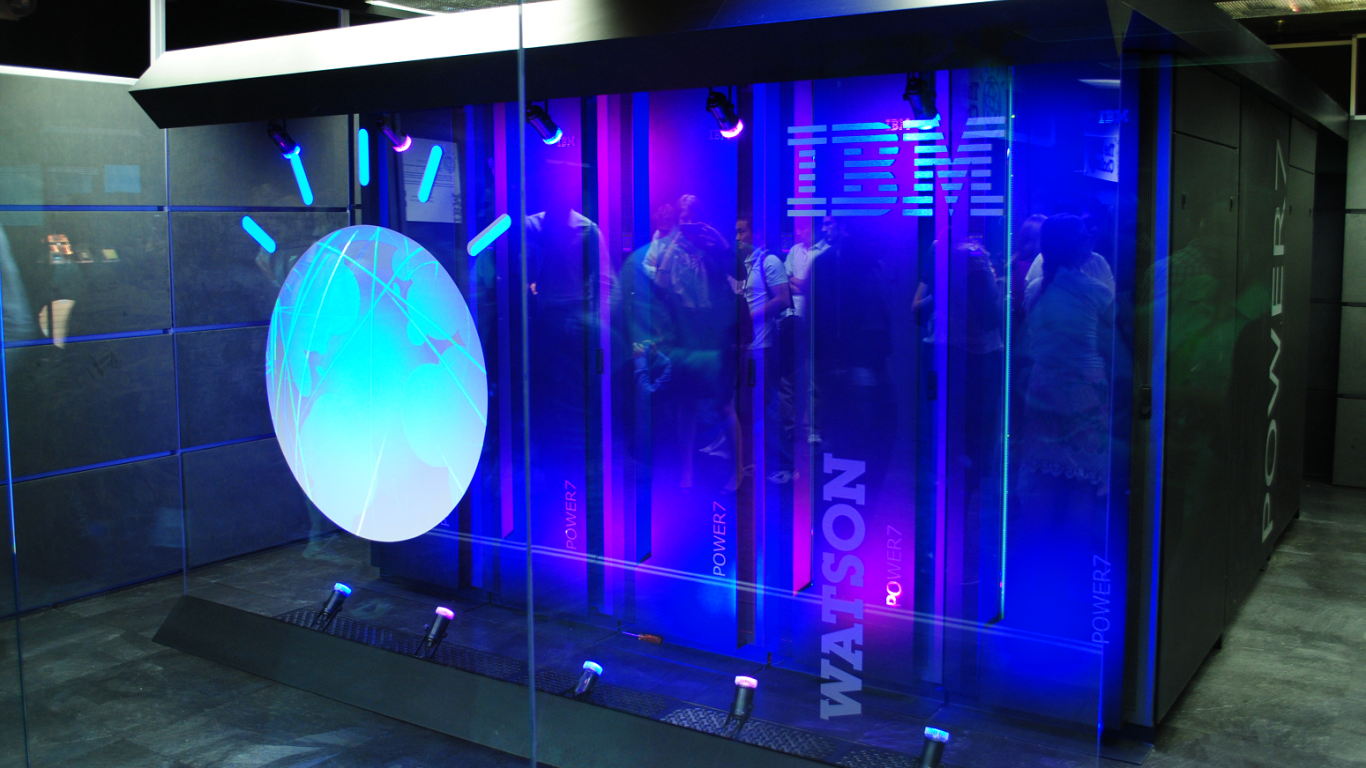

This blue chip leader may still be offering investors the best entry point in years, as it is down almost 4% in 2018. International Business Machines Corp. (NYSE: IBM) is a leading provider of enterprise solutions, offering a broad portfolio of information technology (IT) hardware, business and IT services, and a full suite of software solutions. The company integrates its hardware products with its software and services offerings in order to provide high-value solutions.

IBM’s five major segments are: 1) Cognitive Solutions, 2) Global Business Services, 3) Technology Services & Cloud Platforms, 4) Systems and 5) Global Financing. Analysts cite the company’s potential in the public cloud as a reason for their positive outlook going forward.

For the second quarter, IBM beat analyst expectations on both revenue and earnings per share, despite some currency headwinds. At current trading levels the stock is a bargain, especially if the company can continue to grow its cloud business.

IBM shareholders receive a 4.15% dividend. Merrill Lynch has a $200 price target, while the consensus target is $164.50. Shares closed Friday at $151.35.

This is another strong, large-cap play for investors. KLA-Tencor Corp. (NASDAQ: KLAC) designs, manufactures and markets process control and yield management solutions worldwide.

It offers chip manufacturing products, such as front-end defect inspection tools, defect review systems, advanced packaging process control systems, metrology solutions, in-situ process monitoring products and lithography software; wafer manufacturing products comprising surface and defect inspection, wafer geometry and nanotopography metrology and data management; and reticle manufacturing products, such as defect inspection and pattern placement metrology products.

The company also provides light emitting diode (LED), power device and compound semiconductor manufacturing products consisting of patterned wafer inspection, defect inspection, surface metrology and data management products; thin-film head metrology and inspection, virtual lithography, in-situ process monitoring, transparent and metal substrate inspection and data management products for data storage media/head manufacturing; and stylus and optical profiling and optical inspection products for microelectromechanical systems manufacturing, as well as products for general purpose/lab applications.

Many analysts feel that KLA-Tencor is less cyclical than peers with best-in-class returns. The Orbotech purchase adds growth/diversity and sales/earnings per share accretion. Risks for the shares include industry cyclicality, relatively muted growth and limited operating leverage.

Shareholders receive a 2.87% dividend. The $140 Merrill Lynch price objective compares to the $136.14 consensus estimate. Shares closed Friday at $104.52.

This is a global leader in advanced semiconductor systems. Micron Technology Inc.’s (NASDAQ: MU) broad portfolio of high-performance memory technologies, including DRAM, NAND and NOR flash, is the basis for solid state drives, modules, multichip packages and other system solutions. Its memory chip solutions enable the world’s most innovative computing, consumer, enterprise storage, networking, mobile, embedded and automotive applications.

Micron and Intel announced last year the availability of their 3D NAND technology, the world’s highest-density flash memory. Flash is the storage technology used inside the lightest laptops, fastest data centers and nearly every cell phone, tablet and mobile device.

The company posted outstanding quarterly earnings recently and also provided forward guidance that exceeded Wall Street estimates. With memory demand drivers remaining somewhat underappreciated and with solid demand from end-markets such as data center, artificial intelligence (AI), deep learning, big data, mobile and autonomous driving, Micron continues to execute well on its manufacturing roadmap despite recent issues.

The Merrill Lynch price target is a stunning $85. The consensus target is $80.10, and shares closed Friday at $44.74.

This is a leader in the total addressable hard disk drive (HDD) market. Western Digital Corp. (NASDAQ: WDC) designs, manufactures and markets hard disk drives for use in enterprise storage, servers, desktop and laptop computers and consumer electronic devices. It also has a growing solid state drive and storage systems portfolio and is currently the third-largest enterprise solid state drive manufacturer.

The company is responding to changing market needs by providing a full portfolio of compelling, high-quality storage products with effective technology deployment, high efficiency, flexibility and speed. Its products are marketed under the HGST and WD brands to original equipment manufacturers, distributors, resellers, cloud infrastructure providers and consumers.

The analysts feel the company’s business mix switch to NAND flash could provide earnings momentum and growth as compared to the rather flat revenue streams from the HDD product line. In addition, personal computers account for 50% of hard disk drive sales and the improved performance at Dell and overall PC sales bodes well for the company in 2018 and beyond.

Shareholders receive a 3.29% dividend. Merrill Lynch has set its price target at $110. The consensus target is $100.59, and shares closed at $60.72.

These five stocks have big upside to the Merrill Lynch price targets and also offer investors perhaps a more comfortable entry point. There is a good chance the market could start to trade sideways to down for the balance of 2018 as investors take fourth-quarter profits, and these could be good vehicles for that move.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.