Technology

RBC Gives Strong Support for 2 Memory Leaders, Ignores Another

Published:

Last Updated:

Sometimes analysts make calls on individual companies, and other times they make sector calls. RBC Capital Markets has assumed coverage in the chip space that is rather positive for two companies and not so much for another. The report comes on the heels of a weak forecast for DRAM demand in 2019 from IHS Markit and on the heels of European chip-maker Infineon having lowered its guidance.

24/7 Wall St. has included a synopsis of each call to break down the key points for the assumption of coverage in this space.

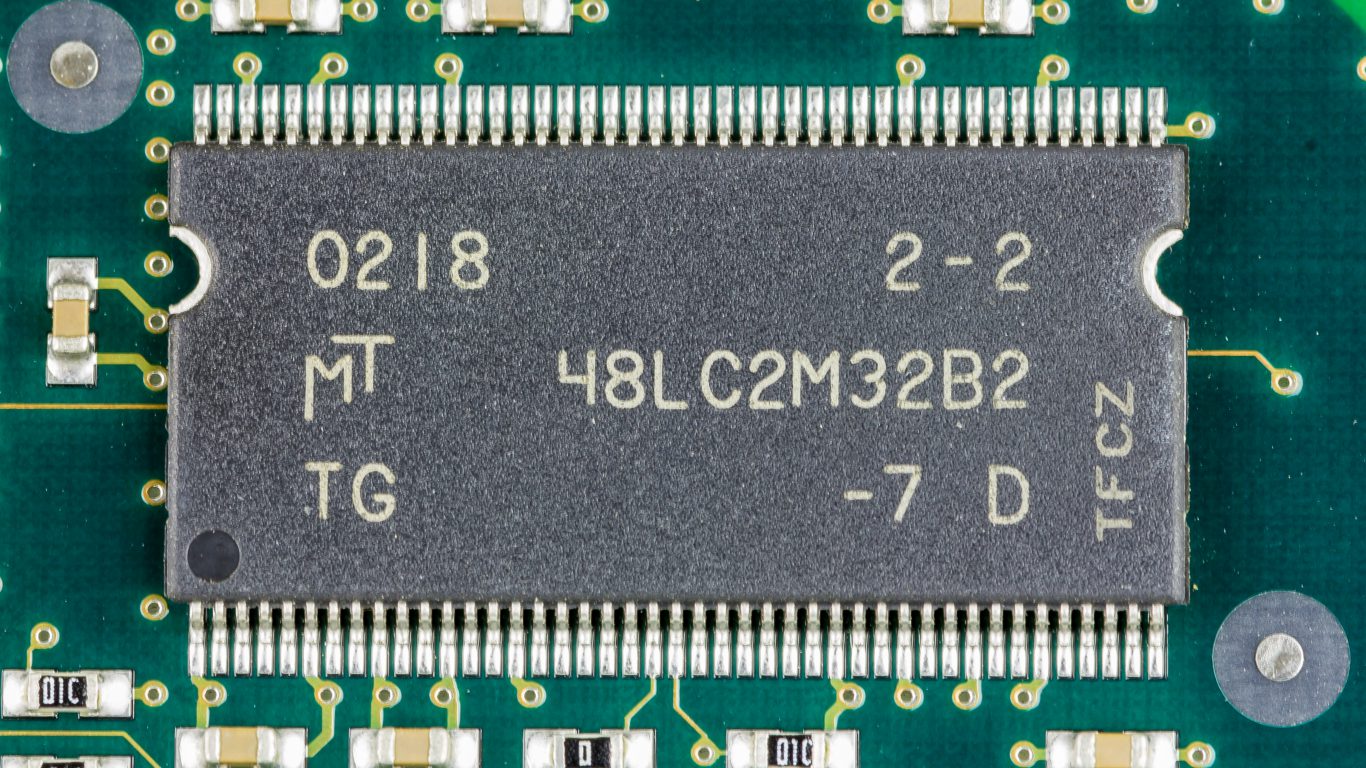

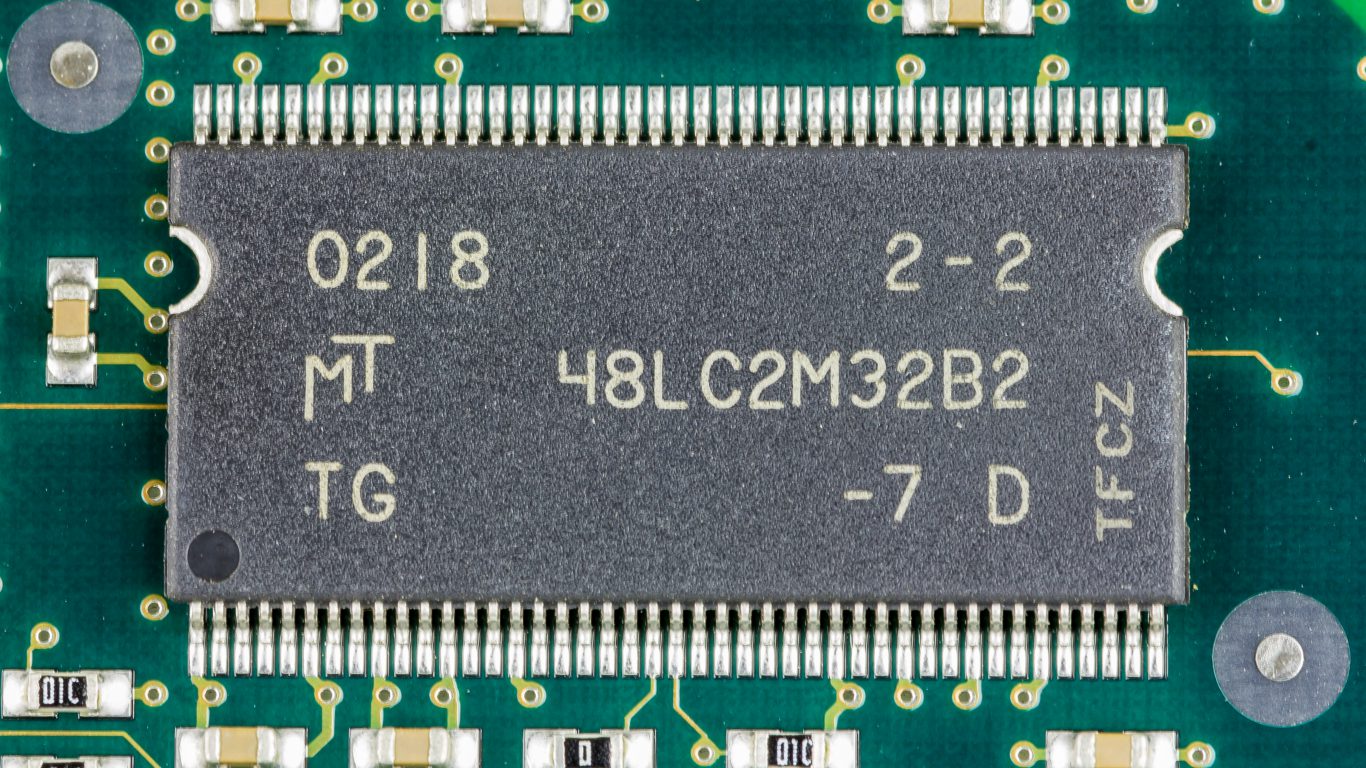

Micron Technology Inc. (NASDAQ: MU) closed down 2.7% at $39.23 on Wednesday after Infineon warned and after IHS Market projected weaker DRAM demand trends for 2019. RBC Capital Markets assumed Micron with an Outperform rating, up from a prior Market Perform rating. The stock was assigned a $50 target price. That is about $4 higher than the Refinitiv consensus sell-side analyst target.

The firm’s call here is that falling DRAM prices should bottom in a few months, even as demand dynamics were called challenging. The analysts expect prices to bottom late in the second quarter or into the third quarter of 2019, as demand from data centers is expected to remain firm.

Micron shares were last seen still trading down 10 cents at $39.12 in late morning trading on Thursday, in a 52-week range of $28.39 to $64.66.

Western Digital Corp. (NASDAQ: WDC) was reinstated with an Outperform rating, compared with RBC Capital Markets’ prior Market Perform rating, and the firm assigned a $55 target price. The target here is about $1.50 under the consensus analyst target.

RBC expects that data center demand will improve in 2019, and the firm sees a boost from handset demand in China and Asia to coincide with a slight rebound in the core hard disk drive (HDD) market. Also worth noting is that the firm sees consensus earnings estimates for fiscal 2020 potentially being too low, and that if the company hits its targets it will translate to $11 or more in earnings per share with strong free cash flows.

Western Digital closed down 3.6% at $45.38 on Wednesday along with a weak memory and chip sector, but its shares were up 1.3% at $45.47 on Thursday morning.

Seagate Technology PLC (NASDAQ: STX) also traded higher along with Western Digital, but RBC’s assumption of coverage only came with a Sector Perform rating and $49 price target. That is still a stronger view than many firms, as Seagate’s consensus target price is $43.44.

While RBC was positive on Western Digital, it sees the valuation being more fair for Seagate and sees near-term demand as more challenging. That said, Seagate’s gross margins are expected to approach to its long-term targets as the HDD market should be roughly stable over the next two to three years.

Seagate closed at $45.82 ahead of the call, and its shares were last seen up just eight cents at $45.90 on Thursday.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.