Technology

Which 3D Printing Company Is a Bonafide Winner? Hint: It's Not 3D Systems

Published:

Last Updated:

3D printer maker 3D Systems Corp. (NYSE: DDD) posted larger-than-expected misses on both the top and bottom lines for the first quarter, and investors are administering severe punishment as a result. The stock posted a new 52-week low Wednesday morning and traded down about 21% at last look.

The company became a media phenomenon in late 2013 traded more than seven times above its share price in January 2012. Less than three years later, it had dropped back to those 2012 levels, and it closed Tuesday night at $10.64, more than $2.00 a share below its January 2012 level.

The wild ride has been shared by other 3D printer makers, although the ups were not quite as high. Stratasys Ltd. (NASDAQ: SSYS) doubled its share price in the 24 months to December 2013, and it trades down more than a third from the initial level, factoring in two reverse splits. The ExOne Co. (NASDAQ: XONE) jumped to nearly three times its IPO price in the same period before finding a home at about 60% below its IPO price. German 3D printer maker Voxeljet A.G. (NYSE: VJET) spiked at $59 in its early 2014 debut and trades below $2 today.

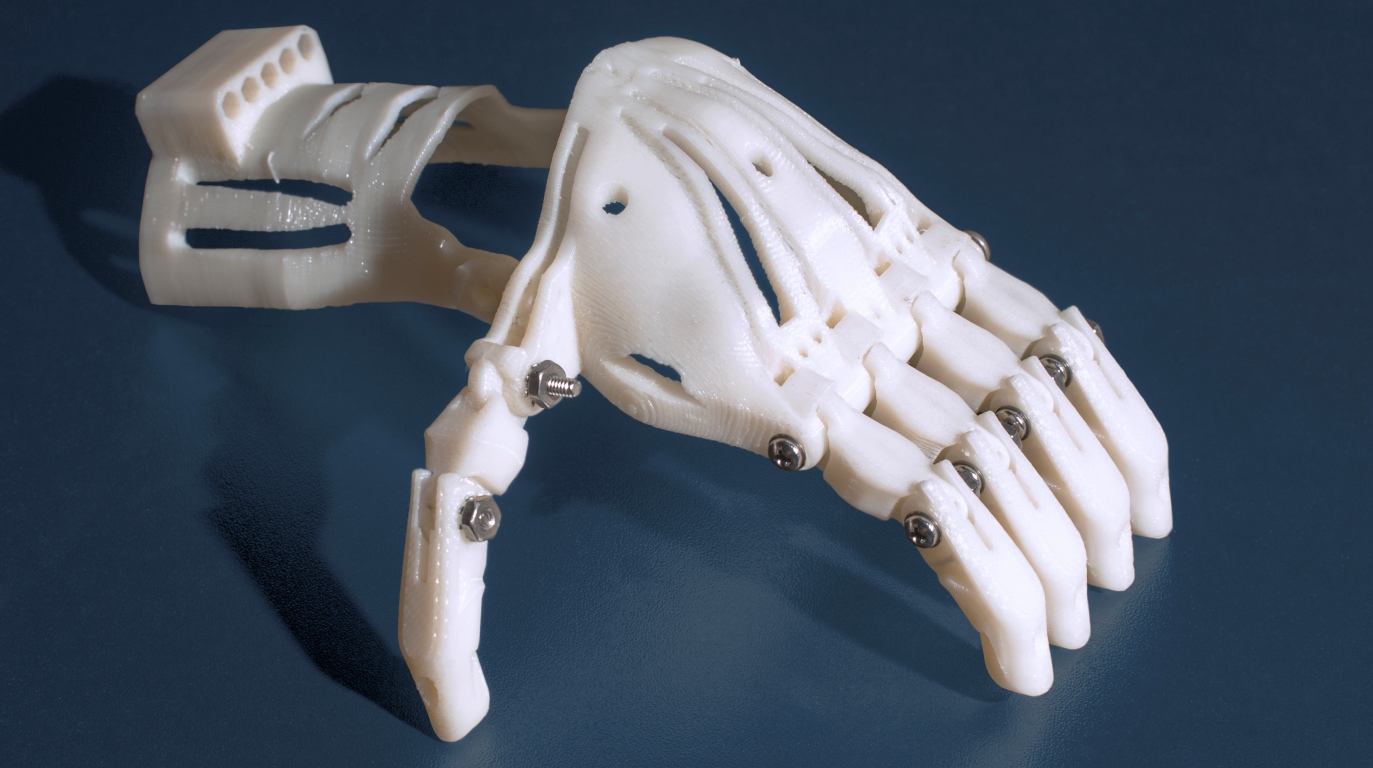

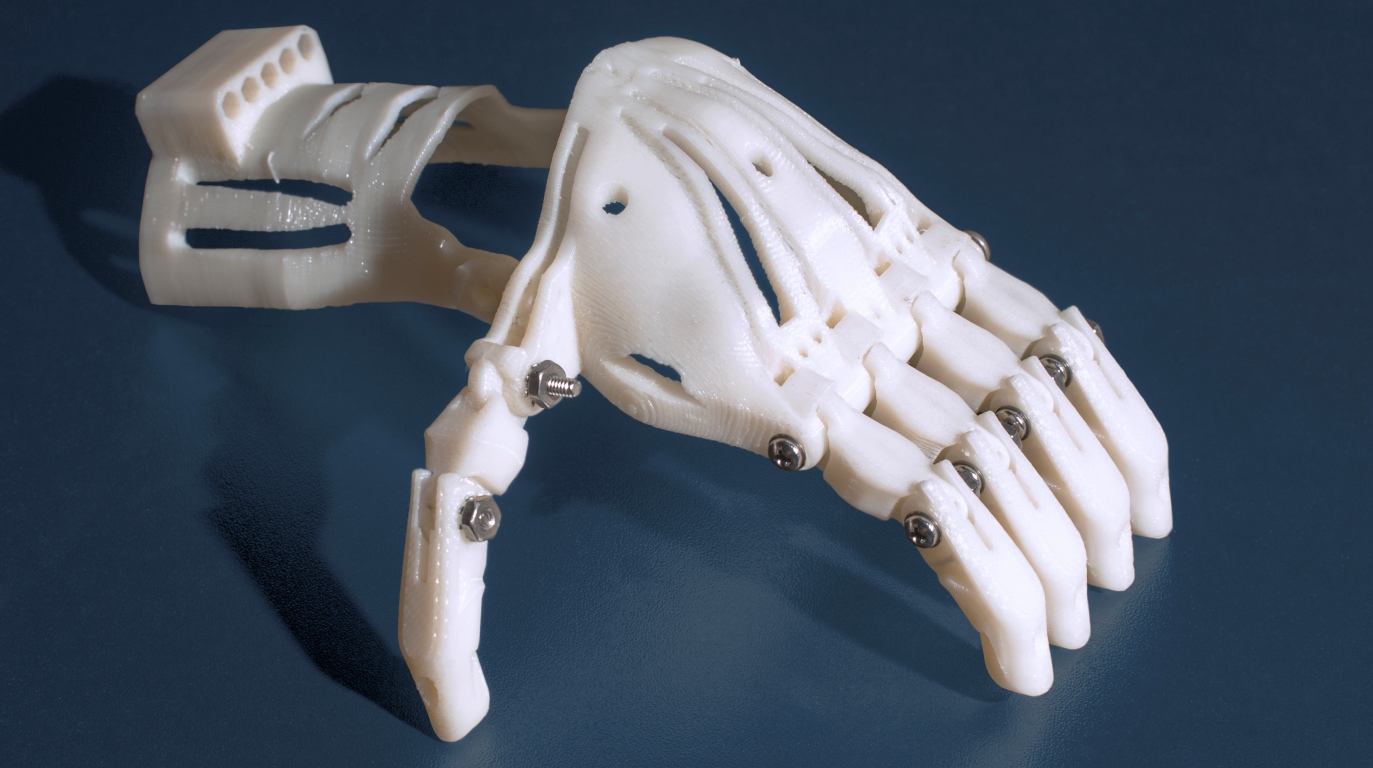

Only two companies associated with 3D printing are showing share price increases since 2012. One, HP Inc. (NYSE: HPQ) has a 3D printer product, but it reflects a very small portion of the company’s business. The other, Proto Labs Inc. (NYSE: PRLB), makes the bulk of its revenue from rapid prototyping of industrial products, including using 3D printing machines. But the company does not make or sell 3D printers.

Just based on share price increases, the winning 3D printing company would be HP, where shares have doubled since 2012. But that hardly seems fair given that HP’s 3D printer business is such a small part of its overall business. And HP is the only one of these firms that pays a dividend, now with a yield of about 3.21%

The only other firm that shows a share price gain for the seven-year period is Proto Labs. Selling its rapid prototyping capabilities as a service rather than as a chunk of hardware has delivered steady share price growth for a long period.

Stratasys stock trades about 34% below its January 2012, 3D Systems stock trades down about 30%, ExOne trades down more than 50% and Voxeljet trades down more than 80%.

One stock we left out because its product is so different is Organovo Holdings Inc. (NASDAQ: ONVO), a biotechnology firm that has developed a technology to 3D print tissues that emulate human biology and diseases. After a spike of about 500% between January 2012 and late 2013 though, it now trades about 40% before the 2012 price. Different product, same result.

For investors who still want to have a play in the 3D printing sector, Ark Invest offers the 3D Printing ETF (PRNT). As of Tuesday’s closing bell, the fund’s net asset value was $22.88 and assets under management totaled just over $40 million. The fund’s top five (of 48 total) holdings are Stratasys (6.34%), SLM Solutions (6.16%), Straumann (6.04%), HP (5.87%) and Renishaw (5.72%). SLM Solutions and Straumann are based in Germany and Switzerland, respectively, and Renishaw is U.K.-based. Since the fund’s inception in 2016, the annualized return is 4.85% and the year-to-date return is 10.57%. The fund’s expense ratio is 0.66%.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.