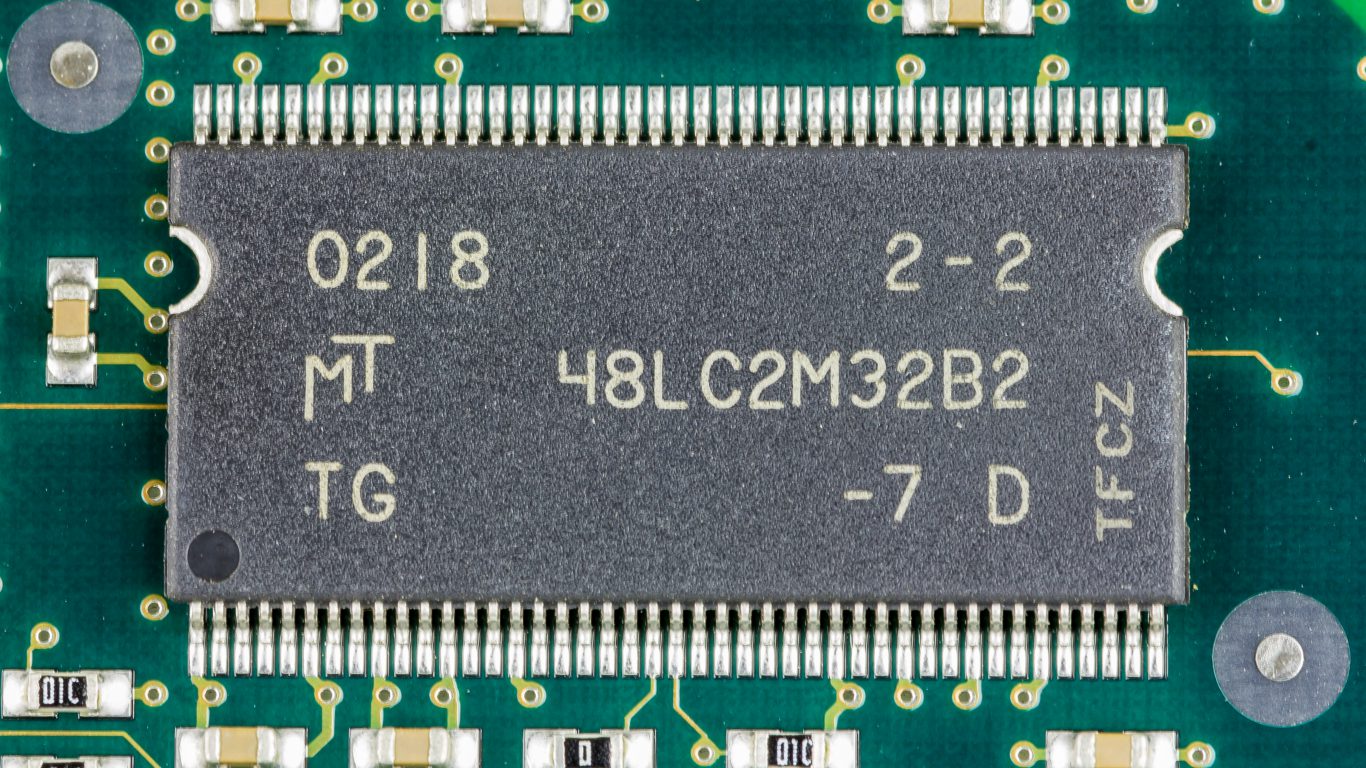

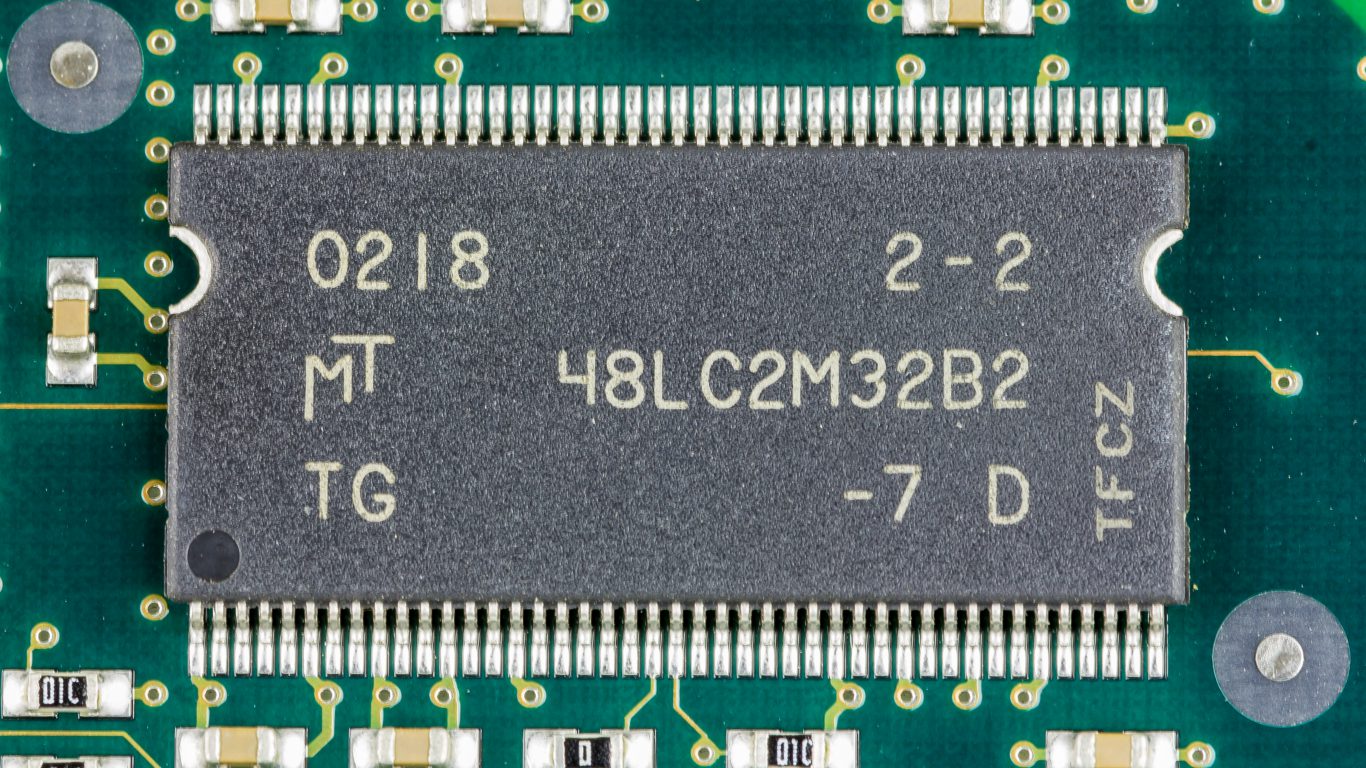

Technology

New Strong Sell Rating on Micron Comes With Drastic Cuts to Earnings Expectations

Published:

Last Updated:

Micron Technology Inc. (NASDAQ: MU) is having one of those days in which sector uneasiness was going to weigh on the shares regardless of the markets. Blame a controversial U.S. Department of Justice ruling against Qualcomm, blame what looks like an extended trade war with China where Micron does so much business or blame more dysfunction in Washington, D.C.

Micron is actually suffering after CFRA’s equity research team issued a downgrade that is likely to raise some eyebrows. The stock was downgraded from Hold to a Strong Sell rating. The firm’s price target was slashed from $46 down to $32 in that call as well, implying nearly 10% more downside, but also implying that the story has deteriorated so much that the bias is very against the stock, even if a big market rally or trade resolution somehow comes from left field.

CFRA cited a below-peer P/E ratio of 8.5 times the firm’s fiscal year 2020 earnings per share estimate of $3.75. The report cited low earnings visibility ahead. The report also noted that its fiscal year 2019 earnings estimate was lowered to $6.06 from $6.40 per share and that 2020 cut was from a prior $5.27 in earnings per share.

Wednesday’s report was issued by Angelo Zino, and he said:

Our downgrade mainly reflects our belief that consensus estimates need to see significant downward revisions. We believe that DRAM prices are unlikely to stabilize in the near term (we estimate over two-thirds of profits) given excessive customer inventories, with both data center and smartphone demand now likely to see more muted sequential growth in 2H.

Zino also warned about Micron’s exposure to China:

Also, we note Micron’s largest customer, Huawei (we estimate at 10%-15% of sales), was placed on the “Entity List” by the Department of Commerce and now assume no revenue on a going forward basis. While we applaud Micron’s ability to improve its balance sheet in recent years, we are growing more concerned about the magnitude of a potential cyclical recovery given the aforementioned issues.

Micron shares were last seen trading down 2.4% at $34.77. Things might have been better had the shares not already been down so much from its highs. Micron has a 52-week range of $28.39 to $64.66, and its consensus sell-side analyst price target was $46.63.

Semiconductor investors can also see how the coming 5G explosion could be a huge boost for four other chip stocks, and fortunately Qualcomm was not on that list.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.