International Business Machines Corp. (NYSE: IBM) is set to report its second-quarter financial results after the closing bell on Wednesday. The consensus forecast calls for $3.07 in earnings per share (EPS) and $19.16 billion in revenue. In the same period of last year, IBM said it EPS of $3.08 and $20.0 billion in revenue.

Back in October of 2018, Big Blue announced a $34 billion agreement to acquire cloud software maker Red Hat. Now that the deal for Red Hat is officially closed, IBM’s stock has gained about 12% since the deal was announced.

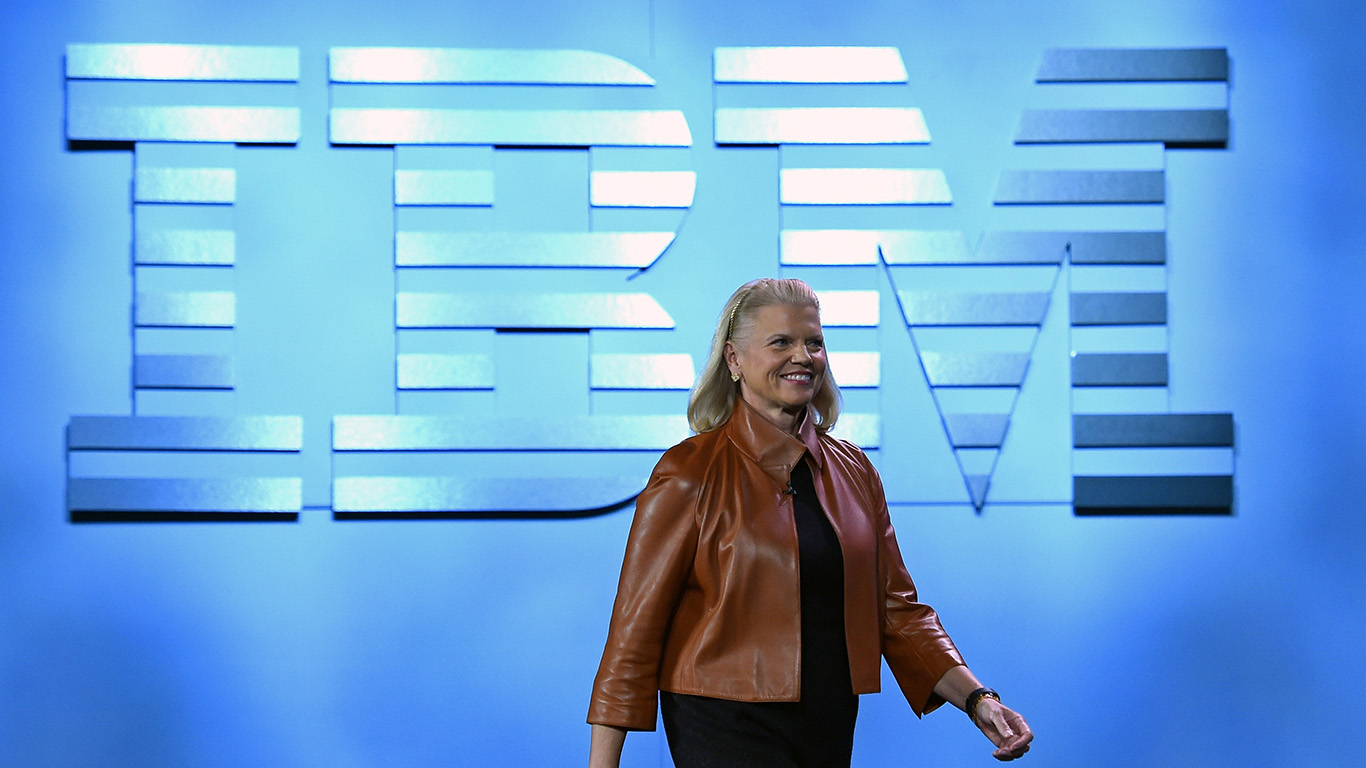

When she announced the deal, IBM CEO Ginni Rometty said this:

The acquisition of Red Hat is a game-changer. It changes everything about the cloud market. IBM will become the world’s #1 hybrid cloud provider, offering companies the only open cloud solution that will unlock the full value of the cloud for their businesses.

By “hybrid cloud,” Rometty means an open-source platform that has to run on competing systems from leading vendors like Amazon’s AWS, Microsoft Azure and Google Cloud. IBM’s hybrid, multi-cloud platform is a first, Rometty claims.

Since 2013, IBM’s cloud services revenue has grown from 4% of total company revenues to 24%, and the company expects Red Hat to add about two points of compound annual growth to that over a five-year period. The big idea is that the IBM/Red Hat platform will permit companies to behave completely agnostically to data stored on-site and on private or public clouds.

A few analysts weighed in on IBM ahead of the report:

- Evercore ISI has an Outperform rating and a $150 price target.

- UBS Group has a Buy rating with a $160 target price.

- BMO Capital Markets rates it as Market Perform with a $155 target.

- Citigroup has a Neutral rating with a $140 target price.

- Credit Suisse has an Outperform rating and a $173 price target.

Shares of IBM traded down fractionally on Wednesday at $142.70, in a 52-week range of $105.94 to $154.36. The consensus price target is $147.21.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.