Technology

Why Semiconductor Capital Equipment Stocks Could Roar Again in 2020

Published:

Last Updated:

After another stellar year for semiconductors and for the capital equipment stocks, many on Wall Street felt that both industries were due for a big-time breather. Given the trade issues and the cyclical nature of the industry, it seemed to make sense. However, commentary from reporting companies in the semiconductor capital equipment space have some rethinking the fourth quarter and 2020, and it could prove to be a much better year than many were anticipating.

In a new Stifel research report, the firm’s lead analyst for semiconductor capital equipment stocks, Patrick Ho, makes the case that based on commentary from Lam Research this week when it presented third-quarter results, not only could 2020 be a solid year for the industry, but it could actually turn into a strong year.

[in-text-ad]

The report noted this in referencing Lam Research management:

We believe management’s commentary, particularly on the NAND flash and Chinese domestic spending fronts, give us more confidence that not only could 2020 represent an “up” year in wafer fabrication equipment or WFE, but potentially a strong recovery year (as in our current +10-20% year-over-year forecast) in spending. We believe management’s comments support our recent NAND flash checks and tracking potential fab build outs in 2020, there is a roadmap for our current WFE outlook or even higher when all is said and done. From a stock’s perspective, while gains in the group clearly reflect a more positive sentiment on 2020, we believe that estimate revisions could still go even higher, particularly as we progress through the year end (2019) and into 2020, when additional color will be provided.

Seven stocks in the capital equipment arena are rated Buy in the report. Here we focused on the four larger-cap industry leaders.

Some on Wall Street feel semiconductor capital equipment leader has the broadest range of exposure to 3D NAND and foundry display. Applied Materials Inc. (NASDAQ: AMAT) is the global leader in precision materials engineering solutions for the semiconductor, flat panel display and solar photovoltaic industries. Applied Material’s technologies help make innovations like smartphones, flat screen TVs and solar panels more affordable and accessible to consumers and businesses around the world.

The analysts are very positive on the stock, and see Applied Materials benefiting not only on the semiconductor side of the business but also from larger, higher resolution and flexible screens on the display side of the business. Applied Materials remains the top pick at Stifel, which believes the company will continue to outperform in the wafer fab equipment arena.

Applied Materials investors receive a 1.57% dividend. The Stifel price target on the shares is $57, and the Wall Street consensus target is $48.38. The stock closed Thursday at $55.07, up almost 9% on the day.

This is another strong, large-cap play for investors looking for exposure to capital equipment. KLA-Tencor Corp. (NASDAQ: KLAC) designs, manufactures and markets process control and yield management solutions worldwide.

It offers chip manufacturing products, such as front-end defect inspection tools, defect review systems, advanced packaging process control systems, metrology solutions, in-situ process monitoring products and lithography software; wafer manufacturing products comprising surface and defect inspection, wafer geometry and nanotopography metrology and data management; and reticle manufacturing products, such as defect inspection and pattern placement metrology products.

Many analysts feel that KLA-Tencor is less cyclical than peers with best-in-class returns. The Orbotech purchase adds growth/diversity and sales/earnings per share accretion. Risks for the shares include industry cyclicality, relatively muted growth and limited operating leverage.

Shareholders receive a 1.81% dividend. Stifel has its price objective set at $1,700, and the consensus target price is $165. The stock closed on Thursday at $168.74, up over 6%.

[in-text-ad]

This remains one of the top chip equipment picks across Wall Street, and it was up big on the bullish report. Lam Research Corp. (NASDAQ: LRCX) designs, manufactures, markets, refurbishes and services semiconductor processing equipment used in the fabrication of integrated circuits. The company offers plasma etch products that remove materials from the wafer to create the features and patterns of a device.

Many Wall Street analysts have highlighted the company and its peers as having a significant equipment opportunity from the NAND evolution as well. Lam Research also appears well positioned to gain share in the wafer fab equipment market, driven by a strong focus on technology inflection spending over the next few years.

The Stifel analysts like the company’s exposure to memory, and they feel the continued strength in the sector is a positive for the coming year. They also think fears of capital intensity are overblown and the company will outpace industry wafer fab equipment trends.

Shareholders receive a 1.78% dividend. The $284 Stifel price target compares with a $194.58 consensus target and the most recent close at $265.60, up almost 14% on Thursday.

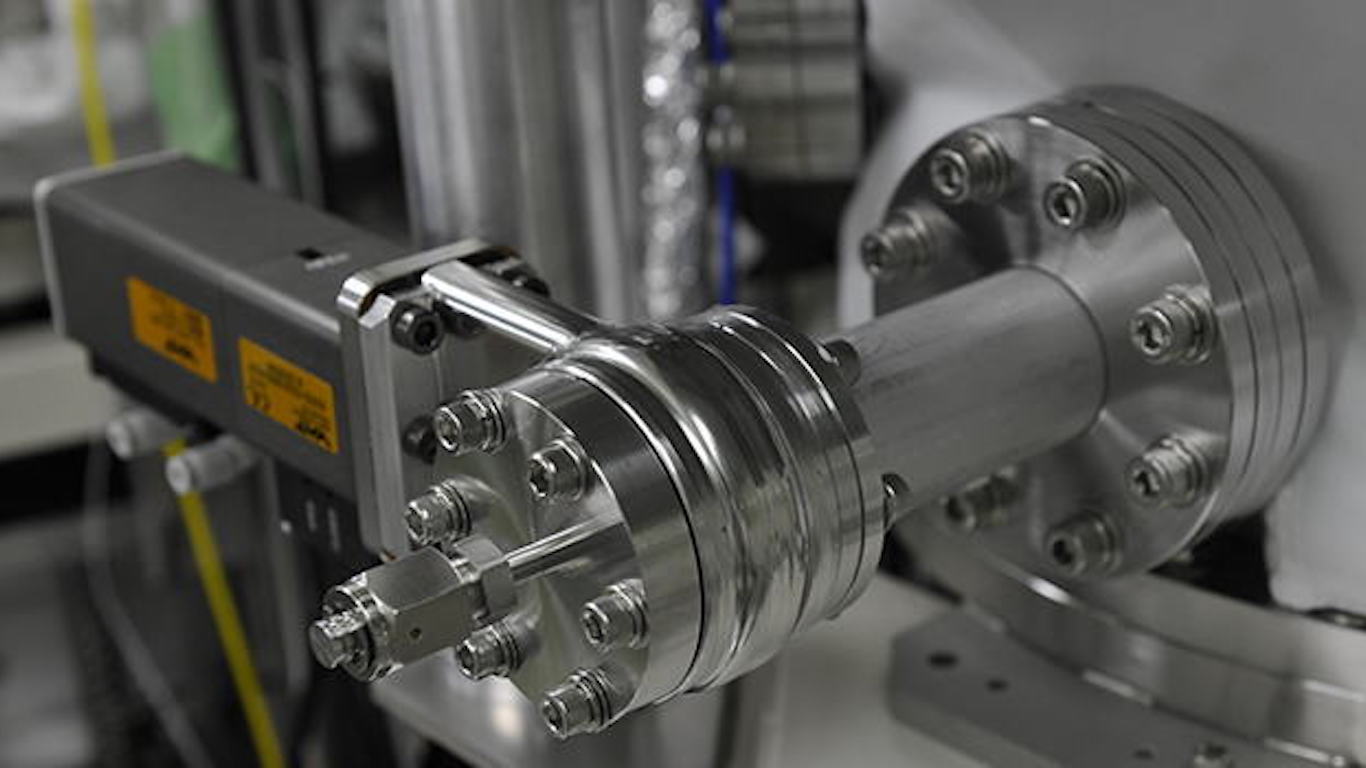

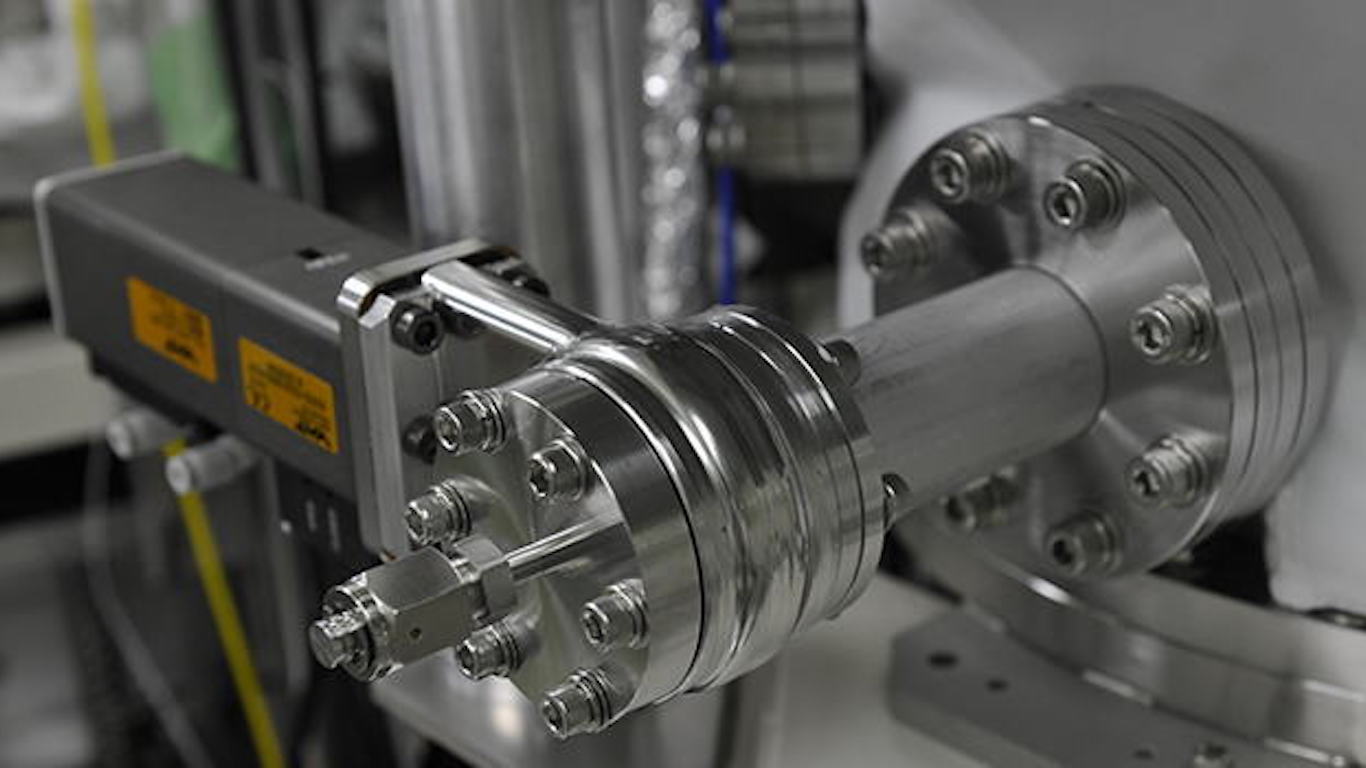

This stock flies somewhat under the radar but offers solid upside. MKS Instruments Inc. (NASDAQ: MKSI) provides instruments, subsystems and process control solutions that measure, control, power, monitor and analyze critical parameters of manufacturing processes in the United States and internationally.

MKS offers pressure measurement and control products used for various pressure ranges and accuracies; materials delivery products, including gas flow measurement products and vacuum valves; automation and control products, such as automation platforms, programmable automation controllers, temperature controllers and software solutions for use in automation, I/O and distributed programmable I/O, gateways and connectivity products; and vacuum products comprising vacuum containment components, effluent management subsystems and custom stainless steel chambers, vessels and pharmaceutical process equipment hardware and housings.

Many on Wall Street have felt for some time that the increase in the Applied Material’s display equipment business will have positive implications for MKS as it supplies many key subsystems for Applied’s display tools. In addition, MKS acquired Newport recently and added the company’s iconic Spectra-Physics laser brand to its product lineup.

MKS offers shareholders a 0.75% dividend. The Stifel price target is $102. The consensus target is $101.57. Shares closed Thursday at $109.49, up almost 16% on another solid earnings report, so the target may be going higher soon.

Noted that these industry giants have had big run-ups this year, and while Lam Research and MKS earnings were outstanding, all the stocks are closing in or at 52-week highs. It may make sense to buy partial positions and wait for pullbacks.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.