When Advanced Micro Devices Inc. (NASDAQ: AMD) reported first-quarter results in late April, the company did not withdraw guidance. Instead, the company said it expects revenue of around $1.85 billion, a year-over-year increase of 21% and a sequential increase of 4%. Adjusted gross margin is expected to dip from 46% to 44% quarter over quarter as the company ramps up production of its next-generation semi-custom products.

AMD also said it expects full-year 2020 revenue to rise in a range of 20% to 30% year over year and expects to realize adjusted gross margin of approximately 45% for the year.

On a conference call Tuesday as part of the Bank of America Securities Global Technology Conference, Devinder Kumar, AMD’s senior vice president and chief financial officer, went into the company’s plans in greater detail. Without ever mentioning the names of Nvidia Corp. (NASDAQ: NVDA) or Intel Corp. (NASDAQ: INTC), Kumar laid out how AMD plans to become cash-flow positive this year and generate a “significant amount of cash” over the next few years.

His comments did not light a fire under AMD’s stock price. Wall Street reacted by taking the shares down slightly as the Dow Jones industrial average rose by just over a full percentage point.

Perhaps AMD deserved to be treated more kindly.

Where AMD Expects Revenue Growth

AMD saw a sequential drop in revenue of around $450 million in the first quarter, which the company attributed to ramping up production of its latest central processing unit (CPU) and graphics processing unit (GPU) chips. The company sees a total available market of $79 billion for its range of products.

The largest piece of AMD’s potential market is the data center space, where Nvidia and AMD have squared off in a fight for some $32 billion. Kumar noted that AMD expects its second-generation EPYC high-performance CPUs to post year-over-year revenue growth of around 25% for the first half of 2020.

More than half of the data center market, some $19 billion, is down to servers. AMD’s third-generation server CPU, code-named Milan, is due to launch by year’s end. Kumar called Milan “an inflection point for the server business.” He expects the data center business to account for “upwards of 30%” of overall revenue over the next several years.

In the graphics processing segment, AMD’s GPU/CPU combination, along with its interconnection technology, have scored two high-performance computing (HPC) wins in the supercomputer space. Next year the company plans to deliver a 1.5 exaflops machine with a 2 exaflops machine on the books for 2024. An exaflop is 1 billion billion floating point operations per second. That is not a typo; an exa-anything is a 1 followed by 18 zeros.

While computer GPUs are often associated with how fast screen displays or gaming consoles can draw pictures, their use as math processors in HPC systems and data center servers may equal or surpass their ability to drive revenue in the gaming sector. AMD projects the total addressable gaming market at $12 billion, and new consoles from Sony and Microsoft, due in time for the 2020 holiday season, are expected to put a jolt into the semi-custom segment.

Has AMD Outpaced Intel in Technology?

Bank of America’s conference moderator, Vivek Arya, commented that “for the first time in AMD’s history, you now have a lead over Intel in terms of process technology.” CFO Kumar modestly accepts the comment, noting that the company has “really pushed the envelope for innovative, high-performance computing design.”

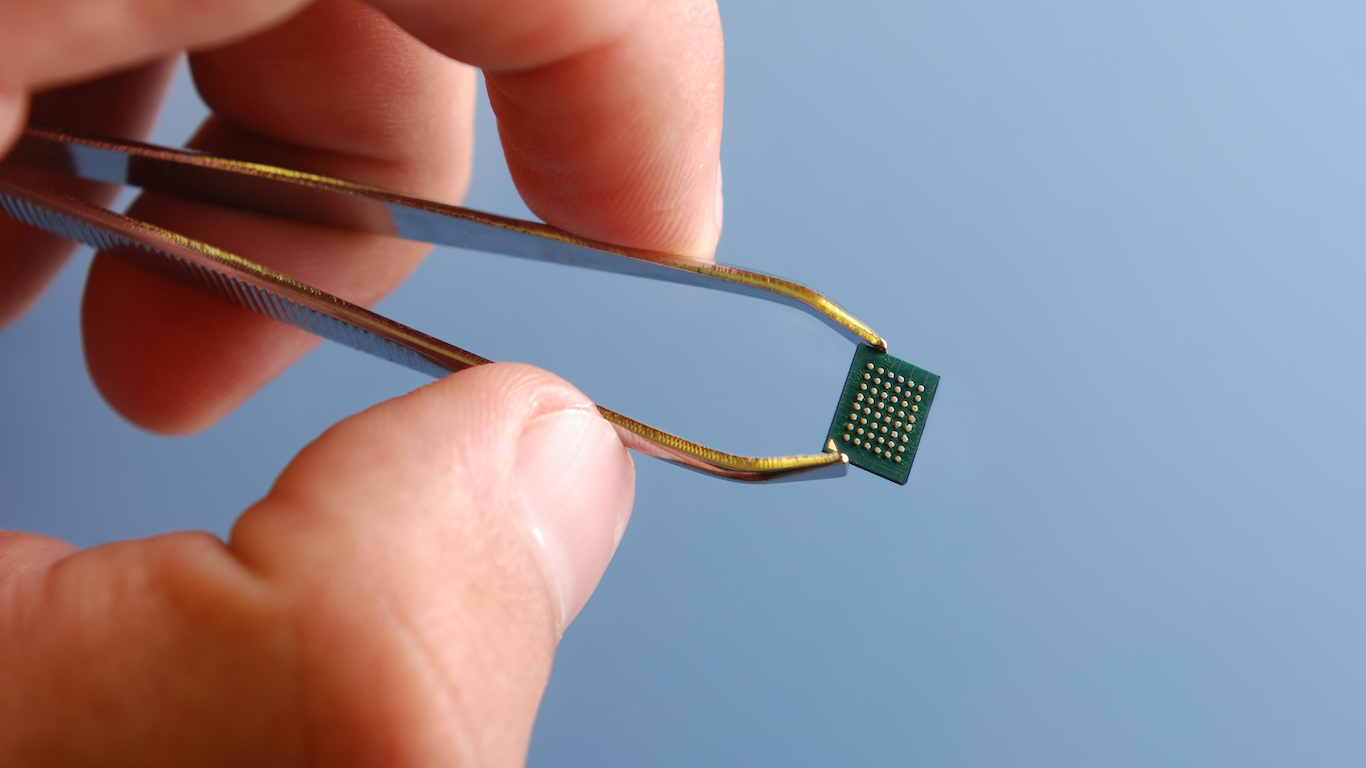

Kumar also acknowledges Taiwan Semiconductor Manufacturing Co. Ltd. (NYSE: TSM), calling the firm “an excellent partner.” AMD and Nvidia are both chip design companies, not manufacturing companies. Both are what is known in the industry as fabless chipmakers. Both also compete for space on TSMC’s production line.

AMD stole a march on Nvidia this year, choosing to focus on 7 nanometer (nm) designs while Nvidia booked 5nm production for 2021 with TSMC and 7nm production for this year with Samsung. Demand has driven Nvidia to seek more capacity for this year than Samsung can supply, while AMD is comfortable with its capacity. For reference, the smaller the number, the more transistors can be packed on a chip and the more difficult and costly it is to fabricate.

For its part, Intel does not expect to regain parity with TSMC or Samsung until it launches its own 7nm parts next year. The firm does expect to return to process technology leadership at the 5nm inflection point. If the company follows the usual technology adoption pattern, Intel will begin shipping 5nm chips in 2023, two years behind TSMC, and also behind AMD and Nvidia.

The $12 billion TSMC wafer plant the company has proposed building in Arizona could be completed by 2024 and will produce 5nm chips. The plant is expected to produce about 20,000 wafers a month. Assuming a 12-inch (300mm) wafer and a chip size of 100 square millimeters, a single wafer could produce around 640 such chips for a total of 12.8 million a month or about 154 million chips a year. This year, TSMC will produce about 13 million 12-inch wafers, enough for about 8.3 billion chips.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.