Technology

High-Riding Nvidia Stock Doesn't Quell Investors' Questions

Published:

Last Updated:

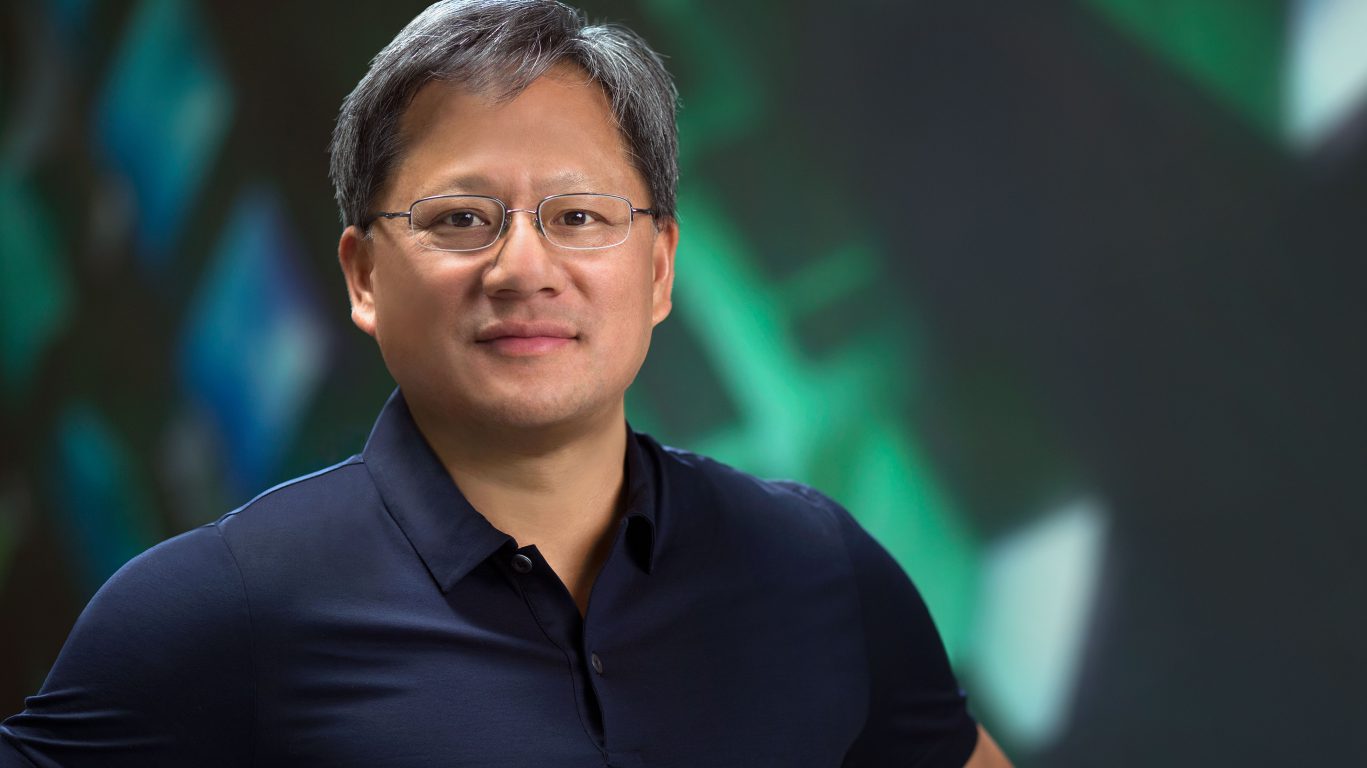

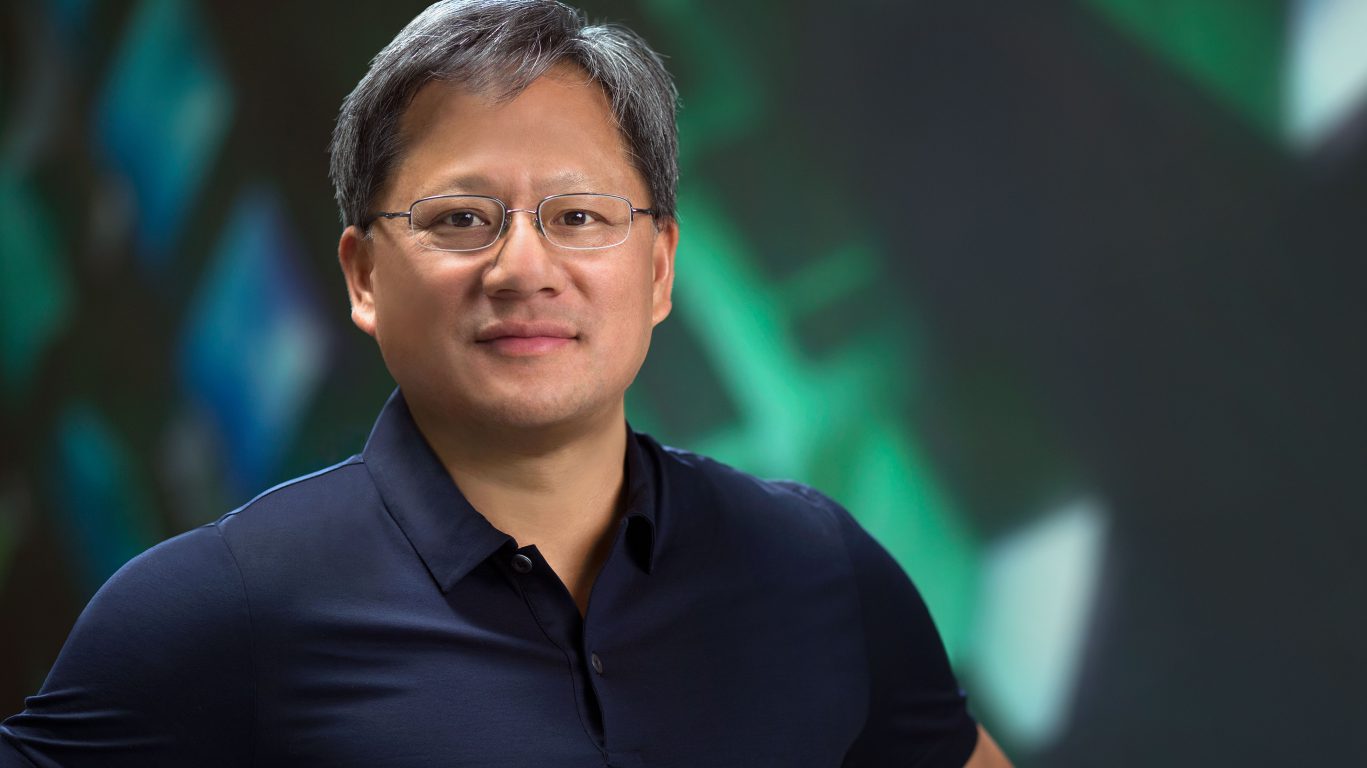

Investors in Nvidia (NASDAQ: NVDA) who tuned in to the livestreamed annual shareholders meeting on Tuesday heard lots of good news from Chief Executive Jensen Huang and other top executives.

The company’s share price has risen by more than 160% over the last year and has weathered the COVID-19 pandemic crisis this year. In May alone, the NVDA stock price increased 21.5%. Nvidia has outpaced both the S&P 500 index and the Dow Jones industrial average.

Even though Nvidia is near record highs, the consensus among analysts who follow the stock is that investors should purchase it. That is based on 31 Buy ratings, 4 Holds and 4 Sells. The median price target is $344.14, which is below Wednesday’s closing price of $374.95.

Although results for fiscal year 2020 showed a 7% decrease in revenue and a 32% drop in earnings per share, the fourth quarter figures were positive. Revenue showed a 41% increase year over year and EPS increased by 66%.

Nvidia recently closed its $7 billion acquisition of Mellanox. The addition of Mellanox is expected to push Nvidia’s data center segment revenues above gaming segment revenues in the second quarter. In the first quarter, gaming brought in $1.34 billion in revenue, compared with data center revenues of $1.14 billion. Data center revenues rose 18% sequentially and 80% year over year.

Rising demand for artificial intelligence and machine learning are expected to drive Nvidia’s stock price, with the global AI market set to grow to more than $200 billion by 2026. That growth will come from multiple sectors, including manufacturing, with China, Japan and South Korea deploying tens of thousands of sophisticated manufacturing robots in the past few years.

No shareholder initiatives were on the agenda Tuesday. Investors approved four company-backed proposals: the appointment of PriceWaterhouseCoopers as the company’s accounting firm; the company’s equity incentive plan and employee stock purchase plan; compensation for senior executives; and re-election of 11 members of the board of directors. (A 12th director retired from the board.)

On compensation, the board recommended roughly the same levels for 2020 as the five named executives received in 2019.

Huang will earn $11.5 million in 2020, compared with $12.6 million a year ago. That is significantly less than the chief executive of one of Nvidia’s main rivals receives. Advanced Micro Devices (NYSE: AMD) paid Dr. Lisa Su $58.5 million in 2019, including a base salary of just over $1 million and stock awards totaling $53.2 million. In 2019, Dr. Su was at the top of the list of highly compensated chief executives.

Nvidia’s chief financial officer, Colette M. Kress, will earn $4.4 million, compared with $5.0 million last year. Executive vice president of worldwide field operations Ajay K. Puri is to be paid $4.9 million, compared to $5.5 million in 2019, while executive vice president of operations Debora Shoquist will be paid $3.5 million, compared with $3.9 million last year. Timothy S. Teter, executive vice president, general counsel and board secretary, will be paid $3.0 million.

All four proposals passed. Then shareholders raised questions in writing about Nvidia’s commitment to diversity, starting with the board.

“I want the board to be composed of the best,” an anonymous questioner wrote. “Having said that, it would be great to have more Latinos and diversity. Do you take into consideration diversity in the board? Why does it appear that there are so few women on your board of directors? Some of the names that appear to me to be men’s names are women’s names. But why does there continue to be a lack of diversity on these boards, no people of color? It is a sad commentary on the vision of this company.”

Huang responded that the company had made progress, including with the diversity of its board, but that it needed to do more. He said that he was committed to increasing “a diverse population at every level of our company.”

The 11 board members who were re-elected Tuesday included two women and no African Americans. Huang, who has a seat on the board, is Taiwanese-American.

Another anonymous shareholder asked about diversity among Nvidia’s employees and whether the company would hire more immigrant employees who are not Asian.

In fiscal year 2019, the company’s workforce was 50.2% Asian or Indian, 3.3 % Hispanic or Latino and 1.0% black, according to the Nvidia website. Whites accounted for 38.7% of the company’s employees. These numbers were relatively unchanged from fiscal year 2018.

The workforce is nearly 19% female, the website says, up from 16% three years ago. Women account for 40% of the named executive officers and 25% of executive staff.

Nvidia also voices support for LGBTQ employees on its website.

Another shareholder asked what Nvidia is doing to help resolve the climate crisis.

“The best way for Nvidia to address the climate crisis will be to continue advancing accelerated computing,” Huang said. “This will enable researchers to more quickly discover technologies that improve sustainable energy sources and invent more energy efficient transportation.”

He said the company was striving to eliminate its carbon footprint by making its buildings energy efficient.

“Some of our global buildings are running at 100% renewable energy,” Huang said.

He added that the company is moving to reduce energy, water and waste in all its endeavors.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.