In the early to middle part of the decade just past, 3D printing and companies that made 3D printers were all the rage. Two of the most popular companies in the industry reported second-quarter earnings Wednesday, and both put up dispiriting numbers.

3D Systems Corp. (NYSE: DDD) reported quarterly revenue of $112.1 million, down nearly 29% year over year, and a net loss per share of $0.13, below the consensus estimate calling for a loss of $0.10 a share. Shutdowns related to COVID-19 get the blame for the sorry showing.

Stratasys Ltd. (NASDAQ: SSYS) reported second-quarter revenue of $117.6 million and a net loss per share of $0.13, better than the consensus estimate for a loss of $0.20 per share, but down by more than 180% year over year.

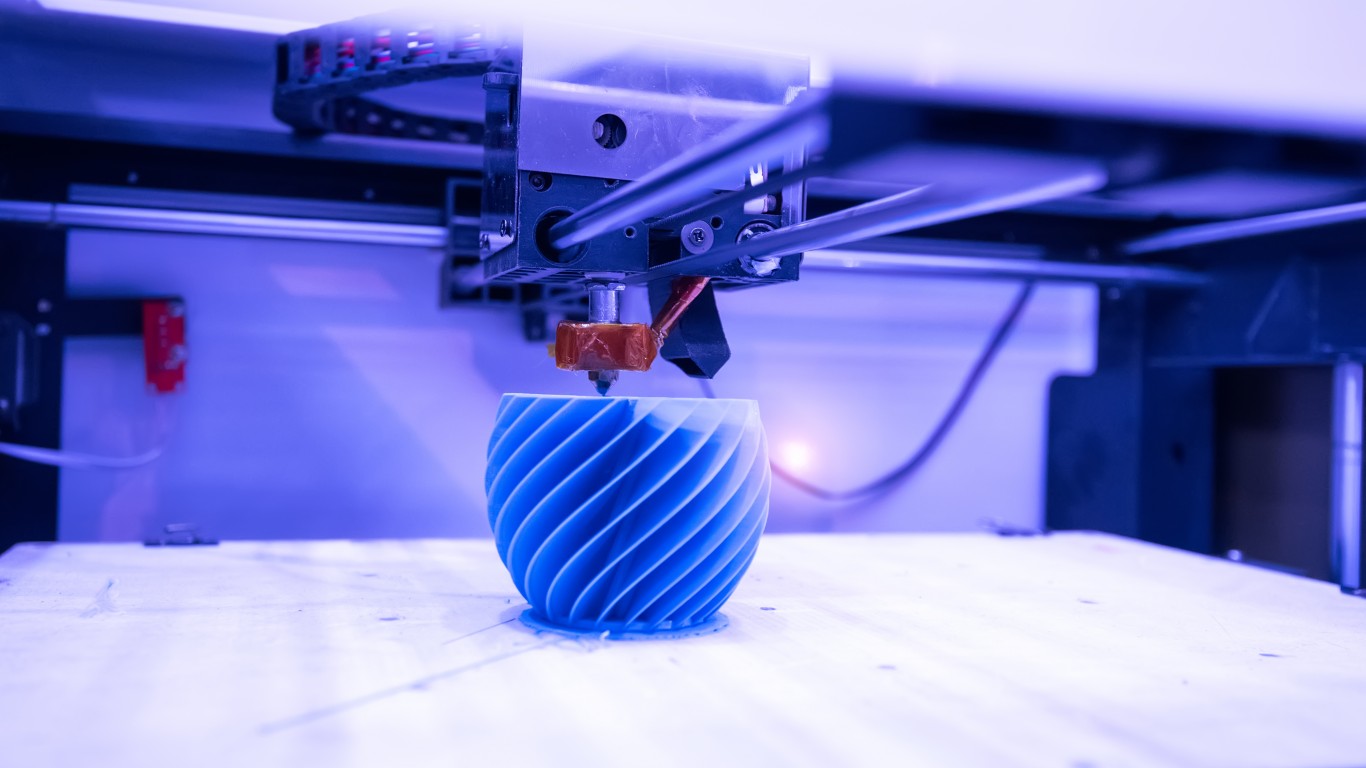

While 3D printing has carved a niche for itself in the rapid prototyping and additive manufacturing space, it never caught on in the consumer space. The failure was not for lack of trying.

3D Systems launched a website called Cubify in 2013 that would convert a headshot photo into a 3D action figure for just $65. The site was discontinued last September.

The following year, Stratasys cut a deal with the now-defunct Martha Stewart Omnimedia to create unique colors and templates to make a variety of Martha Stewart designs. The remains of Martha Stewart’s eponymous company was acquired last year by Marquee Brands. Stratasys no longer offers the brand.

Lacking a grip on consumers’ imagination meant that 3D printing companies had to make headway into the industrial and manufacturing sectors. 3D printers for these applications are far more expensive, but there are only a relative handful of customers to sell to. There was really no other choice if the companies wanted to survive.

Of the two 3D printing companies, Stratasys may have brighter near-term prospects. Both are projected to post net losses in 2020, but analysts think Stratasys will post earnings per share of $0.31 in 2021 compared to a (smaller) net loss of $0.00 per share for 3D Systems.

Revenue estimates for this year call for $510.7 million at Stratasys and $527 million for 3D Systems. In 2021, analysts are forecasting 3D Systems revenue at $571.7 million while Stratasys revenue is pegged at $558.5 million.

Both Ford and Boeing have been using Stratasys large-scale printers for several years to prototype both tools and large production pieces for automobiles and airplanes. While this could be a lucrative market for the company, the drawn-out effects of the coronavirus pandemic could dilute any potential near-term gain.

In the first hour of trading Thursday morning, Stratasys shares traded down about 2.7%, at $15.47 in a 52-week range of $12.18 to $25.52. The stock’s consensus price target is $17.25. At its peak in December 2013, Stratasys stock traded at around $135 a share.

3D Systems stock traded down about 8.8% to $6.44, in a 52-week range of $5.20 to $12.56. The consensus price target is $8.25. At its peak in December 2013, 3D Systems shares traded at more than $92 a share.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.