Banking, finance, and taxes

Was the Ant Financial IPO Delayed by a Regulatory Clampdown?

Published:

Chinese regulators and executives of Ant Financial have issued a joint statement announcing a temporary delay in the Chinese fintech giant’s initial public offering (IPO) in both Shanghai and Hong Kong. Alibaba Group Holding Co. (NYSE: BABA) owns a 33% stake in Ant Financial, and the company’s stock took a beating in early trading Tuesday.

The IPO had been scheduled for Thursday, November 5, and analysts were expecting the total amount raised to be a record-setting $39.7 billion.

According to a filing at the Shanghai Exchange, “The financial technology regulatory environment has … changed. Relevant matters may cause the issuer to fail to meet the relevant issuance and listing conditions or information disclosure requirements of the [Shanghai Stock Exchange] Science and Technology Innovation Board.”

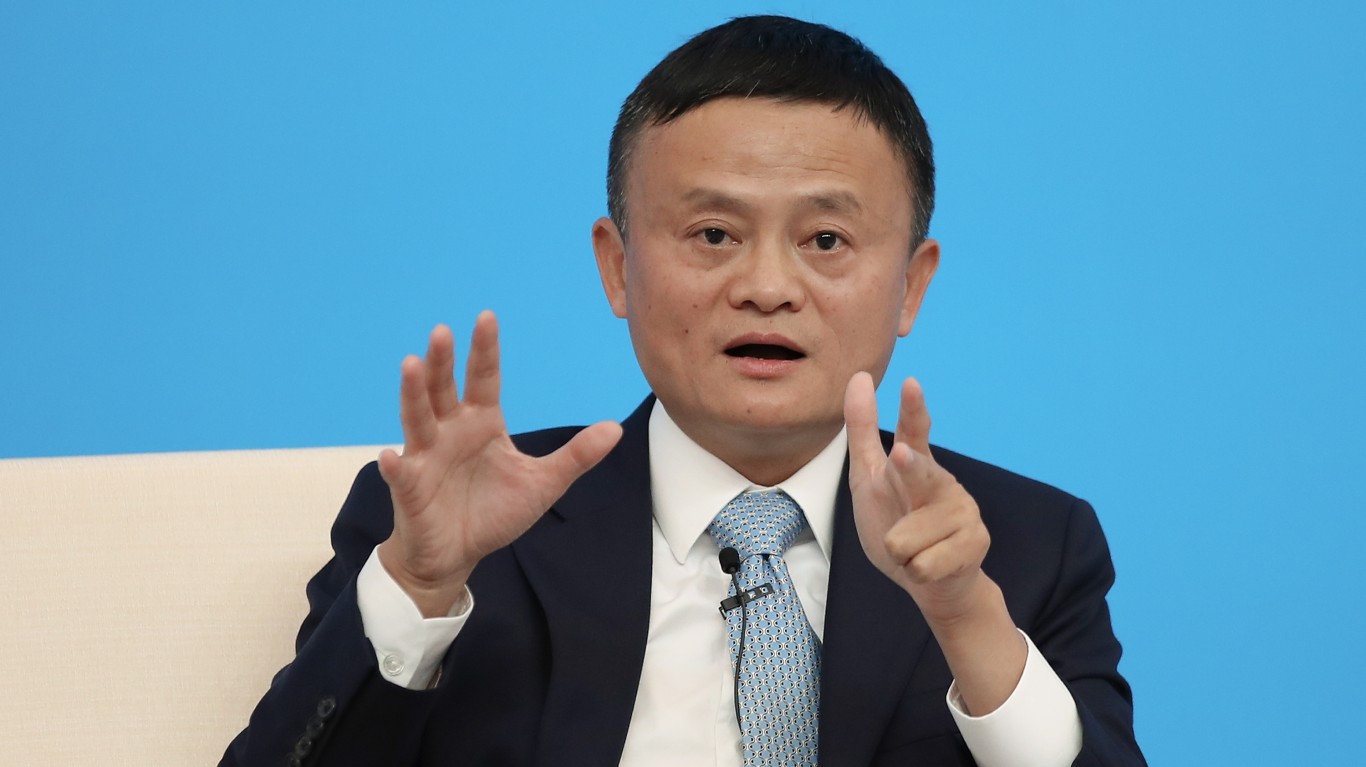

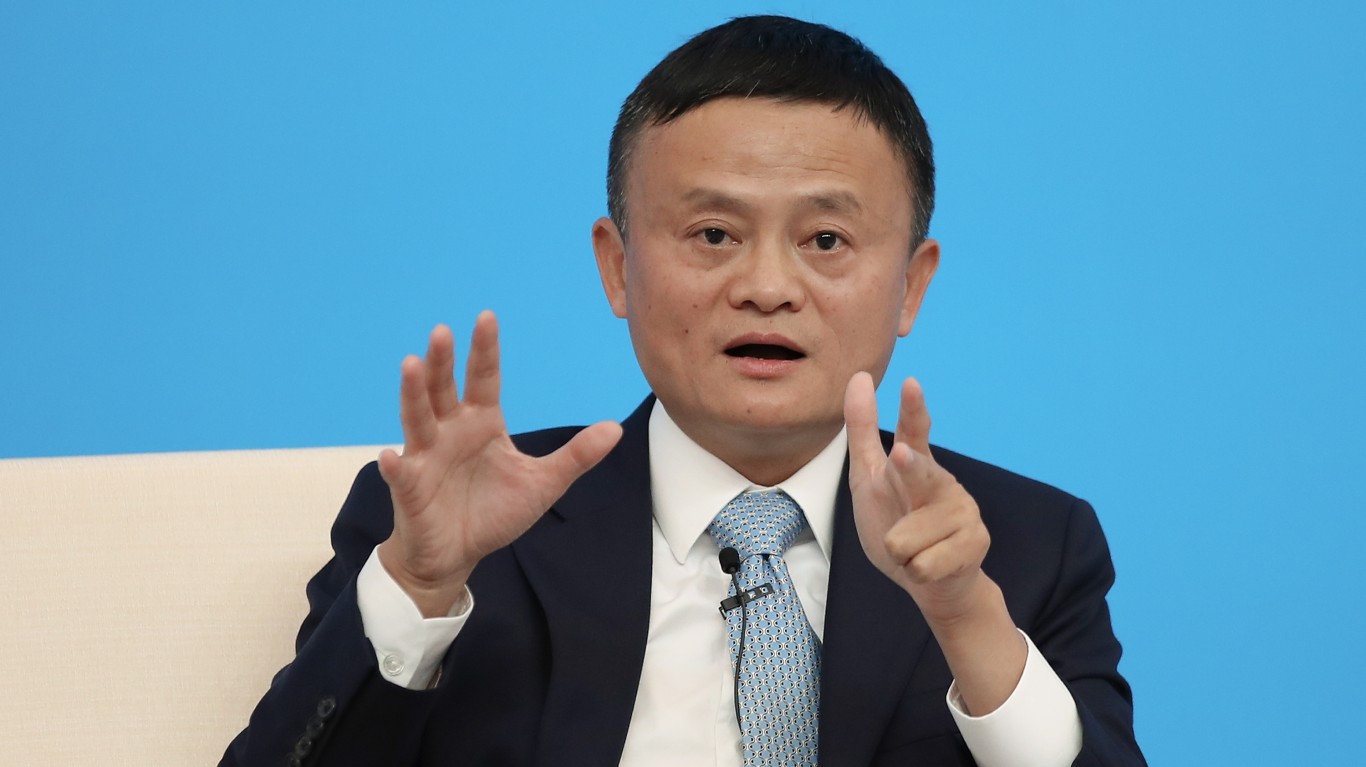

The South China Morning Post (SCMP) reported that four Chinese regulatory agencies met with Ant Financial executives, including Jack Ma, founder of Alibaba and co-founder of Ant Financial. The purpose of the meeting was not revealed, and the regulatory agencies included the China Banking and Insurance Regulatory Commission, the China Securities Regulatory Commission and the currency regulator, the State Administration of Foreign Exchange (SAFE).

Also on Monday, Chinese financial regulators drafted new rules governing the soaring market for small loans (microlending) in the world’s second-largest economy. Ant Financial was viewed as a river of liquidity to China’s small business owners and individuals unable to obtain loans from the country’s traditional banks. Without access to the fintech lenders, borrowers would have to pay up to 30% interest to loan sharks, financial services consultant Zennon Kapron told the SCMP.

Regulators want to reduce debt in the financial system and one way to accomplish that is to chip away at the profits microlenders like Ant Financial could realize by raising compliance costs, reducing the maximum size of loans and forcing the fintechs to put more of their own capital on the line.

The SCMP reported that at the end of September, there were 7,227 microfinance companies in China with 902 billion yuan ($135 billion) in loans outstanding.

A governor of China’s central bank commented that microlending regulations need to consider consumer privacy protection and protection of companies’ proprietary information. “This is a big challenge that worries me,” said Yi Gang.

Ant Financial received $3 trillion in bids from retail investors for its Shanghai shares, overbidding the supply of Shanghai shares by 870 times and the supply of Hong Kong shares by 389 times. Retail investors were to have been notified on Wednesday of whether their bids were successful.

Alibaba’s stock price dropped by more than 9% early Tuesday morning but has recovered some ground and traded down about 6%, at $291.93 in a 52-week range of $169.95 to 319.32. The consensus 12-month price target on the stock is $334.47.

The Chinese e-commerce site is scheduled to report third-quarter results Thursday. Analysts are looking for quarterly earnings per share of $2.11 on revenue of $23.1 billion, compared with earnings of $1.85 per share in the year-ago quarter on revenue of $15 billion.

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.