Evercore analyst Amit Daryanani raised his forecast for the price of Apple Inc. (NASDAQ: AAPL) shares to $160. The stock currently trades near $143, and its market cap is $2.44 billion. His new target is based largely on Apple’s plans to launch its own car. He is the second analyst to sharply raise his forecast for the share price recently. Wedbush analyst Dan Ives has predicted Apple’s market cap will reach $3 trillion in the next 12 to 18 months, based on sales of the Apple iPhone 12.

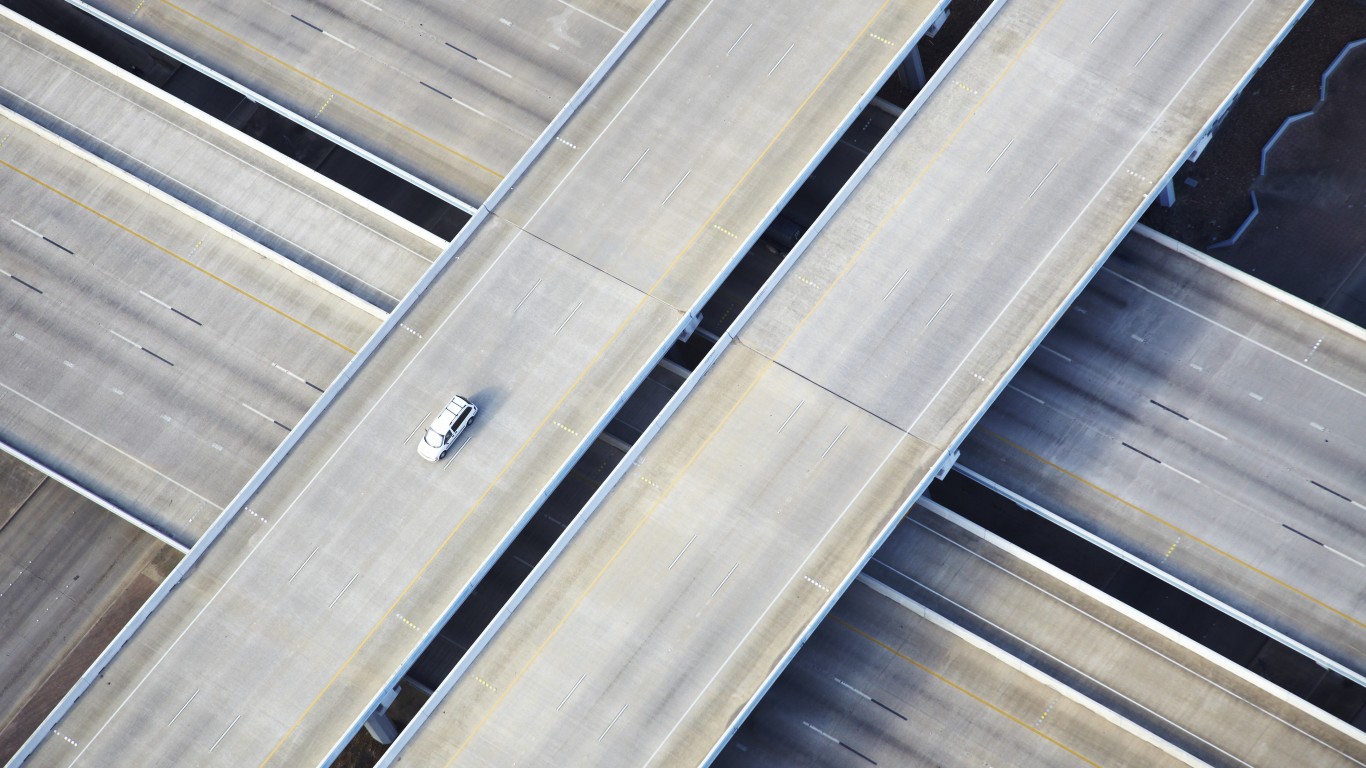

The two analysts have charted different paths to a higher share price. Daryanani believes a car could push Apple’s revenue up by $36 billion a year. It will be, he says, a computer on wheels, just as the iPhone is a “computer in your pocket.” Ives believes Apple iPhone 12 sales are part of a “supercycle” of iPhone upgrades that will take sales of the smartphone to all-time records.

The other primary difference between the two forecasts is one is based on events that will occur in 2021, and the other on a product launch that is at minimum three years away. The iPhone does have stiff competition from companies led by Samsung. However, analysts believe that the iPhone is far more profitable than other smartphones, so increased sales also mean increased profits. Apple’s share price, based on this argument, will rise with a gain in earnings.

The supercycle will be part of a global upgrade to superfast 5G service, the first change in wireless standards in a decade. In the United States, the upgrades are driven primarily by AT&T, Verizon and T-Mobile. Sales also have jumped in Europe and in China, the world’s largest wireless market with a wireless user base of well over twice the U.S. number.

The Apple car will be released in 2024, at the earliest. According to sparse press reports, it will be both an electric and autonomous vehicle. That will put it squarely in competition with Tesla and most of the world’s largest car manufacturers. It also will be up against tech companies such as Alphabet’s Waymo. It would be easy to count Apple out of this market early, but it is no more competitive than the smartphone market is today.

Another very simple argument for an Apple $3 trillion valuation is the current trajectory of its stock. It has risen 80% in the past year and continues to rise more quickly than the broader market.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.