For the first time this year, Apple Inc. (NASDAQ: AAPL) has seen its market cap dip below $2 trillion. Shortly after Monday’s opening bell, the world’s most valuable company’s market cap dropped from $2.048 trillion as of Friday’s close to around $1.987 trillion.

Only 24 U.S.-listed companies have market caps of between $150 billion and $200 billion, and only 37 are valued at more than $200 billion. Apple still tops the list, with Microsoft ($1.71 trillion), Amazon ($1.499 trillion) and Alphabet ($1.447 trillion) the only other U.S. firms north of $1 trillion.

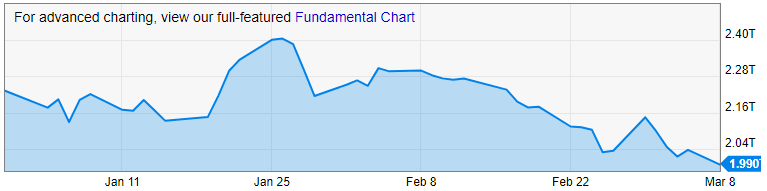

Since closing at a peak valuation of $2.403 trillion on January 26, Apple’s market cap has declined by 17%. Since we last looked at the number on February 19, the company’s market cap has dropped by 8.8%.

Apple’s share price (and market cap) began sliding on January 27, coincidentally the day that Apple released its fiscal first-quarter report. Must have been a lousy quarter, right?

Well, not really. Apple reported earnings per share of $1.68, beating the consensus estimate by 19%, and revenue of $111.4 billion, better than the forecast by nearly 8%. iPhone revenue rose by 17% year over year to a whopping $65.6 billion, while sales of Mac computers rose 21% to $8.7 billion, iPad sales rose 42% and Services revenues jumped 24% to $15.8 billion.

Since the beginning of the year, the 76 stocks that comprise the S&P 500 tech sector have only dropped about 14.5 index points (about 0.6%). Many of the best-performing tech stocks (Applied Materials, up nearly 31%; Intel, up 22%; Micron, up 18%; and Lam Research, up 16%) are chip equipment makers and chipmakers that are riding a wave of semiconductor shortages for all types of chips.

Some of the stocks posting the largest declines are also chip stocks, like Qualcomm (down 17%) and AMD (down 14.5%), but the losses overall are smaller than the gains.

Apple has become a victim of its own success. Warren Buffett’s Berkshire Hathaway sold nearly 10 million shares of Apple stock in the quarter for just over $1 billion. Buffett is Apple’s second-largest shareholder. Vanguard Group, Apple’s largest shareholder, sold more than 25 million shares of the stock in the December quarter, dropping its stake in Apple from 7.53% to 7.48%, according to MarketWatch. Buffett’s stake dipped from 5.55% to 5.28%.

Apple’s other issue is that the company generates so much cash that its stock can sometimes trade in the same way as government or corporate bonds. Bond markets have been worrying about inflation and likely higher interest rates. Inflation lowers the value of bonds that provide investors with a reliable stream of cash flows over the long-term.

Apple’s free cash flow during its 2020 fiscal year totaled $73.7 billion. That’s more than the gross domestic product of nearly 120 countries. Any threat to that cash flow from inflation or rising interest rates is a signal to investors that it might be a good time to sell.

Shares traded down about 2.2% Monday morning, at $118.75 in a 52-week range of $53.15 to $145.09. The consensus price target on the stock is $151.75. Apple’s average daily trading volume is nearly 110 million shares.

“The Next NVIDIA” Could Change Your Life

If you missed out on NVIDIA’s historic run, your chance to see life-changing profits from AI isn’t over.

The 24/7 Wall Street Analyst who first called NVIDIA’s AI-fueled rise in 2009 just published a brand-new research report named “The Next NVIDIA.”

Click here to download your FREE copy.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.