Technology

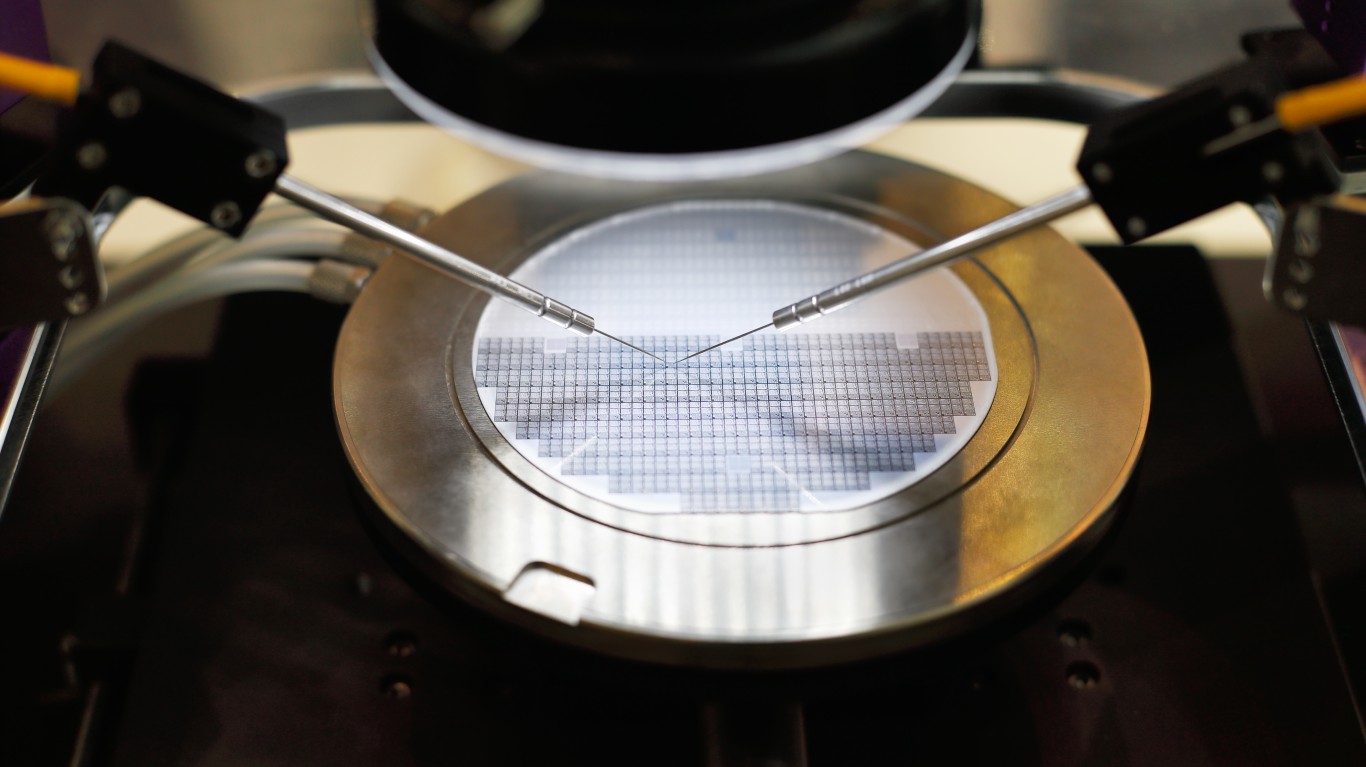

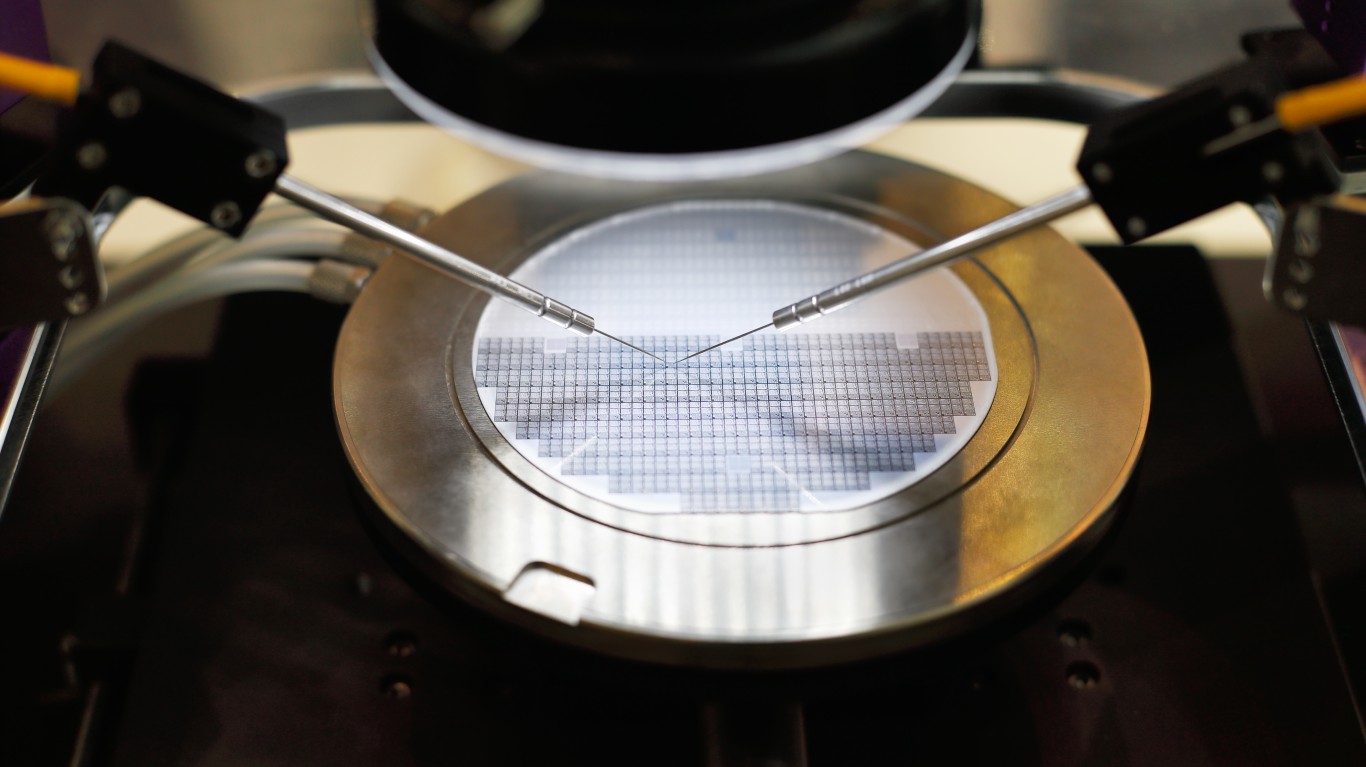

Semiconductor Equipment Sell-Off Overdone: Jump on These 5 Stocks Now

Published:

Interest rate and inflation concerns have absolutely blasted the technology sector recently. While some of the selling may continue, Stifel semiconductor capital equipment analysts Patrick Ho and Brian Chin and their team say now is the time to start buying some of the top stocks in the industry. With a pledge from President Joe Biden to help the chip sector as a tailwind, and continued demand expected as the year goes on, aggressive investors may want to start nibbling at some of the top stocks now.

[in-text-ad]

With the industry leaders looking to expand as demand for semiconductors has grown exponentially, the beat-down on the sector after a strong 2020 really comes as no huge surprise. Stifel remains very bullish and noted this:

With recent volatility in tech stocks and some concerns over demand, we wanted to reiterate our positive stance on the group and note that this recent sell-off is now overdone. Our recent checks indicate that broader demand at leading foundry and memory manufacturers remains firmly intact, most notably at the advanced nodes. While there are clearly pockets of weakness (and perhaps a possible looming inventory correction) related to some Chinese markets (like low to mid-range smartphones), advanced nodes across mobility (high-end smartphones) and high-performance computing (HPC) remain in high demand. In fact, for several of these markets, there are some supply constraints, but overall wafer starts remain on track (or have even been raised). We believe demand trends continue to be very healthy, and there have been no changes in terms of 2021 capex/equipment spending plans.

The analysts remain focused on five top stocks that are all rated Buy at the firm. It is important to remember that no single analyst report should be used as a sole basis for any buying or selling decision.

This is a premier semiconductor capital equipment stock. Applied Materials Inc. (NASDAQ: AMAT) provides manufacturing equipment, services and software to the semiconductor, display and related industries. It operates through three segments.

The Semiconductor Systems segment develops, manufactures and sells various manufacturing equipment that is used to fabricate semiconductor chips or integrated circuits. This segment also offers various technologies, including epitaxy, ion implantation, oxidation/nitridation, rapid thermal processing, physical vapor deposition, chemical vapor deposition, chemical mechanical planarization, electrochemical deposition, atomic layer deposition, etching and selective deposition and removal, as well as metrology and inspection tools.

The Applied Global Services segment provides integrated solutions to optimize equipment and fab performance and productivity comprising spares, upgrades, services, remanufactured earlier generation equipment and factory automation software for semiconductor, display and other products.

The Display and Adjacent Markets segment offers products for manufacturing liquid crystal displays, organic light-emitting diodes and other display technologies for TVs, monitors, laptops, personal computers, electronic tablets, smartphones and other consumer-oriented devices, as well as equipment for processing flexible substrates.

Investors receive just a 0.74% dividend. The Stifel price target for the shares is $160, while the Wall Street consensus is $155.28. Applied Materials stock rose over 4% on Thursday to close at $130.31 a share.

This outstanding mid-cap play has seen some very solid insider buying over the past year. Entegris Inc. (NASDAQ: ENTG) engages in the development, manufacture and supply of specialty materials for the microelectronics industry.

[in-text-ad]

Entegris operates through these business segments:

Shareholders receive a 0.26% dividend. Stifel has a price target of $127, in line with the $126.90 consensus target. Thursday’s $111.16 closing print came after an almost 3% gain for the day.

This stock flies somewhat lower under the radar but offers solid upside. MKS Instruments Inc. (NASDAQ: MKSI) provides instruments, subsystems and process control solutions that measure, control, power, monitor and analyze critical parameters of manufacturing processes in the United States and internationally.

MKS offers pressure measurement and control products used for various pressure ranges and accuracies; materials delivery products, including gas flow measurement products and vacuum valves; automation and control products, such as automation platforms, programmable automation controllers, temperature controllers and software solutions for use in automation, I/O and distributed programmable I/O, gateways and connectivity products; and vacuum products comprising vacuum containment components, effluent management subsystems and custom stainless steel chambers vessels, and pharmaceutical process equipment hardware and housings.

Many on Wall Street have felt for some time that the increase in the Applied Material display equipment business will have positive implications for MKS as it supplies many key subsystems for Applied’s display tools. In 2017, MKS acquired Newport and added the company’s iconic Spectra-Physics laser brand to its product lineup.

Shareholders receive a 0.93% dividend. The $250 Stifel price target is well above the $230.90 consensus target. Shares closed Thursday at $188.06, which was up 3% on the day.

This is another off-the-radar stock that offers investors an excellent entry point. Onto Innovations Inc. (NASDAQ: ONTO) engages in the design, development, manufacture and support of process control tools that perform macro defect inspection and metrology, lithography systems and process control analytical software worldwide.

[in-text-ad]

The company offers process and yield management solutions and device packaging and test facilities through standalone systems for macro-defect inspection, packaging lithography, probe card test and analysis and transparent and opaque thin film measurements. Its process control software portfolio includes solutions for standalone tools, groups of tools or factorywide suites.

Onto also provides spare parts and software licensing services. Its products are used by semiconductor wafer and advanced packaging device manufacturers; silicon wafer and include light-emitting diode, vertical-cavity surface-emitting laser, micro-electromechanical system, CMOS image sensor, power device, RF filter data storage and various industrial and scientific applications.

Stifel has set an $84 price target. That is the same as the consensus target. Thursday’s final trade at $63.97 a share followed an almost 5% rise for the day.

This stock has been hammered, but Stifel still sees big-time upside potential. Veeco Instruments Inc. (NASDAQ: VECO) develops, manufactures, sells and supports semiconductor and thin-film process equipment primarily to make electronic devices worldwide.

The company offers laser annealing, ion beam deposition and etch, metal organic chemical vapor deposition, single wafer wet processing and surface preparation, molecular beam epitaxy and atomic layer deposition and other deposition systems, as well as packaging lithography equipment. Its process equipment systems are used in the production of a range of microelectronic components, including logic, dynamic random-access memory, photonics devices, power electronics, radio frequency filters and amplifiers, thin-film magnetic heads and other semiconductor devices.

Veeco markets and sells its products to integrated device manufacturers and foundries; outsourced semiconductor assembly and test, hard disk drive and photonics manufacturers; and research centers and universities.

Stifel has a $26 price target on Veeco Instruments stock. The $28.33 consensus is higher, and Thursday’s close was at $22.62, which was a 2% gain on the day.

Despite the well-founded bullishness at Stifel, the market is very overbought. With inflation concerns mounting and seasonal summer slowdowns on Wall Street coming, it may make sense to buy partial positions now and scale into more stock over the course of the summer.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.