Chinese e-commerce giant Alibaba Group Holding Ltd. (NYSE: BABA) said Tuesday morning that it would raise its stock buyback program from $15 billion to $25 billion. A year ago, the company boosted its stock repurchase plan from $10 billion to $15 billion. The increased buyback program will be effective through March 2024, the company said in its announcement.

As of last Friday, Alibaba had repurchased 56.2 million American depositary shares (ADSs) for a total of $9.2 billion. Each ADS represents eight ordinary shares of the company’s stock.

The increased buyback program is “a sign of confidence about the Company’s continued growth in the future” and that was certainly needed and welcomed by investors. Over the past 12 months, Alibaba’s ADSs dropped nearly 57% of their value. The shares traded up by as much as 14% Tuesday morning. And that was at the low end of the gains posted by a whole host of Chinese shares.

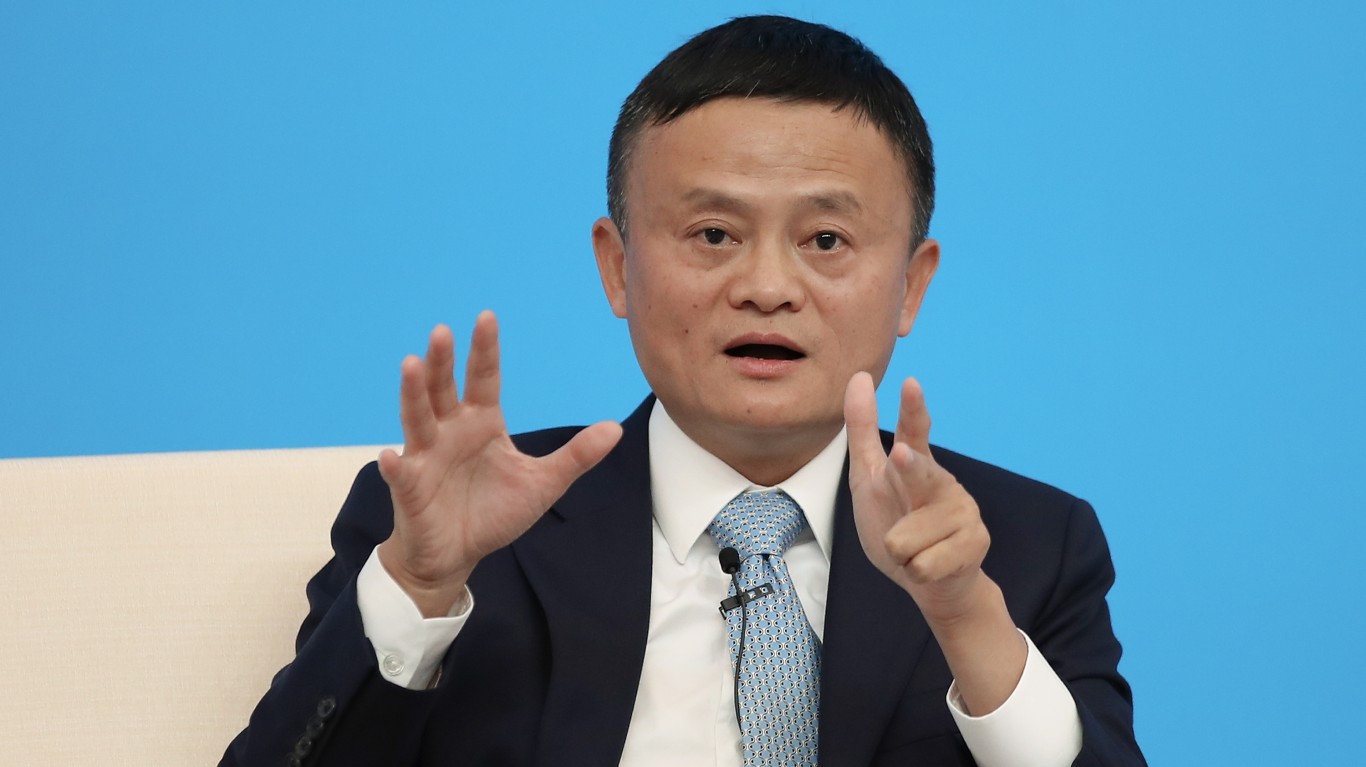

The across-the-board increases are also due in part to recent statements by Chinese regulators that indicate a softening of the government’s hardline against its big tech companies. Alibaba and its founder Jack Ma were squarely in the regulators’ sights after Ma-controlled fintech firm Ant Financial was not allowed to hold an initial public offering. Rules and penalties against tech companies with primary listings on foreign exchanges and tutoring and educational companies were also specifically targeted.

Here is a quick rundown of how well some of the Chinese shares were doing Tuesday and how far they have fallen in the past 12 months.

iQIYI Inc. (NASDAQ: IQ) leads the pack with a share price bump of around 27.5%, after dipping a bit from an earlier high or around 31%. The streaming video and game provider has a 52-week range of $1.86 to $28.97 and traded at around $4.30 in the noon hour Tuesday. The average daily trading volume for the past 10 days is around 38 million, well above the 16 million shares traded on average for the past 30 days.

Tutoring service Puxin Ltd. (NYSE: NEW) traded up more than 27% in the noon hour Tuesday, at $21.34 in a 52-week range of $1.17 to $57.80. The stock is very lightly traded, with a 30-day average of under 500,000 and a 10-day average of under 200,000. Puxin shares are down more than 95% over the past 12 months.

TAL Education Group (NYSE: TAL) also traded down about 95% for the 12-month period. This is another tutoring service that was hit hard by regulators, and the shares traded up more than 13% on Tuesday, at $3.10 in a 52-week range of $1.60 to $66.00. The average 30-day volume is just over 12 million, and the 10-day average is 16.2 million.

Qudian Inc. (NYSE: QD) is a fintech platform that has dropped 54% of its share price value over the past 12 months, including a 20% spike Tuesday. The 52-week range is $0.63 to $2.85, and the average volume over the past 10 days is 1.77 million, about 40% higher than the 30-day average of just over 1 million.

Local on-demand retail and delivery service Dada Nexus Ltd. (NASDAQ: DADA) traded up by about 15% Tuesday morning at $10.06. The shares have dropped by about 66% over the past 12 months, and the 52-week trading range is $5.00 to $33.40. The average volume for the past 10 days is about 3.27 million shares, more than double the 30-day average of nearly 1.5 million.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.