Recent news from the cryptosphere has not been encouraging for people who want to invest in cryptocurrencies or tokens. The implosion of Terra, the 50% drop in bitcoin over the past six months and plunging prices for non-fungible tokens (NFTs) have taken some of the shine off crypto investing.

[in-text-ad]

As with most other investments, falling prices also can be an opportunity. But investors musts select those opportunities carefully. In the cryptosphere, there is another consideration as well: what’s the safest way to invest? Through a broker or directly on an exchange?

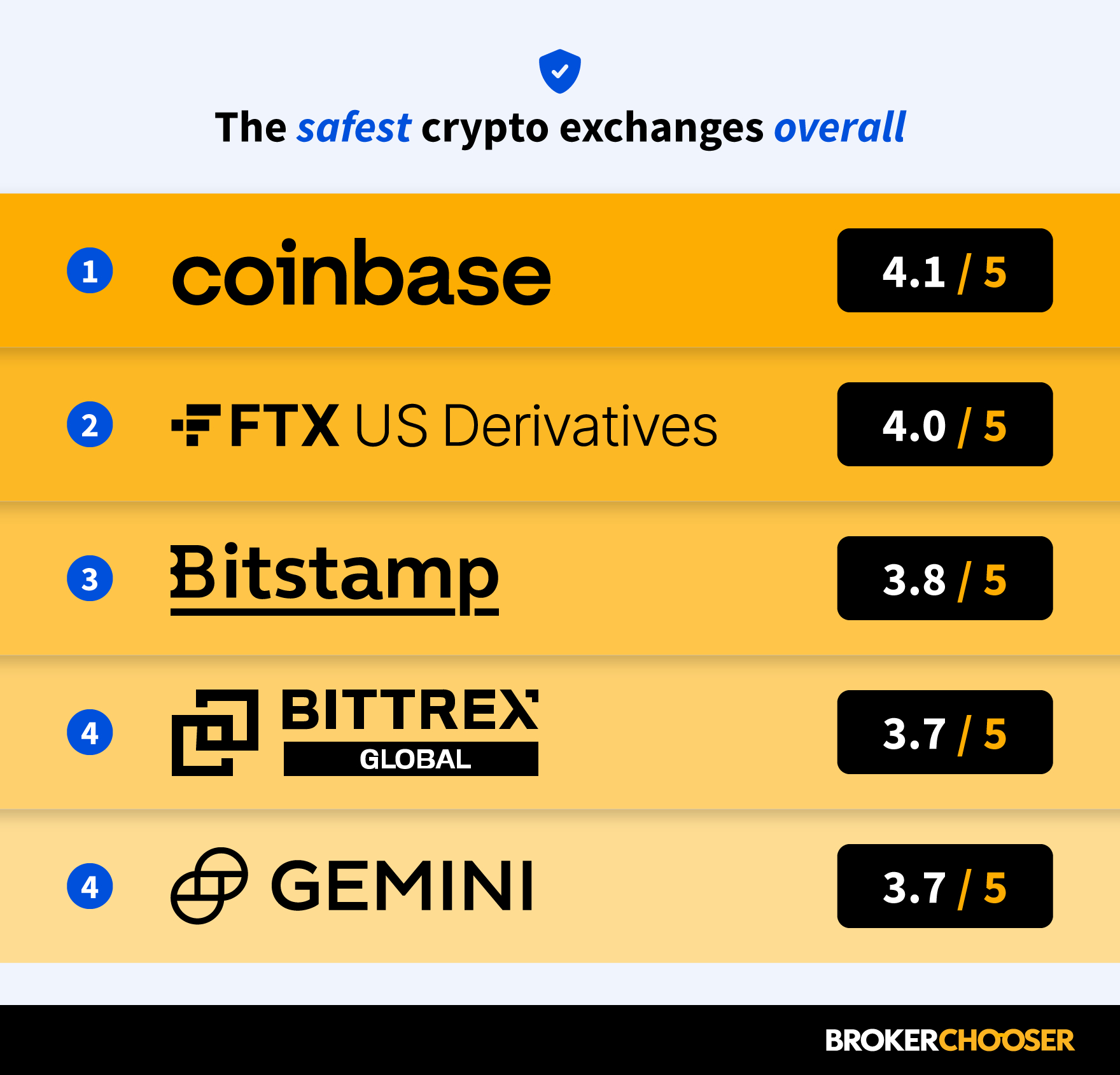

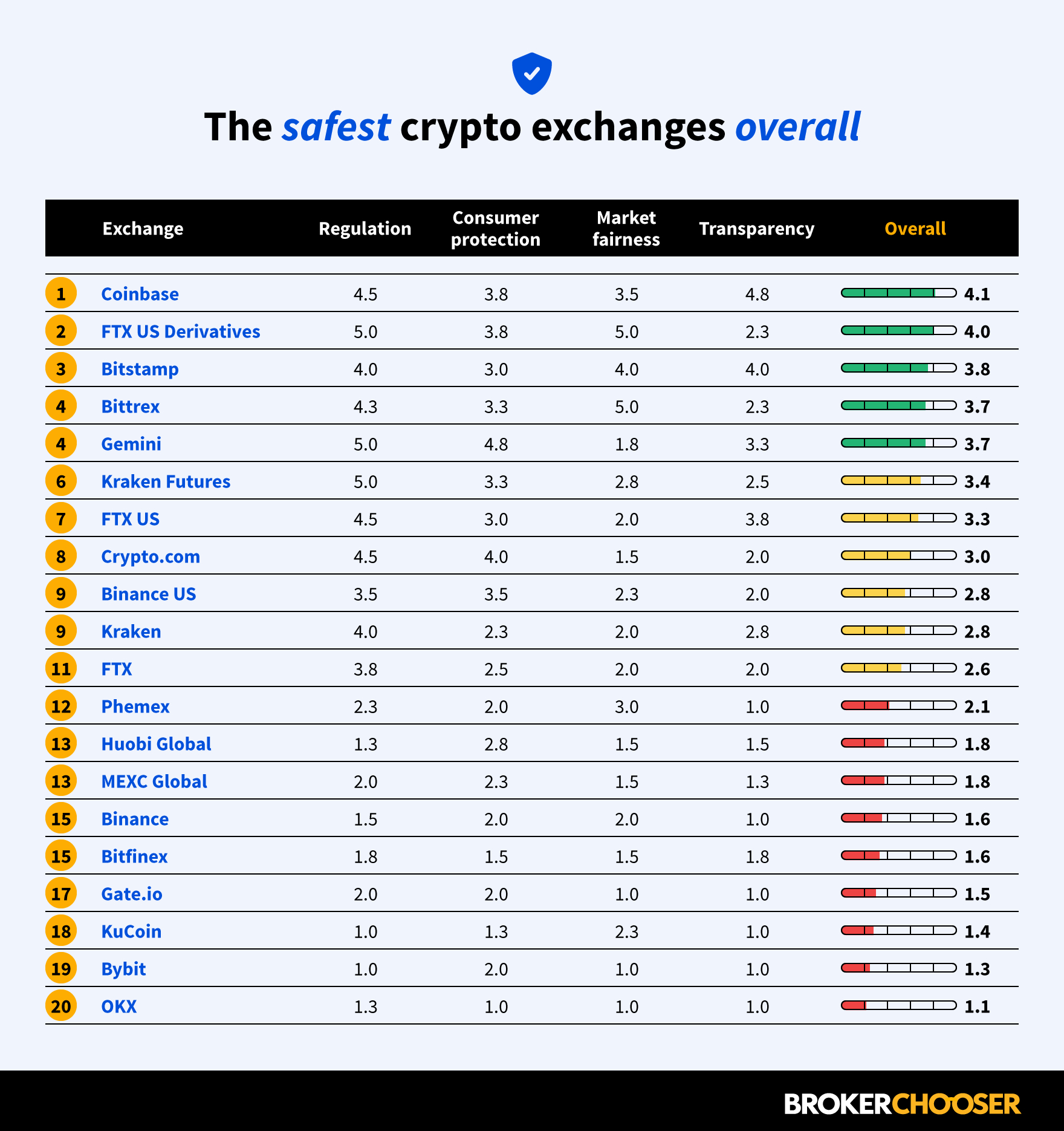

International broker comparison website BrokerChooser has just issued its ranking of the top 5 crypto exchanges based on four categories: regulation, consumer protection, market fairness and transparency. Each category offers a maximum score of five points and an overall score is derived from the category scores.

Here is a second chart showing category scores for each of the 20 exchanges included in the rankings.

Coinbase scored highest in the transparency category (4.8 out of 5), likely due to its being the only publicly traded exchange on BrokerChooser’s list. Coinbase also maintains a “hot wallet” insurance policy for $255 million, to backstop the $255 billion it holds in custody accounts for its customers.

[in-text-ad]

Earlier this month, Coinbase wrote in a federal filing that customers’ crypto assets may be treated as part of the bankruptcy estate if Coinbase were to file for bankruptcy and all its customers could be treated as general unsecured creditors, BrokerChooser’s legal head, Zoltan Kormanyos, commented:

Retail crypto investors use hard cash to buy crypto at Coinbase. The crypto is being held in a Coinbase wallet where Coinbase is acting as custodian. As soon as the crypto is put into the Coinbase wallet, the retail investor loses ownership and is left only with a personal claim for the crypto which they bought with hard cash. …

An average customer is holding approximately USD 3,500 worth of crypto at Coinbase, but the insurance coverage per customer is only USD 3.5 (far less than the USD 250,000 coverage the US government provides to bank depositors).”

FTX US Derivatives, Gemini and Kraken scored perfect 5s in the regulatory category. FTX is regulated by the U.S. Commodities Futures Trading Commission (CFTC), but its low transparency score probably cost it the top ranking. Gemini’s perfect 5 was based on its practice of holding the majority of its funds offline with U.S. dollar balances in segregated bank accounts covered by FDIC insurance.

Gemini also received the top score for consumer protection due to its “high level of protection for both crypto and fiat holdings, hasn’t experienced a hacking incident in the last five years and has sophisticated systems and processes in place to ensure operational resiliency.”

FTX and Bittrex received perfect scores of 5 in the ranking’s market fairness category. Both have policies that “restrict proprietary trading and employee trading and either provide fairly detailed coin listing criteria on their websites or potential issues arising from coin listing are not relevant in their case.”

Bitstamp, rated third-best overall, keeps 98% of its assets in offline crypto storage making it an exceptionally good choice for protecting customers’ investments. The company, based in the United Kingdom and Luxembourg, also includes a crime insurance policy and trails only Coinbase in the transparency category.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.