Investing

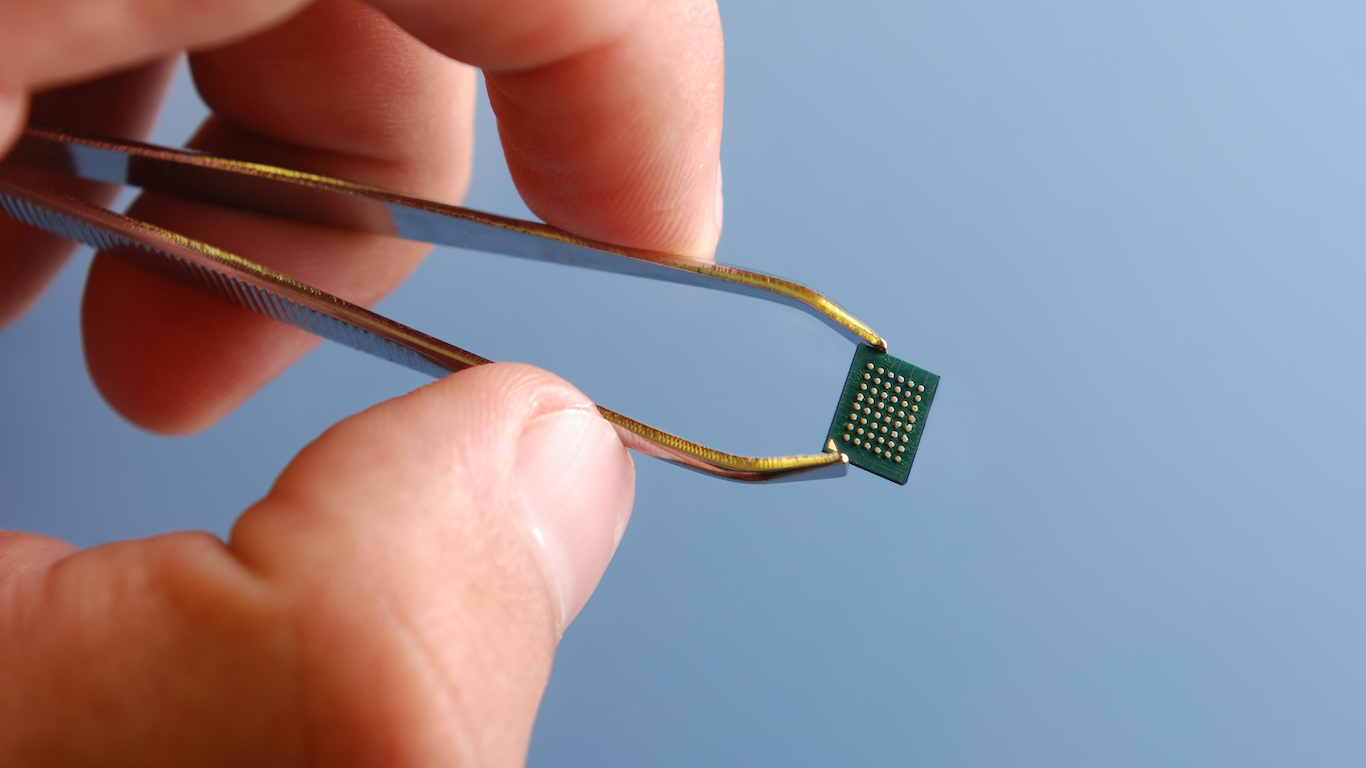

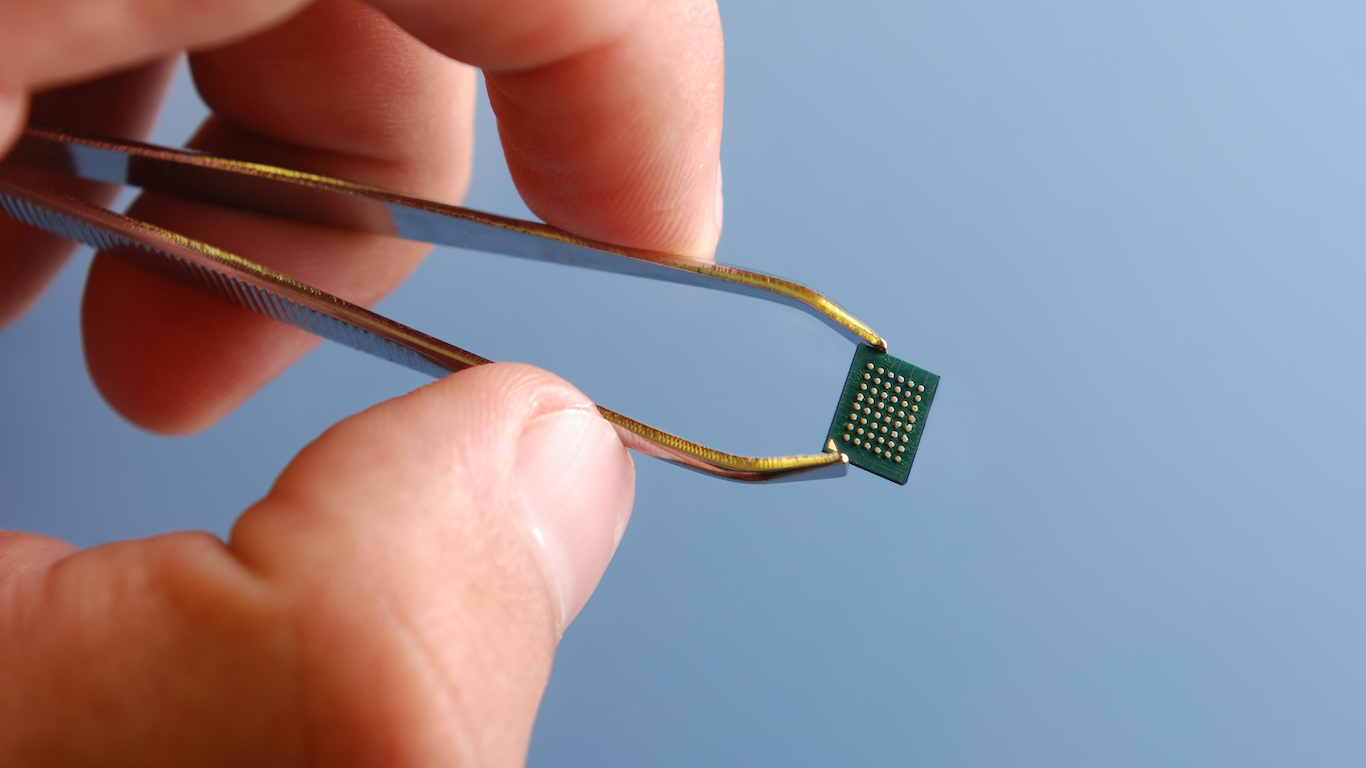

BofA Sees Big Upside in Semiconductor Stocks, Upgrades 2 Chip Design Picks

Published:

The big news in the semiconductor industry is the coming (if slowly) initial public offering of U.K.-based chip designer Arm. The company’s $66 billion acquisition by Nvidia fell through and current owner SoftBank has decided to list the shares in London and New York at a valuation of around $50 billion. SoftBank CEO Masayoshi Son confirmed in May that the company would retain a majority stake in Arm.

Arm does not make chips. It designs them using its own architecture and collects licensing and royalty payments from companies like Nvidia and Apple for using those designs in their products. It is a solid business. Arm reported licensing revenue of $1.13 billion in fiscal year 2021 and $1.54 billion in royalty sales. More than 29 billion Arm-based chips were sold in the past 12 months.

Designing semiconductors is a complex business, and that is where analysts at Bank of America Global Research see longer-term growth. The bank’s semiconductor research team, led by Vivek Arya, has upgraded two companies that make the electronic design automation (EDA) software used in chip design. Cadence Design Systems Inc. (NASDAQ: CDNS) and Synopsys Inc. (NASDAQ: SNPS) were both upgraded from Underperform to Neutral. BofA raised its price objective on Cadence stock from $160 to $175 and also raised its $325 price objective on Synopsys to $360.

Both firms have historically performed well during slowdowns in semiconductor sales: “While semiconductor sales are cyclical, EDA sales are more resilient, given their leverage to [semiconductor] R&D trends which often grows despite industry sales trends.”

While BofA estimates that chip sales will rise by 9.5% this year and decline by 0.7% in 2023 before rising by 7.9% in 2024, the two EDA firms are solid winners over the three-year period. Cadence is forecast to see sales growth of 9.1% this year, 9.8% in 2023 and 10.0% in 2024. Synopsys’s growth track is 16.0% this year, 11.5% next year and 10.5% in 2024.

In its specific comments about Cadence, BofA’s analysts wrote:

We like CDNS leading position in an EDA industry that is levered to the same secular trends as semis but with much more muted cyclicality. While we think CDNS has defensiveness/scarcity value, we remain cautious on company China exposure and potential government restrictions.

Earlier this week, Cadence extended its relationship with Arm. The U.K. company uses Cadence digital design and verification tools in creating its 5- and 7-nanometer chip designs.

Cadence stock traded up about 0.7% at around $151.10 just before noon Wednesday, in a 52-week range of $132.21 to $192.70. At BofA’s price target, the upside potential is around 15.8%.

About Synopsys, the analysts observed:

We like SNPS predictable and recurring revenue model, and believe the company can sustain growth even in the event of a downturn. Still, 15%+ China sales exposure is a risk subject to unpredictable US government restrictions.

Taiwan Semiconductor recently certified Synopsys digital and custom design flows for TSMC’s 3- and 4-nanometer process technologies.

Synopsys stock traded up about 1%, at around $306.75, just before noon Wednesday. The 52-week range is $255.02 to $377.60. At BofA’s price target, the upside potential is around 17.4%.

In the same research note, the BofA analysts downgraded four chipmakers: Teradyne Inc. (NASDAQ: TER) was downgraded from Buy to Neutral, as was Texas Instruments Inc. (NASDAQ: TXN). Qorvo Inc. (NASDAQ: QRVO) and Skyworks Solutions Inc. (NASDAQ: SWKS) were downgraded from Neutral to Underperform.

The Texas Instruments price objective was cut from $190 to $175, and Teradyne’s was cut from $140 to $110. Qorvo’s $125 price objective was lowered to $95, and Skyworks’ was cut from $130 to $105.

Teradyne makes and sells automated test equipment for a variety of industries, including chipmakers, and its largest customer is Apple. BofA’s analysts remain cautious on the stock due to expected slowdowns in chip sales growth.

Texas Instruments makes a variety of semiconductors and is a premier maker of analog chips. According to BofA, “near-term capex commitments could slow free cash flow growth, limiting [free cash flow] upside.”

Qorvo designs and makes semiconductors for wireless (RF) and wired connectivity products. BofA notes that the company “is benefitting from increasing complexity and content in next-generation connected mobile devices such as smartphones and tablets,” but the maturing conversion to 5G handsets and “supply/demand headwinds” may limit Qorvo’s upside.

Skyworks holds “dominant market share in the low-band and emerging broad markets [and internet of things] opportunities,” but the analysts note limited gross margin leverage, the maturing 5G handset business and difficult comparables as current concerns.

Teradyne stock traded down about 6.7% at around $88.90 on Wednesday, in a 52-week range of $85.66 to $168.91. At BofA’s price target, the upside potential is around 23.4%.

Texas Instruments stock traded down about 0.8%, at around $152.90, just before noon Wednesday. The 52-week range is $149.10 to $202.26. At BofA’s price target, the upside potential is around 14.5%.

Qorvo shares traded down about 2.5% to around $96.10 late Wednesday morning, in a 52-week range of $91.91 to $201.46. The stock is currently trading above BofA’s price target of $95.

Skyworks stock traded down about 2.3%, at around $94.00, just before noon Wednesday, in a 52-week range of $88.76 to $197.62 At BofA’s price target, the upside potential is around 11.7%.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.