Profit margins at S&P 500 companies have been falling. The decline is ending, however, and margins, which have begun to rise again in the first quarter of this year, are expected to continue rising slowly.

According to a research note from the portfolio strategy team at Goldman Sachs, the drivers of the 7% margin expansion over the past 30 years have been a massive decline in the cost of goods sold, lower taxes and lower interest rates. Off-shore manufacturing and global sourcing have contributed 70% to higher margins over the period, with taxes and rates responsible for the remainder.

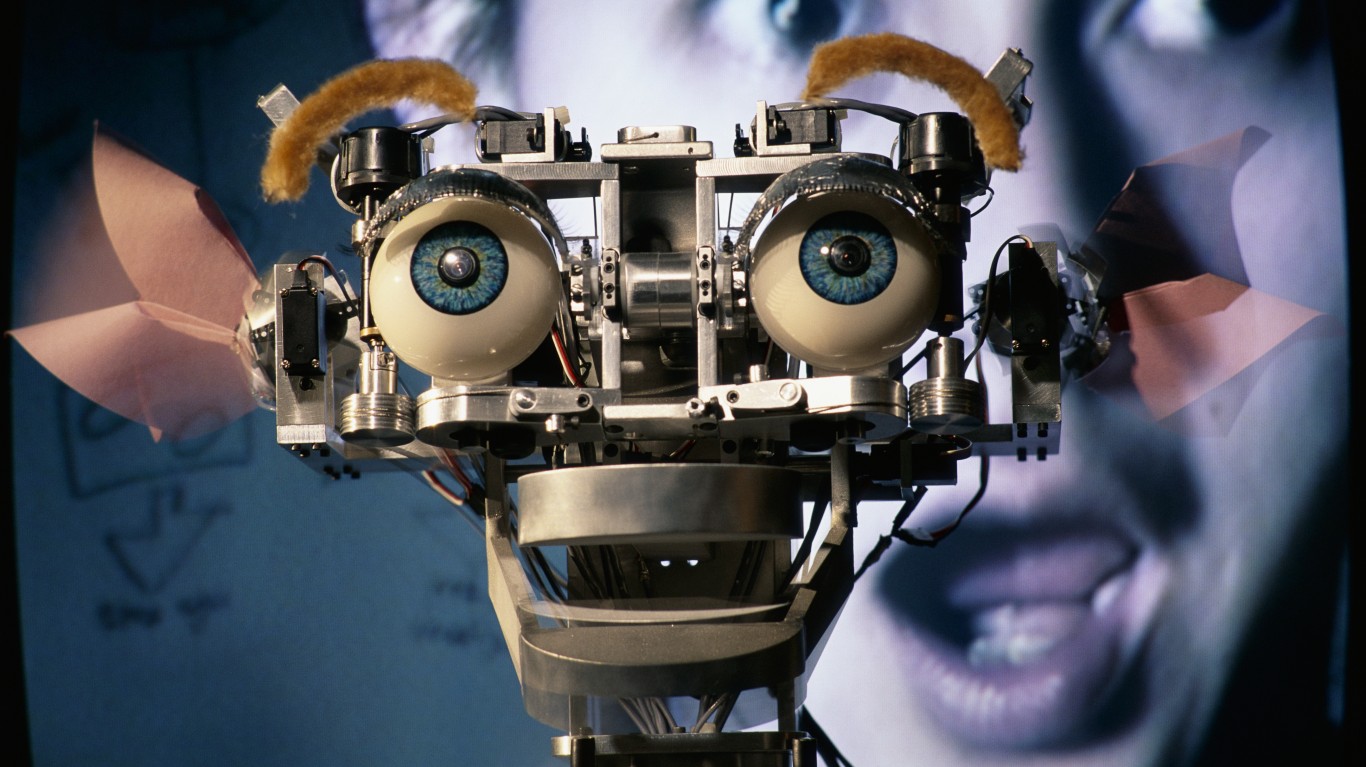

But those drivers threaten to reverse in the coming years. The next driver, according to Goldman Sachs, is artificial intelligence. AI “represents the biggest potential for long-term support for profit margins.” Goldman’s economists estimate that AI could add 400 basis points to net margins over the next decade. That is more than half the seven-percentage-point gain in profit margin over the past 30 years down to just one innovation.

While the question of who benefits from the wider adoption of emerging AI technologies is not completely settled yet, it is a fair bet that Alphabet Inc. (NASDAQ: GOOGL), Microsoft Corp. (NASDAQ: MSFT) and Nvidia Corp. (NASDAQ: NVDA) are not about to give up their early pole positions. Apple Inc. (NASDAQ: AAPL), which has had little to say about AI, has been reported to be working on a health coaching service powered by a ChatGPT-like interface. Amazon.com Inc. (NASDAQ: AMZN) is already working on a chatbot interface for its shopping service, and Meta Platforms Inc. (NASDAQ: META), though not inactive in AI development over the past year, still has some catching up to do.

All six named companies have added at least 30% to their share price since the beginning of 2023. Nvidia’s stock price has more than doubled, Meta’s has doubled, and the others have added between 30% and 37% this year. These are six of the seven U.S. companies with the largest market caps (Berkshire Hathaway, with 48% of its total holdings valued at around $156 billion in Apple stock, sneaked in above Meta).

Others have pointed out that the tech mega-caps are the new safe havens. And, if AI lives up to the promise forecast by Goldman Sachs, these companies are likely to remain winners for years to come. Much depends on how AI adoption shakes out. There are a lot of unknowns, not the least of which is government policy. The potential benefits of AI (and the tailwinds it will create for the tech giants) are difficult to predict. In a final comment on the eventual impact of AI, Goldman Sachs notes:

Despite strong wage growth and contracting profit margins in recent quarters, the labor share and corporate profit shares of US GDP remain close to their extremes of recent decades.

AI could easily widen the gap between rich and poor, and any government policy to ameliorate, if not eliminate, such an outcome will have to come out of corporate profits because that is where the money will be.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.