As we approach the summer months the story of 2024 has been the growth of artificial intelligence. Advancements in AI have been a net positive to most major technology stocks with one glaring exception: Apple (Nasdaq: AAPL) has simply not seen AI as a tailwind propelling its stock alongside peers.

However, we’re betting that the situation could change as soon as June 10th. And what Apple plans to announce that date could keep its stock rallying through the summer and into the fall when the company announces the next iPhone model.

Apple Has Lagged Its Magnificent 7 Peers

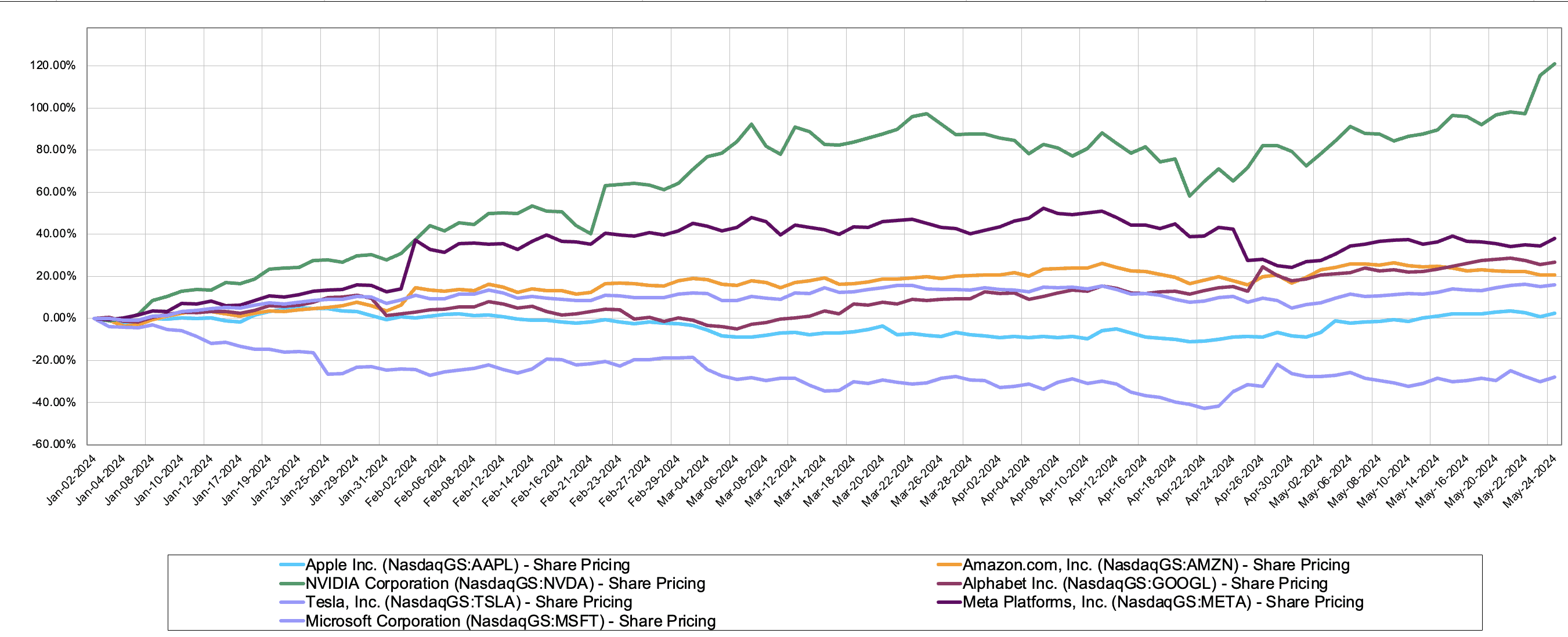

The chart above is compliments of S&P Capital IQ and shows Magnificent 7 performance year-to-date. Breaking down each stock individually we find:

- NVIDIA (Nasdaq: NVDA): Up 121%

- Meta (Nasdaq: META): Up 38%

- Alphabet (Nasdaq: GOOGL): Up 27%

- Amazon (Nasdaq: AMZN): Up 21%

- Microsoft (Nasdaq: MSFT): Up 16%

- Apple (Nasdaq: AAPL): Up 2%

- Tesla (Nasdaq: TSLA): Down 28%

From this viewpoint, it could be worse for Apple. The stock has seen a marginally positive return this year, outpacing Tesla’s 28% decline. Yet, in a year where the S&P 500 is up 11.8% year-to-date and the Nasdaq Composite has a 14.6% return, a meager 2% return isn’t exactly impressive.

More to the point, NVIDIA, Meta, Alphabet, Amazon, and Microsoft have all beaten the market thanks to riding optimism around AI.

- NVIDIA is obviously the poster child for AI and has soundly beaten earnings estimates in both of its quarterly reports this year. Its Data Center group just reported revenues that grew 427% from last year.

- Meta has seen past investments in AI pay off big time, as their huge collection of GPUs has helped improve ad targeting and products like Reels. In addition, the company’s Llama 3 model released in April has been highly lauded.

- Alphabet has seen its share of black eyes around its ability to create a cohesive AI strategy, but recently has flipped the story around. The company hosted an I/O Event that was filled with AI across its products, launched AI across search results, and has impressed with its Gemini AI model after some initial hiccups.

- Both Amazon and Microsoft have seen AI demand re-accelerate revenue growth in their all-important cloud computing segments.

- And while Tesla’s stock is down 28% for the year, its recent rebound coincides with the company focusing on self-driving cars as the company’s key strategy.

Apple Has Yet to Benefit from AI Enthusiasm

Yet, when we look back at Apple’s chart this year, their biggest recent gain came from the company announcing a major share buyback rather than any product news. The company’s stock has been stuck in the mud as sales have declined (down 4% year-over-year last quarter). In addition, Apple’s Vision Pro failed to ignite much excitement.

So, now that we’ve gotten the bad news out of the way, let’s focus on the positives.

Being the one company that hasn’t benefitted from AI excitement doesn’t mean Apple can’t capitalize on investor excitement around the trend in the future.

In fact, Apple’s about to have a huge showcase on June 10th that could begin flipping its story around.

On that date, Apple will host its Worldwide Developer Conference, and we bet that it’ll be loaded with AI features. Here’s a rundown of what to expect:

- Project Graymatter: Apple is set to unveil a set of AI tools that integrates across apps like Safari and Photos. Features like touching up photos with AI are especially compelling as we’ve seen advancements in cameras being one of the reasons that iPhone users choose to upgrade. Simply put: AI features can do a lot more to make pictures look better.

- Better Siri: Siri has been out for more than a decade and many users would say it’s actively getting worse. Advancements in LLMs give the opportunity to dramatically improve Siri and make it a much more useful feature.

- Generative AI: Apple will start bringing generative AI to features like emojis. So, if you’re texting with friends, custom emojis based on your conversations will be created.

- Smart Recaps: Apple will push more AI into areas like notifications to make them more useful and pertinent to your interests.

Apple Has AI Advantages That are Underappreciated

Are any of these features mind-blowing? Not particularly. However, this is the first event where Apple puts AI at the forefront of its strategy. Then in September, the company will host another widely followed event when it releases its next iPhone, which likely will feature the announcement of more robust features like a chatbot (partnering with either OpenAI or Google).

While Apple is widely seen as behind in artificial intelligence – it hasn’t invested nearly as heavily in data centers as either Google or Meta – it does have some key advantages.

First and foremost, selling devices to users is a huge advantage when it comes to AI. According to some reports, about 20% of Apple’s new A-series chips are occupied by dedicated AI processors that they’ve branded their “Neural Engine.” Having this much computing power on an iPhone allows Apple to offload tasks to be run locally. Companies like Google don’t have the luxury of knowing all their users have dedicated AI chips on their phones, which requires them to direct more services from the cloud.

When you’re a company distributing services from the cloud, you incur all the upfront costs of buying tens of billions worth of servers. In Apple’s case, the users themselves pay for the processing that will handle many AI tasks.

That may seem trivial, but it’s an advantage that could potentially be worth tens of billions in value per year!

Wall Street is Getting Behind Apple in AI

Finally, momentum seems to be building that AI is shifting from a market Apple hasn’t “figured out” to being a catalyst. On Thursday Dan Ives of Wedbush raised his price target on Apple from $250 to $275.

His rationale is that new AI features could drive a “supercycle” that adds $30 to $40 to Apple’s stock. The reality is that Apple doesn’t need to grow at extremely outsized rates to see strong performance across the summer. This holiday season Apple is expected to deliver EPS of $2.31. That’s a 6% jump from the last holiday quarter when Apple delivered $2.18 in EPS.

The reality is if Apple delivered even a slight beat (say to $2.35 in EPS) this holiday quarter, that would likely produce enough optimism the company is now an AI beneficiary that shareholders could see an impressive return that takes the stock over $200 per share by early next year.

The bottom line: Apple’s greatest weakness – the belief it has no AI strategy – could rapidly flip as investors believe AI features are driving more iPhone sales. If that happens, Apple is going to be a stock you want to own this summer.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.