Investing

Amazon's Share Price Just Hit $200: Here's the Path to $300 Per Share

Published:

Last Updated:

Amazon (Nasdaq: AMZN) closed Friday at $200.00 per share. That’s an incredible rebound considering Amazon’s stock traded for as low as $81.43 in just January 2023. Yet, alongside most of the Magnificent 7, Amazon has seen impressive gains across 2023 and into 2024. Let’s look at whether Amazon looks cheap or expensive relative to historical values and what a pathway to $300 per share from today could look like.

Like a lot of “Covid winners,” Amazon struggled in late 2021 into 2022. The reason why is Covid pulled forward a lot of growth that had to then be “digested.” Amazon doubled its corporate work staff from September 2019 to September 2022 and hired more than half a million warehouse workers.

When society began to normalize and it became clear Covid was pulling forward demand rather than creating higher growth rates than would last, Amazon had to hit the breaks on spending. Its during this period where sales growth collapsed and margins shrank that Amazon saw its share price sink to around $80 per share at its low point.

After a very tough 2022, the situation at Amazon looks much different today. The company’s value is driven by three important business lines: e-commerce, cloud computing, and advertising. We’ll explore how each has seen its fortunes rebound below:

One of the biggest anchors on Amazon’s share price has been struggles in its cloud computing business. The business is widely considered the “crown jewel” in Amazon’s lines of businesses and could easily exceed a trillion in value if it was ever spun off. Yet, AWS has seen growth rates rapidly deteriorate. In the fourth quarter of 2021, AWS grew at a 40% sales rate.

By mid-2023, that sales growth had sunk to 12%. Even worse, Amazon was falling behind its rivals. Microsoft (Nasdaq: MSFT) Azure has been consistently seeing higher growth rates than AWS while even distant rival Google Cloud has found success winning businesses from AI startups. In its most recent quarter, Amazon managed to re-accelerate AWS growth rates back to 13%. That’s a far cry from the 40% growth Amazon was seeing during the peak of Covid growth, but signs are growing that Amazon is stemming market share losses and AWS will have a much stronger 2025.

Retail isn’t the most “exciting” part of Amazon’s business, but it is their bread and butter. At the start of Covid, Amazon was gaining market share in retail at an astounding rate. Wall Street research showed Amazon gaining more than 50% of all incremental retail sales in the United States at the outset of Covid! However, by late 2021 this situation had changed dramatically. In fact, Amazon was losing market share to Walmart (NYSE: WMT) by the third quarter of 2021. Once again, this period of Amazon’s greatest sales weakness coincides with where its share price began to plummet.

Flash forward to today, and Amazon’s retail has rebounded nicely. Statistics from the most recent quarter have Amazon collecting 28% of all incremental retail sales in the United States. That’s the highest figure of any retailer by far and is significantly above Walmart.

Last, we need to discuss positive trends in advertising. Amazon’s advertising business grew 24% in the first quarter to $11.8 billion. The larger advertising industry saw a bottoming in 2022, which coincided with Amazon’s recent lows. However, trends are now in Amazon’s favor. One area in advertising you won’t want to discount is how much artificial intelligence from the biggest tech companies can boost ad dollars. A recent analysis of Meta‘s (Nasdaq: META) spend on NVIDIA (Nasdaq: NVDA) chips found that the company is driving an incremental $16.3 billion in advertising this year thanks to AI spending.

It’s likely Amazon can use AI as a lever to keep exceeding advertising targets in the year ahead.

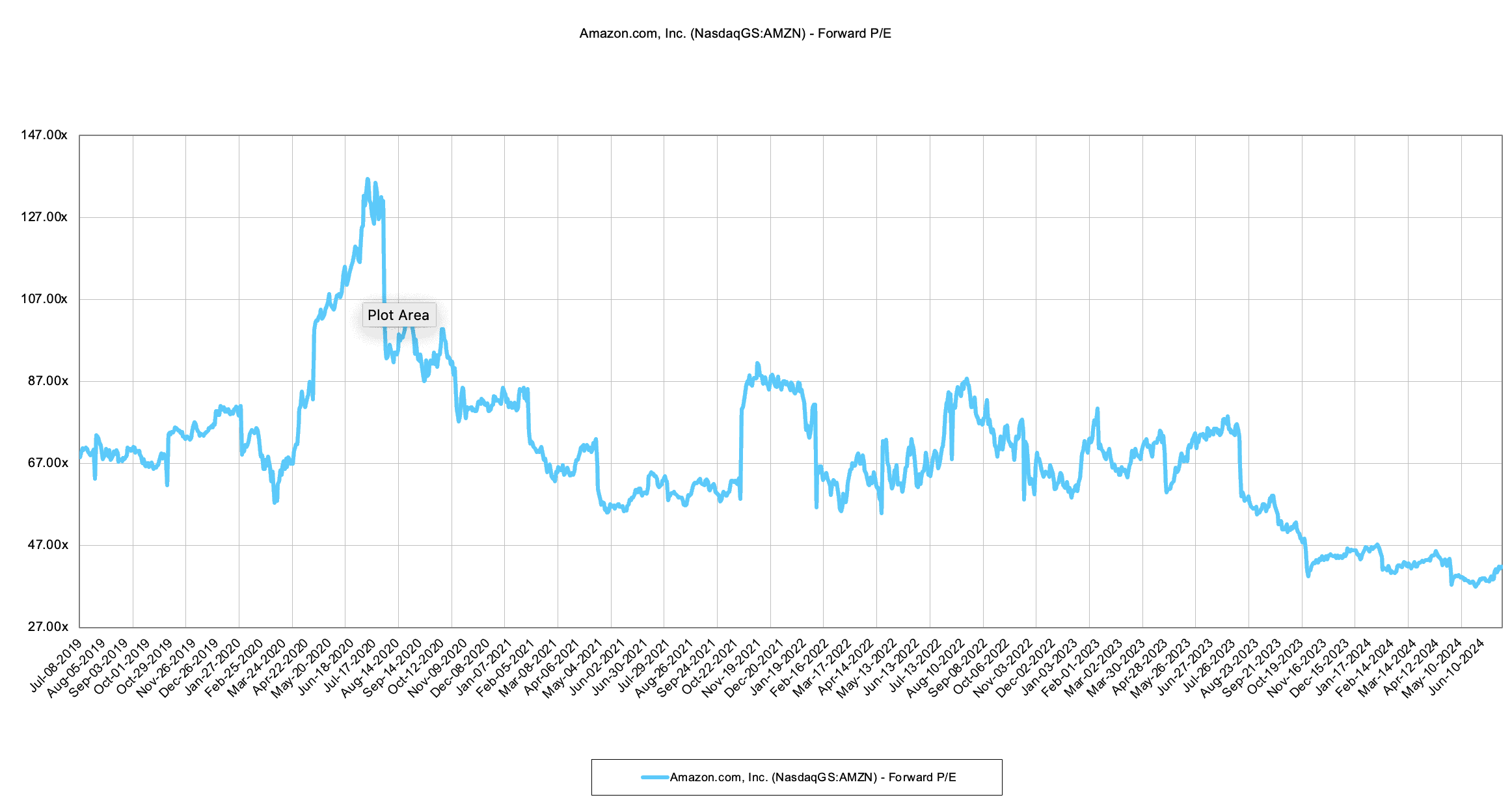

The first chart we’ll want to look at is Amazon’s forward P/E over time. This data comes compliments of S&P Capital IQ.

It might surprise you to see that while Amazon is now trading for all-time highs, its forward P/E is now at the cheapest level it has traded for in the past five years! Today, Amazon trades for a forward P/E of about 42X. That’s an expensive multiple for a company worth $2 trillion, but Amazon trades for a premium in part because projections for the coming years have the company gushing enormous amounts of free cash flow.

Let’s compare Amazon to some Magnificent 7 peers in projected cash flow.

| Company | 2024 Free Cash Flow | 2025 Free Cash Flow | 2026 Free Cash Flow | 2027 Free Cash Flow |

| Amazon | $61.9 billion | $78.8 billion | $102 billion | $117 billion |

| Apple | $110 billion | $123 billion | $135 billion | $154 billion |

| Microsoft | $68.6 billion | $77.7 billion | $92.7 billion | $109 billion |

As you can see, on a trailing basis, Amazon looks very expensive. Free cash flow in 2023 was $36.8 billion, which badly trailed Amazon and Microsoft. However, Wall Street projects Amazon to rapidly catch up with and even surpass the cash flows of Microsoft in the years ahead.

That’s an interesting situation as Amazon trades for a market capitalization of $2.08 trillion while Microsoft trades for $3.48 trillion. So, if you’re an Amazon investor, these are the key areas that could drive shares to $300 in the years ahead.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.