SoundHound AI (Nasdaq: SOUN) is up 199% in 2024, which puts it behind only Super Micro Computer (Nasdaq: SMCI) among the top-performing technology stocks. Let’s take a look at SoundHound’s recent performance and why investors keep bidding up the company’s share price.

Need-to-Know Items

- SoundHound AI is one of the top-performing stocks in the market as investors scour for AI stocks that could have substantial upside. If you’re looking for more AI ideas, make sure to grab a copy of our “The Next NVIDIA” report. It features three top AI plays, one of which could be a dominant software stock in AI with 10X upside potential.

- SoundHound jumped 46% in three trading days last week after it announced its Voice Assistant was now live in cars from Stellantis.

- The company is pursuing a three-pillar strategy that also includes growth in products like cars and smart TVs as well as services like its Dynamic Drive-Thru solution.

SoundHound AI’s Performance in 2024

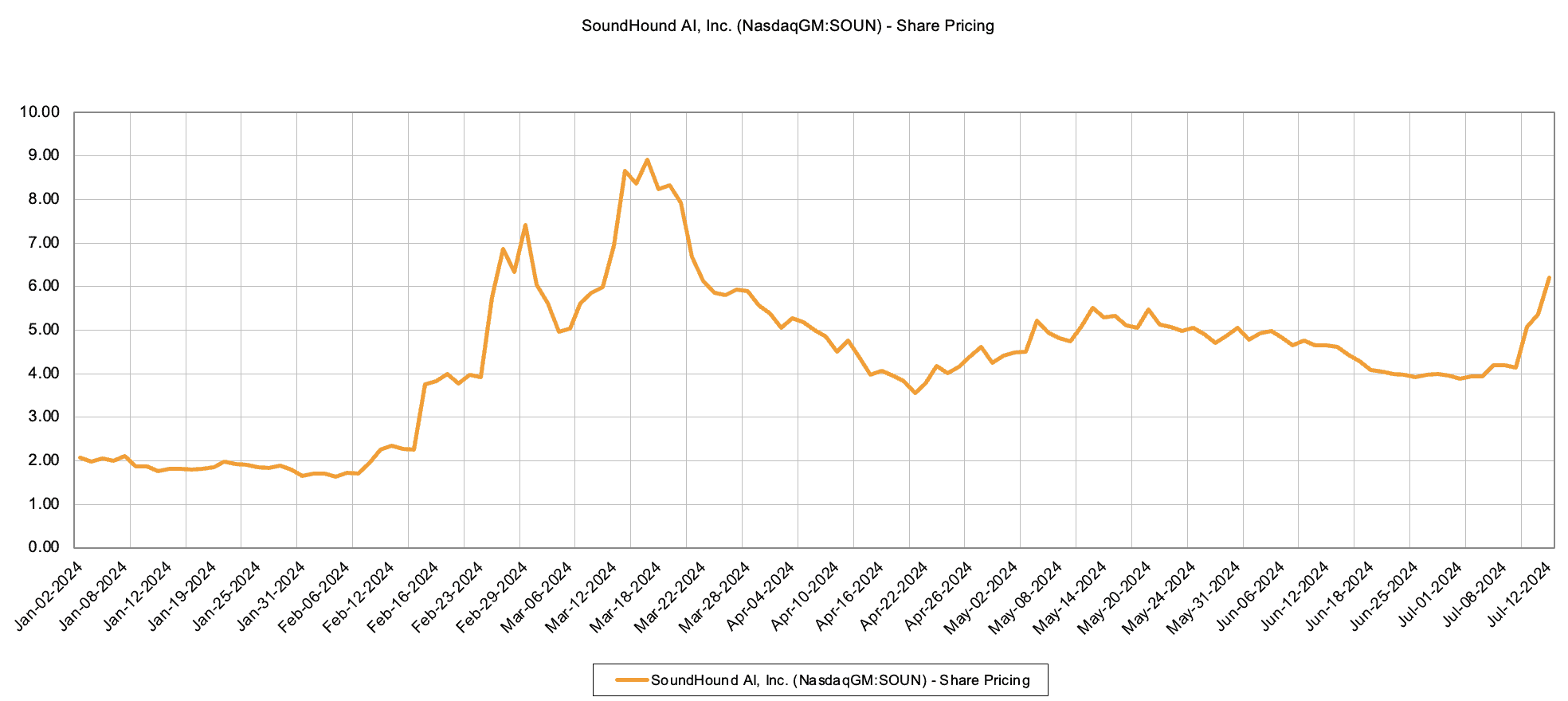

As you can see from the chart above, while SoundHound AI is up 199%, most of its gains have come thanks to two periods of share price growth.

The first period of strong price appreciation took place in mid-February into mid-March. The catalyst for this jump was a 13-F filed by NVIDIA (Nasdaq: NVDA) that revealed the company owned stock in SoundHound. On March 18th, SoundHound issued a press release revealing they were working with NVIDIA on a voice assistant that can work on the edge. That is to say, a vehicle voice assistant that works even when there’s no Internet connection.

SoundHound’s more recent share price jump started in the past week. After opening at $4.24 per share on Wednesday, the company closed trading on Friday at $6.20 per share. That’s a gain of 46% in three trading days!

The primary reason for the jump was another press release form the company announcing a large partnership that’s gone live. Here’s the most important section from that announcement.

“SoundHound AI, Inc. (Nasdaq: SOUN), a global leader in voice artificial intelligence, today announced its SoundHound Chat AI voice assistant with integrated ChatGPT is now live and in production in Peugeot, Opel, and Vauxhall vehicle brands across 11 European markets including Austria, France, Germany, Italy, Spain, and the United Kingdom. By the end of July, the rollout will be extended to 17 markets in 12 different languages.”

What Does Wall Street Expect from SoundHound in 2024 & 2025?

Here’s where current Wall Street estimates for SoundHound stand at:

| Metric | 2023 (Actual) | 2024 (Estimate) | 2025 (Estimate) |

| Revenue | $45.9 Million | $70.3 Million | $103.1 Million |

| Net Income (Adjusted) | -$25.3 Million | -$96.2 Million | -$65 Million |

| Free Cash Flow | -$68.7 Million | -$54.9 Million | -$28.7 Million |

Interestingly, while SoundHound’s shares have been soaring in 2024, Wall Street’s estimates for this year’s sales have actually fallen. A year ago, estimates for 2024 revenue stood at $82.2 million. Today, Wall Street’s revenue consensus for the year is only $80.3 million.

This is to say, the jump in the company’s share price isn’t about announcements that will produce any near-term outsized revenue. Rather its investors betting that investments and new partnerships announced in 2024 will likely bear fruit in the second half of 2025 and beyond.

SoundHound’s Business In a Nutshell

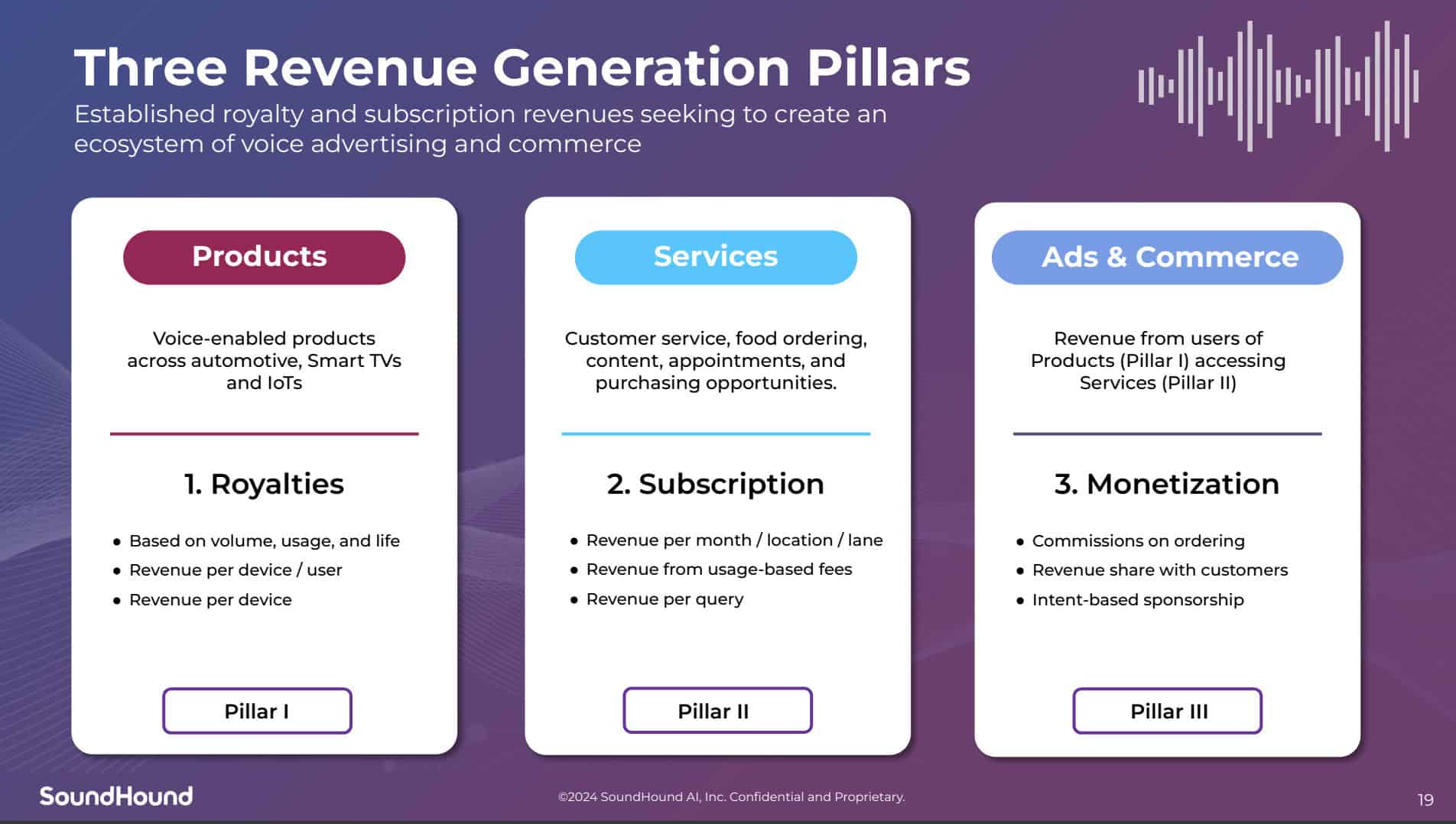

SoundHound is pursuing a 3-pillar strategy. The first pillar is voice products for cars, TVs, and IoT devices. The second pillar is customer service solutions like drive-thru AI voice services. The third pillar is monetization from gaining widespread adoption from the first two pillars.

- Pillar 1 Power Products: This is the business where SoundHound announced a partnership with NVIDIA and its voice assistant going live in Stellantis cars. A key feature SoundHound believes gives it an edge over competitors is its focus on ensuring its assistants work without robust Internet connections. This can obviously be important in products like cars, where high-speed data connections aren’t always available.

- Pillar 2 Customer Service Solutions: Currently about 30% of revenue, which implies that this business is at about a $14 million run rate as of the first quarter. SoundHound says their customer service solutions are currently in production at 10,000 locations, with 100,000 in their pipeline. Running some quick math, if these pipeline locations had similar revenue and they closed them all, that would lead to more than $150 million in annual revenue from this segment. That’s a big if, but shows the revenue potential that has investors excited about this segment. SoundHound pegs the TAM of this business at $100 billion, but that would require significant in-roads into the 30 million businesses across the United States that aren’t restaurants.

- Pillar 3 Monetization: The final pillar that requires widespread adoption of SoundHound’s other products. The idea is that SoundHound could get a cut of voice commerce and ads as usage grows.

Get More AI Ideas

If you’re looking for more AI stocks that could see huge upside from the growth of AI beyond SoundHound, don’t forget to grab a copy of our brand-new “The Next NVIDIA” report. Its 38 pages of research including stock research, an industry map of AI investments, a report on why AI is suddenly taking off in 2024, and more.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.