Investing

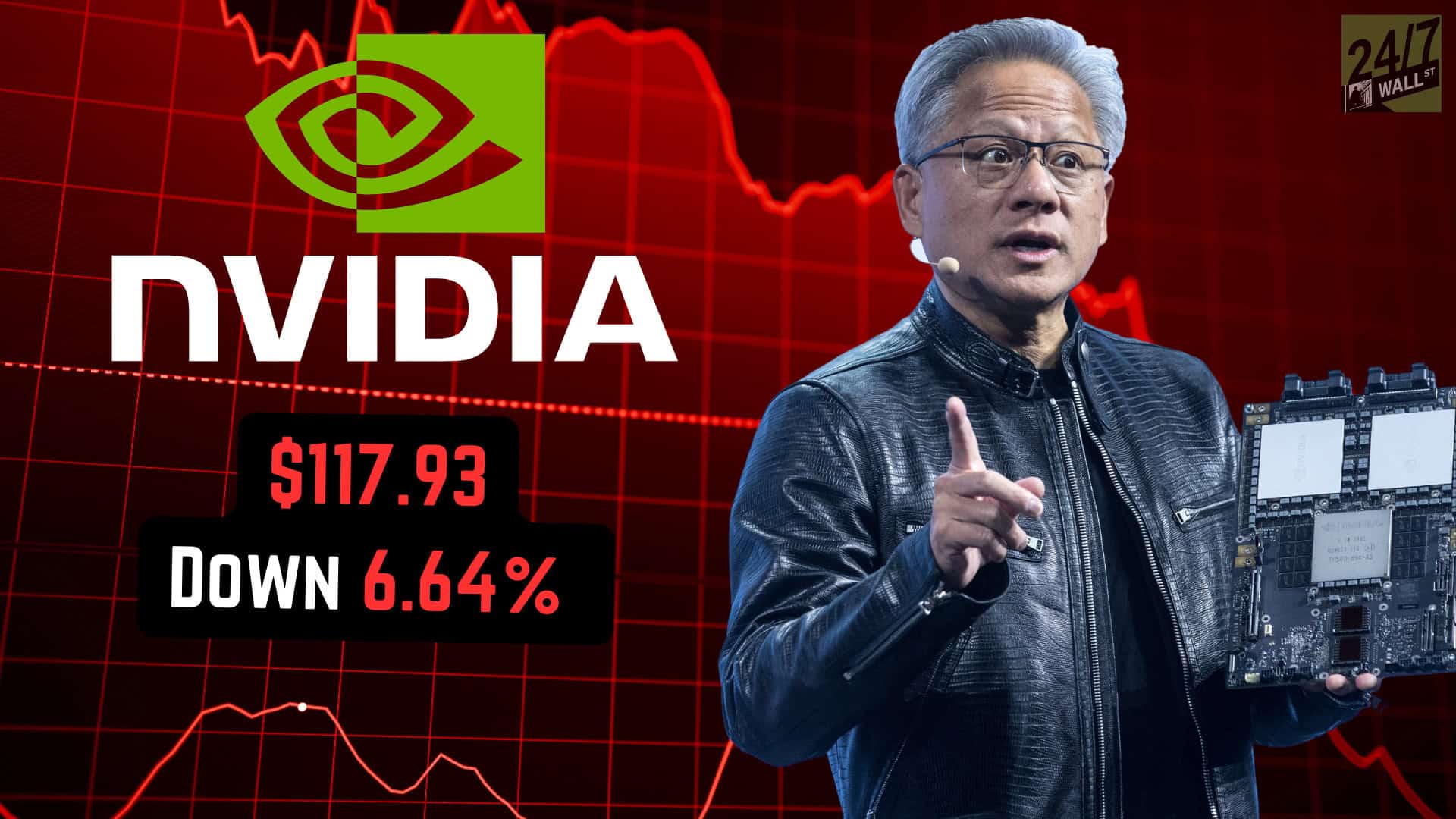

NVIDIA Just Lost $206 Billion in One Day: Did Biden or Trump Cause the Sell-Off?

Published:

NVIDIA (Nasdaq: NVDA) shares closed the day down 6.64%. That’s a big enough loss to wipe out $206 billion in market capitalization in a single day! Yet, there’s no clear-cut answer on why NVIDIA dropped so much on Wednesday. Some reports point the blame at the Biden Administration weighing tougher trade rules that could further block semiconductor sales to China.

Other reports blame quotes from Donald Trump saying Taiwan should pay for its own defense. Finally, there might be another factor in NVIDIA’s dramatic sell-off: a continuing market rotation out of technology stocks that has reached historic proportions.

Let’s dig into each storyline and see how each may be weighing on NVIDIA’s share price.

Late last night Bloomberg broke a story that the Biden Administration was weighing additional trade restrictions against China. The report mainly cited use of the “Foreign Direct Product Rule,” which would allow the US to impose controls on foreign-made products.

As an example, the US could use the FDPR to push for greater restrictions on companies like ASML (from the Netherlands) and Tokyo Electron (from Japan) that sell equipment needed for the most advanced semiconductors.

This news clearly spooked investors, here’s a look at the daily performance of some companies selling the most advanced semiconductor equipment to China:

As you can see, the fall in the companies selling essential semiconductor equipment was fairly uniform.

How much would these companies be hurt by use of the FDPR? It’s unclear. Bloomberg’s article points to the Biden Administration wanting to limit servicing and repair of gear already in China.

That would impact a company like ASML (Nasdaq: ASML), which has a valuable services business. It is worth noting that ASML is already blocked from selling its most advanced lithography devices in China.

Whether or not these restrictions would further impact NVIDIA is unclear. Incredibly, while the company grew its Data Center Group revenue by 427% last quarter, that sales growth came at a time when sales to China collapsed.

NVIDIA’s China revenue sanks from previous levels of 20-25% of total sales (prior to new trade restrictions levied last October) to “in the mid-single digits” in NVIDIA’s most recent quarter. That is to say, China is now about 5% of NVIDIA’s sales.

Verdict: It’s likely this news weighed on NVIDIA’s shares. While any impact on NVIDIA in the near term isn’t significant as the company has already seen sales to China decrease significantly, further trade restrictions would limit hope of the market opening back up.

Another factor blamed for NVIDIA’s decline today was an interview with Donald Trump in Bloomberg. I’ll quote the relevant sections below:

“Look, a couple of things. No. 1, Taiwan. I know the people very well, respect them greatly. They did take about 100% of our chip business1. I think, Taiwan should pay us for defense. You know, we’re no different than an insurance company. Taiwan doesn’t give us anything. Taiwan is 9,500 miles away. It’s 68 miles away from China. A slight advantage, and China’s a massive piece of land, they could just bombard it. They don’t even need to—I mean, they can literally just send shells. Now they don’t want to do that because they don’t want to lose all those chip plants. You know, all those plants and they don’t want to do that. But I will tell you, that’s the apple of President Xi’s eye, he was a very good friend of mine until Covid that I really, you know, I was, I didn’t feel the same way. Same thing with Putin.”

Many observers reading this section have keyed in on the fact Trump seems ‘indifferent’ to defending Taiwan. Any invasion of Taiwan would likely be catastrophic economically. The country produces 92% of advanced chips (the kind NVIDIA designs).

Verdict: Trump’s comments likely had an impact on NVIDIA’s price – and the broader semiconductor space – as well today. Taiwan Semiconductor (NYSE: TSM) was down 7.98%. However, it’s worth noting that another chip manufacturer on the island, UMC (NYSE: UMC), was down a more muted 4.1%.

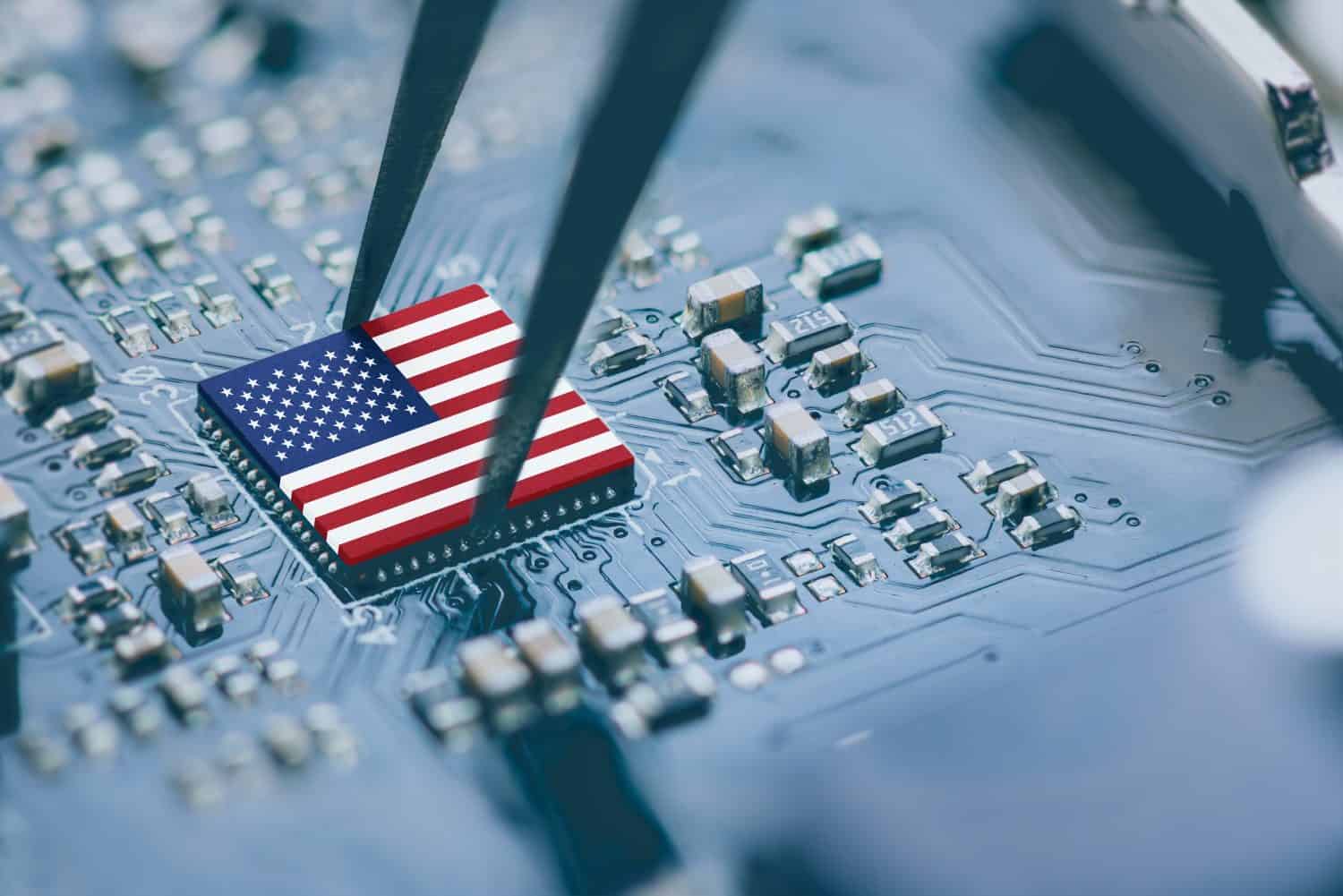

Finally, we need to look at the ongoing sector rotation where investors are flooding into recently unloved stocks and out of technology indices. This rotation is most easily seen comparing the small cap-heavy Russell 2000 (IWM) against the Nasdaq-100 (QQQ).

Here’s a stat that should be fairly mind-blowing: The Russell 2000 just finished its best 5 day gain relative to the S&P 500 ever. In the chart above, the Russell 2000 has outperformed the Nasdaq-100 by 13.49% since last Wednesday!

Why is this situation happening? Well, the Nasdaq-100 had dramatically outperformed the Russell 2000 across the past 18 months and had incredible inflows to the indices. Now that the Federal Reserve has signaled they’ll begin cutting rates – and the market is pricing in three rate cuts in 2024 – investors are betting that small caps have more to gain in the coming year.

Verdict: Sector rotation appears to be a continuing factor. The Nasdaq-100 was down 2.94% today while the Russell 2000 was down 1.06%. While both indexes suffered, a 1.88% performance gap between indices is enormous. Clearly, money continues to move out of tech stocks and into stocks like small caps and other industries that underperformed the prior year. Another beneficiary of this is non-tech stocks in the Dow Jones Industrial Average, for example.

If I were to rank factors driving NVIDIA’s decline today. I would rank them:

1.) News breaking about potential new trade restrictions on China

2.) Sector Rotation

3.) Trump’s Comments

Clearly, all three storylines impacted NVIDIA’s stock today. While Trump’s comments were likely a one-day phenomenon, trade restrictions will continue weighing on semiconductor stocks.

Finally, watching the relative performance of the Russell 2000 and indices like the Nasdaq-100 is likely the most important for NVIDIA investors in the near term.

If money keeps flowing out of technology stocks, that could compress NVIDIA’s earnings multiple. Recently, most of NVIDIA’s Magnificent 7 peers have been trading for 30X to 35X 2025 earnings. We’ll have to see if the market continues valuing companies at those levels.

If it does, NVIDIA should see strong gains in the second half of the year as the Blackwell supercycle plays out.

The big drops in NVIDIA and other semiconductor stocks today are a good reminder that while AI may be the dominant trend in technology, you want to diversify across companies in the space. Our brand-new “The Next NVIDIA” report features a software stock I believe has 10X upside potential. Get the full story on this stock now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.