The 2024 U.S. Presidential election is entering the stretch run. With Donald Trump leading polls, we take a look at what a win in November could do to the price of Bitcoin. Trump has made a number of positive quotes about the cryptocurrency and there’s reason to believe a future Trump administration would create a more favorable regulatory environment for cryptocurrencies in general.

Key Points

- Bitcoin’s price has been on the rise and a factor in its rally has been the possibility of a more favorable regulatory environment after the 2024 Presidential election.

- Donald Trump has said, “[W]e want all the remaining Bitcoin to be made in the USA!” In addition, his running mate JD Vance personally owns cryptocurrencies and has expressed concern with past regulation in the space.

- If you’re looking for investment ideas in the other dominant trend in technology today – artificial intelligence – make sure to grab a copy of “The Next NVIDIA.” It’s available complimentary from 24/7 Wall St. and includes a research report on an AI leader we’re confident has 10X potential.

Could Donald Trump Drive the Price of Bitcoin to $100,000

Here are some highlights from the conversation between Eric Bleeker and Austin Smith.

- The political backdrop has been boosting Bitcoin in recent weeks.

- The big question is, would a Trump victory in November really change Bitcoin’s direction? Let’s look at the details and what specifically Donald Trump has said about Bitcoin and cryptocurrencies in general.

- First off, while politics is playing a part in Bitcoin’s recent price movements, there are other factors.

- First, there are rising expectations of rate cuts from the Fed this year.

- That’s always going to move the price of Bitcoin. We saw Bitcoin fall in 2022 as the Fed Funds rate ratcheted up. We’ve seen it rise as rates stabilized and investors looked ahead to when rate cuts might begin.

- That’s just the recent history and we are in a period now where three rate cuts in 2024 is the consensus estimate from Wall Street.

- So, there’s that aspect.

- The next aspect is what a Trump victory could do for Bitcoin.

- From a pure data perspective, it’s hard to ignore that after the assassination attempt on Donald Trump last Saturday, betting markets quickly increased Trump’s odds of winning the election from around 60% to a high of 69%.

- And at this same time, Bitcoin itself rallied.

- Clearly, traders are betting that a Trump Presidency would be good for Bitcoin.

- Why is that?

- Well, Trump has said, “We want all the remaining Bitcoin to be made in the USA!”

- And has said any attempts to hamper Bitcoin “Only helps China and Russia.”

- In addition, you had Trump choose JD Vance as a running mate.

- Vance was a VC and has said regulation of cryptocurrencies is “backward.” Perhaps most importantly, he actually owns cryptocurrencies himself. So Vance clearly believes in the asset class.

- Finally, I would note this week saw Mark Andreessen and Ben Horowitz – two of the most influential VCs in the crypto space – come out in support of Trump.

- I listened to the Podcast where they laid out their logic. It sounds like a deep, deep frustration with the regulatory apparatus of the Biden administration is the root of their beliefs.

- So, I’m personally buying the idea that a Trump victory would be a major catalyst for Bitcoin’s share price.

- Regulations and a lack of legal clarity have really hampered the development of the broader crypto space. Any activity there and progress should lift all boats, including Bitcoin’s price. And I’m very confident any appointees from a Trump administration would be much more supportive of crypto relative to current SEC Chairman Gary Gensler.

- Further, Trump pushing for looser monetary policy likely strengthens the appeal of Bitcoin itself.

- And finally, you have some catalysts like Trump talking about making Bitcoin a strategic reserve asset.

- So, yes, it would surprise me if given all the above, if Trump is elected you didn’t see Bitcoin break $100,000 during his presidency.

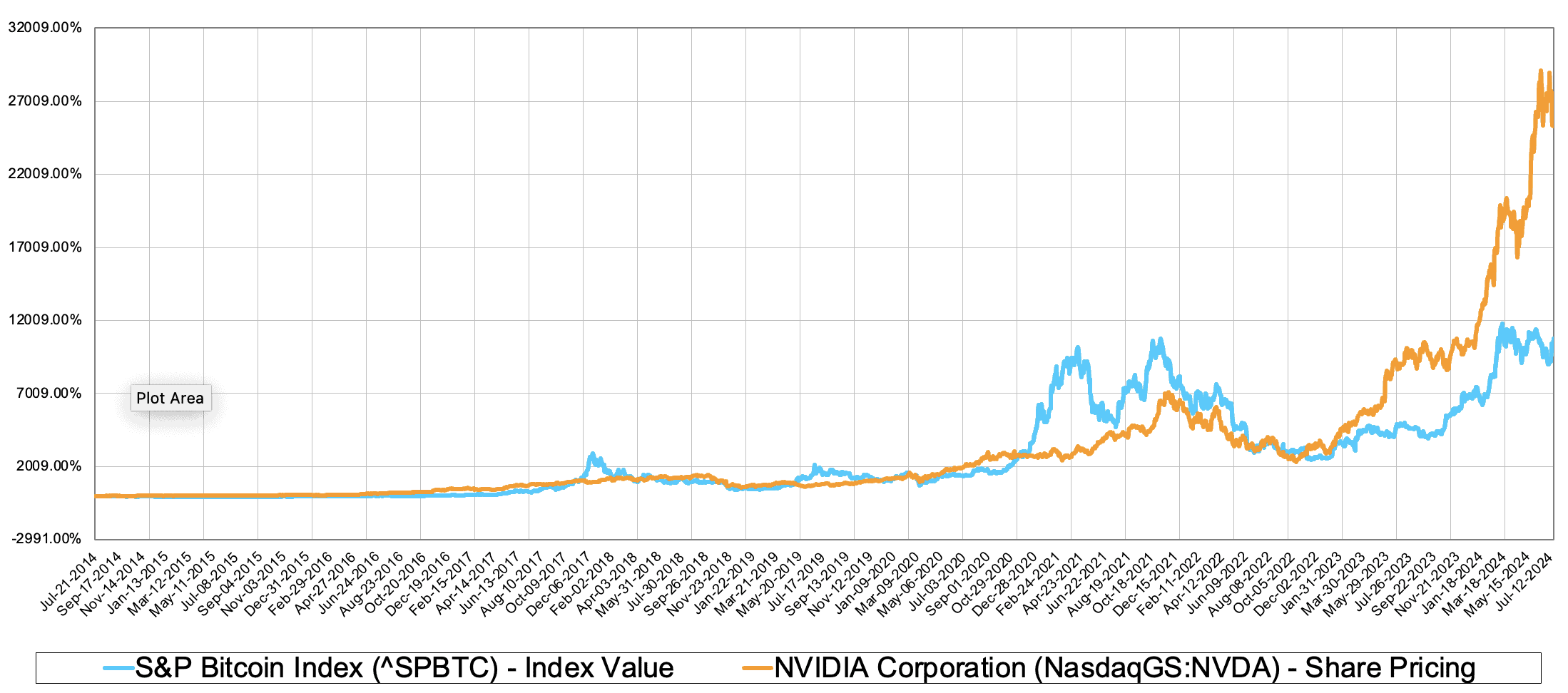

One Investment Has Outperformed Bitcoin

Take a look at the chart above, it’s the returns of two of the best assets in the world across the past decade. Bitcoin is the blue line while NVIDIA is orange, having returned more than 25,000% across the past decade. Given NVIDIA’s performance, you can see why the idea of the next NVIDIA would be so exciting.

So what stocks can ride the next massive trends in artificial intelligence? We recently created a brand-new report named “The Next NVIDIA” that’s absolutely free. You can grab a copy by clicking here.

Transcript:

Eric, Bitcoin is roaring back.

As we film this, it’s up 13% across the past week.

And it seems like the political backdrop is having a large impact on the share price here.

So I’m wondering whether a Trump victory in November would really change Bitcoin’s fortune.

Trump has sort of famously started to embrace cryptocurrencies in this election cycle.

So what has Trump said about Bitcoin that is leading to this enthusiasm?

Yeah, we have a couple of issues around Bitcoin’s price in the past week.

First, there’s rising expectations of rate cuts from the Fed this year.

That’s always going to move the price of Bitcoin.

We saw Bitcoin fall in 2022 as the Fed funds rates rationed up.

We’ve seen it rise again, the price of Bitcoin as rates stabilize.

Investors look ahead to when rate cuts might begin.

That’s just the recent history.

And we are now in a period where three rate cuts in 2024 is the consensus estimate from Wall Street.

So there’s that aspect.

The next aspect is what a Trump victory could do for Bitcoin.

Now, this isn’t political favoritism.

It’s just purely analyzing the situation.

But it’s hard to ignore after the assassination attempt on Donald Trump on Saturday that Bank markets quickly increased the odds of him winning from around 60 to 69%.

And at that same time, the odds of Trump being elected were on the rise.

Bitcoin itself rallied.

Clearly, traders are betting that Trump presidency would be good for Bitcoin.

Now, you need to ask, why is that?

Well, Trump has said, and this is a quote, we want all the remaining Bitcoin to be made in the USA.

And he has said any attempts to hamper Bitcoin only helps China and Russia.

Now, in addition, you have him choosing J.D. Vance as a running mate.

Vance was a VEC, and he said that regulation of cryptocurrencies has been backwards.

And perhaps most importantly, I should say, he actually owns cryptocurrencies himself.

So he’s clearly a believer in the asset class.

Finally, I would note this past week saw Marc Andreessen and Ben Horowitz, two very powerful venture capitalists, come out in support of Trump.

I listened to the podcast where they laid out their logic for this endorsement.

It sounded like a deep, deep frustration with the regulatory apparatus of the Biden administration.

It’s kind of the root of their beliefs.

So I’m personally buying the idea that a Trump victory would be a major catalyst for Bitcoin share price.

Regulations and a lack of legal clarity have really hampered the development of the broader crypto space and any activity there in progress should lift all boats, including Bitcoin’s price.

I’m pretty confident any appointee from a Trump administration would be more supportive of crypto relative to Gensler.

In addition, Trump pushing for looser monetary policy likely strengthens the appeal of Bitcoin itself.

And finally, you have some catalysts that maybe it’s an optionality, but Trump thinking about making Bitcoin a strategic reserve asset.

So Austin, bottom line, yes, it would surprise me if given all the above, if Trump was elected, you didn’t see Bitcoin break 100,000 during his presidency.

Eric, I love all of these points.

And one of the important things for investors to remember, although it seems like Bitcoin has been with us for an eternity, it really hasn’t.

It’s still very much a nascent industry.

And the lack of clarity on regulation is really making it difficult for this industry to advance.

So all of the promised value and utility that the crypto industry and Bitcoin and Ether have been promised, it’s been very hard to manifest those when you’re operating in an uncertain environment and you’re not sure if this technology or this application will be accepted.

Famously, it took years just to get the ETF approved.

And that’s just a very fundamental way to get exposure to Bitcoin.

What we’re not really talking about is what Bitcoin and Ethereum actually promise people, which is a fundamental platform and technology shift.

Clearing the clouds of regulation really also allows this industry to build the promise of the future that it’s been talking about for years with confidence.

You really can’t do that in an uncertain time, especially when you’re looking at things like the lawsuit of Sam Bankman Freed and a lot of the collapses of exchanges.

You’ve got a too defensive regulatory posture that’s making it difficult for the innovators and entrepreneurs in this space to go create value that would push the price up to one hundred thousand dollars.

But Trump looks a lot more favorable to that.

And Bitcoin to one hundred thousand dollars.

Let’s go.

Yeah.

And Austin, one final point.

There’s a regulatory side to something like crypto.

Also, an area that we think a Trump administration would be more favorable to in terms of regulation is artificial intelligence.

Everyone out there, we just released a brand new AI report.

You can get it at video.nextinvidia.com.

It’s absolutely free.

It’s a 38-page report that walks you through the emergence of artificial intelligence as a dominant trend and features three of our favorite stocks to capitalize on the next major trend we see emerging in the space.

So once again, it’s entirely complimentary.

You just type in that URL.

Put an email address for us to deliver.

We’ll send it directly to you.

Don’t delay though, because this is a report that won’t be available forever.

So I just encourage everyone to go out there, check out that report today.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.