Technology

Forget Tesla: This Stock Is the Next Millionaire Maker

Published:

Last Updated:

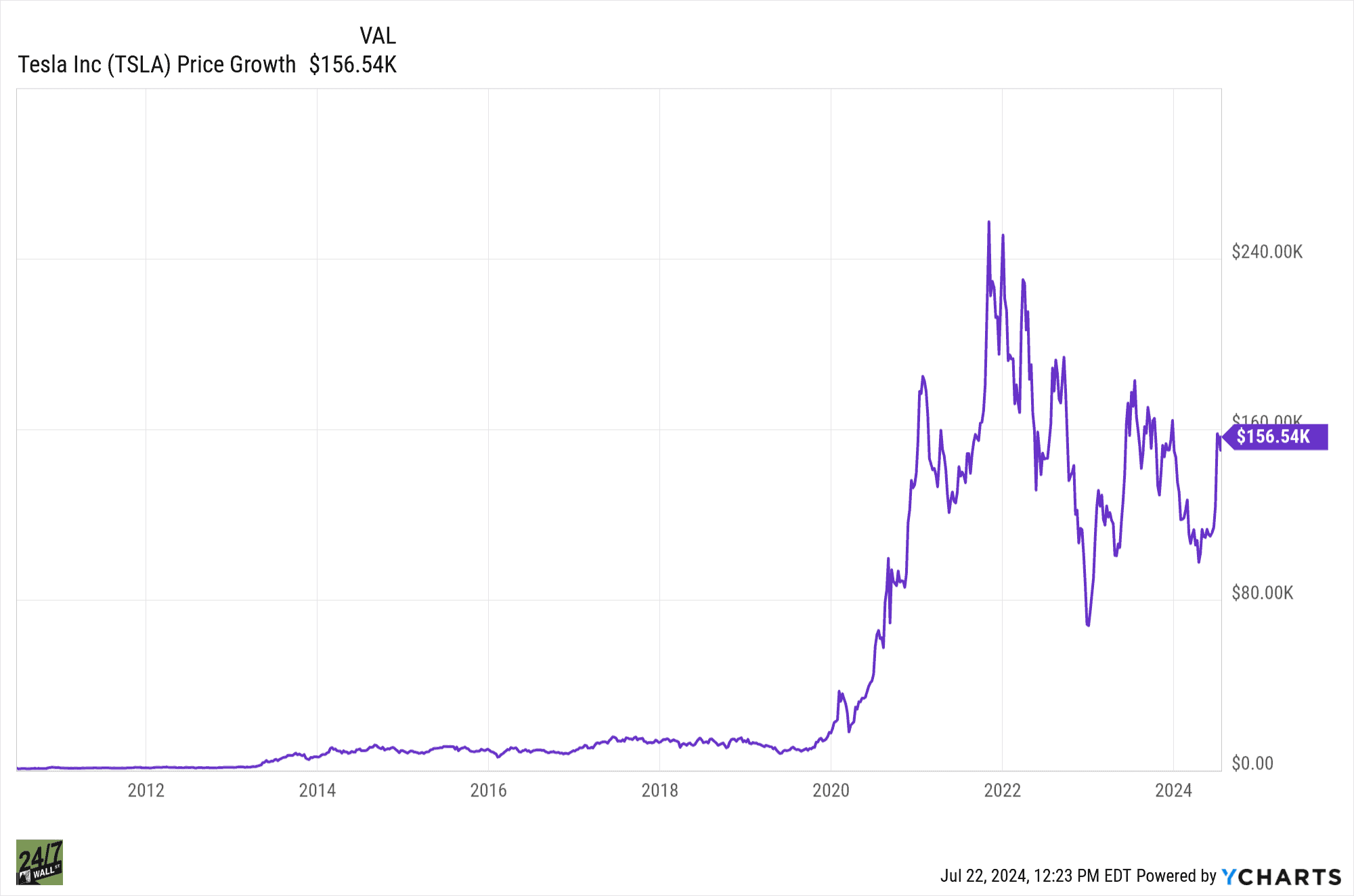

The electric vehicle market has taken off in recent years, especially after the introduction of several governmental regulations. Many cars driving on the road today are electric. Tesla (NASDAQ: TSLA) has been the name in the electric car market. If you invested $1,000 in Tesla at its IPO, it would be around $163,225.50 today.

Chart Source: Courtesy of YCharts

However, there is a new contender that’s roaring onto the scene with the potential to disrupt the industry: Rivian (NASDAQ: RIVN).

Rivian isn’t your average electric car company. Rivian is setting its sights on a specific niche within the EV market – electric trucks. The demand for these vehicles is growing. Rivian is a potentially explosive company, though it also carries lots of risks (just like any high-growth stock).

Rivian’s focus on the burgeoning electric truck market, coupled with its innovative technology and strong partnerships, positions it for explosive growth despite its current financial hurdles. This makes it a potential millionaire-maker for investors with a high-risk tolerance.

We’ll examine exactly why Rivian could be the next millionaire-maker stock. Our Rivian Price Prediction and Forecast article provides a more in-depth explanation. For those running short on time, here are the key takeaways:

The quiet hum of electric motors may soon replace the roar of gasoline engines, and not just in sedans and SUVs. The electrical truck market is just now starting to grow, making it the perfect time to get in on the action.

Let’s look at the sheer size of the traditional truck market, especially in the US. Pickup trucks are consistently some of the best-selling vehicles in the United States, with drivers valuing their power, utility, and towing capacity. The electrical trick market is expected to grow even more.

It’s expected to grow at a CAGR of 15% between 2024 and 2032, according to Global Market Insights. Other experts put the rate growth at as high as 34.2%!

This explosive growth is due to a few different factors, including:

Rivian isn’t just entering the electrical truck market. It’s looking to become a leader by focusing on two key areas: innovative technology and strategic partnerships.

Rivian is not just putting electric motors into existing truck frames. They are designing their own platforms from scratch, specifically for electric vehicles. It’s these innovative technologies that are driving Rivian’s growth.

Their current electric truck platform has several advantages:

Beyond the platform, Rivian is pushing boundaries in other technological areas, too. For instance, Rivian is working on in-house batter development, potentially giving them more control over their vehicle’s range and performance.

Rivian’s future vehicles are expected to be equipped with advanced driver-assistance systems. For instance, they’ll likely include features like automatic emergency braking and lane departure warnings.

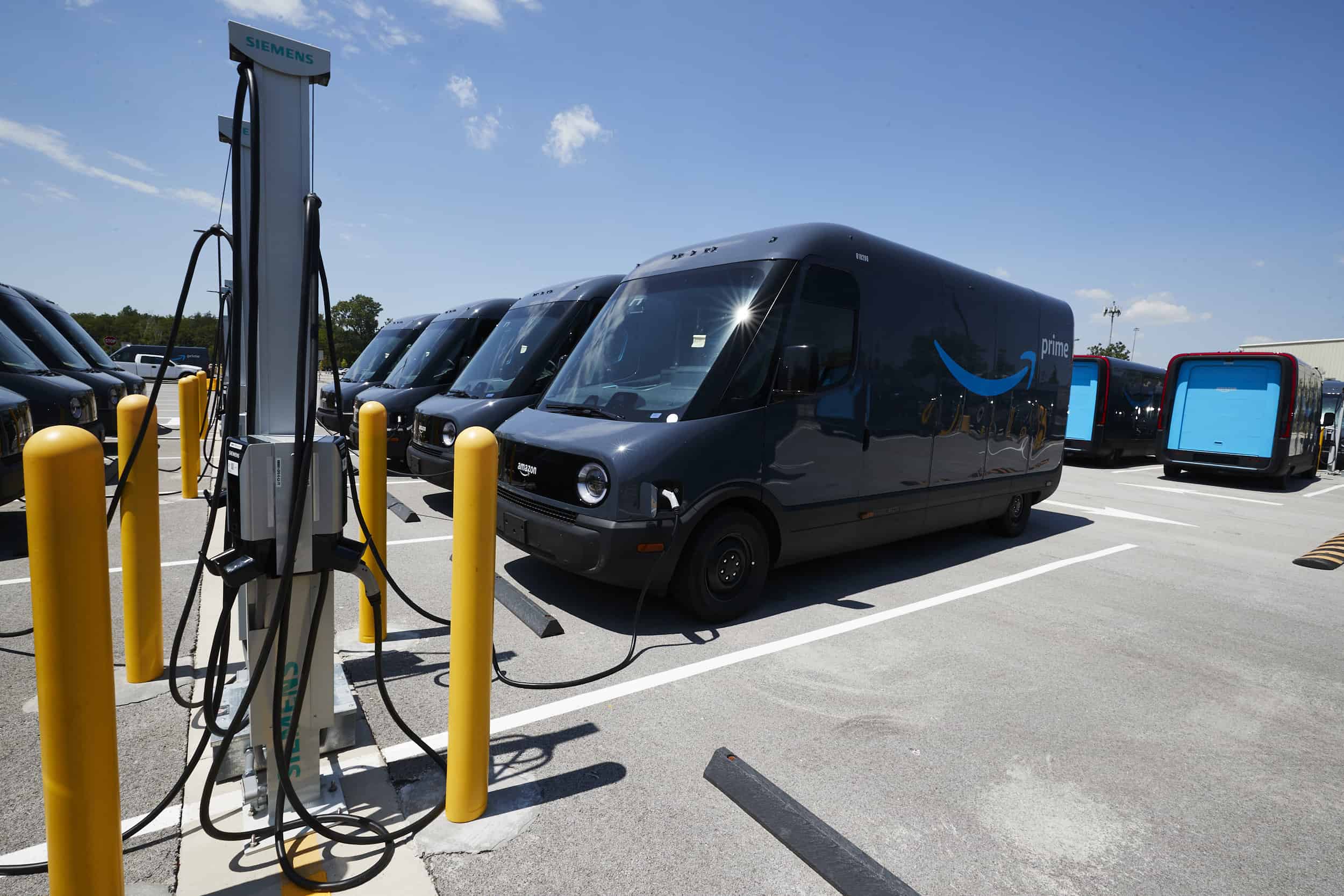

Beyond all of the technological advancements Rivian is working on, they’re also partnering with other electrical vehicle companies. For instance, Rivian has secured a massive investment from Amazon (NASDAQ: AMZN), including a massive order for electrical delivery vans. This deal provides Rivian with crucial capital and serves as a major vote of confidence for their production capabilities.

Ford (NYSE: F) has also invested in Rivian and plans to coNYSE-develop a new electric vehicle. Sadly, the vehicle never became available, but the partnership is still significant. Ford remains one of Rivian’s key shareholders and could potentially collaborate on future projects. Again, the fact that Ford is invested in Rivian is another vote of confidence.

These partnerships provide some financial backing for Rivian and help it tap into other companies’ manufacturing expertise.

Rivian has positioned itself as a serious contender in the electric truck market thanks to all these advantages. However, that doesn’t mean it is without its issues.

Rivian has a potentially very promising future. However, there are some challenges ahead that are important to keep an eye on.

For instance, Rivian is a young company, making it risky. It isn’t nearly as established as other companies. Rivian has also spent a significant amount of investment capital on research, development, and building production facilities. While they’ve secured other additional funding to achieve their ambitious production goals, there is no telling when this will run out.

The electrical truck market is also becoming more competitive. Larger companies like General Motors (NYSE: GM) are starting to see how lucrative this market could be and invest in it. Additionally, traditional truck companies are also starting to develop their own electrical offers, leading to very intense competition.

These hurdles are significant and could stand in Rivian’s way. However, Rivian’s potential rewards could outweigh the risk for investors with a high-risk tolerance.

Despite the roadblocks, Rivian’s potential for explosive growth makes it a very compelling option for investors looking for high returns. Here are our favorite reasons to invest in Rivian:

Remember, high-growth stocks also have the potential to be low-growth stocks. Rivian is a young company, so there is a lot of risk involved. However, if they grow like some experts predict, they could be a huge potential millionaire maker.

Rivian has carved out a unique position in the growing electric truck market. Thanks to its innovative technology, Rivian has become a major player. There is a good chance they will continue growing in the future.

They’ve also made several partnerships that can help them get a bit more of a competitive advantage. For instance, they’ve partnered with Amazon to deliver custom-made electrical vans.

Thanks to these partnerships and Rivian’s technological innovations, Rivian is positioned for potential explosive growth. This high-growth potential, if successful, could make Rivian a very lucrative investment for those who are okay with a little risk.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.