Technology

Marathon Digital, up 29% in the Past Month, Has Short Sellers Attacking

Published:

Since its most recent selloff in early June, Bitcoin (BTC) has rebounded, and since July 7, 2024, the leader of crypto is up nearly 22%. Ethereum (ETH), the second-largest crypto by market cap, has tallied a 19% gain over the same time. Therefore, it would be logical by extension to assume that companies specializing in crypto mining and blockchain technology would follow suit, right? Wrong.

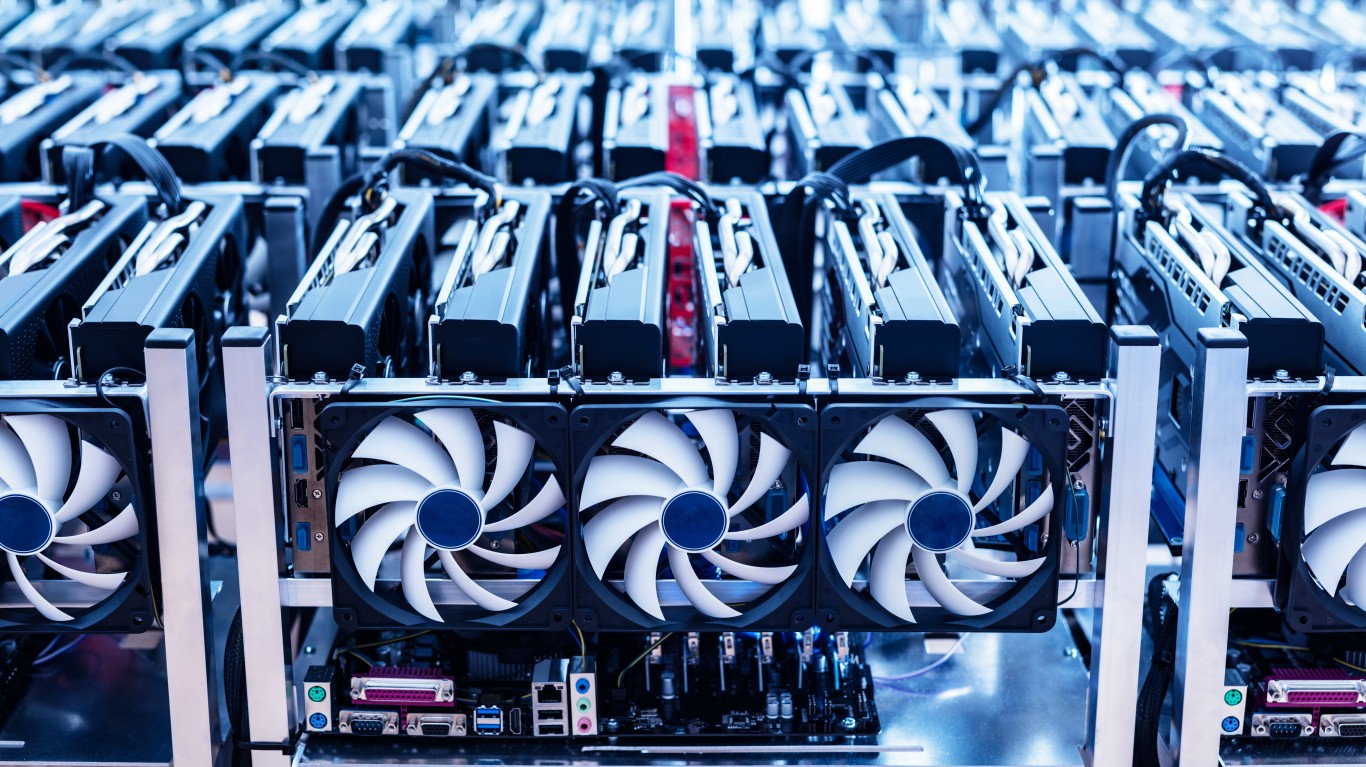

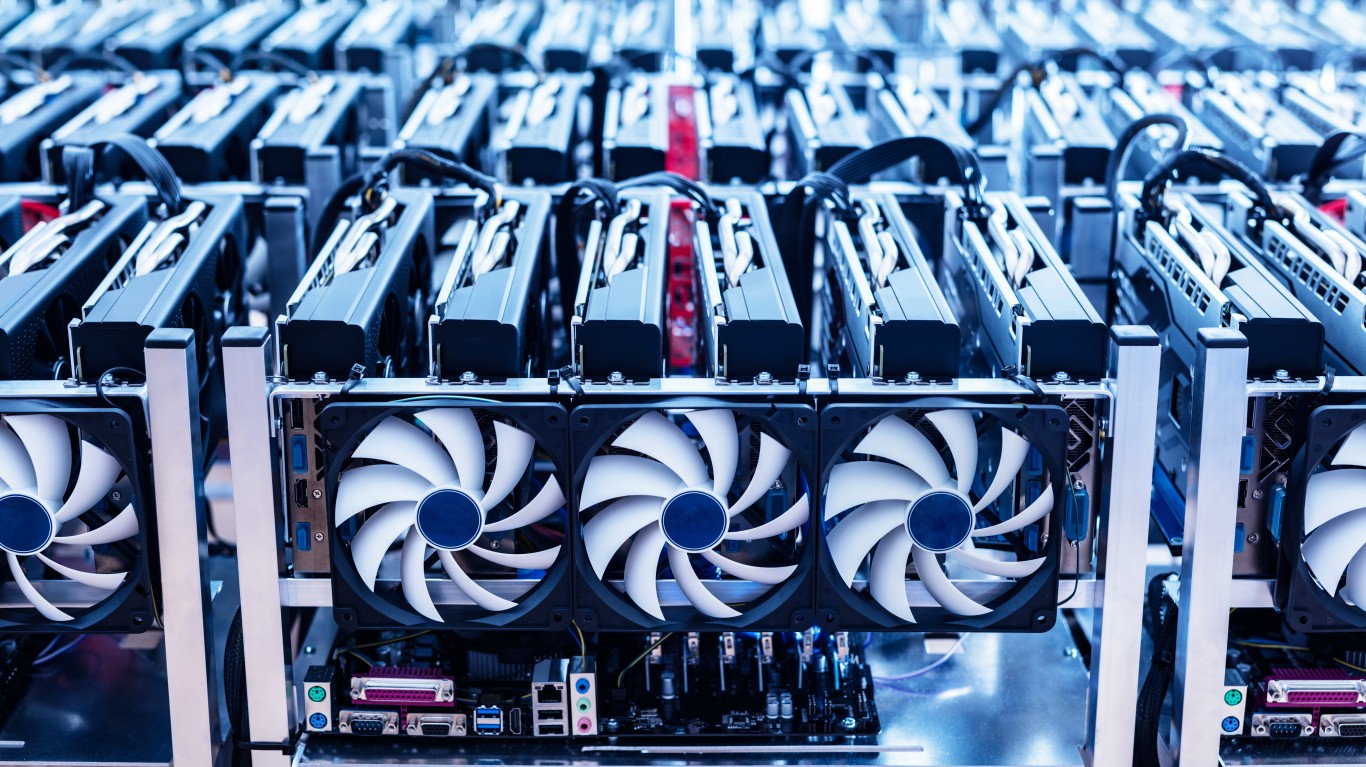

One of those companies is Marathon Digital Holdings Inc. (NASDAQ: MARA), which was founded in 2010 in Fort Lauderdale, Florida, and is currently headquartered in Las Vegas. Marathon Digital Holdings is a digital asset technology company that specializes in crypto mining. And briefly, that business was booming. But the tides have turned, and now the company finds itself the target of significant short seller interest.

Despite its $6.48 billion market cap, Marathon Digital Holdings is bleeding money. On a trailing 12 month (TTM) basis, free cash flow is currently -$343.26 million on TTM total revenue of $387.51 million over the same period.

That’s resulted in a -5.72 price-to-earnings ratio and an analysts’ consensus earnings per share (EPS) forecast of -10 cents for the current quarter. And despite posting positive EPS the past two quarters — of 2 cents and 4 cents, respectively — the preceding six quarters all saw negative EPS announcements form the company.

Shares of MARA have gained 29% over the past month and 64% since its year-to-date low of $14.63 on April 17, 2024. At the time of writing, shares are now up to $23.96, but they remain significantly down from their all-time closing high, which was $166.40 on March 23, 2012. Since that date, Marathon Digital Holdings’ stock has plummeted a staggering 86%.

Short interest now accounts for 70.467 million shares. Of the company’s public float, which stands at 272.956 million shares, short interest now accounts for substantial 25.81%. Institutional ownership has fallen to 38.40% with 126 institutional investors decreasing their positions over the past year and 18 company insiders offloading shares over the same period.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.