AI stocks have been under extreme pressure since July 11th. On that date, the Federal Reserve signaled that rate cuts were coming sooner than expected and a ‘sector rotation’ out of technology stocks began. With technology stocks already under pressure, on July 16th it was reported the Biden Administration was considering further curbs on semiconductor sales to China.

This news rocked the entire semiconductor space, but equipment suppliers like ASML (Nasdaq: ASML) and Lam Research took the biggest hit. Today, ASML is down more than 20% from recent highs. Let’s explore the background on ASML and whether this is an excellent opportunity to “buy the dip” on the company with an iron grip on the world’s most important technology.

Need to Know Facts

- ASML’s stock is down more than 20% from recent highs. This is due to a broader ‘sector rotation’ out of technology stocks and also geopolitical fears that further trade restrictions on China could hurt sales.

- The company is the only producer of EUV machines, which are needed to continue pushing the boundaries on advanced semiconductors.

- If you’re interested in the top stocks in AI, don’t miss out on grabbing a complimentary copy of brand-new “The Next NVIDIA” report. It exhaustively covers ASML’s opportunity and features other stock research reports (you won’t want to miss the software stock we’re confident has 10X potential).

The Background on ASML

ASML produces several advanced machines, but their specialty is advanced lithography systems. In the 1950s, semiconductor engineers discovered you could “print” complex patterns onto silicon wafers by using upside-down microscopes projecting light onto photoresist materials.

Using this method, engineers perfected the printing of thousands of tiny transistors and created computer chips of complexity that was previously impossible.

Of course, the complexity of computer chips has grown at an exponential rate since this time. The first Intel chip was created 50 years ago and contained 2,300 transistors. Flash forward to today, and the brand-new Blackwell chip announced by NVIDIA has 208 BILLION transistors.

Like many other areas of semiconductor manufacturing, the lithography industry used to have dozens of competitors. However, with each passing generation, the capital expenditures and complexity of building new machinery increased dramatically and companies dropped out.

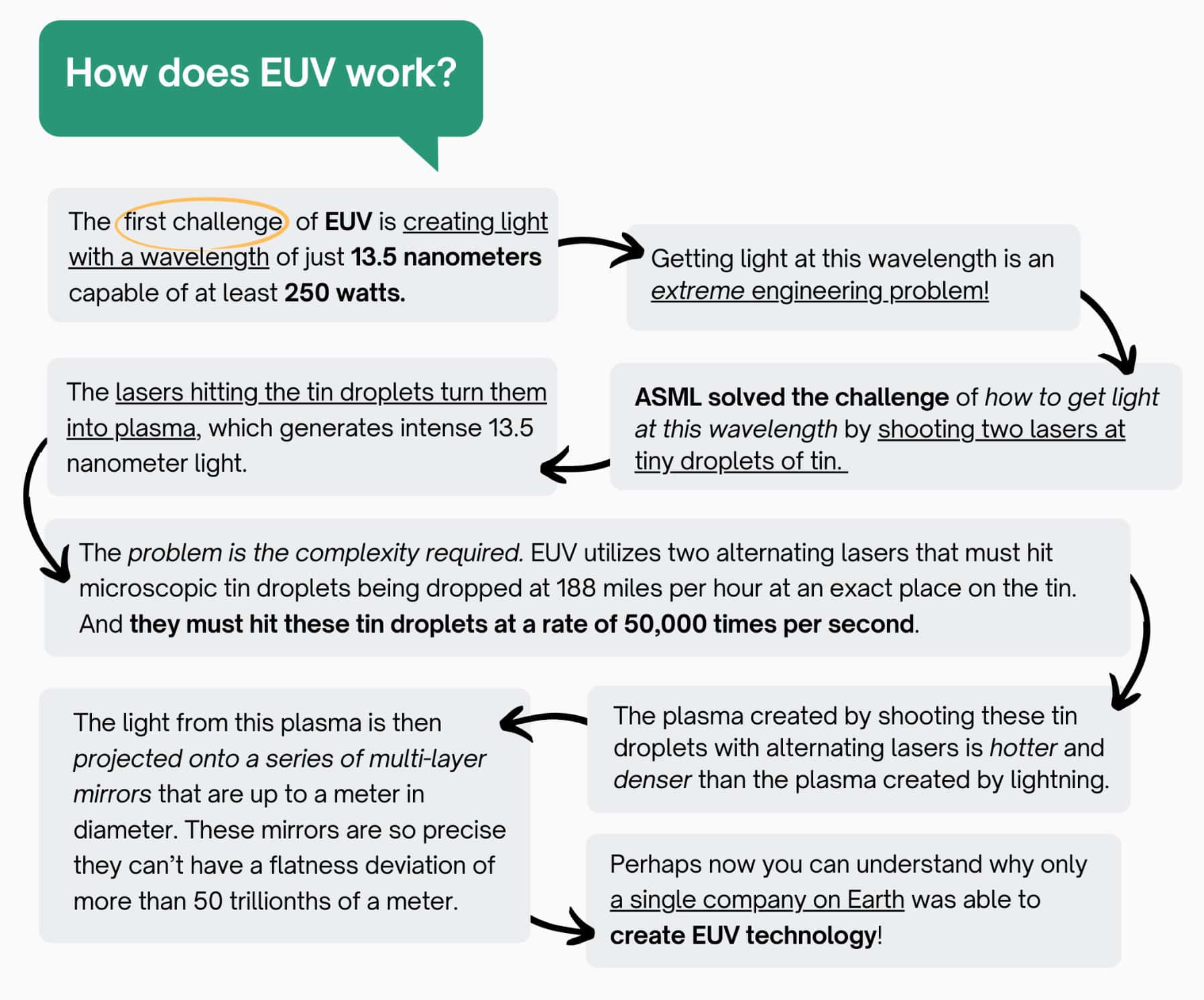

By the turn of the century, only three competitors were left: ASML, Nikon, and Canon. To continue pushing the boundaries of how complex chips could be built, the industry needed to move to a technology known as ‘EUV.’ From concept to completion, the effort to build EUV took three decades with input from dozens of companies and thousands of experts in the field.

More importantly, it cost billions in research and development and proved difficult enough that both Canon and Nikon ceased development of the technology, ceding cutting-edge lithography to ASML. You can find an explainer we’ve created on the complexity of EUV below.

A Monopoly on the World’s Most Important Technology

All of this leaves ASML with a monopoly on the world’s most important technology. Customers wanting to buy the most advanced EUV machines must rely on the company. That’s an enviable position to be in, as ASML’s most advanced machines are expected to sell for $700 million EACH by the end of the decade.

When describing ASML to investors, I’m often immediately met with a “what’s the catch?” type of response. And I must admit, the ‘pitch’ around a single company controlling the choke point to all AI and cutting-edge computer advancements does sound too good to be true, so let’s analyze how strong ASML’s grip on lithography is.

- Market Share: As noted earlier, ASML has a monopoly on EUV systems. However, plenty of industry sales come from older technologies like DUV, where ASML’s market share in immersion lithography is also dominant. Market research estimates now give ASML more than 80% of the market share of the total lithography tool space. In short, even in areas where competition still exists, ASML dominates at an incredible level.

- The China Threat: Another major threat investors fret about with ASML is that export controls to China will lead the country to create an ASML competitor. The truth is reverse-engineering ASML is maybe the greatest challenge in all of technology. The company primarily won the race to EUV because it embraced working with dozens of other companies and industry researchers over a process that took three decades. In addition, ASML EUV machines require incredible expertise in many domains. EUV not only requires mirrors and lasers of incredible complexity owned by ASML but also dozens of other partners building specialized machines that are incredibly hard to replicate. These machines must all then work together at mind-boggling levels of precision.

- The End of Moore’s Law: The biggest threat to ASML may simply be we’re approaching the physical limits of how small transistors on chips can get. The precision on the most advanced chips is now measured in individual atoms. Simply put, if we can’t keep shrinking the size of chips, that’s a major threat to ASML as it takes away the value of continuing to upgrade to their most advanced machines. The company has a technology roadmap that runs through 2036, so I feel very good about its ability to keep innovating across any reasonable timeframe.

The Upside to Buying ASML Today

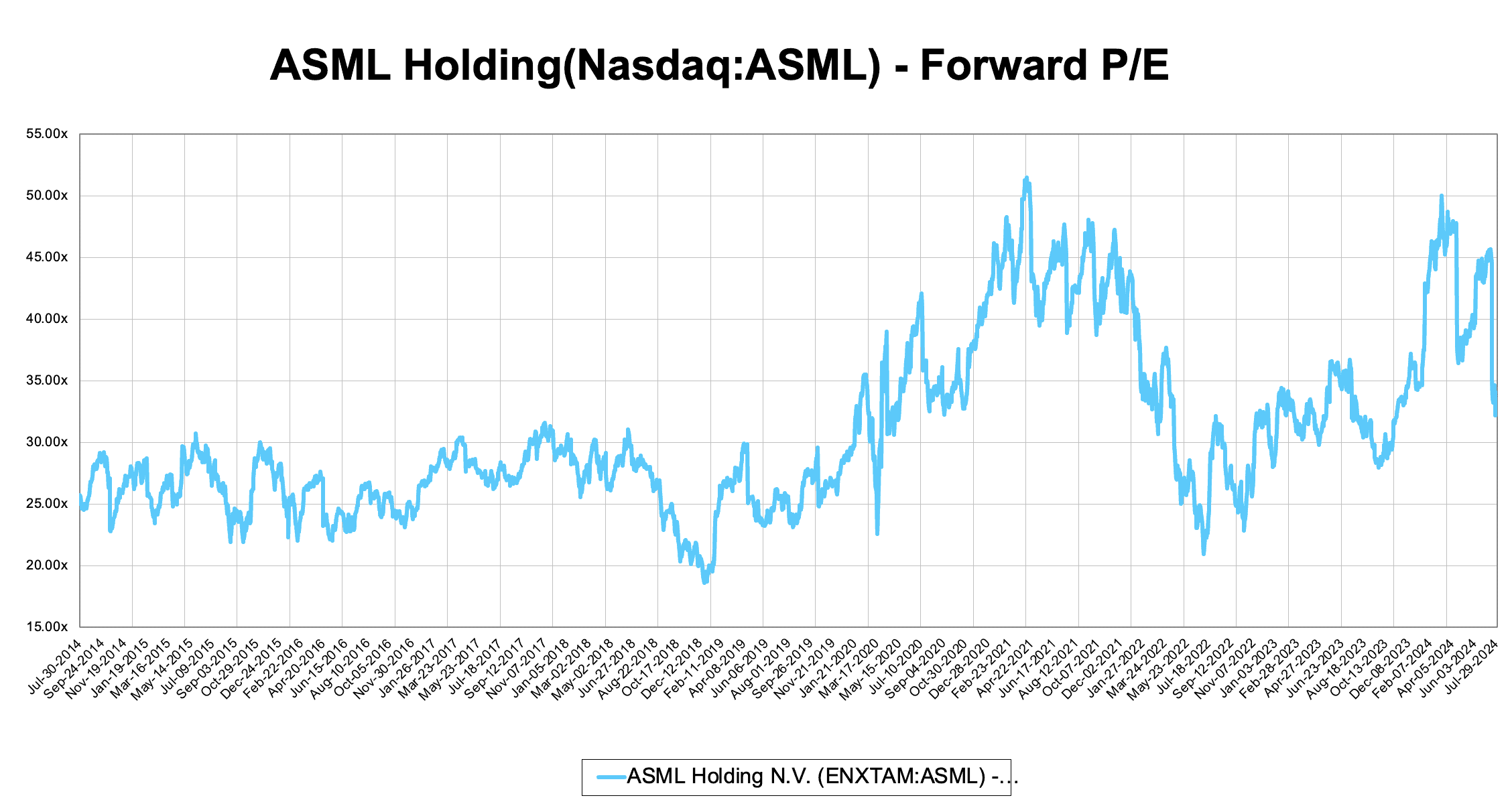

So, what’s the upside to buying ASML across the next decade? With their position in EUV so secure, the greatest threat has simply been the stock has run up so much! At the start of July, ASML traded for north of 45X forward earnings.

Today, that figure is about 32X, which is close to the upper bound of the range it traded in across the past decade.

And you might say, “trading at 32X forward earnings doesn’t look ‘cheap’ compared to where ASML has been across this time.”

The key idea is that ASML’s stock has been a huge winner and seen fantastic returns every time it traded at these levels. If ASML finished the decade with $30 billion in forward earnings expectations (its expectation in 2025 is $12.7 billion) and traded for the same forward earnings as today, its share price would be closer to $3,000 per share.

Even from today’s levels there still appears to be plenty of upside remaining. Then keep in mind, this is all coming from a company with a monopoly in the world’s most important technology with a mega-trend that requires it like artificial intelligence taking off!

In my opinion, this makes ASML one of the best “buy the dip stocks” today. If fears across the AI space and a rotation out of technology stocks persist, I will continue adding to my holdings in the stock.

Threats I’m Watching

Of course, no stock is ‘free money.’ Even with a monopoly in EUV, some major threats face ASML. So, let’s explore the key threats I’m watching in a bit more detail below.

- Shifting Technology: ASML’s lithography tools serve three primary markets: 1.) Logic (processors) 2.) Memory 3.) Storage. Each market is different, but as an example, storage technology relies less on advances in lithography and instead sees advancement from adding more layers to each chip. This could benefit companies in different parts of the semiconductor equipment chain like Lam Research and Tokyo Electron more than ASML. My recommendation to help reduce this risk is to also own a stock like Tokyo Electron, which is an excellent ‘buy the dip’ opportunity right now as well.

- A Loss of China Sales: ASML’s recent share price drop was triggered by reports the Biden Administration is exploring tougher restrictions on semiconductor equipment in the country. On the surface, this is a huge threat to ASML as 49% of their sales were to China last quarter! However, this number isn’t as bad as it looks. First, the company’s backlog of coming sales to China isn’t as large (currently about 20%). Chinese customers are aware that added restrictions may be coming and are stockpiling ASML equipment. However, ASML has a top-tier management team that’s aware of this situation and is maintaining full-year guidance knowing Chinese sales may fall off. In short, they’ve been planning for this situation. A reduction in sales to China definitely hurts ASML, but keep in mind that geopolitical tensions are part of ongoing negotiations. For example, if Donald Trump wins the Presidency in November, he may see more chip access to China as a “negotiating chip” that can get him concessions in other areas. ASML can likely reach 2030 sales targets even with tougher restrictions on China staying in place.

It’s obviously tough investing in a stock like ASML today. NVIDIA’s stock has been in freefall in recent weeks and investors are fleeing technology. In addition, while I’m a big believer in the AI market over the long run, it will certainly have bumps and more sell-offs like the past month along the way to becoming the largest technology trend ever.

I believe if you buy ASML and can ride out the bumps on the ride, you’ll be richly rewarded for purchasing it across the next five years. At a minimum, this is a great stock to add to your watchlist and add to your portfolio if the current technology sell-off continues.

The Most Essential AI Report of 2024

If you’re interested in ASML after reading this, you need to grab a complimentary copy of our brand-new “The Next NVIDIA” report. It dives even deeper into ASML, has 3 stock research reports (including a software stock we’re confident has 10X potential), and covers the growth of the AI industry in exhaustive detail. It will be available for a limited time only, so don’t delay in downloading your own copy today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.