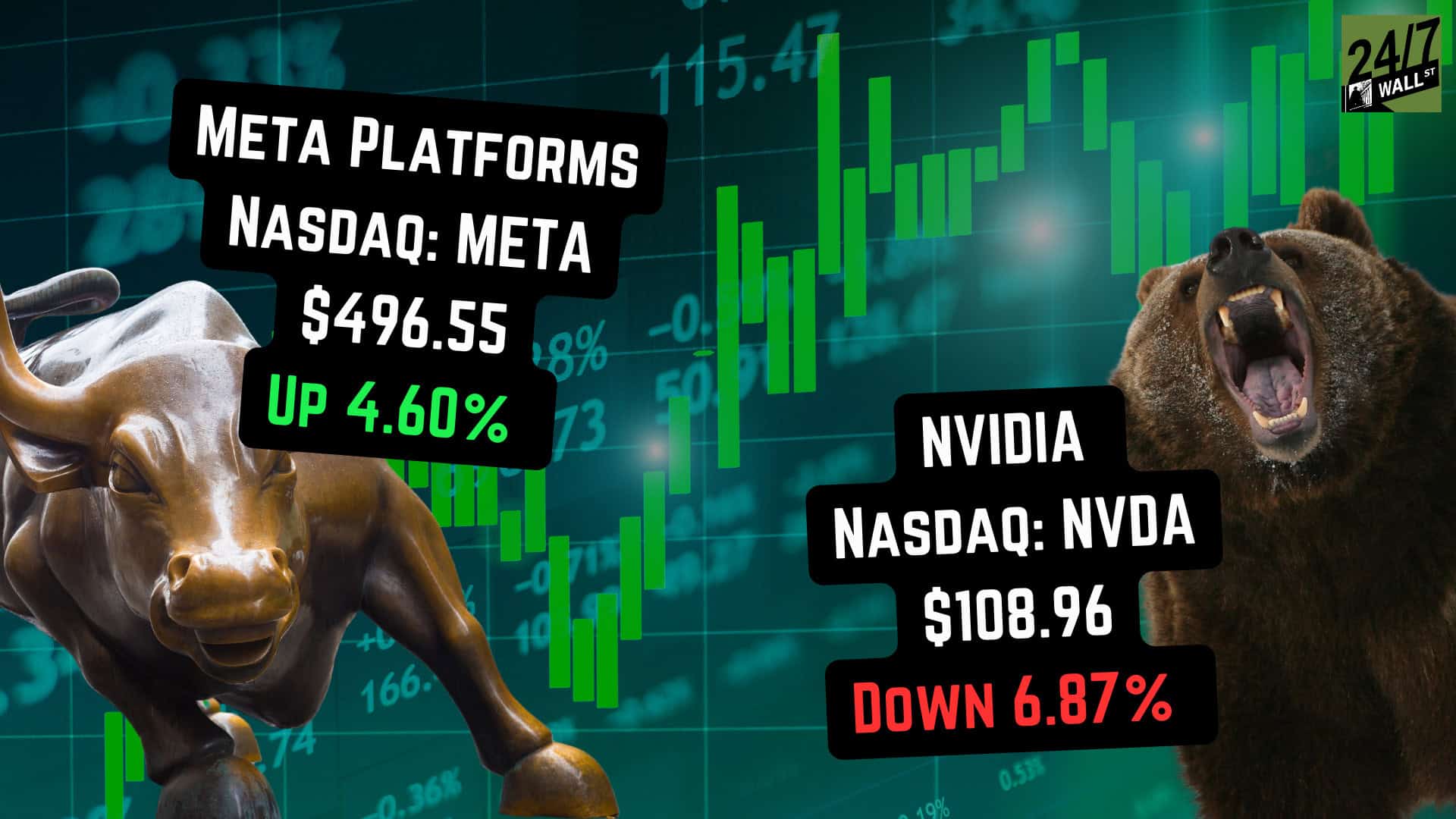

In after-hours trading last night, it looked like technology stocks were going to continue their winning streak. Meta Platforms (Nasdaq: META) released a strong earnings beat that also indicated the company was going to continue ramping up its AI efforts. That news was enough to lift NVIDIA‘s (Nasdaq: NVDA) share price back above $120 per share in after-hours trading.

And yet, at 2:00 p.m. ET, the Nasdaq-100 has now sunk 2.6% while NVIDIA shares are down 6.9%. Meta’s stock is still up on the day, up 4.7%, but it’s given up most of the gains it opened the morning with.

Let’s explore what’s happening.

Need to Know News

- Meta released earnings last night that exceeded Wall Street expectations. Sales were ahead of estimates and grew 22% from the last year. More importantly, Meta guided ahead of expectations for the next quarter, which shows that the company’s strong momentum continues.

- Yet, share price gains across technology evaporated today thanks to poor macroeconomic releases. Jobless claims and a poor ISM manufacturing index reading raised fears that the economy may be headed for a recession. This has led to a broad-based sell-off across stocks.

- Despite today’s sell-off on economy-wide fears, Meta’s earnings included very positive news about AI stocks. If you’re looking for some stocks with huge potential that could be fantastic “buy the dip” opportunities, make sure to grab a free copy of our brand-new “The Next NVIDIA” report. It features a software stock we’re confident has 10X potential.

Meta’s Earnings

Here are some of the key highlights from Meta’s earnings report:

- Revenues up 22% from last year to $39.1 billion. Meta had guided to $36.5 to $39 billion in revenue when it last reported earnings and Wall Street was expecting the company to report $38.3 billion.

- Earnings were up 73% from last year to $13.5 billion. That translated to $5.16 per share in earnings versus Wall Street expectations of $4.73 per share.

- Revenue guidance for next quarter is $38.5 billion to $41 billion. The midpoint of that number is $39.75 billion, which is above Wall Street estimates of $39.1 billion. Obviously, Meta just finished a quarter where its revenue was above what it forecast, so this guidance was met with substantial enthusiasm.

The numbers were good across the board.

As we’ve highlighted on 24/7 Wall Street, Meta has become the poster child for boosting its business via AI. The company now powers 50% of Instagram recommendations through AI and about 40% of Facebook content recommendations through AI.

These content recommendation engines have delivered an estimated 10 to 11% time boost on platforms. Running an estimate on how that impacts revenue, we find that Meta is likely receiving about an incremental $16.3 billion annually from its core AI investments. Wall Street researcher Bernstein believes the company receives about a 22% ROI for its spending on AI hardware powering these AI recommendations.

In addition, they’re driving the string of earnings blowouts that have driven Meta’s share price higher across the past year.

Meta’s Earnings Were Good News for AI Companies

Meta’s earnings also introduced news that’s good for AI companies like NVIDIA and Broadcom (Nasdaq: AVGO). Meta increased their capital expenditure estimates from $35 to $40 billion in 2024 to $37 to $40 billion.

The company has spent $15.2 billion in the first half of 2024. So if they actually hit the higher end of that guidance ($40 billion in capital expenditures), that would imply $24.8 billion in spending in the second half of the year. Put another way, that would mean the company’s AI spending could jump another 63% in the next six months off already lofty rates.

Meta also said they planned to increase capital expenditures significantly in 2025. The company’s positive commentary not just on spending in the months to come but also in 2025 follows similar statements from Microsoft, AMD, and Arista Networks earlier this week. Given this, you’d expect he share prices of AI companies to continue soaring today alongside Meta.

Macro Worries Bury Stocks Today

And yet, stocks across the market are in free-fall today. As of 2:00 p.m. ET, the losses across indexes stand at:

- Dow Jones Industrial Average: Down 1.52%

- S&P 500: Down 1.57%

- Nasdaq-100: Down 2.57%

- Russell 2000: Down 3.44%

In recent weeks, when the Nasdaq fell big it has beyond the Russell 2000 as investors began a ‘sector rotation’ moving out of technology stocks and into areas that had recently lagged performance-wise, like small caps.

However, today the selling is extremely broad-based. The primary reason for the sell-off is macro concerns. Two readings were poor this morning:

- Initial jobless claims reached 249,000 last week, which topped forecasts of 235,000.

- The ISM manufacturing index read 46.8%, which was below expectations and is a signal of decreasing factory activity.

Both these measures were poor enough that Wall Street began discussing whether a ‘recession’ was possible in the coming year. Recession fears will lead to outsized losses in stocks that have had significant momentum like NVIDIA, which is why many AI stocks are selling off at outsized rates today.

NVIDIA set a record yesterday seeing its value grow by $329 billion, but most of those gains have been wiped out in today’s today.

With recession fears now coming to the front, all eyes turn to what the Federal Reserve will do in September. Prior to today’s news, bond markets were pricing in an 86% chance the Federal Reserve would cut rates in September. After today’s economic news, it may have few options aside from moving ahead with cuts.

The Best Stocks to Buy Today

Make sure to grab a copy of our complimentary “The Next NVIDIA” report. With Meta today announcing that its investment in AI will continue accelerating into 2025, there’s never been a better time to get the most comprehensive report available on this massive trend.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.