Investing

NVIDIA Jumps 4% on Monday - Here's Why Wall Street Is Suddenly Bullish Again

Published:

It was a quiet day in the stock market. The Dow Jones fell .36% while the Nasdaq rose .21%. One bright spot amongst the sleepy market dady was technology stocks. NVIDIA (Nasdaq: NVDA) rose 4.06% while other companies like Super Micro Computer (Nasdaq: SMCI) saw strong performance as well.

Let’s dig deep into why AI stocks had a standout day and what events investors have to look forward to this month.

Here’s a rundown of the performance of major indexes on Monday:

It’s noteworthy that the Dow Jones Industrial Average and Russell 2000 underperformed the Nasdaq today. Those two indexes dramatically outperformed the Nasdaq during periods of extreme volatility in July. The key cause of that outperformance was money flowing out of large technology stocks and Nasdaq funds and into pockets of the market that underperformed across the past 18 months like value stocks and small caps.

It appears this ‘sector rotation’ is now slowing, as the Russell has underperformed the Nasdaq in several recent trading sessions. The Russell 2000 jumped by nearly 12% between July 9th and 16th, but has now given up nearly all those gains and is up just 2% year-to-date. By comparison, even after recent choppiness, the Nasdaq is still up about 14% year-to-date.

The biggest factor driving AI stocks like NVIDIA and Super Micro today was likely Wall Street commentary. UBS issued a research note that had a few sections worth highlighting:

Overall, UBS reiterates a “buy” rating and price target of $150 for NVIDIA shares.

Why was this research enough to cause such a strong reaction today?

First, Blackwell is extremely important not just for NVIDIA, but companies like Super Micro and Dell (NYSE: DELL) which will see a huge contribution of revenue from Blackwell systems next year.

Recent estimates from Trendforce point to Blackwell being 80% of NVIDIA’s shipments of GPUs to AI end-markets next year.

Second, the Blackwell delay has added considerable uncertainty around NVIDIA. The company has set an extremely aggressive roadmap for its development of high-end GPU systems across the coming years.

While the aggressiveness NVIDIA is displaying has been celebrated as it extends their lead in the AI space, it also introduces risk.

If trusted Wall Street researchers are confirming Blackwell’s delay should only last about 6 weeks and don’t involve any fundamental flaws with Blackwell chips, that’s going to give investors more certainty that NVIDIA can deliver on its promises for this all-important generation of chips.

Looking forward, NVIDIA’s earnings report on August 28th will likely be its most followed yet. The company will likely give more details on the following:

All of these areas will be closely followed and will not just impact NVIDIA’s share price in the coming months, but the entire sector of AI stocks.

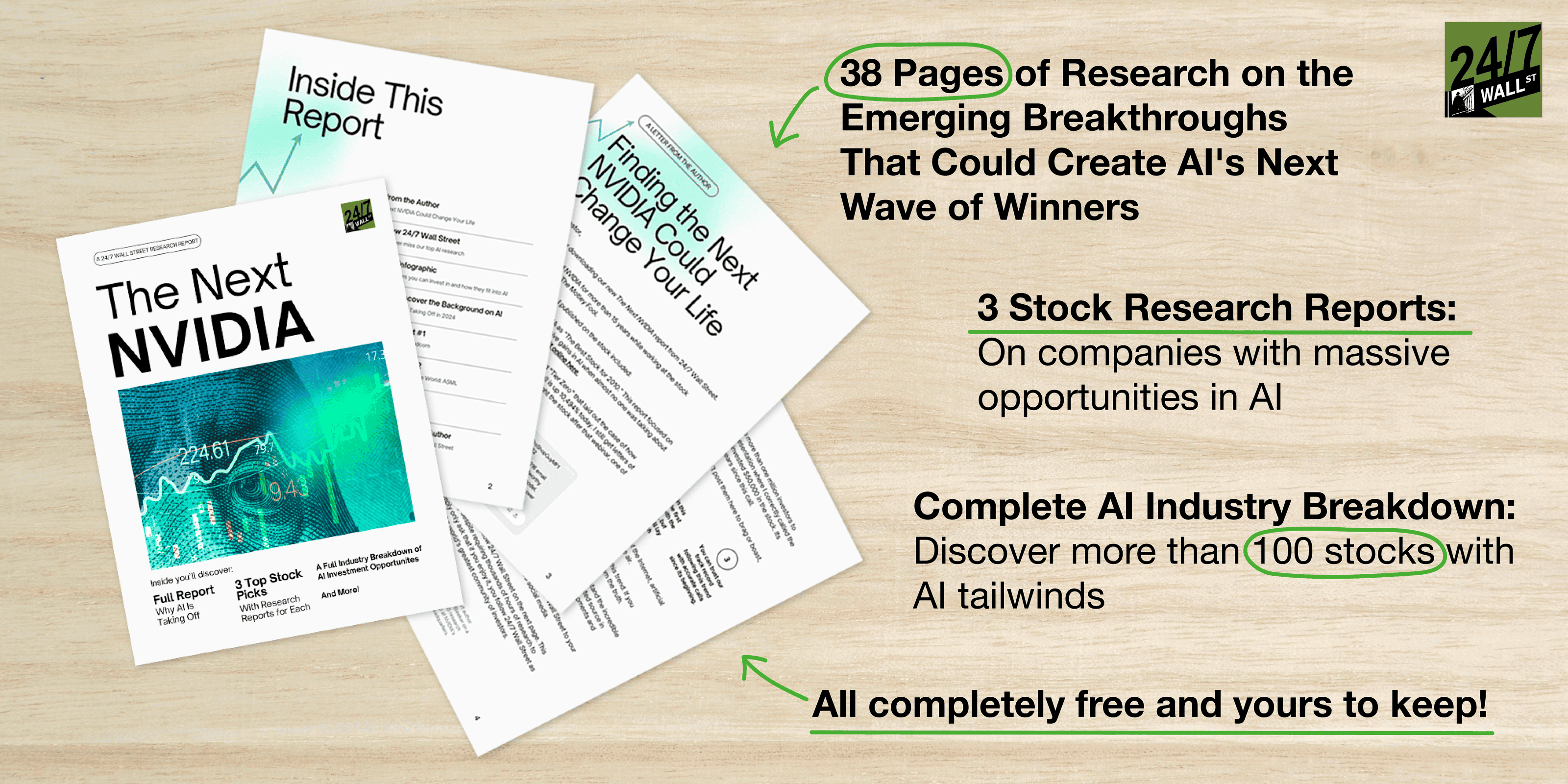

If you’re looking at Wall Street’s bullish research note on NVIDIA today and wondering what other stocks are riding booming AI demand, then you’ll want to grab a copy of our “The Next NVIDIA” report.

It’s complimentary, but available for a limited time only. Grab your free copy today.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.