AI Portfolio

We're Betting $500,000 These 5 AI Stocks Dominate the Next Decade

Published:

Last Updated:

24/7 Wall St. recently launched an AI portfolio where we’re publicly investing $500,000 in a portfolio of leading stocks in the AI space. Our goal: Help investors discover the leading stocks poised to capture the next wave of growth in AI.

One that could catapult the trend past the largest ever previously seen in technology history.

Read on below to see how you can follow along (for free!) and we’ll also review the first four stocks we’ve added to the portfolio along with a brand-new buy announcement revealed just days ago.

On September 12th, we announced the creation of a $500,000 portfolio on our ‘AI Investor Podcast’. The reason we’re creating this portfolio is simple: we’re confident that AI has the potential to be the biggest technology trend ever.

And while NVIDIA has produced generational stock returns thanks to the growth of AI, there is a next wave of growth forming in the space that’s poised to create a new generation of winners that most investors have never heard of. So, we created a portfolio of our top ideas so investors could see the stocks we’re most interested in with specific buy allocations and portfolio moves.

The easiest way to follow along is simply to subscribe to our ‘AI Investor Podcast.’ Every two weeks we discuss the biggest news in the AI investing space and review the portfolio while discussing new buy opportunities. We’ve attached links below to the podcast on major platforms like Apple Podcast and Spotify so you can subscribe. Make sure to subscribe and enable notifications in your podcast player so you don’t miss new episodes!

Follow on Spotify

We’re building 24/7 Wall St. into the greatest community of investors on the Internet. If you come to 24/7 Wall St. you’ll be able to find new analysis on stocks in our AI portfolio every time we post them. In addition, you can join our mailing list and receive our brand-new AI report absolutely free. We send out 1 to 2 emails every week detailing market news and provide updates to our AI portfolio in these emails.

Another place you can follow our $500,000 AI Portfolio is our social media accounts. Episodes and clips from the ‘AI Investor Podcast’ are posted to our YouTube channel. In addition, we’re posting ‘Trade Alerts’ to our account on X (formerly Twitter) before we make portfolio purchases. You can follow the account and set alerts to ensure you don’t miss any future trades.

On September 12th we announced four initial buys to the portfolio. Below we’ll detail each one. Combined, we’re purchasing $60,000 worth of these first four stocks, and they’ll set the ‘foundation’ of our portfolio as we continue issuing more buy alerts in the months to come.

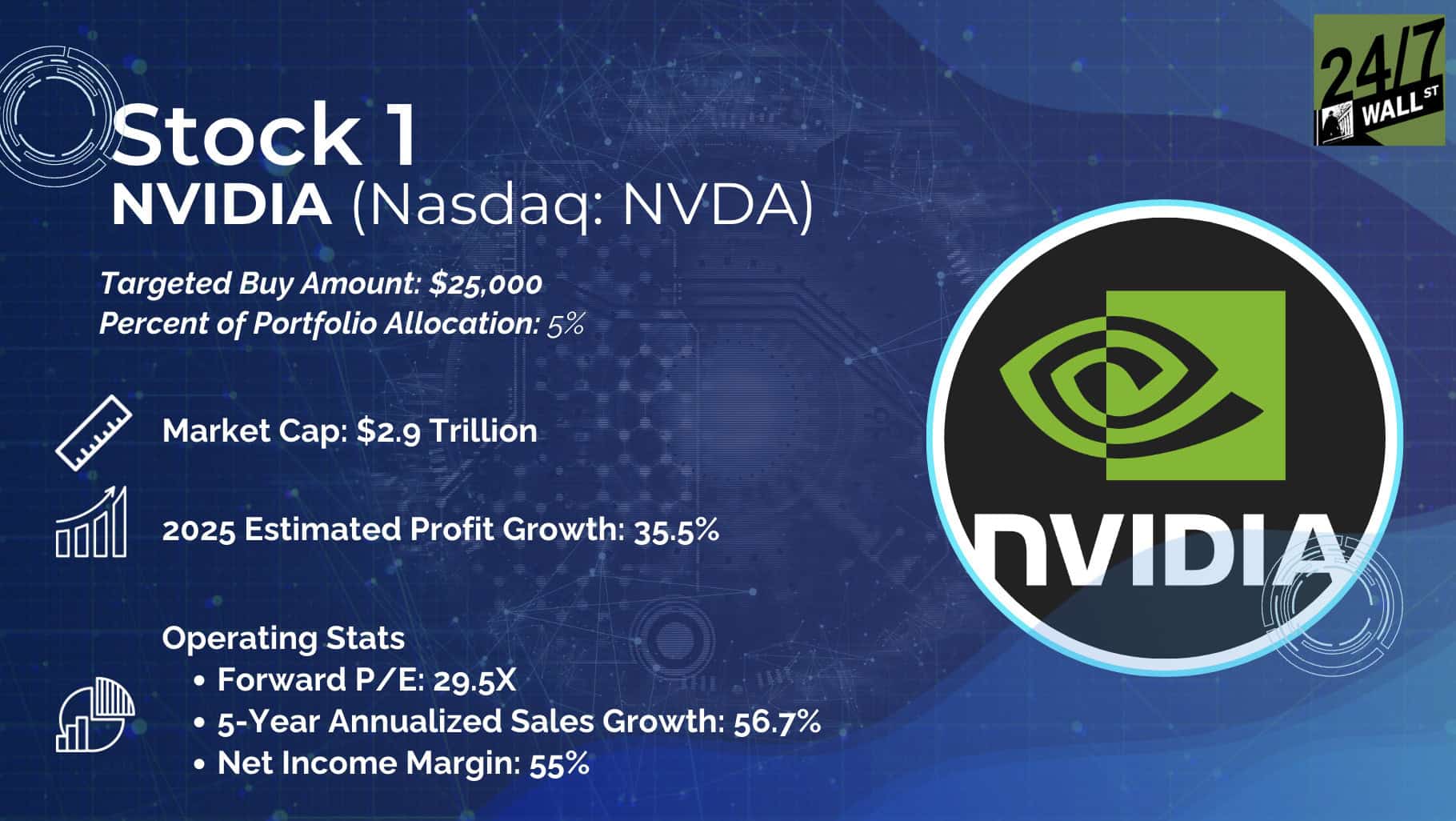

Adding NVIDIA shouldn’t come as a surprise to investors as they’ve become the poster child for the growth in artificial intelligence. However, we continue to believe that Wall Street is underestimating the company’s opportunity in the coming year.

We estimate that NVIDIA’s coming Blackwell cycle could deliver EPS of $4.50+ in 2025, potentially delivering more than $5 in profits per share. That means that contrary to reports of NVIDIA being in a historic valuation “bubble,” the company trades for roughly the same earnings multiple as the broader market while maintaining an iron grip on the most important technology trend of our time.

More importantly, we believe strategic moves NVIDIA has made across the past 15 years now form the foundation of a ‘competitive moat’ that’s stronger than most market observers give NVIDIA credit for. The company not only is dominant thanks to its development of CUDA – a platform for developing on GPUs – but also NVIDIA’s push into networking technology that will be essential as data centers grow from connecting thousands of GPUs to a million or more in the next decade.

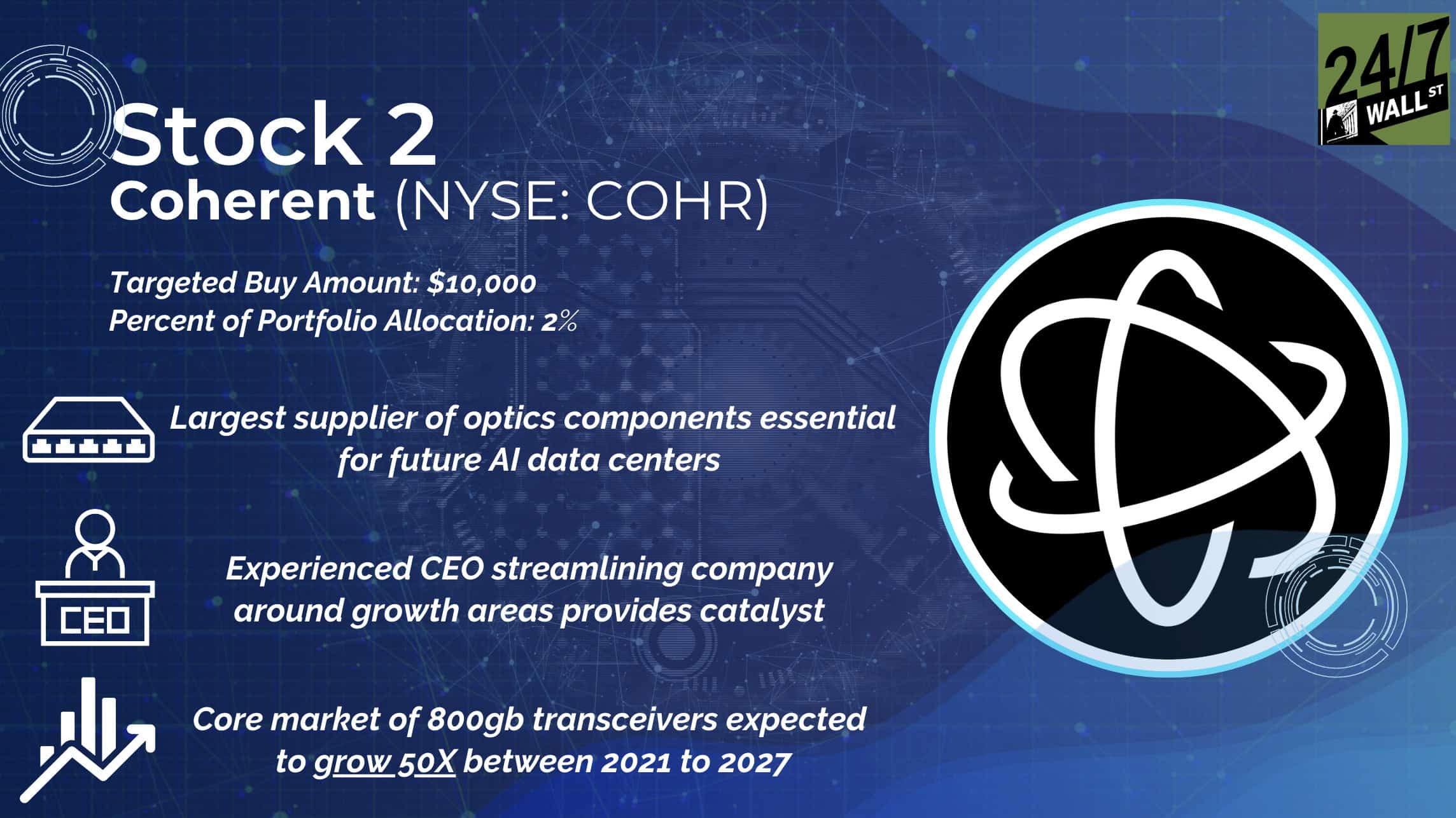

Coherent is the largest supplier of optical communications components. Our bet: that market is about to see massive growth from the next wave of artificial intelligence spending.

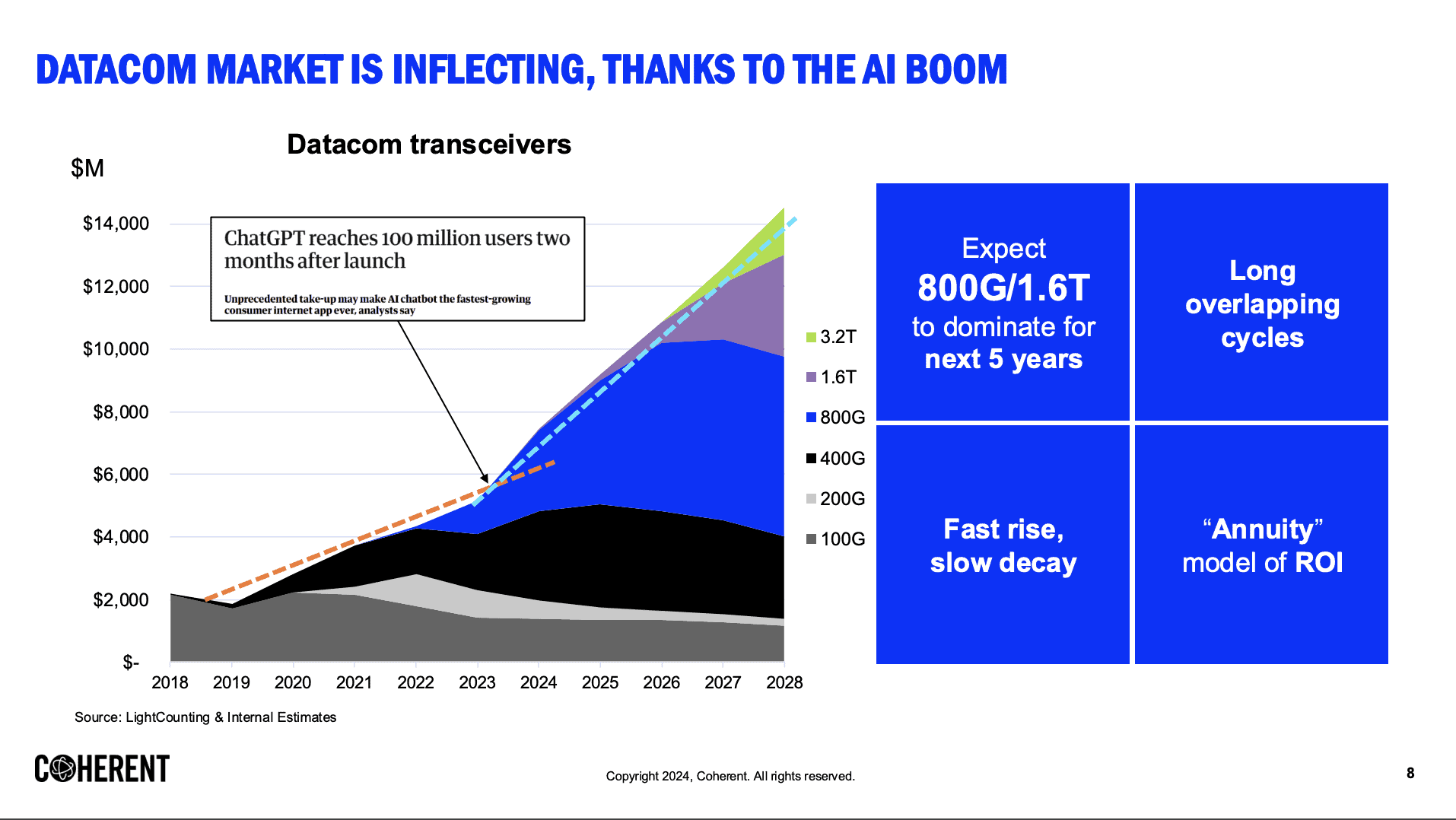

The opportunity Coherent could capture is illustrated well in this slide below:

As you can see, the creation of ChatGPT and resulting boom in data centers being rebuilt around GPUs is creating an inflection point in spending in Coherent’s core market (see the prior trend in an orange line versus the new projected trend line in blue).

Historically, transitions to transceiver modules with more bandwidth have been lumpy. The transition to 400G transceivers has taken longer than expected. While headlines are abundant about booming demand for more data, telecom companies have underinvested in this space in recent years.

However, the growth of AI is changing this dynamic. Optics in data centers support higher-speed connectivity and are more power efficient. Their biggest downside has been their expense, but with building out massive GPU clusters quickly becoming an arm’s race, demand for more complex (and expensive) optical components from Coherent looks set to soar.

Beyond the boom in AI, Coherent also has several catalysts worth following. The company maintains a reasonable debt load ($4.3 billion), and is a beneficiary of rates coming down and lowering the cost of that debt. Also, the company’s CEO – James Anderson – is embarking on an ambitious project to streamline the company.

Add it all up and Coherent is an excellent way to get exposure to the next wave of data center spending.

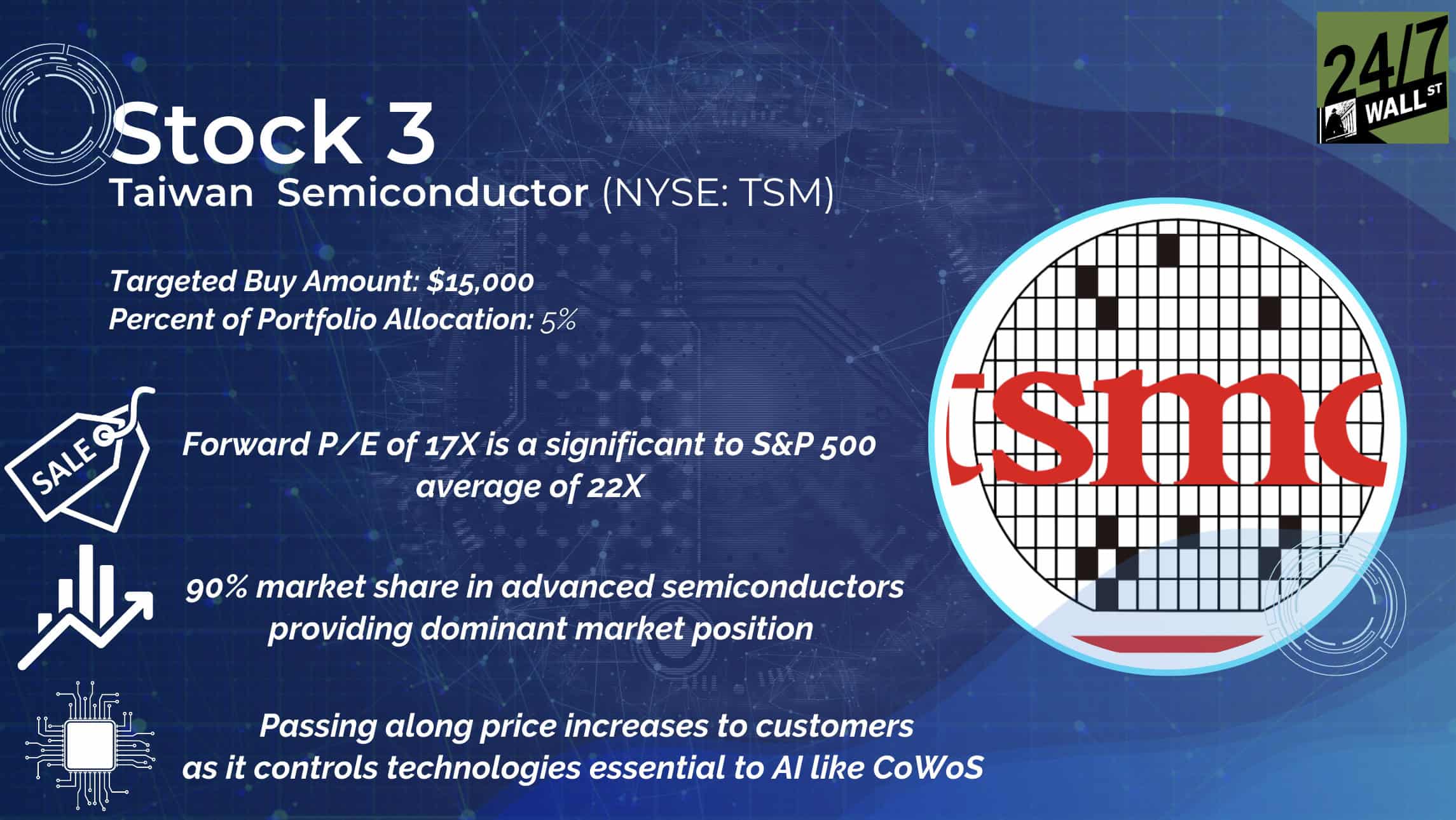

Taiwan Semiconductor is the leading manufacturer of advanced semiconductors. A few decades ago, more than a dozen companies produced advanced semiconductors. However, as each generation of chips became increasingly complex and expensive to make, competitors fell out of the race to make the world’s most advanced chips.

Today, only three companies are in the “race” to produce the most advanced chips in the world: TSM, Samsung, and Intel (Nasdaq: INTC). Both Intel and Samsung have struggled to keep up with Taiwan Semiconductor in the leading nodes (an industry term for the most advanced chips), which has led to TSM controlling a dominant 90% market share in advanced chips used in industries like artificial intelligence.

Taiwan Semiconductor has a dominant position, but it’s also reasonably priced. As of September 12th, when we announced our intention to buy shares of Taiwan Semiconductor in our AI portfolio, the stock traded for 17X forward earnings. That’s significantly less than the S&P 500 market average of 22X.

In addition, the company has several catalysts in the year ahead. While AI sales are growing, TSM’s largest customer is Apple, a company that is expected to see a ‘supercycle’ with the release of its new iPhone 16. Finally, Taiwan Semiconductor has established a leadership position in essential technologies like advanced packaging used in AI chips (CoWoS). This lead gives Taiwan Semiconductor more ability to raise prices on its customers. The company is expected to raise prices on leading chips by 5 to 20% in the year ahead.

Add it all up, and we’re comfortable starting Taiwan Semiconductor at a 3% position in our AI Portfolio and could continue adding shares in the years ahead.

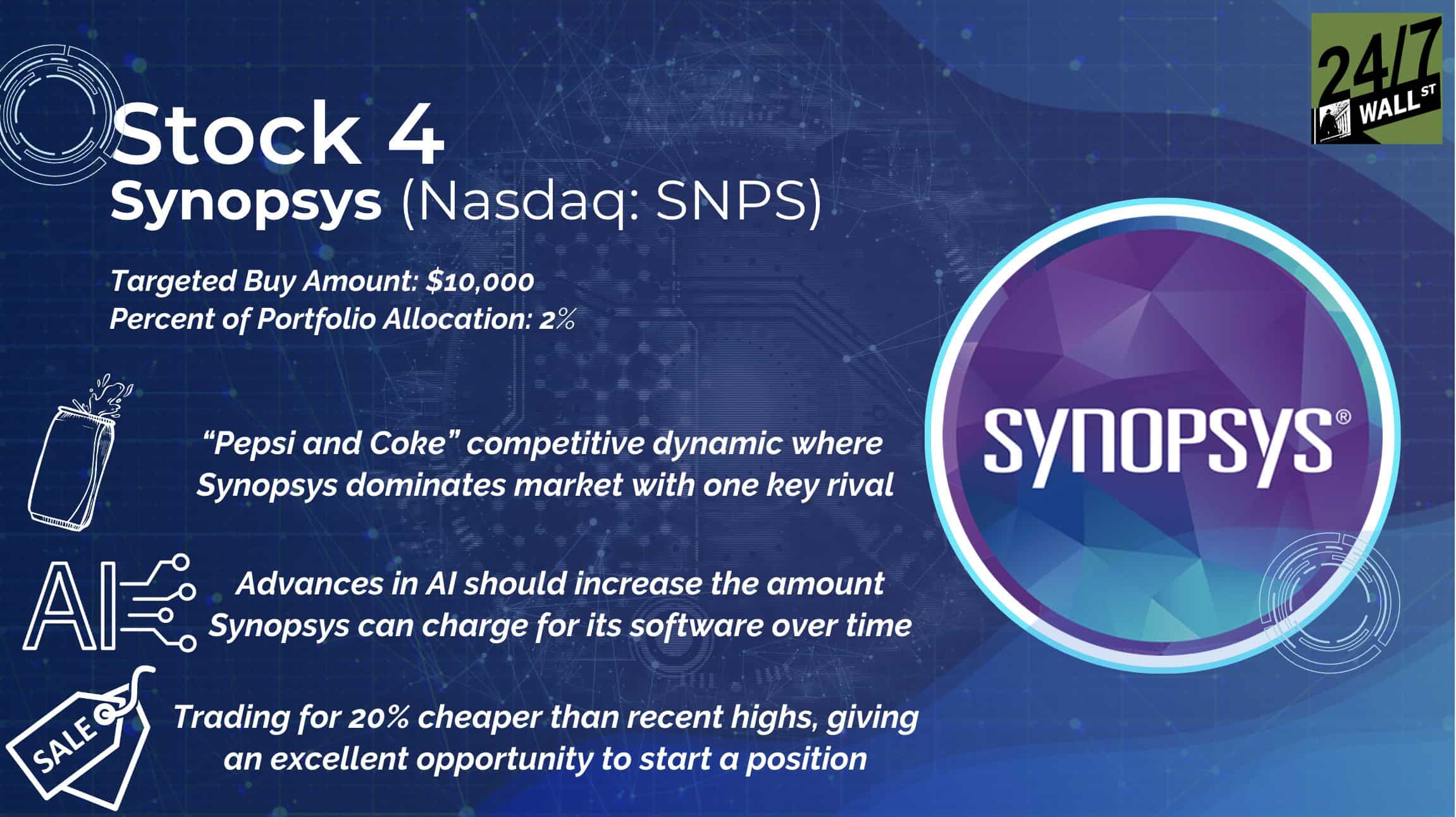

The semiconductor industry is projected to hit more than $600 billion in sales this year. The software that helps companies create all these chips is named ‘Electronic Design Automation.’

The leading EDA companies are Synopsys and Cadence (Nasdaq: CDNS). Dominating the software that semiconductor companies use has been lucrative for both companies. Synopsys is up 257% the past five years and 6,360% since it IPO’d in 1992. Cadence is up 305% in the past five years and around 4,000% since 2010.

We’re confident these gains aren’t over with either. Synopsys has grown operating earnings at a 25% compounded annual rate over the past five years. Across the next five, the growth in artificial intelligence should not only dramatically increase the size of the semiconductor market, but should make the software Synopsys sells even more valuable to its customers.

Synopsys isn’t cheap but trades for about 34X forward earnings for a company with an excellent competitive position that should see outstanding growth in the coming years if artificial intelligence booms. It’s a high-quality company to buy on any “dips” in its share price. We’ll start our position at 2% of the portfolio and may continue adding to that in the years to come.

As we’ve stated above, we’re not just buying four stocks and stopping. We’re constantly scouring through artificial intelligence news to find the stocks best positioned to take advantage of new developments in the space. Over time we’ll continue adding stocks to the portfolio.

On the most recent episode of the ‘AI Investor Podcast’, we announced the next portfolio buy is a small company named Credo Technology (Nasdaq: CRDO). We’re confident the next wave of AI growth involves massive spending not only on creating new data centers, but also improving their networking capabilities. Credo has leading products in the transition to 800g and 1.6 TB networks (see our write-up on Coherent above for more details on this transition) that could lead to a large acceleration in revenue growth in the second half of 2025 and into 2026 that is still underestimated by Wall Street.

We’re starting Credo at a 1% position – or a $5,000 buy – due to its small size. The company is a small cap, worth about $5 billion. In the coming months, we’ll continue adding more companies at the forefront of this trend beyond just Credo.

No. We’re creating a portfolio because it’s the easiest way for investors to see what stocks we have ‘conviction’ behind in the AI space. There are hundreds of articles written each week speculating whether NVIDIA is a ‘buy’ or ‘sell,’ but almost no places you can go to track an actively invested portfolio focused on artificial intelligence.

Even if you follow the portfolio to purchase a handful of stocks, we believe getting more exposure to AI in the years to come could be the difference between underperforming and outperforming the market.

No. We selected a $500,000 portfolio, but you could invest any amount you like. For example, you could buy $2,500 worth of NVIDIA, $1,500 worth of Taiwan Semiconductor, $1,000 worth of Coherent, and $1,000 worth of Synposys and you’d be tracking our initial purchase amounts, just weighted to a portfolio allocating $50,000 to AI stocks. You could also pick your favorite ideas from the show and by a lower amount without needing to buy every pick we discuss.

Yes. Simply send an email to questions at a673b.bigscoots-temp.com and we’ll do our best to address community questions either directly or on the ‘AI Investor Podcast.’ Please note that we cannot give personalized investment advice.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.