Investing

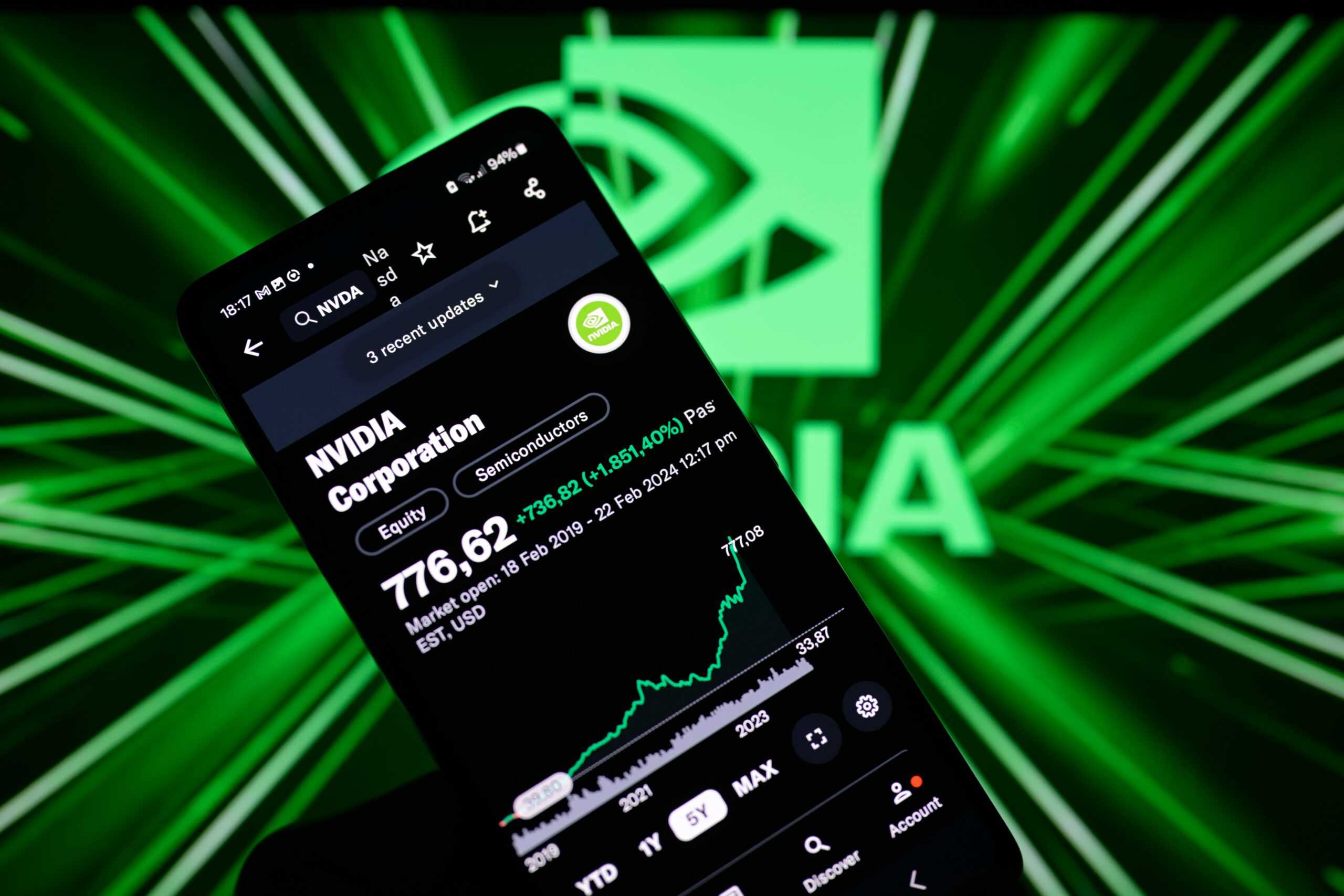

Market Update: NVIDIA and AI Stocks Lead Nasdaq Composite to Big Gains

Published:

Last Updated:

Some of the smallest stocks on the Nasdaq Composite are seeing big gains today”

Among larger stocks, a couple have seen substantial returns in today’s trading:

As we noted in a previous update, Chinese stocks are plunging today after the government gave few specifics on their stimulus program at a Beijing press conference earlier today.

While ETFs tracking Chinese stocks are down anywhere from 8 to 11% today, the damage has spread to some U.S. companies as well. For example, gambling stocks rely on Chinese consumers and many have exposure to Chinese markets as well. MGM Resorts (NYSE: MGM) is down 2.63% today.

Another area of market weakness today is material stocks that are counting on a rebound in China to see strong 2025 earnings. Freeport-McMoRan (NYSE: FCX) is down 5.16% today on Chinese growth fears.

Citi joined the parade on Wall Street banks issuing research notes on NVIDIA today. The company’s analyst covering NVIDIA – Atif Malik – is maintaining a $150 price target on the company.

Here fears that margins will disappoint investors in the near term as the company ramps Blackwell. In the longer run he sees 40% growth next year in data center capital expenditures and sees AI being in the 3rd/4th inning, with the growth of agents being the primary force driving the next wave of AI growth.

Technology stocks continue extending their gains as of 11:15 a.m. ET. NVIDIA (Nasdaq: NVDA) is now up 3.82%. As we noted earlier, bullish Wall Street notes about the demand for the company’s next-generation Blackwell platform are the primary driver of returns today.

24/7 Wall St. recently purchased shares of NVIDIA as part of our $500,000 AI portfolio on the thesis that Wall Street is still dramatically underestimating demand for the company’s 2025 earnings potential. That thesis appears off to a good start.

China came into today as the top-performing market in the world in 2024 thanks to recent gains. However, today that trend is reversing. The iShares MSCI China ETF (Nasdaq: MCHI) is down 10.8% today.

Levered China ETFs are seeing even more dramatic moves. The Direxion Daily FTSE China Bear 3X Shares (NYSE: YANG) ETF is up 35.4% as it inversely tracks the performance of Chinese stocks.

At 10:10 a.m. ET, U.S. markets are off to a hot start to the day. Technology stocks are leading the gains, with AI stocks seeing big gains across the board.

Let’s analyze a few of today’s biggest market storylines and why the Nasdaq Composite is seeing much stronger gains relative to the Dow and Russell 2000.

One of the biggest anchors holding back market returns in October has been the rising price of oil. After Iran launched a massive ballistic missile attack on Israel, there has been widespread speculation that a retaliatory strike from Israel would target Iranian oil and lead to surging prices across the globe. That would lead to more inflation and pricing pressures for a wide swath of companies that rely on oil.

However, tensions have seemed to de-escalate in recent days and West Texas Intermediate oil futures are down 3% today to $74.29 after hitting $77.40 in yesterday’s trading.

The Nasdaq Composite is being driven by strong gains across technology. NVIDIA (Nasdaq: NVDA) is up 2.85%. Other Magnificent 7 stocks are also having good days:

Other popular AI stocks are also seeing gains beyond broader market averages. Palantir (NYSE: PLTR) are up 3.45% and popular plays in optics are booming. Applied Optoelectronics (Nasdaq: AAOI) is up 9.75%) while Coherent (NYSE: COHR) is up 2.36%.

One reason for today’s gains is a particularly bullish research note from Morgan Stanley that predicts revenue from NVIDIA’s next-generation Blackwell chips will surpass its prior-generation chips by the first quarter of 2025.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.