Technology

Palantir Technologies (PLTR) Price Prediction and Forecast 2025-2030

Published:

Last Updated:

Big Data is big business. According to platform provider Edge Delta, the market for data services is projected to grow from $220.2 billion in 2023 to $401.2 billion by 2028 — an increase of 82.2%. Palantir Technologies Inc. (NYSE: PLTR) is a major player in the space. The company was co-founded by entrepreneur and venture capitalist Peter Thiel, who was also the co-founder of PayPal and the first outside investor in Facebook.

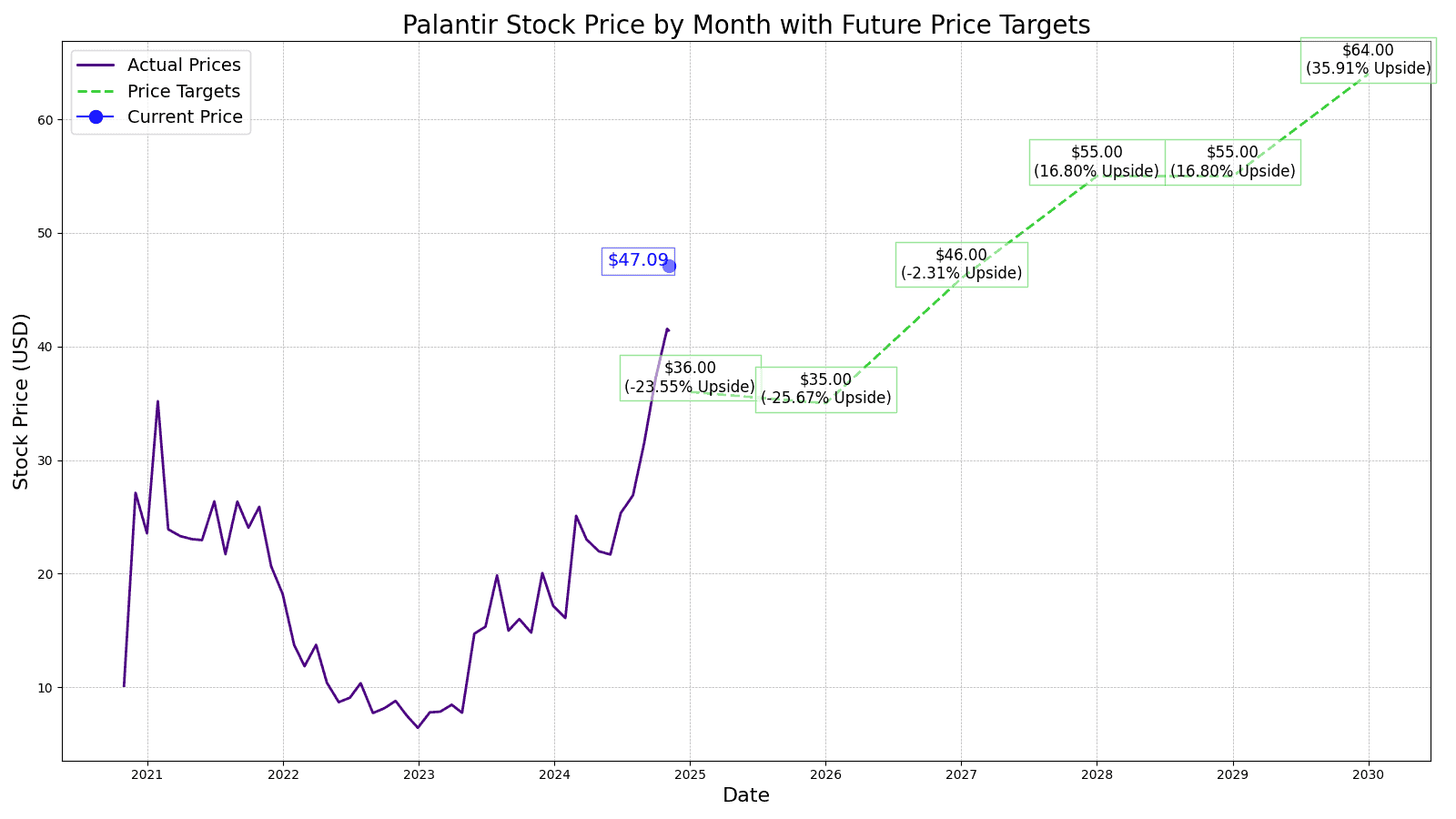

Since going public on Sept. 30, 2020, the stock’s price has risen over 335.89%, and it has seen a gain of more than 141.18% so far in 2024. At that growth rate, a $1,000 investment in Palantir’s IPO price of $9.50 would be worth $4358.95 today — more than double the initial investment in under four years.

Palantir stands as one of Big Data’s industry dominators. However, finding data-driven assessments of where the company’s stock will be in the medium and long term can be complicated. With Wall Street analysts only going as far as providing one-year price targets, it can be difficult for investors to accurately gauge predictions for stocks like these over longer horizons. But for buy-and-hold investors who want to know where Palantir’s stock might be several years down the road, 24/7 Wall Street has done the legwork and can provide insights around the numbers coming from the company, and which market segments the company is operating in that are most exciting to us.

11/4/2024

Palantir’s share price rose 0.1% today, trading as high as $42.04.

10/31/2024

Palantir’s stock price decreased 4.7% today, trading as low as $41.58.

10/29/2024

Storebrand Asset Management, a Norwegian investor, has sold its shares in Palantir (approximately $24 million). The decision was made due to concerns about Palantir’s provision of services to the Israeli military and security forces, which Storebrand believes may violate international humanitarian law and human rights.

10/28/2024

Palantir’s stock increased 0.3% today, trading as high as $45.14 and with a trading volume of 14,740,149 shares.

10/25/2024

Palantir is set to release its third-quarter financial results on November 4th, following the market’s close. Wall Street analysts are forecasting a profit of $0.05 per share, representing a substantial 66.7% year-over-year growth compared to the $0.03 per share earned in the same period last year.

10/24/2024

Palantir’s stock price has risen sharply over this past year by more than 150%. While this is great news for investors, analysts on Wall Street are divided about the stock’s future, with many worried that the price will fall again in the near future.

10/23/2024

Palantir has teamed up with L3Harris to make it even more tech-savvy. The two companies are combining L3Harris’ high-tech sensors and software with Palantir’s AI Platform. This partnership is focused on helping the U.S. Army with things like TITAN and the Unified Network Strategy.

10/21/2024

Palantir’s share prices were down today, trading as low as $42.67.

10/18/2024

Palantir’s share price has been rising today after Mizuho Securities increased its price target from $24.00 to $30.00

10/17/2024

Palantir’s stock rose slightly today while the overall stock market experienced mixed trading. An analyst from Mizuho Securities increased their price target for the company, citing positive software earnings.

10/15/2024

Palantir has teamed up with L3Harris Technologies to revolutionize target detection and delineation. By leveraging AI and machine learning, they’ve optimized edge computing platforms for enhanced performance. Yesterday, L3Harris showcased the power of this collaboration with a fixed-wing aircraft equipped with the company’s WESCAM MX-Series imaging systems and Palantir’s Sensor Inference Platform.

The following is a table that summarizes the performance in share price, revenues, and profits (net income) of PLTR from its inception in 2020 through the second quarter of 2024:

| Share Price | Revenues | Net Income | |

| 2020 | $23.55 | 1.092 | 1.166 |

| 2021 | $18.21 | 1.541 | .520 |

| 2022 | $6.29 | 1.905 | .373 |

| 2023 | $17.17 | 2.225 | .209 |

| TTM | $26.32 | 2.479 | .404 |

Revenue and net income in $billions

Since going public, Palantir saw its revenue grow by 35.44%, while net income fell by 65.35%. That drop in net income can be easily attributed, though. The company’s IPO in 2020 raised $2.6 billion, but that was shortly followed by 2022’s year-long bear market. Nonetheless, by 2023, the Big Data firm was able to reach profitability for the first time in its then 20-year history.

The momentum has continued with a series of earnings beats, most recently on Aug. 7, 2024, when the company reported earnings per share (EPS) of $0.09, which beat analysts’ estimates by 10.55%, and revenue of $678.23 million, which beat by 3.94%. The EPS beat was Palantir’s fourth consecutive and marked the sixth quarter in the last seven when it outperformed consensus. The company ended fiscal 2023 with around $3.7 billion in cash and liquid investments and — notably — no debt.

The current consensus median one-year price target for Palantir’s stock is $27, which represents an upside potential of 34.80%.

24/7 Wall Street’s 12-month forecast projects Palantir’s stock price to be $31 with earnings per share coming in right at $0.43. We see strong CAGR growth in sales of government contracts, upwards of 26% annually, and have factored for $3.186 billion in forecast revenue.

| Year | Revenue | Net Income | EPS |

| 2025 | 3.186 | .522 | $0.43 |

| 2026 | 3.953 | .714 | $0.52 |

| 2027 | 5.133 | 1.118 | $0.64 |

| 2028 | 6.104 | 1.432 | $0.79 |

| 2029 | 7.208 | 1.800 | $0.97 |

| 2030 | 8.380 | 2.268 | $1.17 |

Revenue and net income in $billions

We expect to see revenue growth of just over 20% and EPS of 43 cents for 2025. We expect the stock to still trade at a similar multiple next year, putting our estimate for the stock price for Palantir at $31 in 2025, which is -25.14% higher than the stock is trading today. We also expect the company to surpass $1 billion in free cash flow in 2025, with $1.052 billion.

Going into 2026, we forecast steady year-over-year increases for both revenue and net income of just over 26% and nearly 37%, respectively. 24/7 Wall Street’s price prediction for 2026 is $35, an upside of -15.48% over today’s stock price.

We expect to see a larger increase in revenue for 2027, and by extension, a larger gain in net income, which could breach $1 billion for the first time. Estimates are for revenue increases of 29.85% and an EPS increase of 56.58%, resulting in an annualized EPS of $0.64. We also forecast Palantir to surpass $2 billion in free cash flow by posting $2.380 billion. The stock price prediction for 2027 is $46, up 11.08%.

After breaching $1 billion in net income in 2027, we expect PLTR to take another step forward in 2028 by posting revenue of $6.104 billion, a net income of $1.432 billion, and an annualized EPS of $0.79. We also forecast that the company will exceed $3 billion in free cash flow, posting $3.372 billion. The stock price for 2028 comes in at $55, an upside of 32.82%.

We expect revenue to increase to $7.208 billion for an 18% year-over-year gain, with net income growth of 25.69% and EPS coming in at $0.97, good for a 22.78% year-over-year gain. We also forecast free cash flow to surpass $4 billion by posting $4.566 billion. But our price-to-sales multiple will be lower as growth slows, and the price projection for the year is $57, an upside of 37.65% over today’s stock price.

On the back of forecast revenue in excess of $8 billion, we expect Palantir’s net income to surpass $2 billion for the first time, and post an EPS over $1 for the first time, with estimated year-over-year growth of 16.26%, 26%, and 20.62%, respectively. We expect free cash flow to approach $6 billion by posting $5.895 billion. The price projection for 2030 is $64, an upside of 54.55% over today’s stock price.

| Year | Price Target | % Change From Current Price |

| 2025 | $31 | -25.14% |

| 2026 | $35 | -15.48% |

| 2027 | $46 | 11.08% |

| 2028 | $55 | 32.82% |

| 2029 | $57 | 37.65% |

| 2030 | $64 | 54.55% |

Revenue and net income in $billions

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.