24/7 Wall St. Insights

- Texas Instruments Inc. (NASDAQ: TXN) just rewarded its shareholders with a dividend hike.

- This semiconductor maker’s quarterly dividend has grown for more than a decade.

- Also: 2 Dividend Legends to Hold Forever.

Texas Instruments Inc. (NASDAQ: TXN) is rewarding its shareholders once again, this time a quarterly dividend of $1.36, payable on Tuesday, Nov. 12. That is 4.6% higher than the prior dividend. Though the company’s guidance in the most recent quarterly report was disappointing, the ongoing dividend growth underscores the management’s commitment to delivering consistent value to investors.

Why Investors Like Dividends

Investors favor dividend stocks for two main reasons. The first is that they offer enticing total return potential. Total return is a comprehensive measure of investment performance that includes interest, capital gains, dividends, and distributions realized over time. In other words, the total return on an investment or a portfolio consists of income and stock appreciation. It is one of the most effective ways to boost the prospects of overall investing success.

Dividend stocks can also provide investors with a steady, reliable stream of passive income. Passive income is money that is earned with little to no ongoing effort, usually from assets that generate cash flow. This income can come from a variety of sources, including stock dividends. Generating passive income is a desirable financial strategy for those seeking to diversify their income streams or achieve financial independence.

Texas Instruments Dividend

Texas Instruments has paid a quarterly dividend since the summer of 2013, when it was $0.28 per share. Moreover, the payout has increased since 2001 when it was $0.2125 per share. Thus, the dividend has increased almost 386% since 2013 and 540% since 2001.

Note that the share price has grown by about 514% since 2013, offering investors plenty of growth along with the income.

The Company

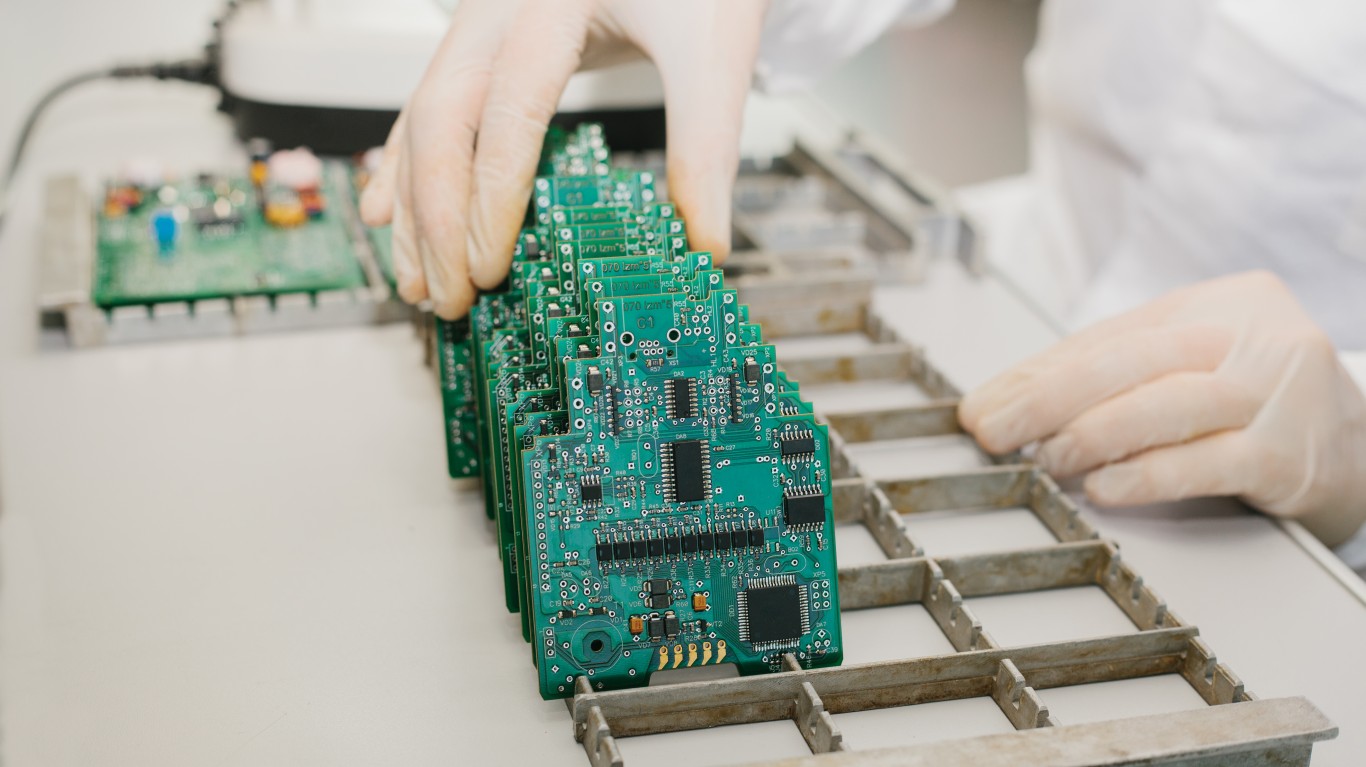

The company designs, manufactures, and sells semiconductors to electronics designers and manufacturers in the United States and internationally. It operates through Analog and Embedded Processing segments.

The Analog segment offers power products to manage power requirements across various voltage levels, including battery-management solutions, DC/DC switching regulators, AC/DC and isolated controllers and converters, power switches, linear regulators, voltage references, and lighting products. Its signal chain products sense, condition, and measure signals to allow information to be transferred or converted for further processing and control, including amplifiers, data converters, interface products, motor drives, clocks, and logic and sensing products.

The Embedded Processing segment offers microcontrollers used in electronic equipment, digital signal processors for mathematical computations, and applications processors for specific computing activity. This segment offers products for use in various markets, including automotive, personal electronics, communications equipment, and calculators. It provides DLP products primarily for use in project high-definition images, calculators, and application-specific integrated circuits.

Its headquarters are in Dallas. The company was founded in 1930 as a provider of seismic exploration services to the petroleum industry. It has been called Texas Instruments since 1951 and went public in 1953. The company now competes with or is similar to Analog Devices Inc. (NASDAQ: ADI), Micron Technology Inc. (NASDAQ: MU), NXP Semiconductors N.V. (NASDAQ: NXPI), Qualcomm Inc. (NASDAQ: QCOM), and others.

Texas Instruments received $1.6 billion from the CHIPS Act. It recently announced it would expand its manufacturing capacity in Japan, and it opened a new distribution center in Germany. The company said in its third-quarter report that it was recovering from its sales slump, but its guidance failed to impress. It also projected that its free cash flow would jump in 2026.

The Stock

The share price has grown about 83% in the past five years, underperforming the Nasdaq. Year to date, the stock is up almost 27%, more or less in line with the Nasdaq. Shares just hit a 52-week high of $220.39, which is higher than the mean price target of $206.39. Fewer than half of the 32 analysts who cover the stock recommend buying shares, though six of them have Strong Buy ratings. Benchmark and Rosenblatt reiterated Buy ratings in the wake of the recent earnings report.

Institutional investors hold almost 92% of the shares. Vanguard is a beneficial owner, and Blackrock and State Street have notable stakes as well. Billionaire Paul Singer has called it the best AI stock. About 911 million shares, or about 2% of the float, are held short.

A 400% Dividend Hike: Here’s How Much Investors Just Got

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.