Technology

Meta Platforms (META) Price Prediction and Forecast 2025-2030

Published:

Last Updated:

Formerly known as Facebook, Meta Platforms Inc. (NASDAQ: META) is now a household name because of the foundational success it experienced in social media. But it has been over a decade since its IPO on May 18, 2012,

As the only company in the ‘Magnificent Seven’ that has yet to undergo a stock split, an investor who purchased $1000.00 worth of META stock on the day it went public at $38.00 per share would now be sitting on an investment worth $14592.76, good for a gain of 1359.28%.

But since its IPO date, a lot has changed. For starters, on Feb. 1, 2024, the company announced — alongside authorizing a $50 billion stock buyback — that shares of META would begin paying a dividend. And while its current yield of 0.36% may not seem like much, at its current price, that equates to $0.50 per share quarterly, or $2.00 per share annualized.

META is the dominant player in the social media landscape but it is now branching out more broadly into tech, and specifically, the artificial intelligence (AI) space. It is the latter that the company is most heavily investing in now, and for that reason, it is also the primary driver of 24/7 Wall Street price predictions and forecasts for 2025-2030.

11/15/2024

Meta’s stock price decreased 2.3% today, trading as low as $562.

11/12/2024

Despite an overall negative trading day, Meta saw a slight uptick of 0.28% today, ending a two-day losing streak.

11/11/2024

Meta has announced a partnership with 13 universities in the U.S. and U.K. to bring virtual reality (VR) into classrooms. This new initiative, called “Meta for Education beta”, aims to test new VR and XR products, make learning more immersive and engaging, and make the company’s VR more mainstream.

11/8/2024

A federal judge has ruled that Mark Zuckerberg, CEO of Meta, is not personally responsible for lawsuits accusing the company of harming children through addictive social media platforms. The judge dismissed claims that Zuckerberg knowingly concealed the mental health risks associated with using Facebook and Instagram. While the judge’s decision exonerates Zuckerberg from personal liability, it doesn’t affect the lawsuits made against Meta itself.

11/7/2024

Meta experienced a 2.7% increase in its share price today, trading as high as $587.77. Trading volume was significantly lower than average, with only 3.7 million shares changing hands.

11/6/2024

Meta has adjusted its policy regarding the use of its AI model, Llama. The company has now granted access to U.S. national security agencies and defense contractors.

11/5/2024

Meta is now facing a $15.6 million fine from the South Korean Personal Information Protection Commission (PIPC) for sharing user data with advertisers. The PIPC is accusing Meta of sharing the sensitive personal information of 980,000 South Korean Facebook users with 4,000 advertisers, violating the country’s privacy laws.

11/4/2024

Meta’s recent attempt to secure additional nuclear power has been rejected. This could hinder efforts by Meta and other tech giants to secure additional energy from nuclear sources to fuel their growing AI operations.

10/31/2024

Meta reported strong third-quarter earnings, with a 19% increase in revenue to $40.6 billion and a 35% rise in net income to $15.7 billion, exceeding Wall Street expectations.

10/29/2024

Meta stock saw a significant rise today, up over 2% to $590.19. This positive momentum has contributed to its impressive 66% year-to-date performance, placing it among the top 20 performers in the S&P 500. Tomorrow, the company is scheduled to release its third-quarter results.

Here’s a table summarizing the performance in share price, revenues, and profits (net income) of META stock from 2014 to 2024:

| Share Price | Revenues | Net Income | |

| 2014 | $80.78 | $12.466 | $2.940 |

| 2015 | $104.66 | $17.928 | $3.688 |

| 2016 | $115.05 | $27.638 | $10.217 |

| 2017 | $176.46 | $40.653 | $15.934 |

| 2018 | $133.20 | $55.838 | $22.112 |

| 2019 | $208.10 | $70.697 | $18.485 |

| 2020 | $273.16 | $85.965 | $29.146 |

| 2021 | $336.35 | $117.929 | $39.370 |

| 2022 | $120.34 | $116.609 | $23.200 |

| 2023 | $353.96 | $134.902 | $39.098 |

| TTM | $517.77 | $161.579 | $55.042 |

Revenue and net income in %billions

Over the past decade, Meta Platforms’ revenue has grown 1,196.16% from $12.466 billion to over $161 billion over its trailing 12 months (TTM), while its net income went from $2.940 billion to over $55 billion TTM during the same period, good for an increase of 1,772.18%. The primary driver of that growth over the past 10 years has been ad space for the company’s social media platforms, which include Facebook, Instagram, Threads, Reel, and WhatsApp, among others.

While Meta Platforms has branched out into augmented reality and virtual reality — a business segment it refers to as Reality Labs — 99% of its revenue generation comes from its Family of Apps business segment, as of year-end 2023. But as the company looks to the second half of the decade, Zuckerberg and the company will focus on a few key focus areas that will have a large impact on Meta Platforms’ stock performance.

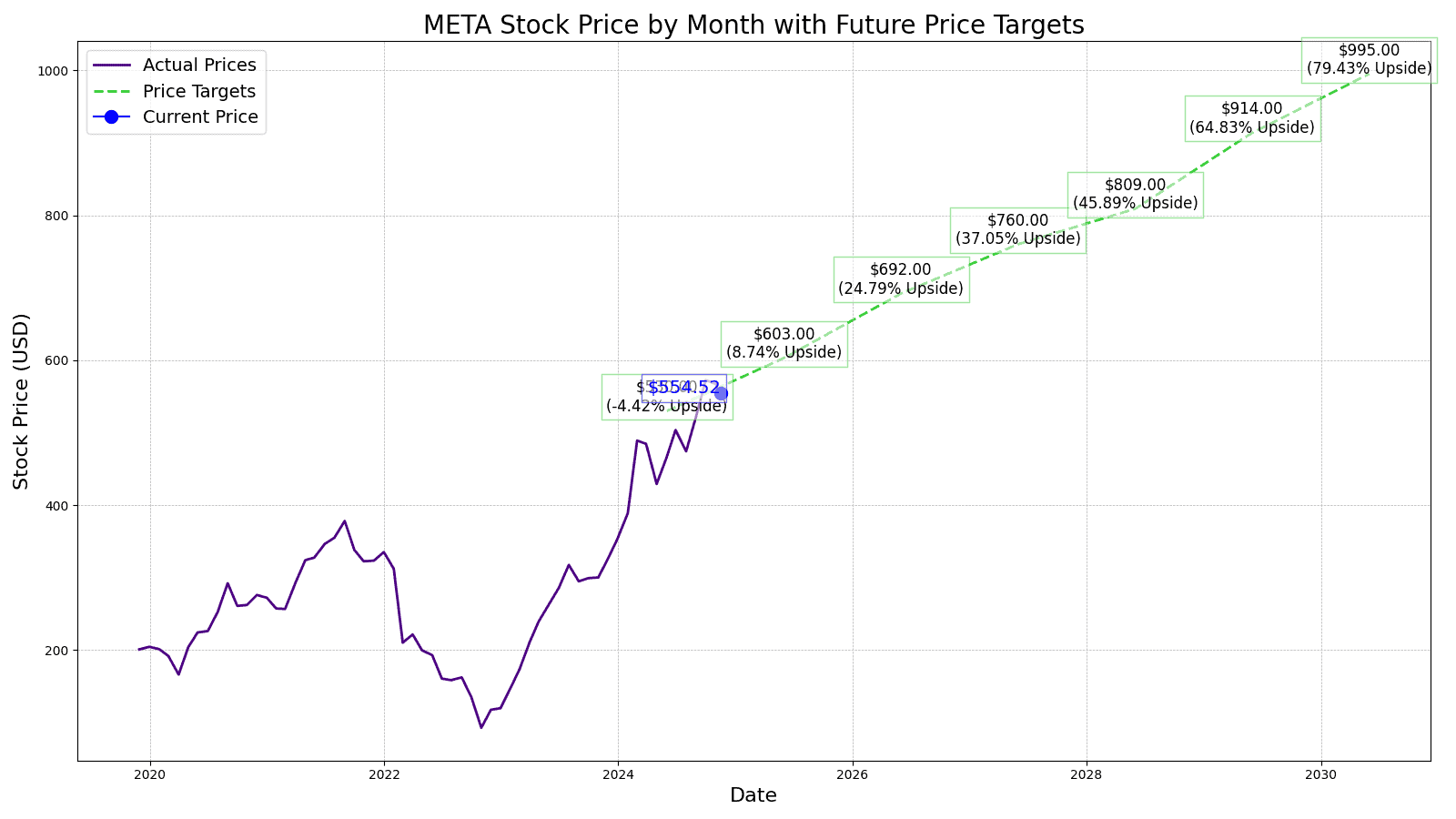

The current consensus one-year price target for Meta Platforms is $597.50, which represents a 6.12% upside potential from today’s share price of $563.10. Of all the analysts covering META stock, it receives a consensus “Buy” rating with a score of 1.5, with 1 being the strongest “Buy” rating and 5 being the strongest “Sell” rating.

24/7 Wall Street’s forecast projects Meta Platforms’ stock price to be $603 by the end of 2025, based on the company’s ability to sustain its strong ad revenue while increasing efficiency, which in turn will drive its bottom line despite capital expenditures increasing toward its AI objectives.

| Year | Revenue | Net Income | EPS |

| 2024 | $161.579 | $54.960 | $21.18 |

| 2025 | $183.459 | $62.250 | $24.12 |

| 2026 | $205.257 | $70.680 | $27.71 |

| 2027 | $226.332 | $78.258 | $30.42 |

| 2028 | $245.319 | $85.912 | $32.38 |

| 2029 | $268.306 | $97.044 | $36.54 |

| 2030 | $274.947 | $91.227 | $39.70 |

Revenue and net income in $billions

We estimate the price per share of Meta Platforms to be $692 with revenue jumping over $200 billion for the first time in 2026. EPS expectations are for $27.71 annualized. That stock forecast represents a gain of 24.89% over today’s share price.

In 2027 we expect META’s stock price to reach $760 with net income increasing to $78 billion on the back of free cash flow exceeding $60 billion for the first time. That stock price represents a 37.16% increase over today’s share price.

24/7 Wall Street forecasts that META’s share price will reach $809 by the end of 2028, as free cash flow surpasses $70 billion. That price per share represents a 46.01% increase from where the stock is trading today.

Then in 2029, we estimate that Meta Platforms will reach $79.262 billion in free cash flow, $97.044 billion in net income and over $268 in revenue resulting in a price per share of $914, or 64.96% upside potential from today’s share price.

By the end of the start of the next decade, we forecast that META’s stock price will reach $995.00, or 79.58% higher than it is trading for today, despite estimates that net income will pull back slightly from over $97 billion to over $91 billion. Revenue growth will continue, with an estimated 2.48% year-over-year increase from 2029.

| Year | Price Target | % Change From Current Price |

| 2024 | $530 | -4.35% |

| 2025 | $603 | 8.83% |

| 2026 | $692 | 24.89% |

| 2027 | $760 | 37.16% |

| 2028 | $809 | 46.01% |

| 2029 | $914 | 64.96% |

| 2030 | $995 | 79.58% |

Revenue and net income in $billions

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.