Technology

Meta Platforms (META) Price Prediction and Forecast 2025-2030

Published:

Last Updated:

Formerly known as Facebook, Meta Platforms Inc. (NASDAQ: META) is now a household name because of the foundational success it experienced in social media. But it has been over a decade since its IPO on May 18, 2012,

As the only company in the ‘Magnificent Seven’ that has yet to undergo a stock split, an investor who purchased $1000.00 worth of META stock on the day it went public at $38.00 per share would now be sitting on an investment worth $15810.53, good for a gain of 1481.05%.

But since its IPO date, a lot has changed. For starters, on Feb. 1, 2024, the company announced — alongside authorizing a $50 billion stock buyback — that shares of META would begin paying a dividend. And while its current yield of 0.33% may not seem like much, at its current price, that equates to $0.50 per share quarterly, or $2.00 per share annualized.

META is the dominant player in the social media landscape but it is now branching out more broadly into tech, and specifically, the artificial intelligence (AI) space. It is the latter that the company is most heavily investing in now, and for that reason, it is also the primary driver of 24/7 Wall Street price predictions and forecasts for 2025-2030.

12/20/2024

Meta’s stock fell 1.73% today amid a positive day for the broader stock market. This marks the fourth consecutive day of losses for Meta.

12/18/2024

Emarketer has forecasted that Instagram will generate $32.03 billion in U.S. advertising revenue next year, a substantial 24.4% increase from 2024. This projected growth will solidify Instagram’s position as the primary driver of Meta’s U.S. ad revenue, marking the first time it surpasses the 50% threshold.

12/16/2024

Meta’s Ray-Ban smart glasses are getting smarter, with the latest update (v11) introducing AI-powered video recording and real-time language translation. These features are now available to early access program members.

12/13/2024

Meta’s “Video Seal” technology aims to address the issue of AI-powered scams and deepfake technology. The company’s new technology allows users to watermark AI-generated videos, making it easier to identify and prevent the spread of manipulated content.

12/12/2024

Meta has donated $1 million to the inaugural fund of President-elect Donald Trump. Interestingly, just a few months ago Trump also threatened to send Zuckerberg to prison for life.

12/11/2024

The Australian government has successfully compelled Meta to adhere to the News Media Bargaining Code, requiring the company to continue compensating Australian publishers for their journalism.

12/9/2024

Prosecutors in Italy have concluded an investigation into Meta for alleged tax evasion of €887.6 million, which was centered around two executives of Meta’s Irish unit. Next, the prosecutors will file a formal request for trial unless the accused can successfully prove their innocence.

12/6/2024

Meta reached a new all-time high today following a U.S. appeals court ruling. The court upheld a law mandating that ByteDance, TikTok’s Chinese owner, divest the app by early 2024 or face a potential ban. This decision could potentially boost Meta due to a decline in TikTok’s user base and advertising revenue.

12/5/2024

Meta announced a new partnership with filmmaker James Cameron’s technology company, Lightstorm Vision. This collaboration aims to revolutionize the way 3D entertainment is experienced on Meta Quest VR headsets.

12/3/2024

Meta’s shares are surging today, hitting a new all-time high. The stock rose above its previous record of $601.20.

Here’s a table summarizing the performance in share price, revenues, and profits (net income) of META stock from 2014 to 2024:

| Share Price | Revenues | Net Income | |

| 2014 | $80.78 | $12.466 | $2.940 |

| 2015 | $104.66 | $17.928 | $3.688 |

| 2016 | $115.05 | $27.638 | $10.217 |

| 2017 | $176.46 | $40.653 | $15.934 |

| 2018 | $133.20 | $55.838 | $22.112 |

| 2019 | $208.10 | $70.697 | $18.485 |

| 2020 | $273.16 | $85.965 | $29.146 |

| 2021 | $336.35 | $117.929 | $39.370 |

| 2022 | $120.34 | $116.609 | $23.200 |

| 2023 | $353.96 | $134.902 | $39.098 |

| TTM | $517.77 | $161.579 | $55.042 |

Revenue and net income in %billions

Over the past decade, Meta Platforms’ revenue has grown 1,196.16% from $12.466 billion to over $161 billion over its trailing 12 months (TTM), while its net income went from $2.940 billion to over $55 billion TTM during the same period, good for an increase of 1,772.18%. The primary driver of that growth over the past 10 years has been ad space for the company’s social media platforms, which include Facebook, Instagram, Threads, Reel, and WhatsApp, among others.

While Meta Platforms has branched out into augmented reality and virtual reality — a business segment it refers to as Reality Labs — 99% of its revenue generation comes from its Family of Apps business segment, as of year-end 2023. But as the company looks to the second half of the decade, Zuckerberg and the company will focus on a few key focus areas that will have a large impact on Meta Platforms’ stock performance.

The current consensus one-year price target for Meta Platforms is $597.50, which represents a -1.05% upside potential from today’s share price of $603.86. Of all the analysts covering META stock, it receives a consensus “Buy” rating with a score of 1.5, with 1 being the strongest “Buy” rating and 5 being the strongest “Sell” rating.

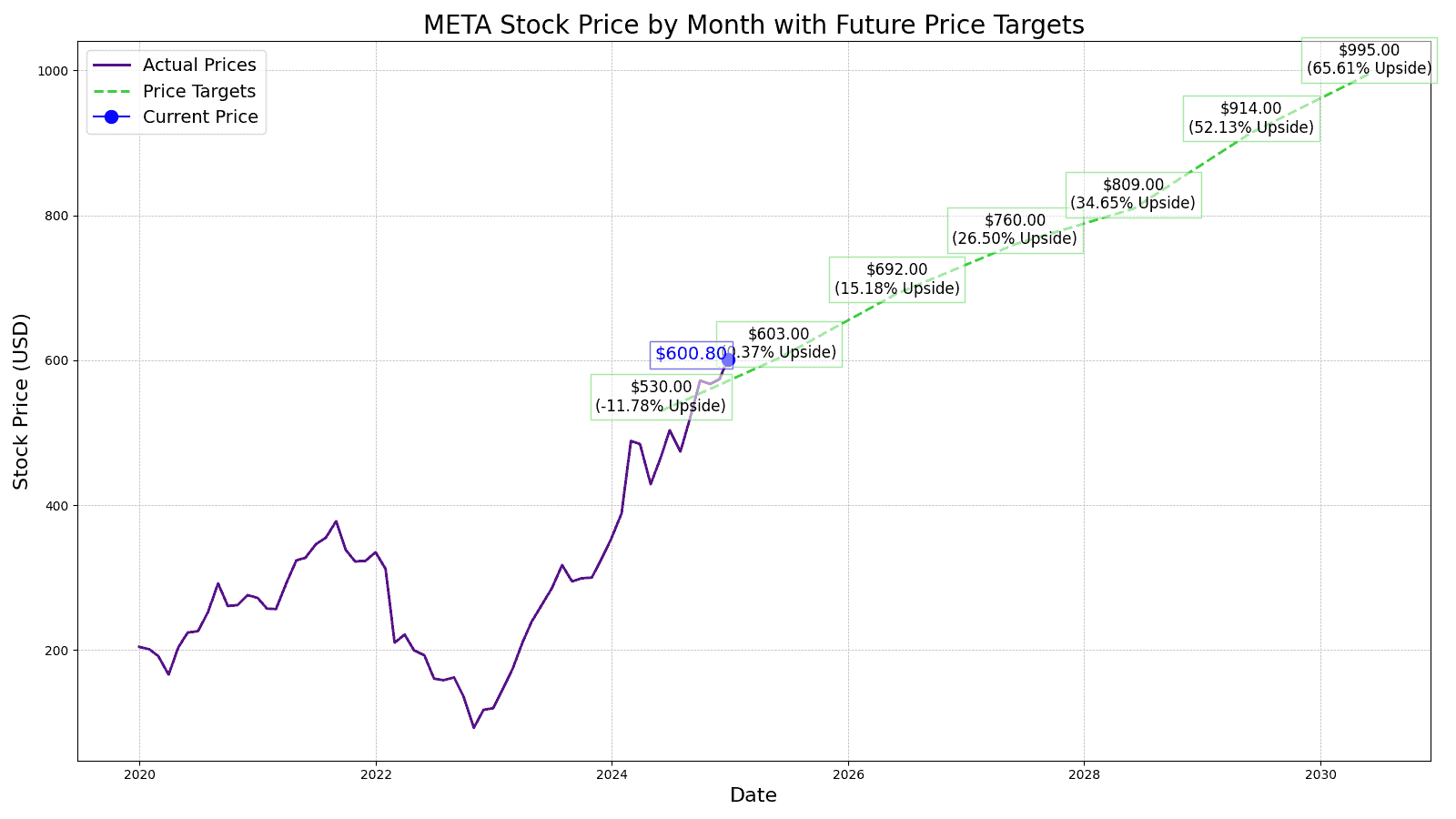

24/7 Wall Street’s forecast projects Meta Platforms’ stock price to be $603 by the end of 2025, based on the company’s ability to sustain its strong ad revenue while increasing efficiency, which in turn will drive its bottom line despite capital expenditures increasing toward its AI objectives.

| Year | Revenue | Net Income | EPS |

| 2024 | $161.579 | $54.960 | $21.18 |

| 2025 | $183.459 | $62.250 | $24.12 |

| 2026 | $205.257 | $70.680 | $27.71 |

| 2027 | $226.332 | $78.258 | $30.42 |

| 2028 | $245.319 | $85.912 | $32.38 |

| 2029 | $268.306 | $97.044 | $36.54 |

| 2030 | $274.947 | $91.227 | $39.70 |

Revenue and net income in $billions

We estimate the price per share of Meta Platforms to be $692 with revenue jumping over $200 billion for the first time in 2026. EPS expectations are for $27.71 annualized. That stock forecast represents a gain of 15.36% over today’s share price.

In 2027 we expect META’s stock price to reach $760 with net income increasing to $78 billion on the back of free cash flow exceeding $60 billion for the first time. That stock price represents a 26.70% increase over today’s share price.

24/7 Wall Street forecasts that META’s share price will reach $809 by the end of 2028, as free cash flow surpasses $70 billion. That price per share represents a 34.87% increase from where the stock is trading today.

Then in 2029, we estimate that Meta Platforms will reach $79.262 billion in free cash flow, $97.044 billion in net income and over $268 in revenue resulting in a price per share of $914, or 52.37% upside potential from today’s share price.

By the end of the start of the next decade, we forecast that META’s stock price will reach $995.00, or 65.87% higher than it is trading for today, despite estimates that net income will pull back slightly from over $97 billion to over $91 billion. Revenue growth will continue, with an estimated 2.48% year-over-year increase from 2029.

| Year | Price Target | % Change From Current Price |

| 2024 | $530 | -11.64 |

| 2025 | $603 | 0.53% |

| 2026 | $692 | 15.36% |

| 2027 | $760 | 26.70% |

| 2028 | $809 | 34.87% |

| 2029 | $914 | 52.37% |

| 2030 | $995 | 65.87% |

Revenue and net income in $billions

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.