AI Portfolio

How To Follow 24/7 Wall St's $500,000 AI Stock Portfolio

Published:

Last Updated:

The growth of artificial intelligence could be the biggest technology trend in human history, and 24/7 Wall St. wants to help you follow our expert guidance on how to build a portfolio filled with the top AI stocks.

You’ve likely heard of NVIDIA (Nasdaq: NVDA) and some other names in the space, but there are hundreds of companies poised to see record profits in industries ranging from chips, to software, to power generation, and beyond thanks to AI.

Here’s how it works in three simple steps.

In our ‘AI Investor Podcast’ we’re tracking a $500,000 portfolio of our favorite AI stocks. Every podcast we’ll announce new buy recommendations and sell stocks if they’ve fallen out of favor. The podcast is free and you can subscribe here on your favorite podcast service.

You don’t need to buy every stock or invest $500,000 to follow along. You can selectively purchase your favorite ideas, a smaller fraction of each recommendation, or just listen along to learn so you can invest later.

Every week the AI Investor Podcast discusses what’s happening across the stock market, the biggest AI news, and gives actionable investment guidance you can use.

Think back to the growth of past massive technology trends like the birth of the Internet, cloud computing, or social media, and think about the profits that could have been made if you had a trusted source to follow the growth of these world-changing industries.

24/7 Wall St. is trying to create a ‘one-stop-shop’ that’s your top source for everything related to artificial intelligence investing.

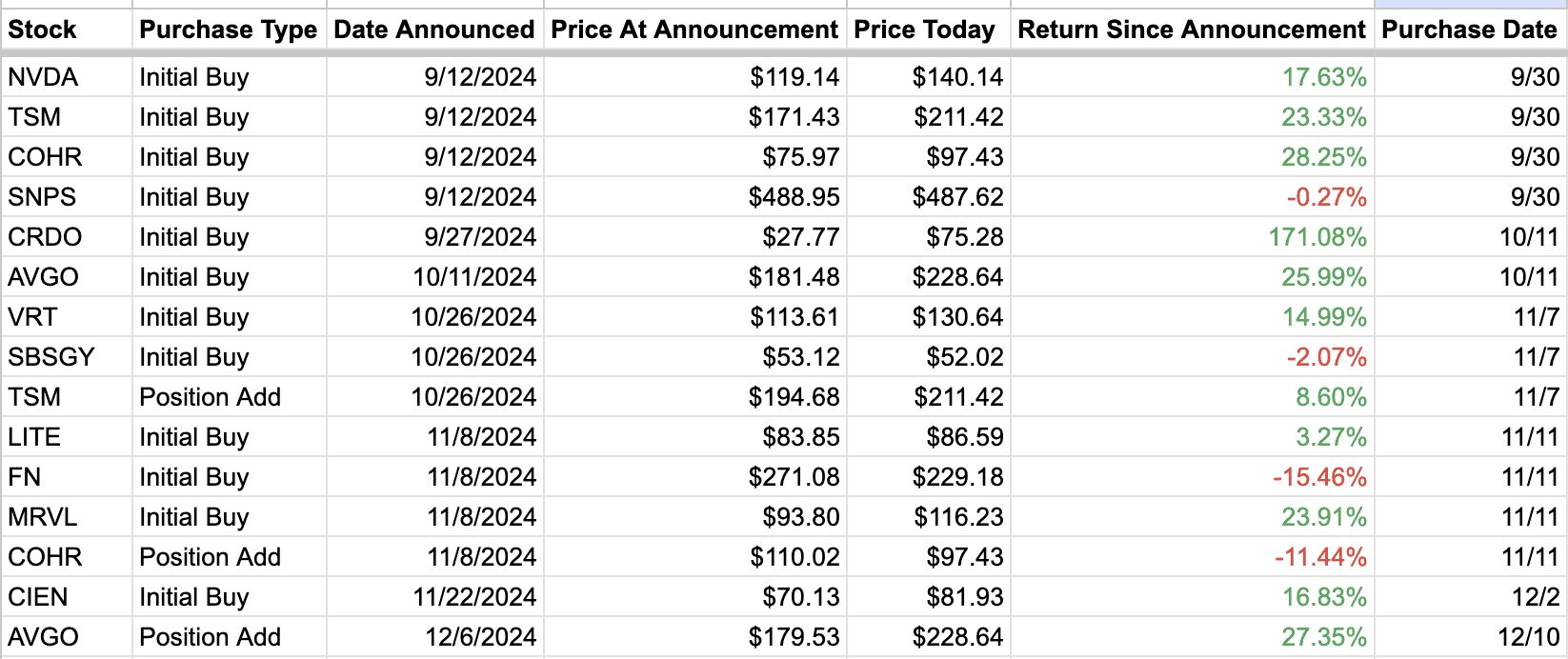

We’ve created a spreadsheet that tracks past buy recommendations and their performance which you can visit here. Our goal is to be as transparent as possible about our performance.

Every pick won’t be a winner, but we’re betting that by having a complete portfolio of top ideas, investors will win big if artificial intelligence becomes the biggest technology trend ever.

If you’re looking for a quick summary of why we added each stock in the $500,000 AI Portfolio and what they do, we’ve provided that below in our Frequently Asked Questions section.

The screenshot above is from a673b.bigscoots-temp.com’s home page. Beyond podcasts, we publish articles analyzing stocks in the AI Portfolio.

In addition, we post extras like live blogs So, if NVIDIA is reporting earnings, you’ll want to Google ’24/7 Wall Street’ and head to the site where we’ll have live analysis from our stock experts on many stocks in the portfolio.

Another way to follow is to get on our newsletter. You can join by downloading a copy of our “Discover the Next NVIDIA” report. It’s a great report (that’s free!) that offers a detailed map of the AI investment landscape, a complete report on the rise of AI, and three research reports on leading AI companies. It’s 38 pages of detailed information you’ll want to have.

In our newsletter, we send updates on the AI portfolio, top stories to watch each week, and more. The newsletter is an excellent way to stay up to date and if it’s not your cup of tea, you can unsubscribe with the click of a button.

You can also follow our analysis on YouTube where you’ll find clips like the one below analyzing what it will take for NVIDIA to hit $200 per share.

Here are some of the frequently asked questions about our $500,000 AI Portfolio.

The $500,000 AI Portfolio is managed by Technology Analyst Eric Bleeker and is composed of his own personal capital.

Eric Bleeker previously worked at The Motley Fool for 15 years where he served in a variety of roles including leading Technology & Telecom coverage and serving as the General Manager of Fool.com.

Eric has long covered the rise of NVIDIA. You can still read his call naming NVIDIA his “Best Stock for 2010” – where he predicted the company would dominate future ‘high-performance computing’ applications like artificial intelligence at a time when the field was still tiny and unknown.

Eric hosted dozens of webinars on artificial intelligence, including ones where he named NVIDIA his top technology recommendation in 2016 (a call now up more than 10,000% turning every $10,000 invested into more than $1,000,000) and later doubled down on his NVIDIA predictions. In January 2019 he invested $50,000 of his personal capital in NVIDIA declaring it his “Top Tech Stock for 2019.” That call is now up more than 3,000%.

After leaving The Motley Fool, Eric cofounded Flywheel Publishing, the owner of a673b.bigscoots-temp.com. He is a CFA Charterholder and also an Angel Investor in fast-growing private companies like ShiftMed and Hungry.

Simply put: 24/7 Wall St. was founded by a team that’s worked in financial markets for over 20 years. We’ve seen the life-changing potential of past technology trends and believe artificial intelligence will be the biggest trend in human history.

The $500,000 AI Portfolio was the result of a single thought: “How life-changing would it have been if people had a single source to follow news on events like the birth of the Internet with only the need-to-know news and actionable buy recommendations. How do we create that in the early stages of artificial intelligence’s rise?”

Many investors know that artificial intelligence is a big deal, they just don’t know how to get started. The AI Investor Podcast aims to solve this. We cover news in the space in as accessible a way as possible. In addition, we provide actionable investment guidance on a continued basis.

Here’s a list of stocks that we’ve recommended in past episodes of the AI Investor Podcast. You can find the date we recommended and purchased each along with their performance in our tracking spreadsheet. In addition, we recorded an episode that reviewed all stocks in the portfolio (as of the beginning of 2025) which you can also listen to if you’re catching up on past portfolio buys.

Key themes we’ll continue investing in.

Yes! As mentioned above, we keep an AI Portfolio section on a673b.bigscoots-temp.com. In addition, you can find shorter video clips and exclusive market analysis on our YouTube page. You can also access our portfolio tracking spreadsheet at any time to see recent portfolio buys and sells and performance.

Also, if you download any of our free reports – such as ‘The Next NVIDIA‘ – you’ll receive market commentary and updates from 24/7 Wall St.

The bottom line is we’re trying to build the world’s best community for forward-thinking investors. As long as you’re visiting 24/7 Wall St. or following us on YouTube or social media, you should get commentary on our top AI recommendations.

No. We’re creating a portfolio because it’s the easiest way for investors to see what stocks we have ‘conviction’ behind in the AI space. There are hundreds of articles written each week speculating whether NVIDIA is a ‘buy’ or ‘sell,’ but almost no places you can go to track an actively invested portfolio focused on artificial intelligence.

Even if you follow the portfolio to purchase a handful of stocks, we believe getting more exposure to AI in the years to come could be the difference between underperforming and outperforming the market.

In addition, you don’t need to invest $500,000 to make use of the portfolio.

We selected a $500,000 portfolio, but you could invest any amount you like. For example, you could buy $2,500 worth of NVIDIA, $1,500 worth of Taiwan Semiconductor, $1,000 worth of Coherent, and $1,000 worth of Synposys and you’d be tracking our initial purchase amounts, just weighted to a portfolio allocating $50,000 to AI stocks. You could also pick your favorite ideas from the show and by a lower amount without needing to buy every pick we discuss.

Yes. Simply send an email to questions at a673b.bigscoots-temp.com and we’ll do our best to address community questions either directly or on the ‘AI Investor Podcast.’ Please note that we cannot give personalized investment advice.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.