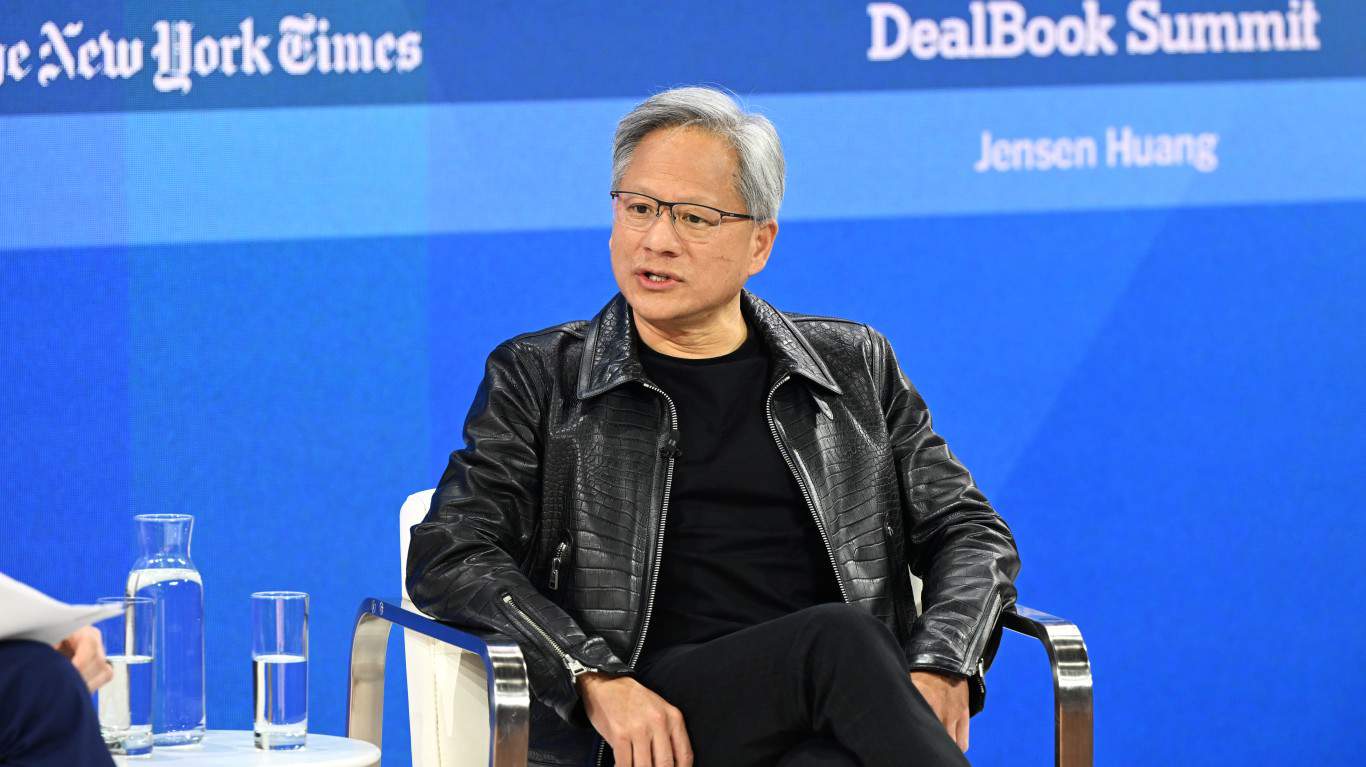

Nvidia Corp. (NASDAQ: NVDA) just announced blowout earnings. However, the market remained skeptical about the company’s fortunes, and its stock traded flat after the report. Due to these concerns, Nvidia’s stock is down 8% for the past month, while the S&P 500 is off 4%. Nvidia CEO Jensen Huang’s net worth is closely tied to its share price. So far this year, his net worth has dropped $2.5 billion to $112 billion, which makes him the world’s 15th richest person, according to the Bloomberg Billionaire Index.

24/7 Wall St. Key Points:

-

Nvidia Corp. (NASDAQ: NVDA) just announced blowout earnings.

-

Yet, CEO Jensen Huang’s net worth dropped by $2.5 billion afterward.

-

Take this quiz to see if you’re on track to retire. (sponsored)

Huang co-founded Nvidia in 1993 and has been its CEO and president since then. The price of the shares has skyrocketed 1,844% in the past five years. Its market cap is $3.22 billion, which puts it second to Apple ($3.26 billion). Huang owns almost 4% of Nvidia’s shares.

Nvidia started to provide graphics chips for gaming and multimedia. For years, Intel Corp. (NASDAQ: INTC), which made most of the chips for personal computers and commercial servers, overshadowed Nvidia. (As the need for Intel’s chips fell off, the company faltered. Its stock price is off 57% over the past five years.)

Nvidia began to build chips for early artificial intelligence (AI) functions in 2012. In 2022, it launched its Omniverse platform, which has evolved into the chip families that run most AI applications. By 2023 Nvidia had over two-thirds of the data-center AI chip market. Some analysts put the figure as high as 80%.

Tech companies and data center operations are expected to invest $1 trillion in AI expansion over the next five years. These investments will almost certainly be led by some of the world’s richest companies: Microsoft, Amazon, and Meta. If Nvidia holds its market share, Huang is likely to get richer.

Two Stocks Still Worth Buying to Play Quantum Computing for the Long Haul

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.