Technology

Meta Platforms (META) Price Prediction and Forecast 2025-2030 For March 12

Published:

Last Updated:

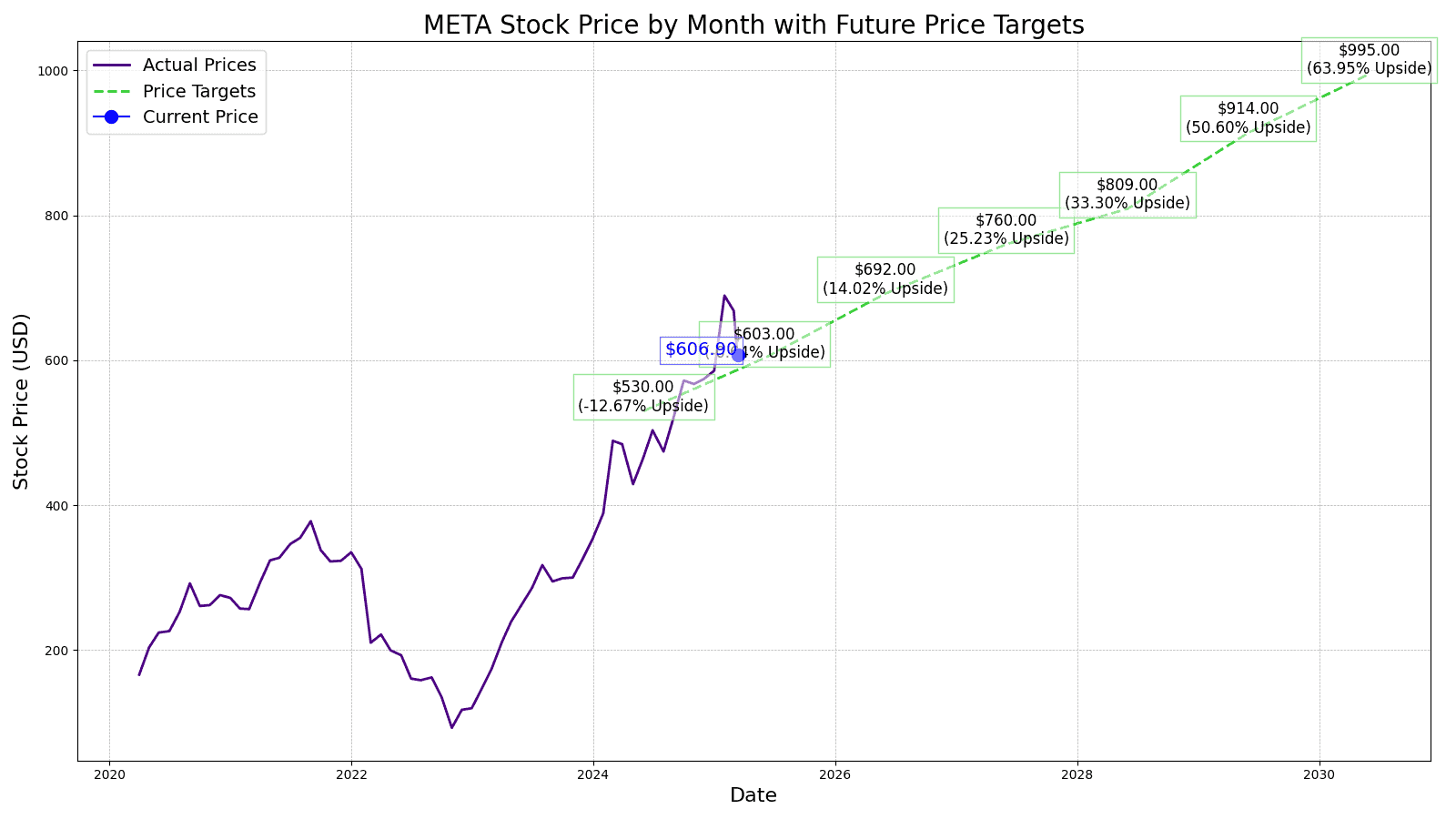

Shares of Meta Platforms Inc. (NASDAQ: META) lost -1.55% in morning trading on Wednesday, compounding a rough week and month that has seen the stock fall by -3.94% and -14.26%, respectively. Year-to-date, the company has eked out a meager 3.76% gain.

It has been mostly downhill since hill for META since hitting its one-year high on Feb. 14, but the stock is still enjoying a gain of more than 24% over that period. As the only company in the Magnificent Seven that has yet to undergo a stock split, shares are up 1,526.37% since its IPO on May 18, 2012.

But since then, a lot has changed. For starters, on Feb. 1, 2024, the company announced — alongside authorizing a $50 billion stock buyback — that shares of META would begin paying a dividend. And while its current yield of 0.33% may not seem like much, at its current price, that equates to $0.50 per share quarterly, or $2.00 per share annualized.

META is the dominant player in the social media landscape but it is now branching out more broadly into tech, and specifically, the artificial intelligence (AI) space. It is the latter that the company is most heavily investing in now, and for that reason, it is also the primary driver of 24/7 Wall Street price predictions and forecasts for 2025-2030.

Here’s a table summarizing the performance in share price, revenues, and profits (net income) of META stock from 2014 to 2024:

| Share Price | Revenues* | Net Income* | |

| 2014 | $80.78 | $12.466 | $2.940 |

| 2015 | $104.66 | $17.928 | $3.688 |

| 2016 | $115.05 | $27.638 | $10.217 |

| 2017 | $176.46 | $40.653 | $15.934 |

| 2018 | $133.20 | $55.838 | $22.112 |

| 2019 | $208.10 | $70.697 | $18.485 |

| 2020 | $273.16 | $85.965 | $29.146 |

| 2021 | $336.35 | $117.929 | $39.370 |

| 2022 | $120.34 | $116.609 | $23.200 |

| 2023 | $353.96 | $134.902 | $39.098 |

| 2024 | $599.24 | $164.501 | $62.36 |

*Revenue and net income in %billions

Over the past decade, Meta Platforms’ revenue has grown 1,196.16% from $12.466 billion to over $164 billion, while its net income went from $2.940 billion to over $62.36 billion during the same period. The primary driver of that growth over the past 10 years has been ad space for the company’s social media platforms, which include Facebook, Instagram, Threads, Reel, and WhatsApp, among others.

While Meta Platforms has branched out into augmented reality and virtual reality — a business segment it refers to as Reality Labs — 99% of its revenue generation comes from its Family of Apps business segment, as of year-end 2023. But as the company looks to the second half of the decade, Zuckerberg and the company will focus on a few key focus areas that will have a large impact on Meta Platforms’ stock performance.

The current consensus one-year price target for Meta Platforms is $764.61, which represents a 22.92% upside potential from today’s share price. Of all the analysts covering META stock, it receives a consensus “Strong Buy” rating with 44 of 48 analysts assigning it as a buy.

24/7 Wall Street’s forecast projects Meta Platforms’ stock price to be $603 by the end of 2025, based on the company’s ability to sustain its strong ad revenue while increasing efficiency, which in turn will drive its bottom line despite capital expenditures increasing toward its AI objectives.

| Year | Revenue | Net Income | EPS |

| 2024 | $161.579 | $54.960 | $21.18 |

| 2025 | $183.459 | $62.250 | $24.12 |

| 2026 | $205.257 | $70.680 | $27.71 |

| 2027 | $226.332 | $78.258 | $30.42 |

| 2028 | $245.319 | $85.912 | $32.38 |

| 2029 | $268.306 | $97.044 | $36.54 |

| 2030 | $274.947 | $91.227 | $39.70 |

Revenue and net income in $billions

By the end of the start of the next decade, we forecast that META’s stock price will reach $995.00, or 62.77% higher than it is trading for today, despite estimates that net income will pull back slightly from over $97 billion to over $91 billion. Revenue growth will continue, with an estimated 2.48% year-over-year increase from 2029.

| Year | Price Target* | % Change From Current Price* |

| 2024 | $530 | -14.12 |

| 2025 | $603 | -2.29% |

| 2026 | $692 | 12.13% |

| 2027 | $760 | 23.15% |

| 2028 | $809 | 31.09% |

| 2029 | $914 | 48.11% |

| 2030 | $995 | 61.23% |

*Revenue and net income in $billions

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.