Technology

5 Chip Equipment Stocks to Buy as Industry Rebounds in 2015

Published:

Last Updated:

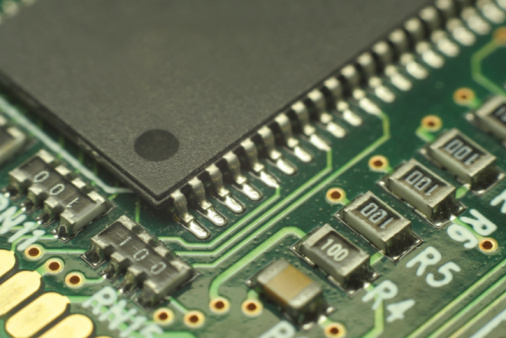

With the ongoing strength in the chip industry, it should come as no surprise that the semiconductor capital equipment industry could be poised for an outstanding 2015. A new report from Merrill Lynch maintains a very bullish stance on the industry and forecasts that wafer fab equipment (WFE) spending could hit $35 billion in 2015, which is up a very solid 9% year-over-year. The analysts feel that the key drivers for segment strength will continue to be the move toward smaller nodes and complex 3D architectures.

In the report, the Merrill Lynch team highlights five top stocks to buy, with three top picks leading the way.

Applied Materials Inc. (NASDAQ: AMAT) has long been the powerhouse name in chip capital equipment. The company is one of the three top picks for 2015 at Merrill Lynch, as they see a good valuation trading at just 17 times estimated 2015 earnings. The company is ramping up efforts to be a bigger player in the NAND sector. For Applied Materials, where its share has been low in this arena, the new architecture throws open doors for a new and very profitable business opportunity. We had noted a rising short interest position in the stock last year, but with the current short position of just over 6%, many of the bears seemed to have left.

Applied Materials investors are paid a 1.7% dividend. The Merrill Lynch price target for the stock is $26, and the Thomson/First Call price target is at $26.73. Shares closed Monday at $23.66.

ALSO READ: 4 Top Semiconductor Stocks With Big 2015 Upside Potential

Lam Research Corp. (NASDAQ: LRCX) is another of the top chip equipment picks at Merrill Lynch. It designs, manufactures, markets, refurbishes and services semiconductor processing equipment used in the fabrication of integrated circuits. The company offers plasma etch products that remove materials from the wafer to create the features and patterns of a device. Many Wall Street analysts have highlighted the company and its peers as having a significant equipment opportunity from the NAND evolution as well. Lam Research also appears well-positioned to gain share in the WFE market, driven by a strong focus on technology inflection spending over the next few years.

Lam Research investors are paid a 0.9% dividend, and the analysts say the company may increase dividends and share repurchases going forward. The Merrill Lynch price target is posted at $92. The consensus target is lower at $87.19. The stock closed Monday at $77.31 a share.

ASML Holding N.V. (NASDAQ: ASML) is the third of three top picks at Merrill Lynch for this year, and the firm predicts solid earnings recovery for the company to drive share price gains. The company engages in designing, manufacturing, marketing and servicing semiconductor processing equipment used in the fabrication of integrated circuits or chips worldwide. It provides PAS 5500 family products that comprise wafer steppers, and step and scan systems suitable for the i-line, krypton fluoride and argon fluoride processing of wafers. ASML’s guiding principle is continuing Moore’s Law towards ever smaller, cheaper, more powerful and energy-efficient semiconductors.

ASML investors are paid a small 0.7% dividend. The Merrill Lynch price target is a whopping $132, and the consensus target stands at $93.71. The stock closed Monday at $103.45.

ALSO READ: The Bullish and Bearish Case for Intel in 2015

KLA-Tencor Corp. (NASDAQ: KLAC) is a top chip equipment name to buy at Merrill Lynch. The company is engaged in the design, manufacture and marketing of process control and yield management solutions for the semiconductor and related nanoelectronics industries. With a portfolio of industry standard products and a team of world-class engineers and scientists, the company has created superior solutions for its customers for more than 35 years.

Investors are paid a solid 2.9% dividend. The Merrill Lynch price target is $75, and the consensus target is $72.93. Shares closed trading on Monday at $67.09.

Ultratech Inc. (NASDAQ: UTEK) is another company that may be less well known, but it has been an industry powerhouse for years. Ultratech is a leading supplier of lithography, laser-processing and inspection systems used to manufacture semiconductor devices and high-brightness LEDs. It is also the market leader and pioneer of laser spike anneal technology for the production of advanced semiconductor devices. In addition, the company offers solutions leveraging its proprietary coherent gradient sensing technology to the semiconductor wafer inspection market.

The Merrill Lynch price target is an impressive $30, while the consensus number is much lower at $23. The shares closed trading at $17.40.

ALSO READ: High-Yielding Dividend Ruler Stocks With Solid Growth Prospects for 2015

The explosion in ever advancing chips for smartphones, tablets and PCs, plus the huge demand for memory chips, keeps the industry growth strong. These stocks are a good choice for a risk-tolerant aggressive growth portfolio with a long-term bias.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.