Technology

3 Networking Stocks to Buy That Could Post Big Earnings Soon

Published:

Last Updated:

As the demand for more and more mobile data grows, the corresponding demand for networking gear is accelerating at a rapid pace. With some of the biggest names in the industry ready to report as early as Thursday after the close, it may be time for aggressive traders to look at top stocks in the sector.

In a new research note, while SunTrust Robinson Humphrey concedes that the macro environment is somewhat uncertain, litigation overhang remains for one company and currency headwinds still have an impact on earnings, three top companies in the sector are outstanding buys now. All three are rated Buy at SunTrust.

Arista Networks

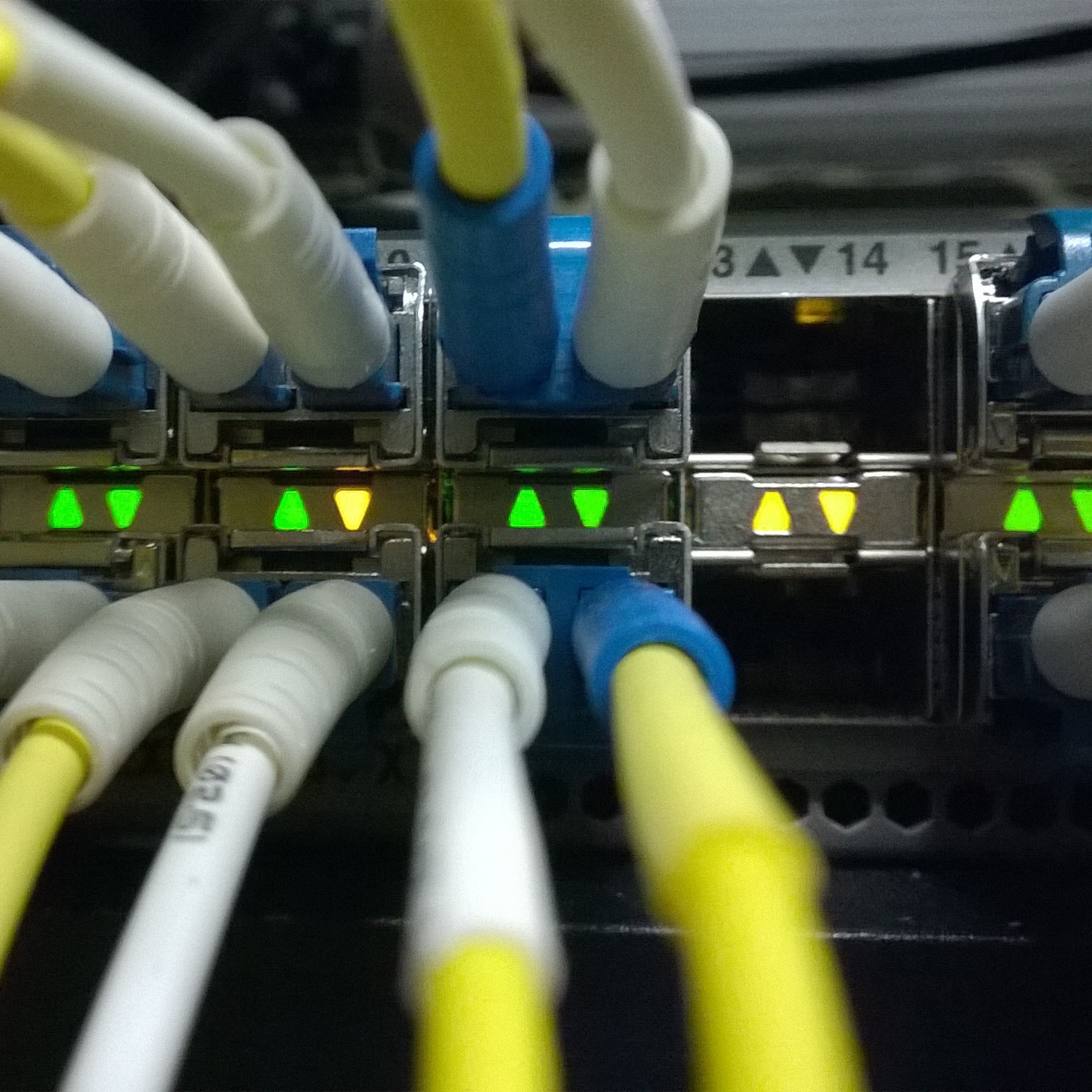

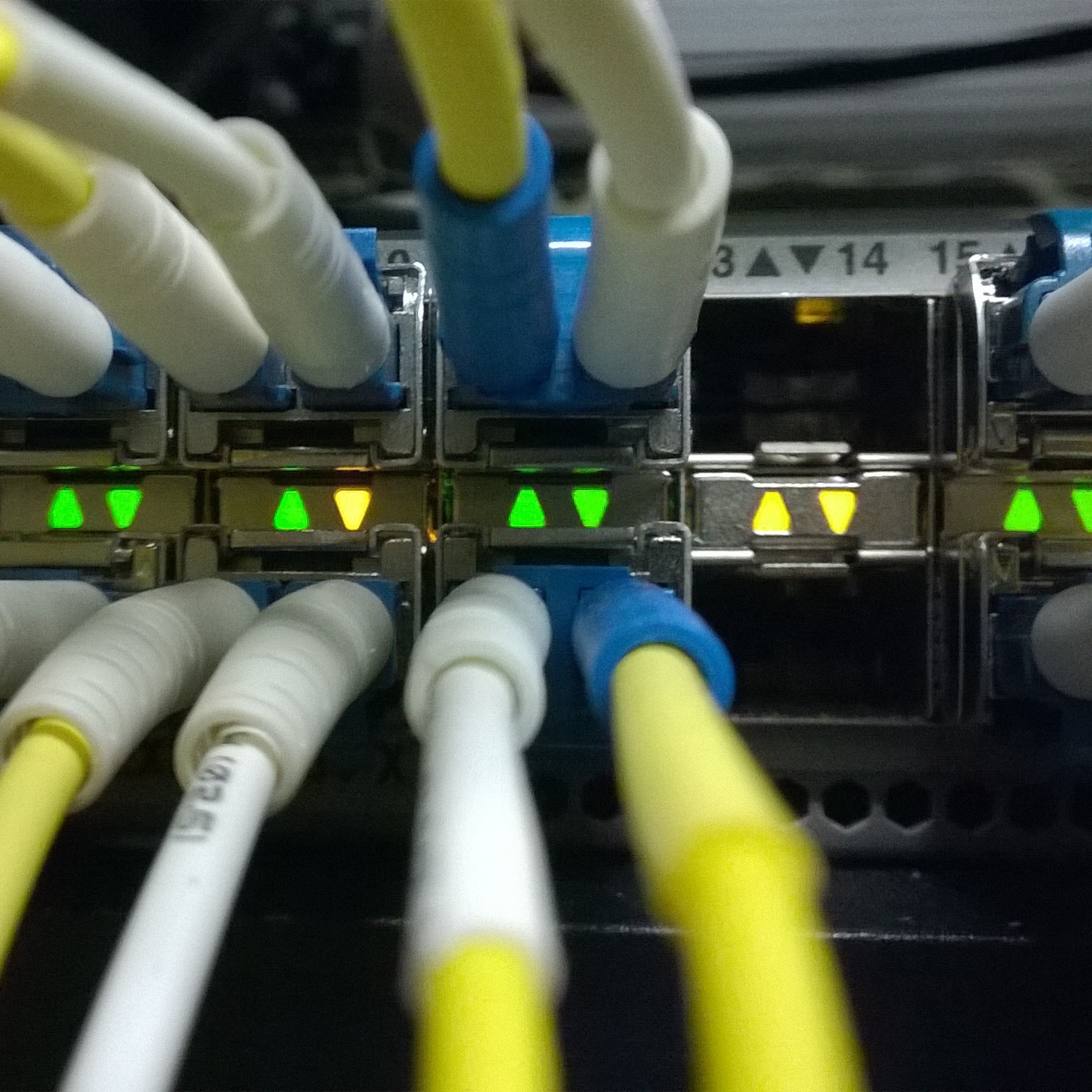

This company went public in the summer of 2014 and has continued to be one of the hot tech IPO stories of the past year. Arista Networks Inc. (NYSE: ANET) delivers software-driven cloud networking solutions for large data center and computing environments. The company will report after the markets close Thursday.

The company’s 10/40/100 gigabit Ethernet switches offer scalability and performance, and they have over 2,700 customers and more than 2 million cloud networking ports deployed worldwide. At the core of Arista’s platform is EOS, an advanced network operating system. Arista Networks products are available worldwide through distribution partners, systems integrators and resellers.

ALSO READ: 4 Safe Blue Chip Dividends to Buy, Even If the Market Has Topped

Many on Wall Street think the company could benefit from dual supplier requirements at the Web 2.0 and cloud portals, and that Arista could see upside to the lofty 30% compound annual growth rate currently forecast. Some also see the stock benefiting as a networking vendor that is leveraged to data center deployments. SunTrust reminds investors of the patent lawsuit filed by Cisco and an expected preliminary determination coming in January.

While the upside if earnings are strong could be tempered by the ongoing legal issues, investors stand to make huge gains if judgements are in their favor. The analysts also think that the issues have not stopped Arista customers from buying product, and most of the headline risk is already priced into the stock at current levels.

The SunTrust price target for the stock is $105. The Thomson/First Call consensus price target is $88.17. Shares closed Wednesday at $63.

Cisco

This is one of the top mega-cap technology stock picks on Wall Street and perhaps a surprising defensive pick for volatile markets like we have witnessed. Cisco Systems Inc. (NASDAQ: CSCO) posted outstanding earnings in August, and many on Wall Street have raised price targets for the networking giant significantly higher. The company reports earnings next week, and SunTrust anticipates solid results. Cisco is also one of the 24/7 Wall St. top 10 stocks to own for the next decade.

Cisco earlier this year won an important contract for the Verizon build-out of its next-generation 100G metro network. While Cisco’s optical business is small as a part of total revenue, this win is seen by Wall Street as a significant endorsement of the investments Cisco has made into its optics business.

Wall Street research suggests that Cisco is likely to introduce 100G+ data center optical platforms sometime next year, and target the Web 2.0 and cloud customer base, in addition to sales opportunities in carrier-neutral data centers. With half of sales derived internationally, any further dollar strength could provide headwinds and perhaps dictate pricing and incentives.

Analysts across Wall Street point to an estimated double-digit bookings momentum for Cisco’s Meraki Cloud Services. Many think that Meraki likely will be a $1 billion plus run-rate business this year, with an incredible 50% to 70% compounded annual growth rate. A jump from 40 GE to 100 GE data center switching and next generation security also add to the total sales profile and product mix. This is another company leveraged to the huge deployments at data centers that SunTrust likes.

Cisco investors receive a very solid 2.96% dividend. The SunTrust price target is $34, and the consensus target is $31.14. The shares closed most recently at $28.47.

ALSO READ: 3 Cell Tower Stocks With Huge New Network Upside Potential for 2016

Zayo Group

Zayo Group Holdings Inc. (NYSE: ZAYO) provides comprehensive bandwidth infrastructure services in over 300 markets throughout the United States and Europe. It delivers a suite of dark fiber, mobile infrastructure and cloud and connectivity services to wireline and wireless customers, data centers, Internet content providers, high-bandwidth enterprises and government agencies across its robust 82,000 route mile network. It also offers 45 carrier-neutral data center facilities across the United States and France. Zayo was the first to offer bandwidth shopping and buying in under two minutes through Tranzact.

Several Wall Street firms love the strong defensive business model and cite the company’s solid growth trajectory, the highly recurring revenue model, high incremental EBITDA margins and management’s experience and ability to drive high returns on invested capital. Like others in the sector, Zayo’s favorable multiyear secular tailwinds, as well as the increased probability of a REIT structure over the long-term, make it a solid buy for investors now.

SunTrust stresses that investors also focus on the long-term for the company, given quarter-to-quarter volatility with bookings. In addition, the company has been active in acquiring smaller, complimentary companies, and the analysts also feel that fiscal 2017 estimates may be too low.

The SunTrust price target is $34, and the consensus target is $31.88. The stock closed on Wednesday at $26.21.

ALSO READ: Top Analyst Recommends the Fastest-Growing Enterprise Tech Company in History

Telecom services demand continues to grow at breakneck speeds. Adding any of these stocks to portfolios with no allocation or small allocations to the sector makes good sense. Scale buying shares is a good idea, with the market still very volatile and trading near highs.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.