Telecom & Wireless

Has Alcatel-Lucent Finally Bottomed Out? (ALU, CSCO, JNPR)

Published:

Last Updated:

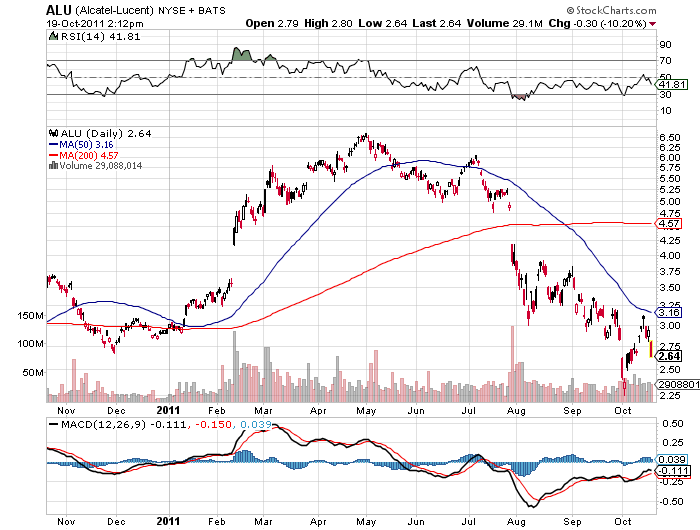

It was not that long ago that Alcatel-Lucent SA (NYSE: ALU) was being thrown around as the best networking stock of 2011. It had risen from under $3.00 per ADR at the start of January and shares hit $6.00 by April before entering June at $6.50. Then the summer “sell in May and go away” put pressure down to $5.00 before recovering back to $6.00 in July. Since then the shares were marked by a sharp drop in July to August followed by a series of lower-lows and lower-highs. Despite a large drop today, some are wondering if Alcatel-Lucent may have finally started to find a bottom.

It was not that long ago that Alcatel-Lucent SA (NYSE: ALU) was being thrown around as the best networking stock of 2011. It had risen from under $3.00 per ADR at the start of January and shares hit $6.00 by April before entering June at $6.50. Then the summer “sell in May and go away” put pressure down to $5.00 before recovering back to $6.00 in July. Since then the shares were marked by a sharp drop in July to August followed by a series of lower-lows and lower-highs. Despite a large drop today, some are wondering if Alcatel-Lucent may have finally started to find a bottom.

Just this morning came a downgrade from Jefferies where Alcatel-Lucent was cut to “Underperform” from a prior “Buy” rating. The $5.00 price target was slashed all the way down to $2.35. The downgrade came on the heels of the news that Alcatel-Lucent received a binding offer for its Genesys from Permira. Some might argue this, but a contrarian might argue that one of the last bullish analysts has finally stepped out of the way and now the value buyers and bottom fishers can get in on the cheap.

Cisco Systems, Inc. (NASDAQ: CSCO) has recovered handily from its lows. Juniper Networks, Inc. (NYSE: JNPR) is down after some hoped for better guidance from the networking equipment “baby-Cisco.” We just listed Juniper as one of 13 stocks which are expected to outperform Apple in the year ahead.

Barron’s wrote an article on Tuesday titled “Cheap Shares of Alcatel Poised to do Well” but that was before today’s big price drop. Bob O’Brien of Barron’s noted, “But though Alcatel-Lucent has bungled the last several cycles of telecommunications technology, the company is poised to re-emerge as a force in the telecom equipment business…”

With shares down almost 10% today at $2.65, the 52-week range is $2.25 to $6.63 amd the consensus price target is still about $5.25 or so per ADR. We would caution that this is technically now a French company rather than an American company under Lucent, and that means greater and greater exposure to the woes of Europe.

Our take is a simple one. Alcatel-Lucent is one we believe has a leveraged bet on Europe, where it was rise handily if Europe recovers but will slide even worse if Europe cannot get its house in order. Another issue is that if Europe is going to bail out the banks then it may have to cut capital spending elsewhere.

Alcatel-Lucent’s shares are too low of a price, with too much volatility, and with too far in between option strike prices for investors to use options for speculation. If you look at the chart below from Stockcharts.com, this may be one of the ugliest charts around.

Earnings are due on November 4, 2011 for its third quarter results. Thomson Reuters has earnings estimates of $0.07 EPS on nearly $5.7 billion in sales (both translated from Euro). It has to at least be asked… does $0.46 EPS sound right as an estimate still for 2012? That would be less than 6-times forward year earnings estimates and we are not yet convinced that estimates have been brought down enough.

After having been more than cut in half in share price since the start of summer, don’t be surprised when you see an awful earnings report. Today’s reaction looks a bit severe, and at some point Alcatel-Lucent will already be cheap enough that the bad news should be priced in.

JON C. OGG

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.