Telecom & Wireless

Analyst Cautions on RIM, Serious Overhang Approaching

Published:

Last Updated:

Shaw Wu of Stern Agee has a Neutral rating on RIM and no price target on the stock. His report today noted, “With RIMM shares rallying recently, many have asked our take on the state of the company’s fundamentals. Our supply chain checks indicate still sluggish demand trends where continued weakness in developed countries is offsetting emerging markets strength in Southeast Asia and India. In addition, we have picked up carrier interest in BlackBerry 10. The big questions remain whether the company can turn profitable again and can carrier interest translate into developer and end user excitement?”

The report also noted something which investors need to consider from a survival standpoint. We said that the strength is that the interest from carriers is being driven as carriers are increasingly growing leery of the growing dominance of the Apple Inc. (NASDAQ: AAPL) for iPhones and Google Inc. (NASDAQ: GOOG) for Android phones. This alone might create a place for a 3rd and possibly a 4th platform so that the carriers do not lose too much leverage against the smartphone makers.

One problem Wu brings up is that there are only about 105,000 apps for BlackBerry versus about 700,000 for iOS and Android each.

Wu also asked about the financial model by saying, “The other big question surrounding the company, does it have a sustainable long-term business model that is profitable? In our view, that remains an unknown as the company needs to invest in development, as well as sales and marketing to keep up with the vast resources of AAPL, GOOG, and MSFT. RIMM is currently losing several hundred million dollars per quarter with profitability likely 12-18 months away.”

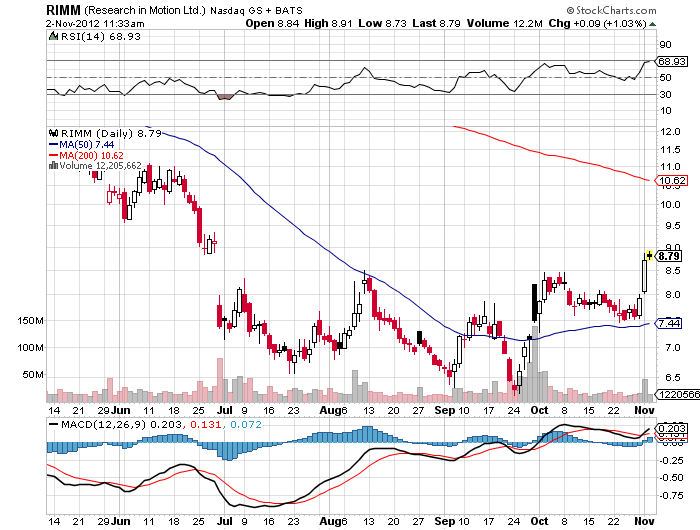

RIM shares are currently up 0.7% at $8.76 on close to 13 million shares but the 52-week trading range is $6.22 to $19.95. Keep in mind that RIM is still down more than 90% from its peak in 2008.

24/7 Wall St. would again caution on a caveat here when trying to use simple logic: “The caveat here is that this stock lost some 90% or so of its value so bottom-fishers try to pile in here whenever a turn is conceivable. That being said, RIM’s rally can defy logic if traders ever want to really get behind a move to the upside.”

If you take a look at the stockcharts.com chart below, RIM shares are approaching a very critical juncture. As shares are close to $9.00, every single new buyer of shares who bought in since the drop from $9 to $7.50 at the end of June is now very profitable. This will also give a lot of other buyers who were in right before the drop a chance to get out at either breakeven or close enough to breakeven.

JON C. OGG

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.