After the second day of the Mobile World Congress in Barcelona, Spain, we wanted to see if there have been any key winners or losers identified so far. BlackBerry Ltd. (NASDAQ: BBRY) was a clear winner, at least as far as it stock was concerned after it announced a new phone for Indonesia and on hopes of its messaging system.

24/7 Wall St. wanted to see if analysts were identifying any clear winners yet. It turns out that Oppenheimer has issued a list of companies with key takeaways. It is going to be slim pickings because the Oppenheimer summary called the show somewhat disappointing, with little in new technology or disruption.

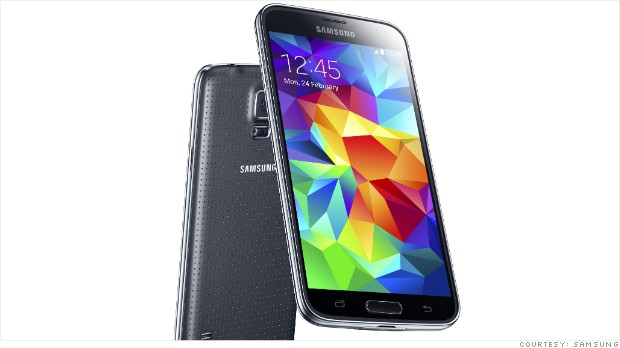

Samsung is not actively traded for U.S. investors, but everyone knows the company for its phones and other products. Oppenheimer said it was the winner by noting:

Focusing on devices, the king of the show was no doubt Samsung. The Galaxy S5 (launching in April) and the new large screen tablets (~12 inch) are simply cool — great screen, unique features to Samsung and just a feel you want to have. Samsung’s booth was almost as big as a football field, and the traffic was still heavy. Samsung seems to us as the only real credible threat to Apple in devices (smartphones and tablets), and it is staking an early claim in wearables (Gear 2, Gear 2 Neo, Gear Fit…).

While BlackBerry shares rose, Oppenheimer is very cautious here and has an Underperform rating. The firm said:

WhatsApp cornered a market, BlackBerry is now one of several vendors. Our position remains the same: we think BlackBerry will need to go lower before it can go higher again.

Oppenheimer said of Qualcomm Inc. (NASDAQ: QCOM), with an Outperform rating:

For the first time in a long time, it felt like there was nothing too controversial about Qualcomm. China is ramping, low-end Snapdragon is addressed, long-term TAM expansion opportunities are identifiable in everything from watches, machine-to-machine, automotive. … The message is unchanged as is the confidence level — high. We believe Qualcomm will work hard to continue to expand its TAM longer term, and while the opportunities above seem interesting, we can’t identify one right now that could have a material positive impact on its financial outlook. They are all nice. But they all seem small, slow to develop and adding less value per device/connection. We’ll have to give this some more thought, but perhaps non-organic expansion is a way to go.

Nokia Corp. (NYSE: NOK) was mentioned cautiously after Nokia introduced its Nokia X Android devices, a group with a special version of Android that tries to build on Microsoft services such as OneDrive and Skype. Oppenheimer called it an interesting idea, but it sees two issues — apps will not support in-app purchases and also pricing would be just slightly below Nokia’s Windows devices. The report said:

We don’t know yet what direction management will take Nokia, but we’re inclined to think that odds are that Nokia keeps all its remaining businesses.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.