Is it possible that shares of AT&T Inc. (NYSE: T) are trying to form a bottom? After three years of going nowhere, investors cheered the telecom and wireless giant’s latest earnings. Also, AT&T addressed its potential to acquire DirecTV (NASDAQ: DTV).

24/7 Wall St. could not help but notice the gain of better than 4% following the report. However, what really stood out was some of the analyst commentary after the earnings report. Included in the summary here are a couple of analysts’ calls in relation to AT&T earnings and a summary of details from each call.

The telecom giant posted adjusted diluted quarterly earnings per share (EPS) of $0.63 on revenues of $32.6 billion. In the same period a year ago, the company reported EPS of $0.71 on revenues of $32.48 billion. First-quarter results also compare to the consensus estimates for EPS of $0.62 on revenues of $32.84 billion.

The company said only that “full-year standalone guidance” was “on track,” but did not offer any specific numbers. The consensus estimates for the second quarter call for EPS of $0.63 on revenues of $32.99 billion. For the full year, estimated EPS totals $2.50 on revenues of $134.29 billion.

ALSO READ: Why Value Investors Should Be All Over AT&T

After earnings, S&P Capital IQ said of AT&T:

We raise our 2015 operating EPS estimate by $0.01 to $2.53 and 2016’s by $0.04 to $2.59. We trim our 12-month target price by $2 to $39, on lower revised enterprise value-to-EBITDA near peers. AT&T posts first quarter operating EPS of $0.63 vs. $0.71, beating our $0.62 estimate.

Sales rose fractionally, as higher wireless revenue offset wireline declines. We positively view 1.2 million wireless subscriber addition (includes 441K postpaid and 684K connected cars) and 20% U-verse growth. We are optimistic about potential synergies (up to $2.5 billion from $1.6 billion) from the pending DirecTV deal.

Canaccord Genuity noted that AT&T’s earnings were essentially in line. The brokerage firm made some modest changes to estimates while maintaining a Hold rating with a $34 price target. The firm had some key takeaways, as described in its report by analyst Gregory Miller:

We believe it is clear that the company is managing the increasingly competitive US wireless market well and dealing with continued secular headwinds in the wireline market appropriately, along with looking out for what it believes to be attractive businesses/markets that might drive growth in the future (i.e., DirecTV, Mexico Wireless).

We will remain on the sidelines with any purchase recommendation, however, until it is clear that the accelerating growth of video streaming adoption by consumers has not put at greater risk the to-be-acquired video operator (DTV) that commands one of the highest video average revenue per users (ARPUs) in the industry.

ALSO READ: AT&T the Most Shorted NYSE Stock at the End of Q1

Oppenheimer maintained its Outperform rating with a $36 price target. The normalized first quarter EPS of $0.63 was a penny below Oppenheimer’s estimate, despite an EBITDA beat. The firm noted that AT&T’s postpaid net additions of 440K were in line on better churn, although phone net additions were weak, down roughly 300,000.

Revenue came in 1% below Oppenheimer’s forecast, but normalizing for currency and asset sales, revenue was in line. The company did reiterate guidance for the year and suggested that wireless ARPU is bottoming. As a result, Oppenheimer maintained its EPS estimates.

AT&T’s own projections were that it sees an expected cost synergies from the DirecTV transaction increasing significantly to $2.5 billion. Randall Stephenson, AT&T chairman and CEO, said:

The first quarter was a significant step in a transformative year for AT&T. The repositioning of our wireless customer base to no-device-subsidy plans drove industry-leading postpaid churn. IP technologies continue to transform our wireline operations, expand our broadband base and drive strong demand for strategic business services. Plus, we established a good foothold in the Mexican wireless market with our acquisition of Iusacell and we are on track to close our acquisition of Nextel’s Mexico operations shortly. This, along with our expectation that we’ll gain final approval of the DIRECTV deal in the second quarter, adds to our confidence that we’re on track to be a very different company uniquely positioned for growth.

Shares of AT&T closed up 4.2% at $34.23 on Thursday. This appears to be the highest closing price, adjusting for dividends, back to February 10. The stock had a consensus analyst price target of $34.25 and a 52-week trading range of $32.07 to $37.48.

ALSO READ: 5 Cheap Large Cap Stocks to Buy in a Pricey Stock Market

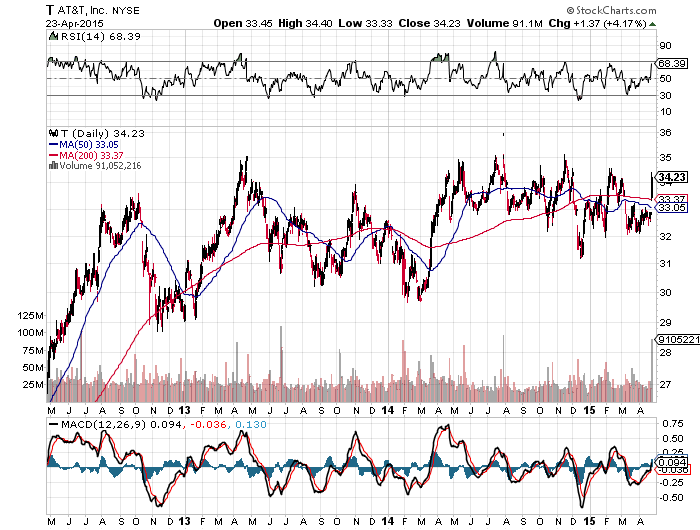

As far as whether AT&T shares have bottomed out, the chart below (from StockCharts.com) shows that AT&T has crossed back above the 50-day and 200-day moving averages. That does not mean that investors should expect AT&T to rise from $34 and instantly take out the three-year highs of just over $35.00 immediately. Still, this should offer a solid implied floor for dividend investors who want to capture AT&T’s hefty 5.5% dividend yield.

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.