Telecom & Wireless

How BlackBerry Stunned Investors with Q3 Earnings

Published:

Last Updated:

BlackBerry Ltd. (NASDAQ: BBRY) reported its fiscal third-quarter financial results before the markets opened on Friday. The company had a net loss of $0.03 per share on $557 million in revenue. That compared to consensus estimates from Thomson Reuters of a net loss of $0.14 per share on $489.04 million in revenue. The same period from the previous year had earnings of $0.01 per share on $793.00 million in revenue.

One thing worth pointing out that helped enable this quarter was that software and services revenue totaled $162 million, is up 183% year over year and up 119% quarter over quarter.

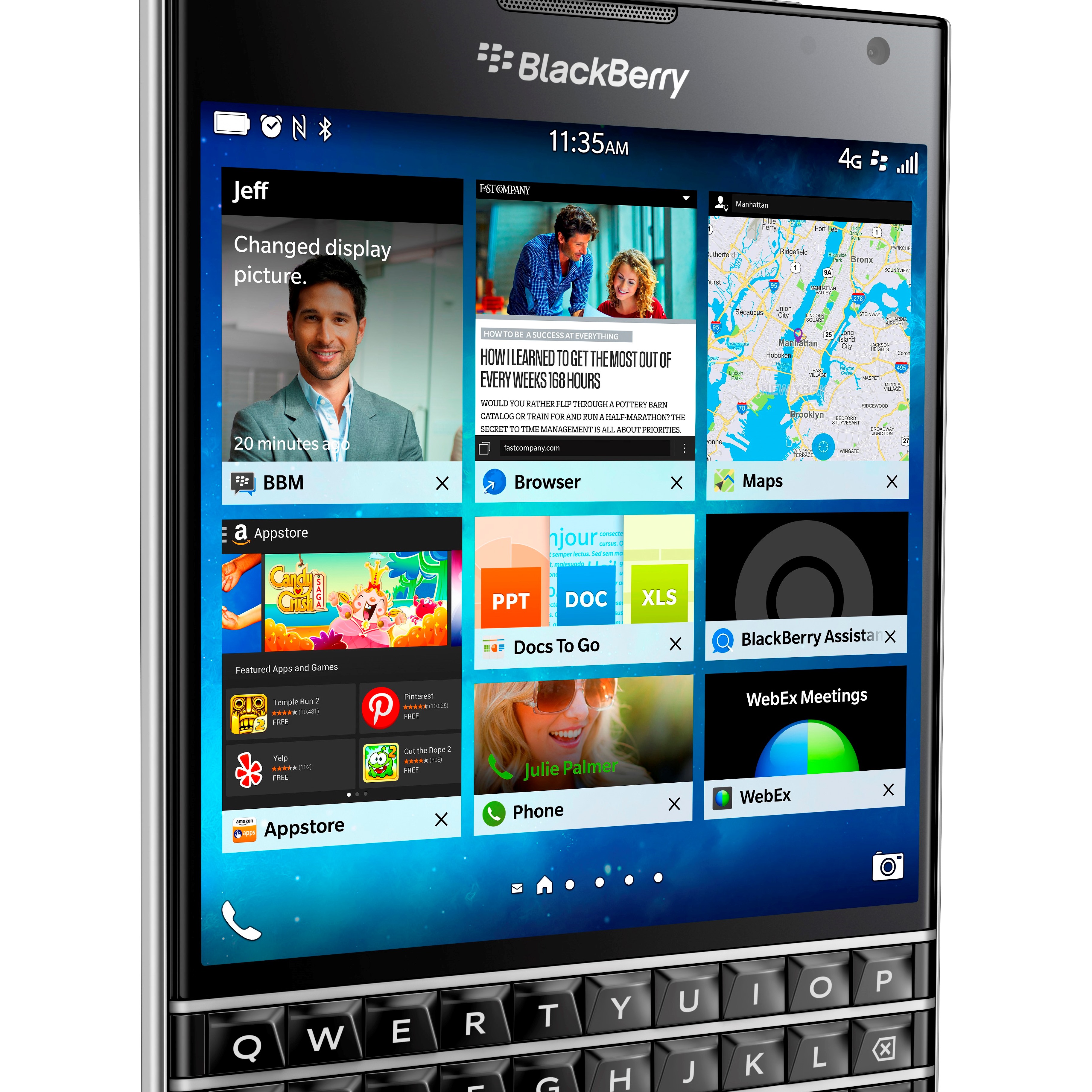

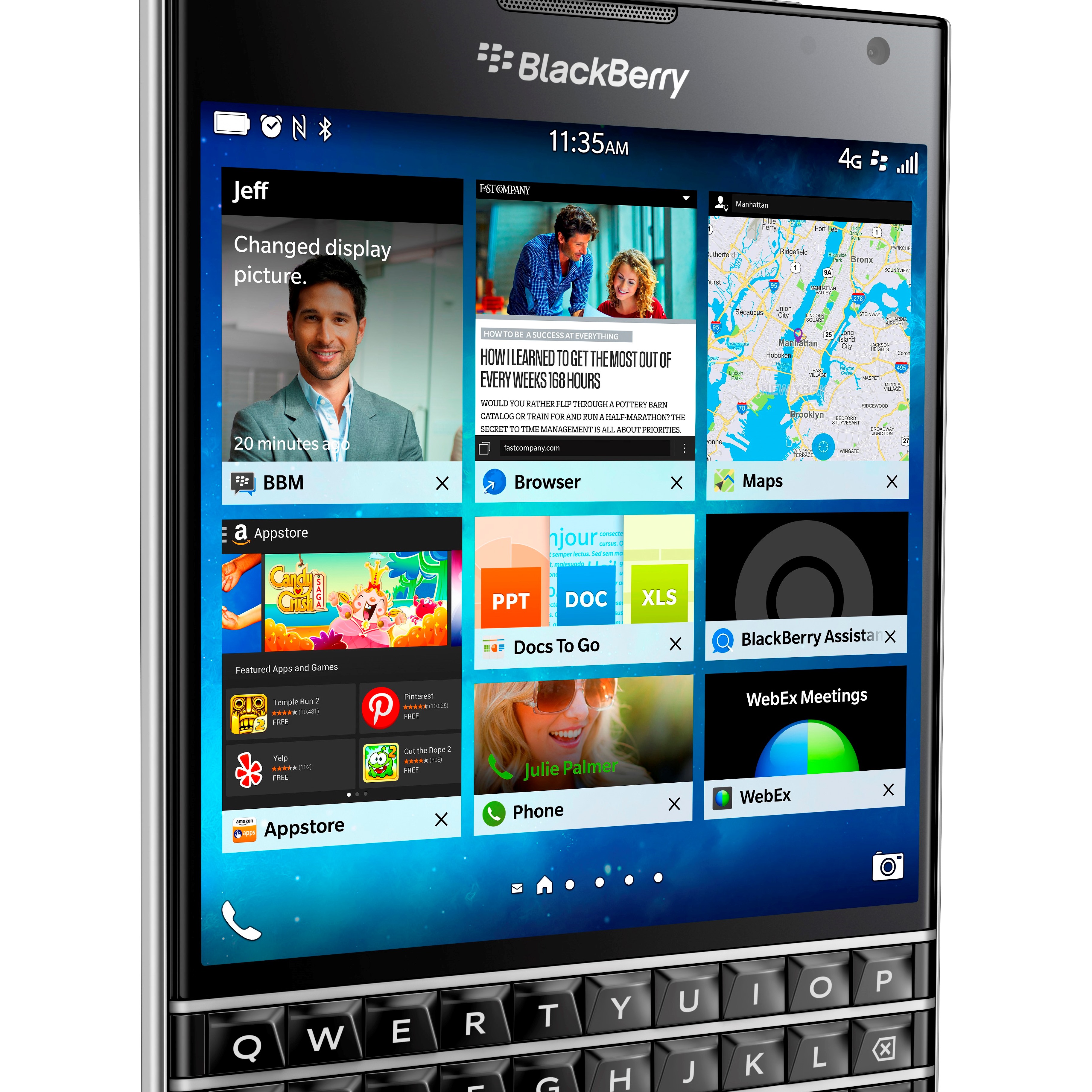

During this quarter, BlackBerry completed the acquisitions of AtHoc and Good Technology. Apart from this, the company launched the PRIV in November, which is the only smartphone that combines BlackBerry-level security with the Google Store’s 1.6 million apps. BlackBerry also confirmed plans to release its OS version 10.3.3 on BlackBerry 10 to support NIAP certification.

On the books, cash, equivalents and short-term investments totaled $2.30 billion in the fiscal third quarter, compared to the end of the previous fiscal year that had $2.89 billion.

I am pleased with our continued progress on BlackBerry’s strategic priorities, leading to 14 percent sequential growth in total revenue for Q3. We delivered accelerating growth in enterprise software and higher revenue across all of our areas of focus. Our new PRIV device has been well received since its launch in November, and we are expanding distribution to additional carriers around the world in the next several quarters.

He continued:

BlackBerry has a solid financial foundation, and we are executing well. To sustain our current direction, we are stepping up investments to drive continued software growth and the additional PRIV launches. I anticipate this will result in sequential revenue growth in our software, hardware and messaging businesses in the fourth quarter.

Shares of BlackBerry closed Thursday down 4.7% at $7.80, with a consensus analyst price target of $7.25 and a 52-week trading range of $5.96 to $12.63. Following the release of the earnings report, shares were up 5.8% at $8.25 in early trading indications Friday.

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.