BlackBerry Ltd. (NASDAQ: BBRY) is scheduled to report its fiscal fourth-quarter financial results before the markets open on Friday. The consensus estimates from Thomson Reuters call for a net loss of $0.10 per share on $563.18 million in revenue. In the same period of the previous year, it posted earnings per share (EPS) of $0.04 and $660.00 million in revenue.

This company has witnessed one of the greatest falls from grace and prime time in the modern era of consumer electronics. The company has a relatively new CEO in John Chen, and he is considered stellar for keeping things up better than they might otherwise be. The problem here is that some analysts and some investors are still very concerned about BlackBerry’s future.

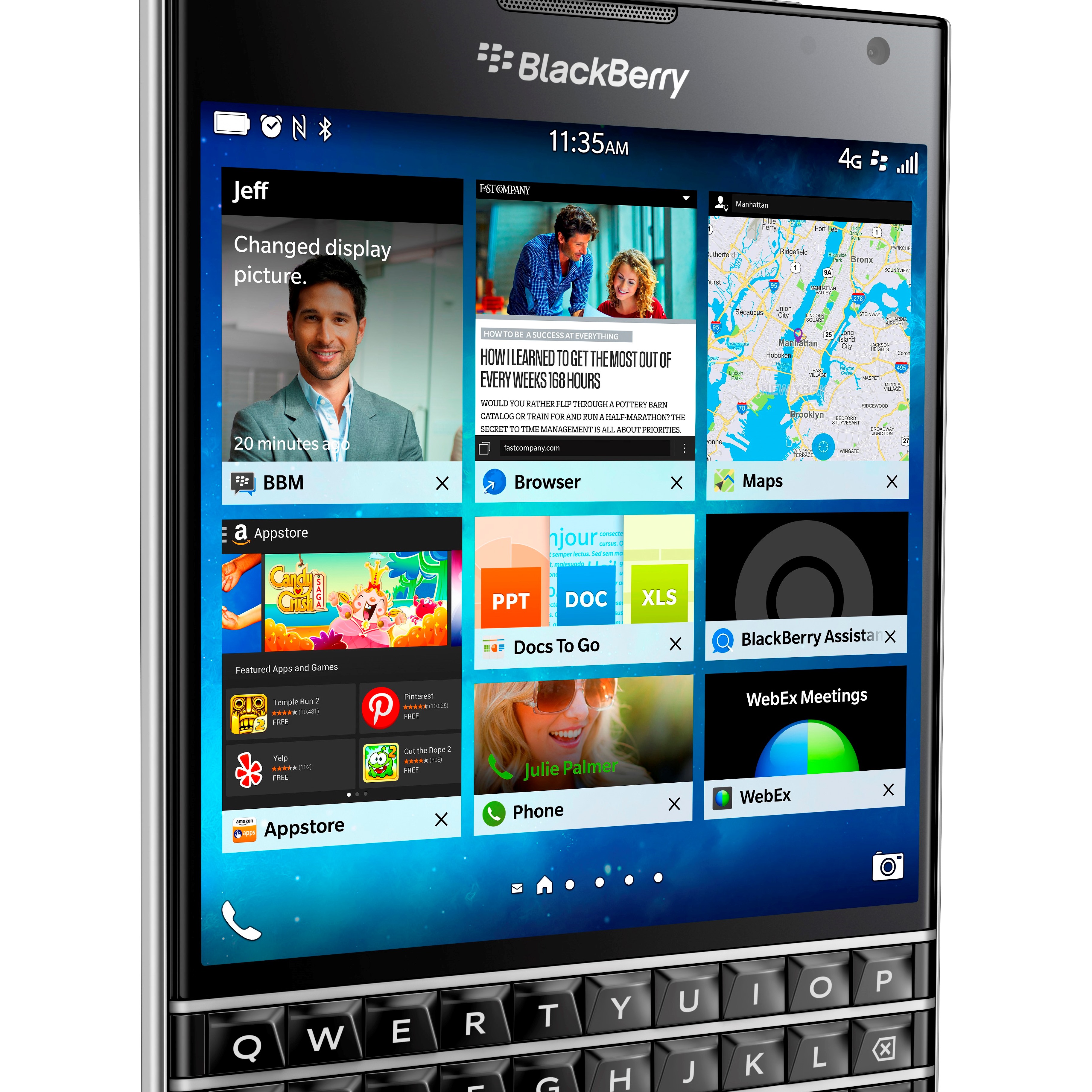

BlackBerry provides wireless communications solutions worldwide, including the sale of BlackBerry handheld devices, the provision of data communication, and compression and security infrastructure services enabling BlackBerry handheld wireless devices to send and receive wireless messages and data.

A few analysts weighed in on BlackBerry prior to its report:

- Morgan Stanley reiterated an Equal Weight rating with a $7 price target.

- TD Securities initiated coverage with a Buy rating and an $8 price target.

- Howard Well initiated coverage with a Sector Perform rating.

So far in 2016, BlackBerry has underperformed the market, with the stock down about 14%. Over the past 52 weeks, the stock is only down 9%.

Shares of BlackBerry were trading up 0.7% at $8.07 on Thursday, with a consensus analyst price target of $7.86 and a 52-week trading range of $5.96 to $11.09.

The Average American Has No Idea How Much Money You Can Make Today (Sponsor)

The last few years made people forget how much banks and CD’s can pay. Meanwhile, interest rates have spiked and many can afford to pay you much more, but most are keeping yields low and hoping you won’t notice.

But there is good news. To win qualified customers, some accounts are paying almost 10x the national average! That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 3.80% with a Checking & Savings Account today Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 4.00% with a Checking & Savings Account from Sofi. Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.