Telecom & Wireless

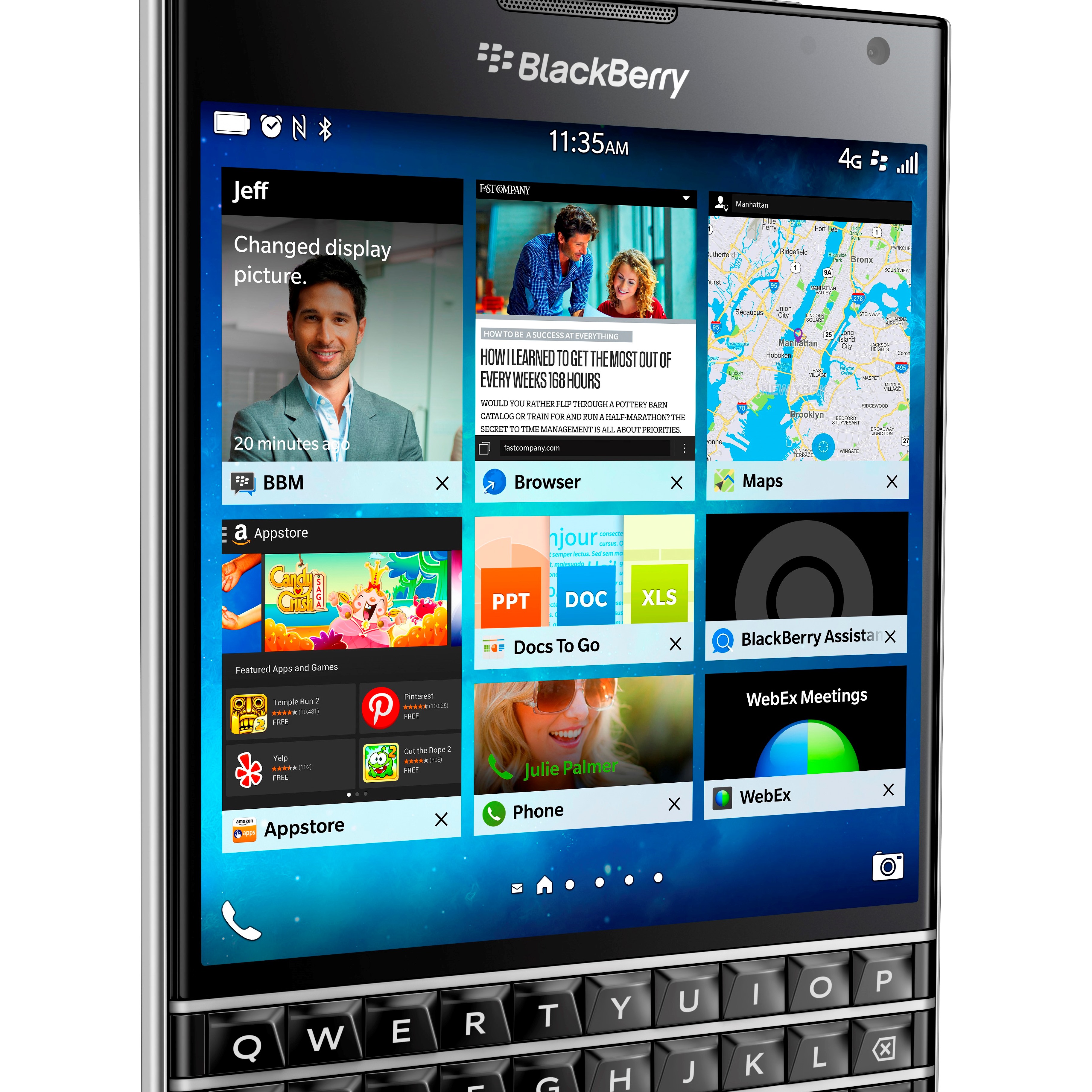

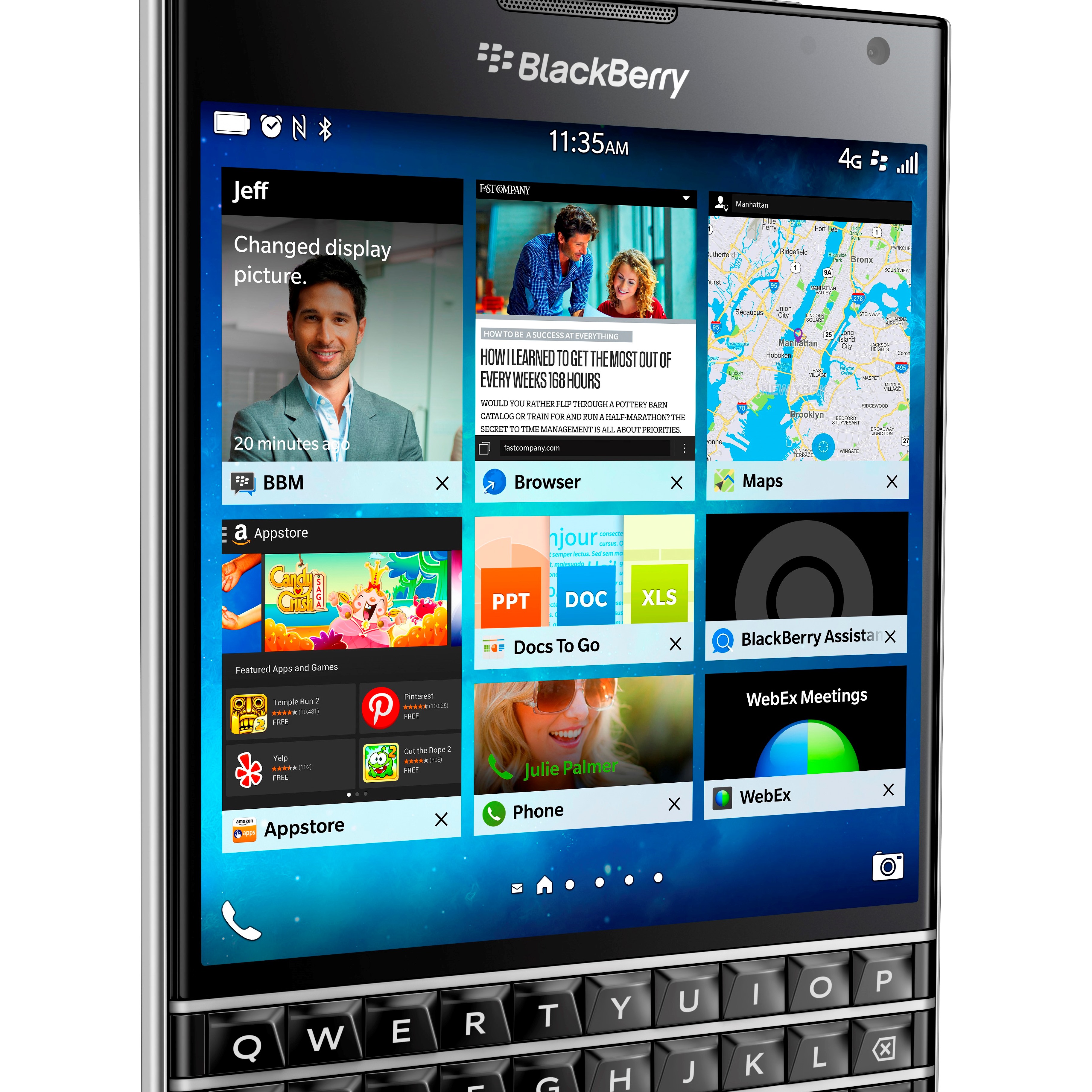

What to Expect When BlackBerry Reports Earnings

Published:

Last Updated:

BlackBerry Ltd. (NASDAQ: BBRY) is scheduled to release its fiscal first-quarter earnings report before the markets open on Thursday. The consensus estimates from Thomson Reuters are a net loss of $0.08 per share on $470.94 million. That compares with the net loss of $0.05 per share on $658.0 million posted in the same period of last year.

Overall, BlackBerry’s fourth-quarter performance was solid, according to management, as the company made progress on the key elements of its strategy. Paramount to this strategy is for BlackBerry to grow software faster than the mobility software market, achieve device profitability and generate positive free cash flow.

This company has witnessed one of the greatest falls from grace and prime time in the modern era of consumer electronics. The company has a relatively new CEO in John Chen, and he is considered stellar for keeping things up better than they might otherwise be. The problem here is that some analysts and some investors are still very concerned about BlackBerry’s future.

A few analysts weighed in on BlackBerry ahead of the earnings release:

So far in 2016, BlackBerry has underperformed the market with the stock down 24%. Over the past year, the stock is down roughly 23%.

Shares of BlackBerry were trading at $6.96 midday Wednesday. The stock has a consensus analyst price target of $7.75 and a 52-week trading range of $5.96 to $9.46.

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.